The tailings storage facility at BHP’s Escondida copper mine in Chile. (Photo: BHP)

E&MJ explores new ways of managing mine tailings

By Carly Leonida, European Editor

The past five years have been nothing short of transformative for the way in which mine operators view and manage their waste streams, and nowhere more so than in tailings. The Brumadinho dam collapse on January 25, 2019, sparked a chain of events which have seen tailings management elevated in priority across the industry and in the eyes of its stakeholders.

What was, for most, an unfortunate by-product of mineral processing which must be managed in perpetuity at the expense of the operator has taken on new potential, with stronger governance and fresh investment opening possibilities for more responsible storage methods and even valorization opportunities.

In addition to finding uses in mine backfill and the construction of final landforms, more widespread tailings characterization is helping miners to better understand the minerals they steward as well as possible applications and markets, turning some tailings from a liability into a potential new business line.

Managing Tailings Responsibly

While circular business models and new products are exciting prospects (and we’ll come to those shortly), the reality is that it takes time to identify markets for tailings constituents and to build new businesses. Every operation and organization is unique, and it would be unrealistic and impractical to expect that all tailings will be eliminated or repurposed, certainly in the foreseeable future, anyway.

According to the Global Tailings Review, in 2020, there were approximately 8,500 active, inactive and closed tailings storage facilities (TSFs) worldwide, of which around 3,250 were classed as active. These must be managed properly to ensure the safety of local communities and environments. The Global Industry Standard on Tailings Management (GISTM), which was published in August 2020, aims to do just that.

The GISTM’s establishment has made the safety and integrity of tailings dams a top focus for reputable mining and metals companies. Underpinned by an integrated approach to tailings management, implementation of the 15 principles and 77 auditable requirements across six topic areas, aim to prevent catastrophic failures and enhance the performance of TSFs.

Upon its release, members of the ICMM immediately committed to implementing the standard, with the goal of bringing all TSFs with ‘extreme’ or ‘very high’ potential consequences into conformance by August 2023. All other TSFs operated by members not in a state of safe closure should be in conformance with the standard by August 5, 2025.

On July 27, 2023, ICMM’s 25 members published their progress towards conformance with the GISTM for their highest consequence TSFs. Aidan Davy, ICMM’s COO discussed this milestone and what it means for the industry.

“When the GISTM was published, ICMM members committed to conform their highest consequence facilities to the standard within three years,” said Davy. “This galvanized immediate and sustained action by members, representing one third of the global mining industry.

“Although not all companies have achieved full conformance, implementation of GISTM has already resulted in improvements across the global mining sector in tailings engineering, management, governance and monitoring. Implementation is catalyzing collaboration between tailings management, social performance, environmental and engineering professionals to help strengthen management, oversight and accountability. And it has elevated tailings management to the highest levels of company oversight and accountability, while promoting transparency, collaboration, and meaningful engagement with stakeholders.”

For the industry, this is fuelling change in how TSFs are managed. Stakeholders local to those facilities are now better informed about potential risks, related consequences and how they’re being managed to prevent adverse impacts from occurring. And for anyone concerned with the industry’s approach to managing mine wastes, implementation of the GISTM provides assurances that tailings are being properly managed.

Davy acknowledged that progressing implementation while working through related site level challenges within three years has proven challenging in some cases, but that the commitment by ICMM members is unequivocal. Members are working to bring any remaining facilities into full conformance as soon as possible and the ICMM is supporting them in this.

“ICMM has been working closely with members’ tailings experts, social performance practitioners and senior leadership to support implementation, including facilitating opportunities for collaboration and sharing knowledge and experiences on a peer-to-peer basis, and will continue to do so,” he explained. “ICMM has also produced resources that are freely available for use, such as conformance protocols for the GISTM, a Tailings Management Good Practice Guide and associated training material. We’re also planning to launch a webinar series later this year to help share learnings on related topics.”

The GISTM has put responsible tailings management on the agenda of executives and boards in a way that rarely happened before the standard was developed, and its influence and impacts stretch far beyond the ICMM’s members.

Davy said: “ICMM, the United Nations Environment Program (UNEP) and Principles for Responsible Investment (PRI) have reinforced the importance of uptake beyond ICMM membership and called on non ICMM companies to adopt and implement the standard too. As of February 2023, 128 companies (including ICMM’s 25 members) representing over 70% of the market (by capitalization of publicly listed companies) have indicated their intention to implement or are formally reviewing the standard.”

ICMM, UNEP and PRI continue to advocate for broad-based uptake and implementation of the standard. Although compliance is voluntary, there are consequences for ignoring it. For example, the Church of England Pension Board, which manages about $4.9 (£4 billion) in assets, has said it will vote against the chairs of companies that have not committed to implementing the standard.

On the other hand, companies that can credibly demonstrate comprehensive management of tailings are more likely to attract favorable terms for insurance and may benefit from lower costs of capital.

Reducing Tailings Through Valorization

Another of the ICMM’s long-term goals, which goes hand-in-hand with its work in responsible TSF management, is to significantly reduce the quantity of tailings that the industry produces. In September 2022, it published a Tailings Reduction Roadmap which lays out innovative approaches and solutions capable of significantly reducing tailings from the mine lifecycle.

The Roadmap details mature solutions that can be implemented in the short-term, such as coarse particle flotation (CPF) technology and solutions with the potential to reduce tailings in more significant quantities, but that will require further development over the next 10-15 years, such as higher precision mining and artificial intelligence.

Christian Spano, Director of Innovation at the ICMM, explained: “Existing technologies can be capable of reducing the volume of tailings produced by up to 15%, while more advanced technologies could, in the future, be capable of reducing more like 90%. The Roadmap, which was developed through a series of engagements between technology suppliers, innovators and ICMM members, offers strategic direction on accelerating the development and adoption of technologies to reduce tailings. It addresses technological challenges, such as testing new technology on a range of ore characteristics, and enabling factors, including business case and regulatory requirements.”

Mine tailings are often considered a liability but, if we flip the conversation and think of them as an opportunity instead… what different types of value can they potentially provide? E&MJ asked.

“The industry has traditionally considered tailings as waste, but they’re in fact a resource that holds metal and other materials with high market value,” replied Spano. “This value can be significant, with some tailings holding higher metal contents than new mining projects.

“Valorization of tailings is a type of approach that has practical options for creating value by transforming tailings into valuable commodities. By leveraging these opportunities, operators can benefit from reduced costs and new revenue streams while lessening environmental impacts. Tailings valorization also creates job opportunities for local communities and supports consistent supply of crucial products for both consumers and industries.”

ICMM members are piloting many of the technologies laid out in the Roadmap which match their commodities and site characteristics, so that solutions can be scaled up to benefit the whole industry.

For instance, Vale is developing a new sustainable source of silica made from the treatment of iron-ore tailings that would previously have been disposed of in dams. Dubbed ‘Vale’s Sustainable Sand’, the company began producing and selling the product in 2021. It’s essentially an aggregate combining gravel and crushed rock. Each ton of sand produced represents one ton less of tailings being disposed and can then be processed and destined for sale or donation for use in concrete, mortar, prefabricated materials, artifacts, cement and road paving.

This leads to a reduction in demand for natural sand, which is the second most consumed natural resource in the world, and also a reduction in carbon emissions. Such a strategy not only presents commercial benefits, but also meets a significant global demand.

Member companies, including Sibanye Stillwater and Codelco, are also reprocessing their tailings with high commodity grades to extract residual metals, including copper and platinum. And Anglo American’s Hydraulic Dewatered Stacking (HDS) project (more on this later) seeks a holistic approach, using tailings as a sub-product to spur innovation and water recovery from the last stage of processing to generate safe and stable tailings. Ultimately, the land from this transformed area can then be repurposed.

Circular Economy in Tailings

The mining and metals industry has been integrating circular principles at the site level for many years to reduce the negative impacts of extraction and because it makes good business sense. For many companies, reducing waste and tailings, optimizing water usage, regenerating closed mine sites, recycling other waste, such as tires, and focusing on efficiency is already at the heart of their strategies.

Spano spoke to this: “To become truly circular and reduce tailings in more significant quantities, we must innovate, and consider both process and product circularity in tandem,” he said. “Mines must reduce their immediate environmental and social footprint at the site level and recover the value in any waste stream as part of a core operational strategy. Equally, the materials they extract should be viewed and treated as resources that can be used again and again, designed for tracking and recovery to facilitate their continuous reuse.

“A blended approach that marries process and product circularity, applying various circular strategies covering waste reduction, reprocessing and re-use can help to make the most impact. If companies take a comprehensive and innovative approach, circular principles have the potential to redefine the mining industry, from an extractive sector supplying a limited resource to a regenerative industry supplying a durable resource recovered forever.”

Several technologies are already being used for metal recovery from tailings and the repurposing of mineral residues into both high and low-value products (see the examples above). Additionally, the ICMM is focusing on creating a collaborative space to allow different circular strategies to be successful, including regulation, technology availability and market incentives.

“Through identifying areas for collaboration, we can support a systematic move to circularity across the global economy. Tailings reduction is a core element in this strategy,” Spano added.

An example of the potential impacts can be seen with bauxite. At Hydro’s Paragominas mine in Brazil, a new method for storing bauxite tailings has been introduced to eliminate the need for new permanent TSFs while helping to protect biodiversity, reduce the company’s environmental footprint and improve operational safety.

Hydro is using a tailings dry backfill method where, instead of piling tailings to store in dams, the slurry-type mixture of clay, rock and water generated when the bauxite is initially processed is spread out in a carefully planned way. This allows the mixture to dry within 30-60 days, at the end of which, it’s used to safely backfill the area that was mined.

The dry tailings aren’t a potential source of contamination to soil and groundwater due to having similar chemical and physical characteristics to the ore that was extracted. To accelerate the recovery of these mined areas, the original form of the soil is reproduced through adding organic matter before plant seedlings are introduced to restore the vegetation.

Rehabilitation of mined areas at the Paragominas site stretches to 2,300 hectares and is supported by an on-site nursery, which produces 200,000 seedlings annually of native species. Thanks to tailings dry backfilling and its commitment to restoration, the Hydro Paragominas mine ensures that for every hectare disturbed by mining, a hectare of forest is restored.

It’s a great example of the circular economy in action. But the mining industry isn’t known for its speedy adoption of new technologies and processes. What barriers are there to the greater adoption of circular principles in mining and, specifically, in tailings? E&MJ asked Spano.

“The adoption of circular principles, especially in the tailings space, does face barriers, and understanding these is crucial for devising solutions,” he replied. “The key barrier is how to deliver tailings innovation at the speed and scale required and with the highest safety standards. Mining operations are large-scale operations, integrating new technologies swiftly and effectively becomes a complex task.”

BHP and Rio Tinto Tackle Tailings Tech Together

BHP, is collaborating with a number of companies to advance its tailings management approach and embrace circular principles. In October 2022, it formed a partnership with Rio Tinto to accelerate the development of technology that could significantly increase water recovery from mine tailings and, in turn, reduce potential safety risks and environmental footprints associated with TSFs.

“It’s important that we keep working together across the global mining sector to raise standards and make sure our operations are as safe and sustainable as they can be,” said Laura Tyler, chief technical officer for BHP. “Responsible management of tailings and improved water use is a big part of that.”

Her comment was supported by Rio Tinto’s Chief Technical Officer, Mark Davies, who added: “It’s in everyone’s interest that we, as an industry, find safer and more sustainable ways to manage tailings. As two of the leading companies in the sector, we want to bring our combined knowledge and expertise to address this challenge.”

The first project involves testing the application of a large-volume filtration unit at a BHP copper mine in Chile which will remove up to 80% of the water in the tailings stream before it’s deposited in a TSF. When the partnership was announced, manufacture of the filter unit was underway, with pilot construction scheduled for 2023 and operation to begin in early 2024. The pilot will test the scalability and cost-effectiveness of the filter for use across global mining operations.

Rio Tinto has been using smaller-scale tailings filters for bauxite residues at its alumina refineries since 2005 and brings this valuable experience to the project. The organizations said they will work in collaboration with leading technology and equipment providers, technical experts, research groups and the academic sector.

This was followed by a further announcement and a call to action in May 2023; the two companies announced they had entered into a new agreement to extend their collaboration and create a portfolio of tailings management partners with whom they can work to accelerate the development of technologies that could increase water recovery and reduce potential safety risks and environmental footprints associated with TSFs.

With help from ChileGlobal Ventures and Fundación Chile, the new Tailings Management Consortium put out an open call for technology providers, equipment manufacturers, reagent suppliers, startups and research groups with innovative ideas and technologies to help improve tailings dewatering and management performance. The scope covers applications from tailings dewatering and transport technologies, to chemical amendment and dust mitigation.

According to a statement on the Tailings Management Consortium website, the open call received a “high level of interest” with over 70 submissions from more than 15 countries in just three months. The call has now been paused to allow assessment of the submissions, but the consortium hopes to resume applications in 2024.

BHP and Rio Tinto are also working together through the Future Tails project with the University of Western Australia which provides research, training, education and practice for both current and prospective tailings management professionals. The aim is to build talent and capability at a range of levels, build a repository of technical references which summarize leading tailings analysis, design, operation and management, and to address deficiencies in the knowledge and understanding of fundamental geotechnical engineering issues through applied research.

“As the mining industry responds to concerns about the risks associated with tailings management and the GISTM initiative, Future Tails seeks to influence, inform and, where necessary, adapt to these advancements,” the companies said in a joint announcement in August 2023.

LKAB and Boliden Team Up for ReeMAP

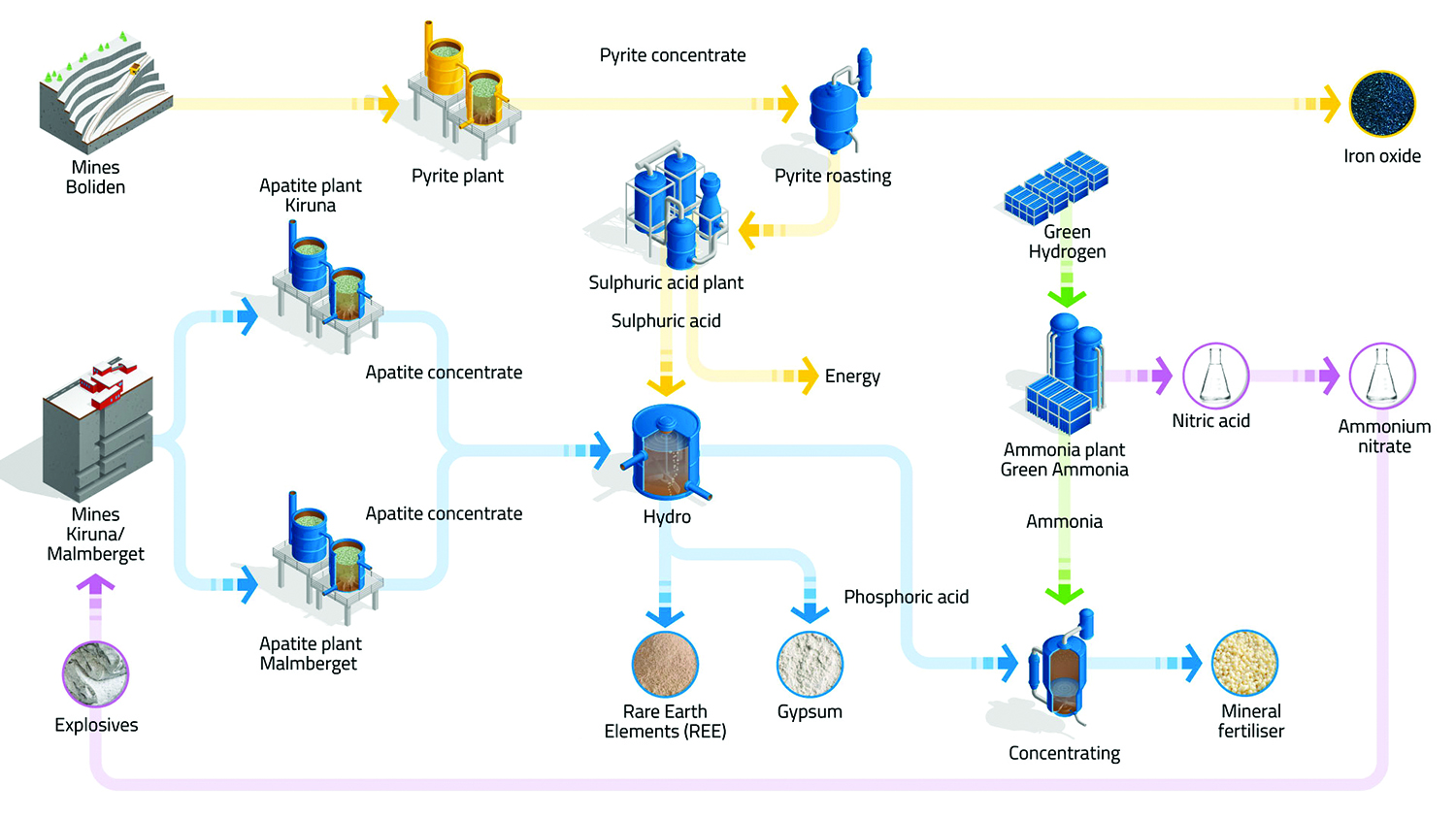

In November 2021, Sweden’s two biggest mining and minerals companies — LKAB and Boliden — announced they were working together to investigate the possibility of extracting pyrite concentrate from mine waste at Boliden’s Aitik mine, which LKAB will subsequently process into fossil-free sulphuric acid. The sulphuric acid will then be used to extract rare earth elements (REEs) and phosphorus from mine waste generated at LKAB’s Malmberget and Kiruna mines.

This clever application of circular principles, which is part of LKAB’s ReeMAP project, not only eliminates a portion of both companies’ waste streams but will, in time, create a domestic supply of minerals which are critical to European supply security.

LKAB’s Chief Technology Officer, Professor Pär Jonsén, spoke to E&MJ about the project: “This is a business case that we built together with Boliden,” he said. “Today, Boliden’s waste material from the Aitik mine contains pyrite, this is what we plan to process into pyrite concentrate. It will be transported by train to LKAB’s planned Industrial Park for critical minerals in Luleå. The pyrite will be used to produce sulphuric acid and the excess heat generated can be used in the industrial park. Large volumes of iron oxide will also be produced as a by-product. The project has re-use of mine waste, resource efficiency and minimizing waste as an overall goal.”

The ReeMAP process uses multiple steps of flotation to separate apatite from LKAB’s non-valuable tailings prior to their deposition in a traditional TSF, and the same approach will be used at Aitik for the pyrite. Both companies have significant expertise in mineral processing and the development of circular business models. Jonsén said that, today, more than a third of LKAB’s industrial minerals business is based upon upgrading waste and by-products.

How is work progressing? E&MJ asked.

“So far, all is going according to plan,” replied Jonsén. “For LKAB, we will use the pyrite for our roasting and sulphuric acid production processes. The project is dependent upon environmental permitting, both for LKAB’s production of apatite concentrate in Malmberget and the industrial park in Luleå, including the production of sulphuric acid based on pyrite from Aitik. The plan is to industrialize in stages during the upcoming years, starting with the extraction of REEs and phosphorus, which in turn is dependent on the pyrite concentrate from Boliden.

“This is an important partnership for us as we want to be as circular as possible when we build products from our waste. The extraction of critical minerals, such as phosphorus and REEs from our existing waste streams requires significant quantities of sulphuric acid. Rather than this being produced using products from oil refineries, the waste streams from Aitik hold great potential. Increased resource utilization combined with potential profitability may mean that, together, our companies can provide even more value in the climate transition.”

Schematic diagram showing the flowsheet for the ReeMAP project. (Image: LKAB)

Securing EU Critical Mineral Supplies

The objectives of the ReeMAP project, once fully operational, are: to recover and upgrade mine waste to produce phosphorus corresponding to five times Sweden’s current demand (400,000 metric tons of apatite concentrate which is upgraded to phosphoric acid and mineral fertilizer products); 2,000 mt of REEs to Europe; produce fluorine for the chemicals industry and for medical applications; and gypsum — enough to cover all building construction needs in Sweden. No REEs are currently mined in Europe, which means that LKAB could become one of the first producers of these critical minerals.

“The planned industrial park is initially based on today’s existing mine waste streams,” Jonsén explained. “The concentrations are not extremely high, but the volumes are large since we’re already mining the ore to access the iron. This means it will be an important contribution for Sweden and the EU’s self-sufficiency, and reduced dependency on China and Russia when it comes to REEs and phosphorus fertilisers. LKAB already mines around 85% of all iron ore produced within the EU.

“As further expansion potential, we recently reported the exploration results from the Per Geijer deposit north of Kiruna, showing that the deposit contains up to seven times more phosphorus than the orebodies that LKAB is currently mining in Kiruna. Further studies have shown the deposit has more than 1.3 million metric tons of rare earth oxides. If mined, this would mean great expansion potential and contribution to the EU’s self-sufficiency.”

ReeMAP has naturally generated a lot of interest within the international mining community, and Jonsén said that LKAB hopes to inspire other companies to further embrace circular mining.

“There are many companies in our industry that have demonstrated a strong commitment to material efficiency, and we draw inspiration from their efforts as well,” he said. “It’s important to acknowledge that each company operates under unique circumstances. What sets us apart is our comprehensive approach to circular and fossil fuel-free production with a strong focus on utilization of by-products generated during our processes. This perspective has garnered particular attention, as it aligns with our commitment to a sustainable future.”

Hydraulic Dewatered Stacking (HDS) system at Anglo American’s El Soldado mine in Chile. (Photo: Anglo American)

Anglo American Fosters Industry Collaboration With HDS License Model

Another project which has garnered much attention is Anglo American’s Hydraulic Dewatered Stacking (HDS) technology; a concept that forms part of the company’s FutureSmart Mining approach and aims to safely dispose of mine tailings while recovering valuable water which would otherwise be lost to evaporation or seepage from a tailings pond. Approximately 80% of Anglo American’s assets are already located in water-constrained areas, so reducing dependency upon local supplies is key to their sustainability.

Phil Newman, Anglo American’s Innovation Lead, spoke to E&MJ about the development of HDS and how the project is progressing.

“Anglo American was investigating the application of coarse particle recovery (CPR) when we recognized the unique properties of the rejected sand from a CPR circuit,” he explained. “We initially patented the combination of CPR and discrete CPR sand stacking in 2016. We then considered the potential to blend tailings and CPR sand while still retaining the rapid dewatering properties of a final tailings stack. This led to a second patent on blended stacking.”

During 2019, it was hypothesized that the free draining sands, which were unique in that they contain little or no ‘fines’ (particles smaller than 75 microns), could be used in an engineered co-disposal tailings storage design to effectively wick water from the tailings. This led to a ‘wicking’ patent and the concept of HDS was born.

Laboratory trials were initiated immediately, and a proof-of-concept design developed, involving a 1m x 1m x 1.5m heavily instrumented Perspex box.

“The results from this test work were very encouraging with saturation levels of 60%-80% recorded, thereby reducing the risk of liquefaction, delivering improved water recovery and rapid consolidation,” said Newman. “Following these results, Anglo American initiated a 150,000 m3 demonstration at its El Soldado copper mine in Chile. Permits were granted in 2021 and construction finished in 2022. The demonstration is now approaching the halfway stage and results have been encouraging, with water recovery exceeding the 80% target we had set.”

While the HDS demonstration at El Soldado is being piloted at a small scale, Newman said the process is designed to be scalable and the company is evaluating the approach across a range of potential applications, both across and beyond its operations.

“The provision of the fines-free sand could be considered an obvious constraint,” he explained. “So, a precious metals operation with a very fine grind material and no CPR process employed could experience challenges with the approach, but it would need to be assessed. Tailings with a high acid generating potential may also not be suited to HDS, since the fines-free drainage sand used in the channels will wet and dry a number of times.”

The El Soldado demonstration has successfully operated under both summer and winter conditions, and it continues to dewater rapidly, delivering consolidated tailings within the design parameters. According to Newman, two variations of the initial patent are being tested, while engineering and design studies continue to take the learning and work of the HDS team forward to develop large-scale operating systems.

“During June this year, we initiated a second demonstration at our Mogalakwena mine in South Africa targeting the application of HDS in an existing facility,” he told E&MJ. “This is significant in that existing facilities can, in some instances, be reconfigured mid-life to take advantage of HDS, thereby offering the potential to improve their water recovery and reduce closure costs.”

He added that Anglo American continues to evolve HDS and improve its understanding of the scientific and engineering challenges. “Robust and efficient sand placement is key to delivering a safe technology that can keep pace with the scale of modern mining operations,” said Newman. “We have good relationships with some OEMs who are applying their innovative mindset to develop bespoke equipment to improve execution. While the concept was conceived from our work on CPR, the approach can also be applied to many mines that don’t use CPR.”

Importantly, Anglo American is looking for partnership opportunities to further develop and license HDS – this is tailings management as a business model.

Newman explained: “Anglo American believes the technology has the potential to change the conversation on tailings management and make a difference to the mining industry. We’ve recently seen an increase in cooperation between mining companies on sustainability issues, and tailings in particular. Within the license model, we’re proposing a community of practice that will build on this collaborative approach and drive cooperative innovation, sharing of technical information and experience. As with all technologies, learning will continue apace for the first few years, and it’s in the wider interest of the mining industry to accelerate safe and reliable implementation.”

In summary, today, through a combination of partnerships, the development of more stable, unsaturated TSFs which can be re-purposed quickly, and possibilities for waste valorization, mining companies can realize options to deliver a positive socio-economic and environmental impact in the regions in which they operate. And that, is a very good thing indeed.