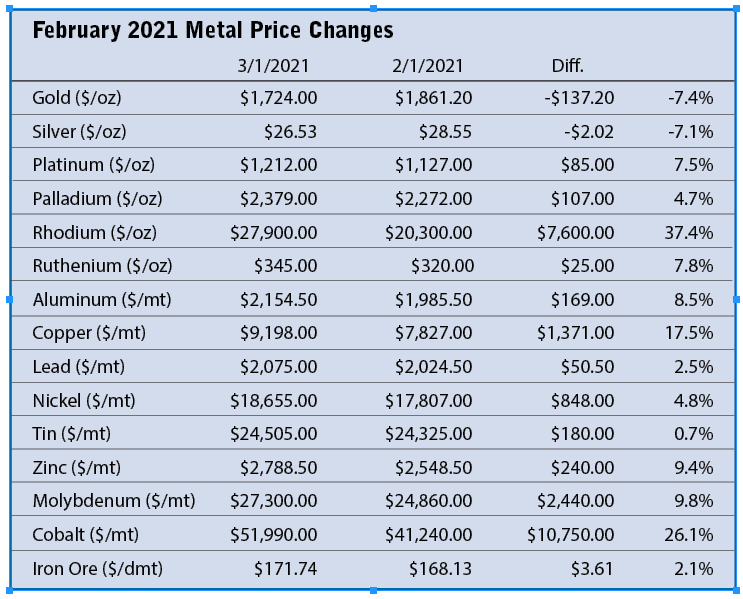

Copper, cobalt and palladium continued their upward march last month. During February, copper prices climbed 17.5% to $9,198 per metric ton (mt) or $4.18/lb from $7,827/mt or $3.56/lb. This was the largest monthly gain for copper since 2016. A imbalance of supply versus demand created when smelters in China recovered from COVID-19 before many of the mines could reopen is pushing copper prices to new highs. As the economic recovery grows globally, copper demand will continue to increase.

Copper, cobalt and palladium continued their upward march last month. During February, copper prices climbed 17.5% to $9,198 per metric ton (mt) or $4.18/lb from $7,827/mt or $3.56/lb. This was the largest monthly gain for copper since 2016. A imbalance of supply versus demand created when smelters in China recovered from COVID-19 before many of the mines could reopen is pushing copper prices to new highs. As the economic recovery grows globally, copper demand will continue to increase.

Nonferrous base metals as a whole did well during February. Zinc and aluminum finished February up 9.4% and 8.5%, respectively. Iron ore climbed to $171.74 per dry metric ton (dmt) from $168.13/dmt.

Cobalt prices climbed more than 26% to $51,990/mt or $23.63/lb from $41,420/mt (or $18.75/lb). Market demand and speculation continues to drive the prices for battery minerals, such as cobalt, to new highs.

Platinum group metals rallied as well. Platinum prices increased $85/oz (or 7.5%) to $1,212/oz from $1,127/oz. Palladium continued to push its way toward $2,500/oz, posting a $107/oz gain (4.7%) to $2,379/oz. Traders and speculators were simply saying the lack of metals is driving prices higher. Rhodium climbed 37.4% to $27,900/oz from $20,300/oz last month.

Gold and silver lost their luster during February. U.S. Treasuries and the dollar strengthened, taking more steam away from the gold rally. Gold prices fell $137.20/oz (7.4%) to $1,724/oz from $1,861.20/oz. Silver followed suit, falling $2.02/oz (7.1%) to $26.53/oz from $28.55/oz.

Mining costs are also on the rise as inflation sets in. Morgan Stanley Research reported a 30% year-on-year increase in its Mining Cost Index as the cost for key inputs such as steel, rubber, diesel fuel and energy continue to increase. The firm explained that this is not necessarily bad news as historically, profit margins for mining companies increased during periods of robust demand.