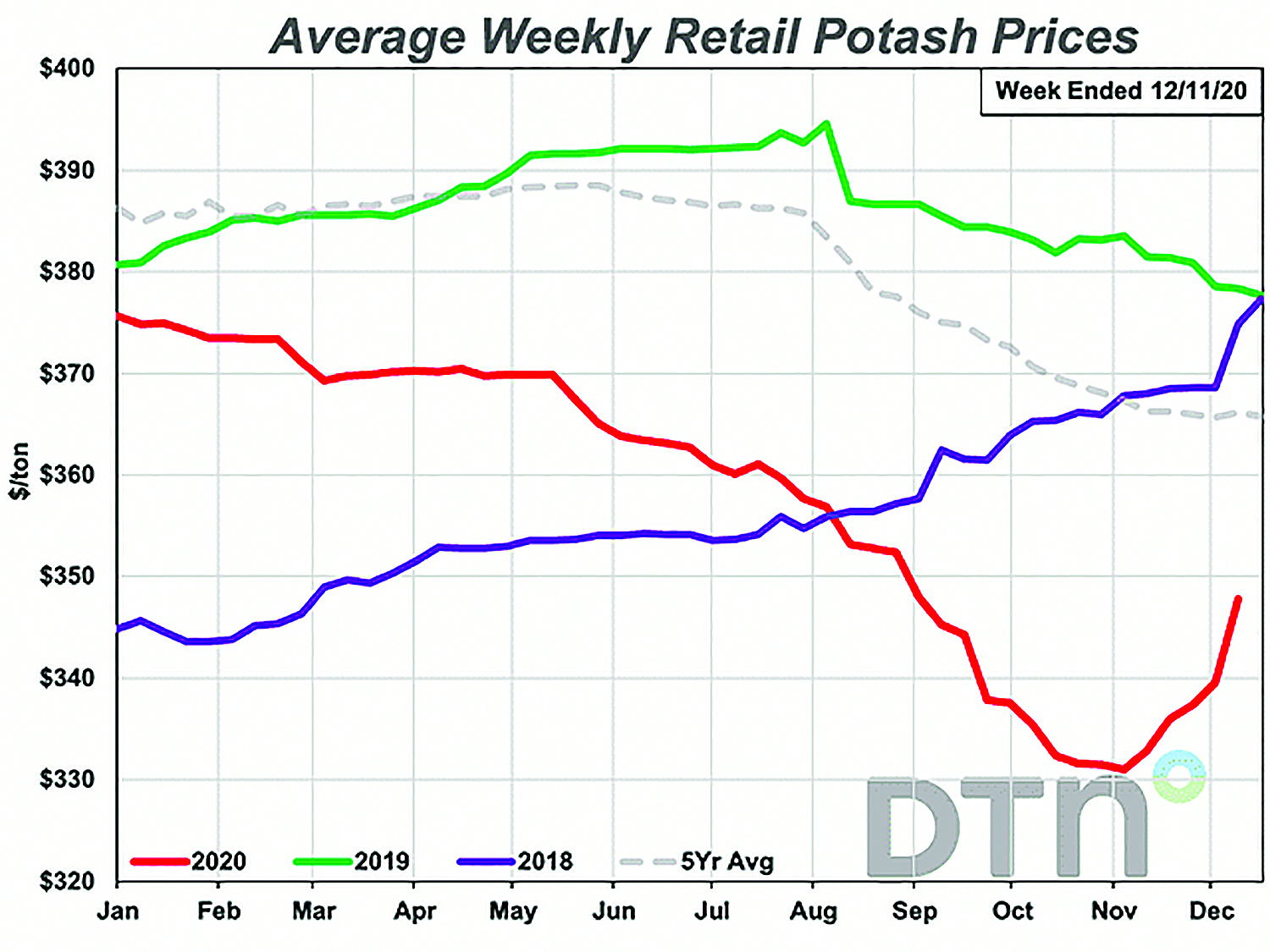

Prices for potash, which is used as a fertilizer, plummeted with the COVID-19 disruption in 2020. The market is now tightening and spot prices are increasing from recent three-year lows. While they have a long way to go before achieving the highs experienced in 2019, potash prices are heading in the right direction for miners.

Prices for potash, which is used as a fertilizer, plummeted with the COVID-19 disruption in 2020. The market is now tightening and spot prices are increasing from recent three-year lows. While they have a long way to go before achieving the highs experienced in 2019, potash prices are heading in the right direction for miners.

For the third week of January, DTN reported at average retail price for potash of $379/ton, which was up $14/ton from the same period in December. DTN tracks market data for North American farmers. That would be equivalent to $418 per metric ton (mt).

During early February, Intrepid Potash announced it was increasing its

potash prices by $50/ton at all locations for all new orders, saying that

the potash prices were now $140/ton above the 2020 summer-fill value. “Intrepid continues to benefit from great early season demand for fertilizers as increasing commodity prices, tightening inventory levels and strong farm economics are quickly leading to the best spring season in years,” Intrepid Executive Chairman, President and CEO Bob Jornayvaz said.

The market leaders, Nutrien and Mosaic, were planning fourth-quarter announcements for mid-February and not commenting on the market. Nurtien and its agent Canpotex, however, were complaining about the Belarusian Potash Co.’s (BPC) recent potash sales to China and India.

BPC signed a potash supply agreement with China at a contract price of $247/mt CFR ($224/ton), saying it would be a $27/mt increase from its previously reported China contracts. A month earlier, BPC signed an agreement to supply Indian Potash Ltd. 800,000 mt at a price of $247/mt CFR. BPC exports the potash mined by JSC Belaruskali and controls up to 20% of the global supply.

Canpotex said these prices were significantly below current market levels for potash in key offshore markets and a complete disconnect from the strong fundamentals currently being seen for major agricultural commodities in numerous growing regions throughout the world. Record potash shipments were made in 2020, and Canpotex anticipates further export market demand growth in 2021.