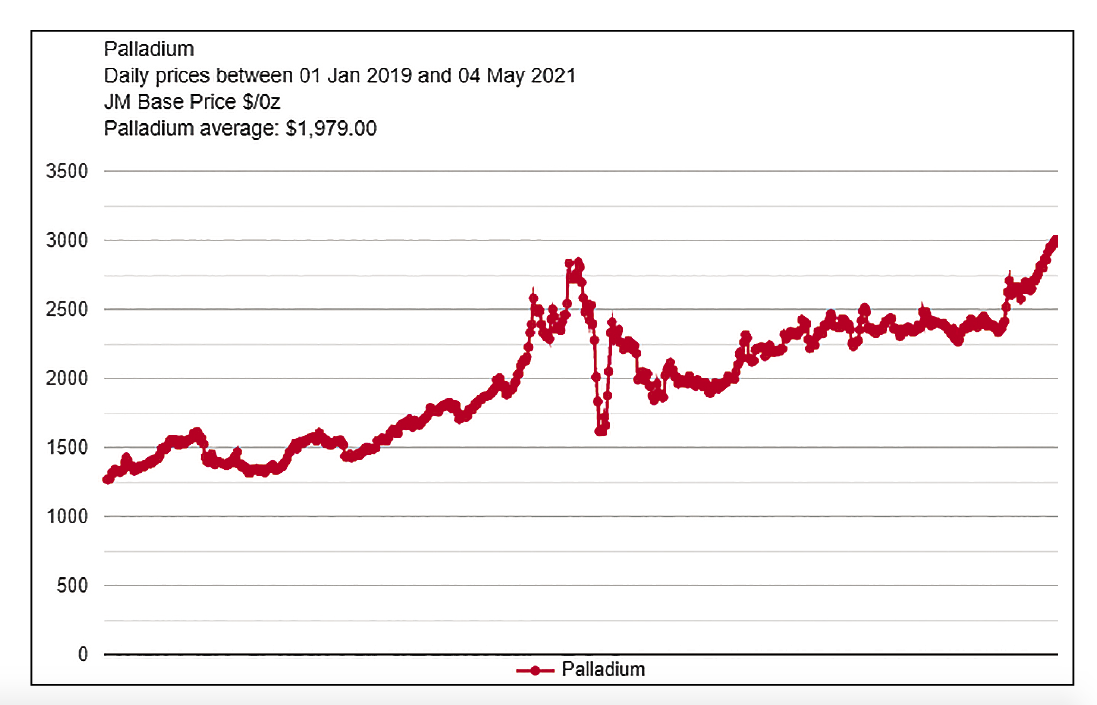

Prices for several metals, namely palladium, copper and iron ore, continued to press higher during April. Palladium reached an all-time high of $3,011/oz on May 4, which was a 13.7% increase over last month ($2,648/oz). Palladium prices reached multiple record highs during April, topping the highs last seen in 2020. The global recovery and the market for vehicles sales bode well for the metal, which is used for catalytic converters and emission control in gas power vehicles. Platinum group metals were up across the board, including platinum (4.2%), rhodium (8.9%) and ruthenium (13.8%).

Prices for several metals, namely palladium, copper and iron ore, continued to press higher during April. Palladium reached an all-time high of $3,011/oz on May 4, which was a 13.7% increase over last month ($2,648/oz). Palladium prices reached multiple record highs during April, topping the highs last seen in 2020. The global recovery and the market for vehicles sales bode well for the metal, which is used for catalytic converters and emission control in gas power vehicles. Platinum group metals were up across the board, including platinum (4.2%), rhodium (8.9%) and ruthenium (13.8%).

“PGM markets remain tight with the fundamental outlook for these metals positive,” said Neal Froneman, CEO, Sibanye Stillwater, which operates the Stillwater palladium mine in Montana. “In the medium term, the rollout of COVID-19 vaccines across the globe continues and stimulus measures will drive a global economic recovery. Longer term, our PGMs and green metals are expected to continue to play a critical role as global sentiment shifts toward a more environmentally conscious future.”

Copper prices reached $4.53/lb, a 13.6% improvement over last month, and were also approaching record highs of $4.58/lb from February 2011. Capstone Mining, a mid-cap copper miner, reported its first-quarter 2021 results at the end of April. “Q1 2021 operating cash flow of $95 million was the strongest in our 15-year history as a producer. Excellent operating performance and cost containment in a higher copper price environment surpassed our expectations,” said Darren Pylot, president and CEO of Capstone. “We are now debt free and generating cash flow.” Non-ferrous base metals as a whole were up across the board, including aluminum (10%), lead (11.5%), nickel (11.6%), tin (18.4% and zinc (7%).

Iron prices also climbed 15.9% month-on-month to $189.72 per dry metric ton, which was also testing its 10-year high. “As the year progresses, it will become abundantly clear that the pricing environment we are in — and will continue to benefit from going forward — is not a consequence of luck,” Cleveland Cliffs Chairman, President and CEO Lourenco Goncalves said. “This will allow us to generate record levels of free cash flow and pay down a substantial amount of debt. With our leadership position in the industry, we are as focused on profitability as we are on environmental stewardship and on supporting good paying middle-class union jobs. Our commitment to reduce our environmental footprint will further strengthen America’s position as the cleanest steelmaking country among all the major steel producing nations.”