Students gather around a haul truck simulator at a career fair. (Photo: ASARCO)

ASARCO has a major focus on educating the public on the importance of mining to their everyday lives and on developing the next generation of miners. Recently, ASARCO participated in the Southern Arizona Construction Career Days in Tucson and the Mines for Limitless Minds Career Fair at the University of Arizona (UofA). The 2-day Construction Career Days annual event provides hands-on experiences to more than 3,500 students from 6th through 12th grades.

The company brought its haul truck simulator to the fair, courtesy of the Mission mine, giving kids the opportunity to explore what it would be like to drive one of these giant machines in a mine. Trainers spoke to students about their experience at the mine and the job opportunities available.

The UofA career fair offered college students the chance to explore high-paying job opportunities and to interface with local employers among not only ASARCO and other mining companies but also with many local businesses that provide highly specialized goods and services to the industry.

ASARCO’s Education Committee represents a collaboration of industry partners that have come together to create compelling curricula for schools and career pathways for students to understand their local and global mining career choices. Mining education is a special priority in the communities where ASARCO operates and is the cornerstone of ASARCO’s outreach as demonstrated at ASARCO’s Mineral Discovery Center south of Tucson.

Since opening its doors in 1997, the ASARCO Mineral Discovery Center has been implementing its founding vision to educate communities on the vital importance of the copper mining industry to civilization, to educate students and teachers in earth sciences, and to preserve Arizona’s mining history.

On Wednesday through Sunday each week, the center invites guests to take a free self-guided tour of indoor and outdoor exhibits that walk visitors through the copper mining process to the end uses of this metal that is crucial to their everyday lives. Visitors can then join a bus tour of the ASARCO Mission copper mine for a firsthand look at the 2.5-mile long by 1.5-mile wide 1,200-foot-deep open pit mine on 20,000 acres composed of the Mission, Eisenhower, Pima, Mineral Hill, and South San Xavier properties and the nearby North San Xavier mine.

The Discovery Center is suitable for all ages and ASARCO supports Arizona schools by encouraging teachers to bring their students to the center on field trips providing them with free transportation. No visit to the site would be complete without taking time to peruse the company store for unique, beautiful, and often educational gifts.

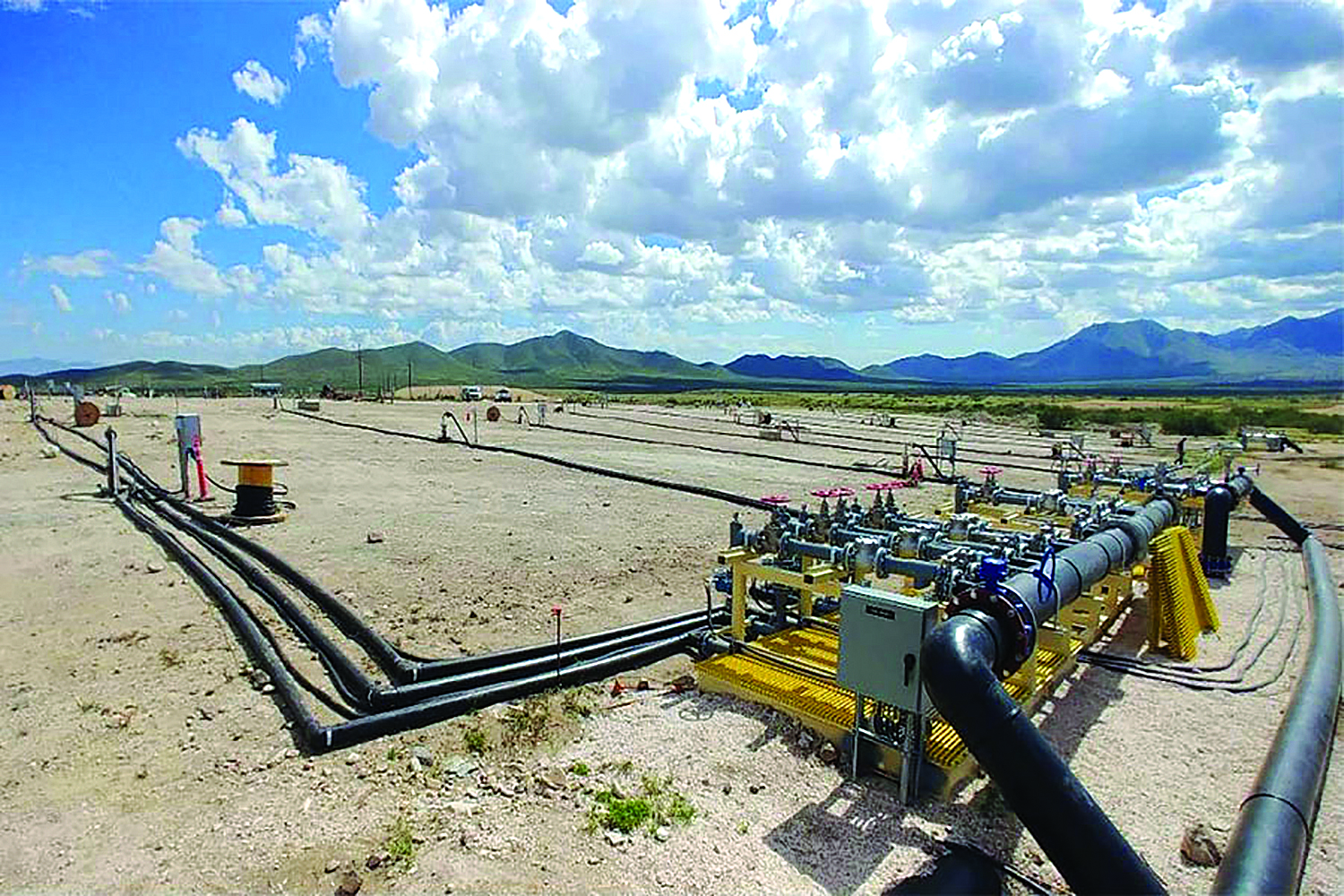

Wellfield stimulation has the potential to fundamentally change the performance of Excelsior’s ISR wellfield at its Gunnison project. (Photo: Excelsior)

Excelsior Provides Update on Mining Activities

Excelsior Mining Corp. is working the mining camp encompassed by the Gunnison copper project, the past producing Johnson Camp copper mine (JCM) and the Strong and Harris exploration projects, all of which are located in Cochise County, Arizona. The Gunnison project is a low cost, environmentally friendly in-situ recovery (ISR) copper extraction project that is permitted to 125 million lb/y of copper cathode production.

“There are relatively few large copper development projects in safe jurisdictions around the world that have our permitting track record and near-term production potential,” said Stephen Twyerould, president and CEO of Excelsior. “[The camp has] the combined potential for more than 150 million lb/y of copper.”

Additional well stimulation modeling has been completed at Gunnison, which supports the results of prior modeling, indicating well stimulation has the potential to greatly improve flow, connectivity and permeability, thereby improving sweep efficiency and gas bubble removal. The company has identified contractors for certain aspects of the well stimulation trials and long-lead item equipment has been acquired or ordered.

Excelsior is taking a broader and more integrated view of the entire mining camp under its control, including the potential for a large, centralized processing facility taking advantage of the recent advances in sulphide leaching technology, like those provided by Nuton LLC, combined with more traditional mining approaches like large open pit mining.

During July 2023, Excelsior entered into an option agreement with Nuton to evaluate the use of its copper heap leaching technologies at JCM. Under the agreement, Excelsior remains the operator and Nuton funds Excelsior’s costs associated with a two-stage work program at JCM. Nuton will provide a $3 million pre-payment to Excelsior for Stage 1 costs and a payment of $2 million for an exclusive option to form a joint venture with Excelsior on JCM after the completion of Stage 2.

“With Nuton’s support and technologies, we have the potential to realize the value of the sulphide resources at JCM in a way that is both economical and beneficial to the environment,” Twyerould said. “JCM has the potential to progress towards cash-flow while we continue to develop our other assets, including progressing Gunnison towards well-stimulation trials.”

The Stage 1 program involves Excelsior completing diamond drilling, permitting activities, detailed engineering, and project execution planning. Nuton will complete mineralogy, predictive modeling, engineering and other test work. Based on the results of the Stage 1 work program, Nuton has the option to proceed to Stage 2. The Stage 1 work started in August and will take 6 to 9 months to complete.

If Nuton proceeds to Stage 2, it will make a $5 million payment to Excelsior for the use of existing infrastructure at JCM for the Stage 2 work program. Nuton will also be responsible for funding all of Excelsior’s costs associated with Stage 2. The full Stage 2 work program is anticipated to take up to five years. Revenue from operations will first be used to pay back Stage 2 costs to Nuton and will then be credited to Excelsior’s account.

L-R, Bryan Seppala, principal advisor economic development and social investment, Resolution Copper; Superior Mayor Mila Beisch; Vicky Peacey, general manager, Resolution Copper; and Superior Town Manager Todd Pryor. (Photo: Resolution)

Resolution Signs Economic Agreement With Superior

The town of Superior, Arizona, and Resolution Copper have signed a Regional Economic Development (RED) agreement, cementing a collaborative effort to fortify Superior’s economic landscape. This historic agreement marks a significant step toward ensuring a prosperous and resilient future for the community, according to Resolution Copper.

The 3-year, multi-million-dollar agreement is a commitment to fostering economic growth and supporting vital community initiatives. With a focus on multifaceted de-

velopment, this partnership will bolster essential projects and programs that directly benefit the residents of Superior.

Superior Mayor Mila Besich expressed her enthusiasm. “This agreement continues our ongoing alignment to achieve a diversified and sustainable economy for a resilient Superior community,” she said. “The collaboration with Resolution Copper underscores our dedication to nurturing economic opportunities and enhancing the quality of life for our residents.”

Vicky Peacey, president and general manager of Resolution Copper, echoed those sentiments, emphasizing the transformative impact of this collaboration. “We are thrilled to continue our long-term partnership with Superior to drive economic development and community empowerment,” she said. “This partnership reflects our shared vision for a thriving Superior, focusing on initiatives that support education, workforce development, and the overall well-being of the community.”

The agreement’s focal points encompass a wide array of initiatives, including substantial support for the Superior Multi-Generational Center and the Superior Enterprise Center/Workforce Development Center. These funds will enable community service programming, capital improvements, and robust workforce development programs.

Moreover, the agreement will propel Superior’s annual marketing and tourism program, amplifying efforts to attract visitors and stimulate economic activity. The infusion of resources will also advance economic development capacity, maintain senior economic advisory services, and fortify an economic development toolkit, further solidifying Superior’s economic foundation.

In a bid to foster educational advancement, the agreement champions the new Superior Lego Robotics program for grades 4-5, fostering innovation and STEM education among the youth. Additionally, it extends support to the Superior Youth Council, empowering young leaders to actively engage and contribute to the town’s growth.

Arizona Gold Begins Leach Test Work on the Philadelphia Project

Arizona Gold & Silver Inc. started initial column leach test work on its Philadelphia gold-silver property, located in Mohave County, Arizona, during December 2023. Arizona Gold is a young exploration company focused on exploring gold-silver properties in western Arizona and Nevada. The flagship asset is the Philadelphia gold-silver property where the company is drilling an epithermal gold-silver system.

“Column leach test work will be performed on two bulk samples taken from underground workings and from a bench on the surface,” said Greg Hahn, vice president-exploration for Arizona Gold. “The tests are the standard method for determining the amenability of oxide gold and silver bearing material to heap leach methods. This program will establish on a preliminary basis the optimum crush and recovery characteristics for potential heap leaching.”

Additional column test work and agitation leach test work is planned for 2024 on dedicated drill core samples and coarse rejects of reverse circulation (RC) cuttings from both the high-grade veins and the stockwork mineralized zones throughout the deposit. This will characterize the leach characteristics and kinetics along the entire strike length of the deposit.

During November, the company published a non-resource technical report on the Philadelphia property. It provides a detailed summary of the property status and all of the historical exploration activity prior to Arizona Gold’s tenure, as well as a up-to-date summary of the exploration activities undertaken by Arizona Gold, including a summary of the 141 drill holes completed on the property to date.

The recommended work plan includes 25,000 ft of both RC and core drilling along the strike and dip of the mineralized target identified by drilling to date, mostly confined to “gaps” within the existing drilling database to provide sufficient drilling density to commission an NI43-101 maiden resource report at the end of the proposed drilling campaign.

Bradda Receives ‘Highly Encouraging’ Test Results

Bradda Head Lithium Ltd. announced what it described as “highly encouraging” metallurgical test results on samples taken from the Jumbo exploration target at the company’s project in the San Domingo District, Arizona. Bradda is positioning itself as a new breed of lithium explorer with exposure to the three types of lithium deposits: brine, hard rock (pegmatites) and sedimentary (clays). The main focus is on the company’s sedimentary assets in Arizona, to develop lithium assets with a zero carbon footprint.

The lithium explorer said the test results were better than expected, albeit preliminary, with contractor SGS able to produce a “sellable” Li-oxide concentrate product through a dense media separation process (DMS) with a measured head grade of 3.05% from high grade sample material, 1.03% from medium grade and 0.34% from lower grade material.

Metallurgical test work has now paused, pending further samples from the company’s newer drilling.

“To produce an ‘in spec’ sellable gravity concentrate reflecting more than 50% recovery to the concentrate from a sample grading 1.03% Li2O on first pass test work is simply mouth-watering,” Executive Chair Ian Stalker said. “DMS is a standard, low cost, simple process with a small, relatively non-invasive footprint. It’s the kind of processing operation that is quick to design and install, and yet can deliver very attractive economic returns.

“We are therefore highly encouraged, and when the next phase of drilling at San Domingo is complete and sufficient sample material is available, we will revert quickly to SGS with a more detailed test work and study program to further the above objective,” Stalker said.

Intrepid Closes MAN Acquisition

During December 2023, Intrepid Metals Corp. closed its previously announced option to acquire a 100% interest in the MAN Property from Mining and Mineral Opportunity Ltd. (MMO) within its Corral copper project, in Cochise County, Arizona. The Corral copper project area includes 50,000 meters (m) of historical drilling data, with shallow copper and gold mineralization of copper.

The terms of the agreement give Intrepid the option to acquire a 100% interest in the property in return for certain cash and share payments. Intrepid has made the initial $200,000 cash payment and issued 3.5 million shares to MMO. Intrepid will take over as operator of the property and will be responsible for future exploration work and maintaining the properties in good standing.

“We are very pleased to close this integral acquisition as it completes the consolidation of a 3 km trend of impressive copper and gold mineralization within our larger Corral Copper Project area,” said Ken Brophy, CEO of Intrepid. “We are excited to begin to unlock the value within the district as the previous fragmented land ownership has acted as a barrier to a district scale approach to exploration and development. We now control over 9,500 acres, with 1,800 acres made up of patented mining claims and additional surface rights that host the mineralized trend.”

Located 15 miles east of Tombstone, the Corral copper project is a district scale advanced exploration and development opportunity. The district has a mining history that dates back to the late 1800s, with several small mines extracting copper from the area in the early 1900s, producing several thousand tons with grades up to 9.2% copper ore. Between 1950 and 2008, various companies explored parts of the district, but the effort was uncoordinated and focused on discrete land positions due to the fragmented ownership.

Intrepid has been able to secure data from various sources which provides a solid foundation in creating geological interpretations and identifying new target areas. By combining modern exploration techniques with historical data and with a clear focus on responsible development, Intrepid said it is confident the Corral copper project can quickly become an advanced exploration stage project and move towards feasibility level studies.

Arizona Metals Acquires Additional Private Lands

Arizona Metals Corp. completed the acquisition of a private land parcel totaling 46.4 acres, located 950 meters northeast of its Kay Mine deposit for $2.5 million. The property was acquired from an arm’s length California-based public company and the transaction included the surface, mineral, and water rights, among other rights and benefits.

“Including the 71 acres of patented land that host our Kay Mine deposit, this acquisition will increase our total holdings of private and patented land to 224 acres,” Arizona Metals CEO Marc Pais said. “The property is contiguous with and adjacent to the 107 acres of patented land (including water rights and wells) the company acquired in January 2021. The additional flat land we are acquiring increases the private land suitable for future mine infrastructure by more than 40% and is in-line with our vision of a minimally-disruptive operation.

“We believe that our Kay Mine project has the potential to become one of Arizona’s newest and highest-grade copper-gold-zinc-silver mines, with the main deposit and potential for all infrastructure to be located on private land,” Pais said. “This would allow for a small footprint while also providing high-paying jobs to the local community of Black Canyon City.”

The Kay Mine property is located on a combination of patented and Bureau of Land Management (BLM) claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a proven and probable reserve of 6.4 million tons at a grade of 2.2% copper, 2.8 g/mt gold, 3.03% zinc, and 55 g/mt silver. The reserve estimate has not been verified as a current mineral resource.