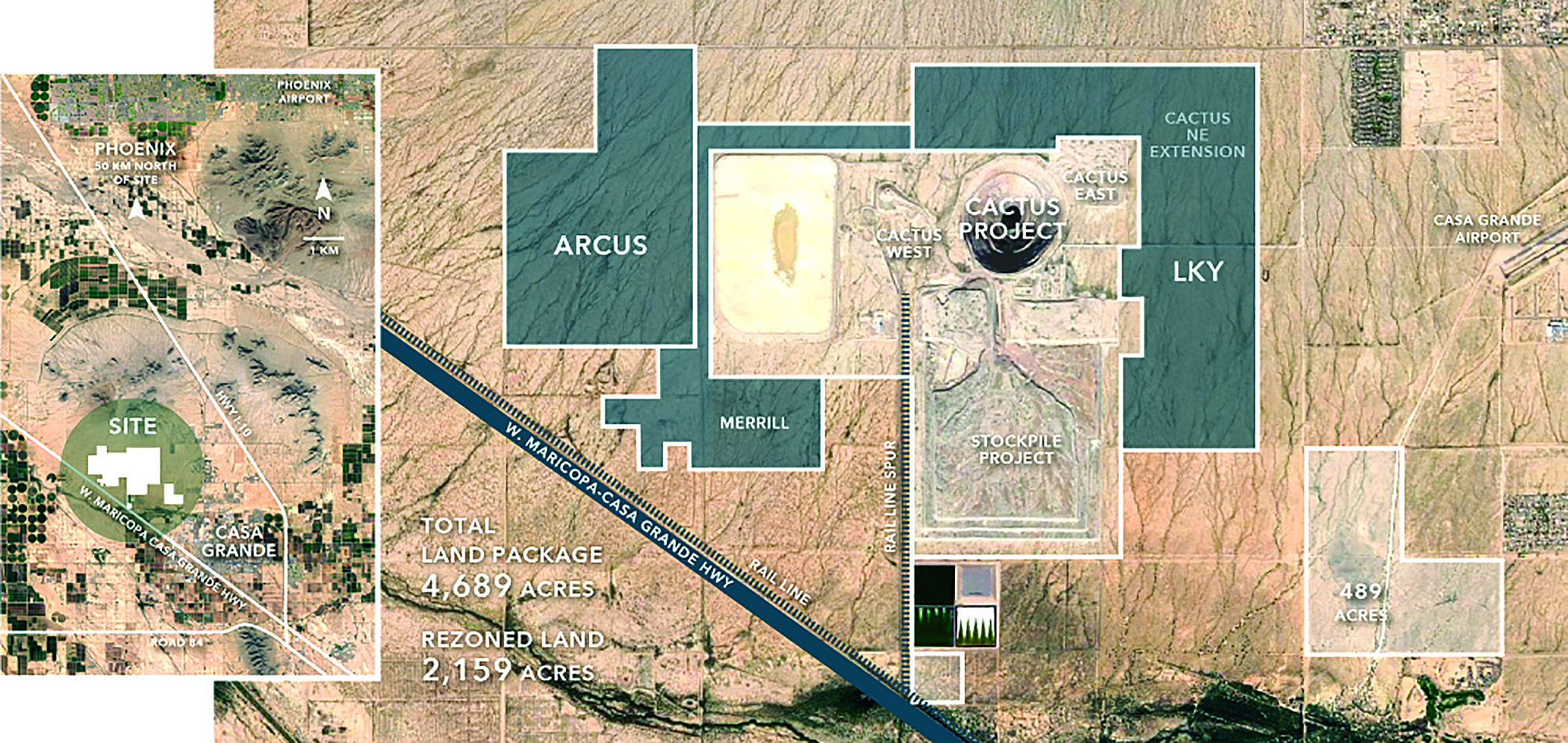

For the Cactus Project, ASCU assembles a 4,300-acre private land package surrounding the dormant Sacaton pit.

Using modern leaching techniques, mining company plans to reopen a dormant copper mine with a layered approach that begins with processing a waste pile

By Steve Fiscor, Editor-in-Chief, E&MJ

Headquartered in Tempe, Arizona, the Arizona Sonoran Copper Co. (ASCU) intends to develop the Cactus Project, which is located about 44 miles south of Phoenix near Casa Grande. Formerly known as the Sacaton mine, the Cactus Project today consists of a large private land package in copper country with an idled open-pit mine, a concrete lined shaft and a 500-acre, oxide-rich waste dump, and a significant copper mineral resource at Cactus West and Cactus East.

Yesterday’s waste dump has become today’s Stockpile Project. The current plan for the Cactus Project consists of three phases, the Stockpile, Cactus West and Cactus East, which span about 20 years. Back in the day when American Smelting and Refining Co.’s (ASARCO) was mining, the oxide cap was viewed as waste, and looking forward, ASCU plans to relocate the dump and use modern leaching technology to recover copper from it. Cactus West will involve reopening the pit and mining leachable ores with a layback that will ultimately lead to Cactus East portals accessing an underground leachable orebody.

During the last two years, ASCU has amassed a significant land package surrounding the Cactus Project. In July 2020, the company closed on a Purchase Agreement (PA) and a Prospective Purchaser Agreement (PPA) with the ASARCO Custodial Trust, Environmental Protection Agency (EPA) and the Arizona Department of Environmental Quality (ADEQ), respectively, to acquire ASARCO Sacaton-related land parcels now named the Cactus Project, as well as the remaining infrastructure and mineral rights. All of which was placed in a multistate custodial trust administered by the EPA as part of the 2009 ASARCO bankruptcy settlement, and subsequently remediated using the multi-state $20 million fund prior to the ASCU acquisition.

ASCU also purchased the neighboring Parks/Salyer Project, and acquired a prospecting permit for nearby land, owned by the Arizona State Lands Department. In 2021, the company purchased an additional 1,750 acres of land adjacent to the Cactus Project. Today, it holds more than 4,300 acres of private land.

With titles in hand, ASCU mobilized exploration drills to the site and began resource definition drilling, ultimately bringing Cactus West to an inferred status while confirming historical ASARCO drilling of Cactus East as indicated. Today, ASCU has estimated 1.6 billion lb of indicated and 1.9 billion lb of inferred resources for the Cactus Project, as reported in their 2021 NI 43-(101) compliant resource report and Preliminary Economic Assessment (PEA). The company has also completed additional reclamation work and plans to release a prefeasibility study (PFS) midyear 2022. Depending on the financing and the permitting processes, the company believes first production could be achieved by the second half of 2024.

An aerial photograph shows the pit in relation to the Stockpile Project and the reclaimed surface facilities.

Rich Copper History

ASARCO geologists first discovered the Sacaton mineral deposit in the early 1960s. “Focusing on an outcrop in the middle of a flat Sonoran desert, now known as Discovery Hill, these guys quickly found evidence of a leach cap and so they embarked on a six-hole exploration program, as the story goes,” ASCU COO Ian McMullan said. “Five holes in, they had not found the deposit. Another geologist came in from headquarters and had them drill in the opposite direction and they sunk a hole in the middle of what today is known as the Sacaton or Cactus West Pit.”

The ASARCO drilling program ultimately defined two copper mineralization zones, a west zone that contained an orebody that could be accessed by open-pit methods and a deeper east zone.

That discovery set the wheels in motion for a copper mining operation that ran from 1972 to 1984. Primary and secondary sulphide ores mined from the Sacaton pit was processed in a 9,000-ton-per-day (t/d) flotation mill and the concentrate was shipped to the ASARCO smelter in El Paso, Texas. ASARCO also sunk a shaft and performed some exploration drilling in the eastern zone, but didn’t get a chance to pursue it. The copper market softened, and the underground development was suspended in 1981.

The Sacaton mine was permanently closed at the end of the first quarter of 1984 after exhausting its reserves, but not before mining and processing more than 38 million tons of ore. Over the course of its life, Sacaton produced 400 million lb of copper, 27,455 oz of gold and 759,000 oz of silver.

What remains today is the pit, circular in shape (3,000 ft in diameter and 1,040 deep), the shaft and a 500-acre waste rock dump. The site also has a 300-acre tailings storage facility that has been revegetated. The ore crushing facility, flotation mill, maintenance buildings, and headframe have been dismantled and removed as part of the remediation process.

Seeing the Opportunity

When the Sacaton mine was operating, all of the oxides and all sulphide copper mineralization below a 0.3% copper-grade cutoff were discarded. That waste dump and its high mineralization by today’s standards formed the basis of ASCU’s Stockpile Project. Meanwhile, with the solvent extraction/electrowinning (SX/EW) being a tested and true processing technique, the company was keenly aware of the significant opportunity to extract and process the oxides and enriched ores left in the ground by ASARCO.

“When we first began to consider the site a couple years ago, we started looking at the records to better understand what resources were available,” McMullan said. “We realized there were oxides and enriched ores left in the ground, and an opportunity with the waste dump as far as low hanging fruit to access early mining activity to generate cash flow, while also advancing the in-ground ores, by reprocessing it on a leach pad.”

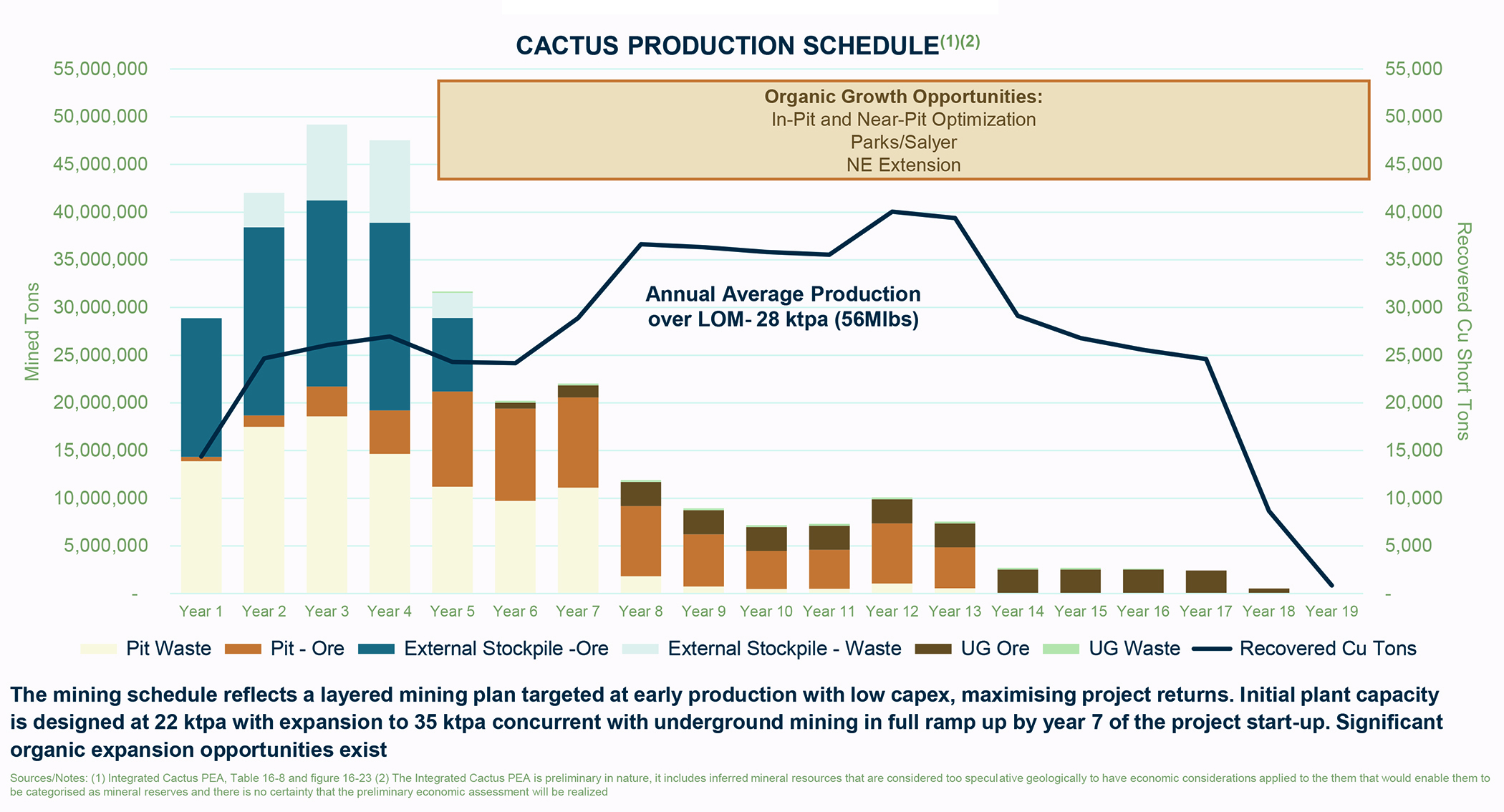

Following up on a March 2020 preliminary economic assessment (PEA) that only considered processing of the waste dump, or Stcokpile Project, ASCU published a PEA in August 2021 that considered three overlapping projects: the Stockpile Project, the Cactus West Project and the Cactus East Project. Material handling would begin with the Stockpile Project. As copper recovery begins in that area, ASCU would start the Cactus West Project, mining a layback. Once Cactus West is in full swing, the company will begin underground development at the Cactus East Project.

“We have designed this as a layered approach,” McMullan said. “We start with Stockpile mining, which is concurrent with pit stripping operations, such that by year four, when the Stockpile is winding down, mining activity in the pit has fully ramped up, and then by year six, we’re developing Cactus East. By year eight, the pit and underground are operating at capacity and by year 13, the focus transitions to underground mining.”

For the Stockpile and Cactus West projects, the current plan is to operate a large front-end loader with a small fleet of 100- to 150-ton trucks mining from multiple faces. “This is still in the planning stages, and we will determine the best mix of equipment for the PFS we are compiling,” McMullan said.

The other prize that ASARCO left behind was a concrete-lined, 20-ft diameter shaft that they had sunk to the 1,800-ft level. “From what we can tell from old records, they mined 500 ft laterally from the shaft bottom to establish a sublevel station,” McMullan said. “A pump station was in the process of being developed. We know they encountered water because they pierced a water bounding feature called the Basement Fault.” To date, ASCU has not identified any mineralization beneath the basement fault.

The current PEA considers transverse longhole stoping for the Cactus East Project. In year six, portal access to the underground orebody will be available when the pit layback reaches a depth of 700 ft, McMullan explained. “At that point, we will drive twin-portal declines more for ventilation and haulage later on when the mine reaches a steady state,” McMullan said. “It’s a quick run to the top of the orebody, and then from there, we would develop twin spirals to the bottom of the ore body. Midway down, we will drive a level in and through a 12- to 18-month process mine out a mid-sill and fill that with cemented rock.”

The Cactus Project’s annual average production over the life-of-mine is expected to be 56 million lb of copper.

Longhole stoping would take place from the mid-sill up to the top of the orebody, then development would begin from the bottom up to that mid-sill in the lower portion of the orebody. “This allows us to split the mine into two smaller mines, a little bit of a derisking feature, before ultimately reaching steady state production of 7,000 t/d,” McMullan said.

The annual average production over the life-of-mine is expected to be 56 million lb of copper. The PEA contemplates a hydrometallurgical approach using heap leach and SX/EW to process the oxidized copper resources in the Stockpile Project and the oxide and enriched sulphides in the Cactus Projects. Initial plant capacity will be designed at 22,000 t/y, expanding to 35,000 t/y concurrent with full ramp-up of underground mining by year seven of project startup. Significant organic expansion opportunities exist.

For the PEA, the Stockpile Project was drilled to an inferred category (400-ft spacing). “For the upcoming PFS, we will complete drilling on the Stockpile Project down to a 200-ft facing with a view to making that material resource improvement to indicated and then applying a mining plan and metallurgical recoveries,” McMullan said.

For the drilling on Cactus West, ASCU relied on historical data. Cactus East, the underground orebody, was largely already indicated from all the drilling ASARCO had done previously, McMullan explained.

“Since early third quarter, we have been drilling to bring Cactus West to an indicated level as well as doing some expansion drilling, step-out drilling of the Cactus East orebody, and we will bring portions of both Cactus East and West to a measured level by this time next year,” McMullan said.

ASCU expects to release a PFS report midyear 2022. “Because we will have accomplished a lot of early drilling and engineering upfront work during PFS, we think we can deliver the bankable feasibility study by the end of 2022,” McMullan said.

Permitting is never simple, but it is a streamlined process on private land, McMullan said. “There is no federal nexus,’ McMullan said. “We work with state, county and city regulatory agencies for all of our permitting. With an 18-month build, we could see first production by the second half of 2024.”

Reclaiming Brownfield Lands for Carbon-free Copper

Of the $71 million in funding established by custodial trust in 2009 to clean up 18 ASARCO sites in multiple states, $20 million was set aside to remediate the Sacaton site. The remediation of Sacaton was completed to the approval of the ADEQ prior to the acquisition by ASCU, McMullan explained. “The TSF was reclaimed with 8 in. of alluvium cover and hydroseed was applied,” McMullan said.

The waste dump was originally part of that reclamation plan and ASCU convinced the EPA to leave it out so the company could drill it. “We wanted to understand it a little better,” McMullan said. “It became an important aspect of the deal, whereby we would take on the waste dump as a reprocessing opportunity, which could also be viewed as a clean-up opportunity because we would be moving the material from an unlined facility to a lined facility. We would realize an economic benefit from doing so. Or, if we found it was not worth it, we would then have had to reclaim the waste dump ourselves in place.”

Reclaiming a brownfield site falls in line quite well with ASCU’s ESG (Environmental, Social and Governance) goals, McMullan explained, and part of that overall strategy is trying to be a low-carbon or carbon-neutral copper producer.

Indeed, ESG is a large part of ASCU’s upcoming PFS study and McMullan said it will feed into the ultimate capital requirements for the site. “When we first formed as a company back in 2019, all the way through to today, and especially given the proximity of our site to the local community, we have proven to all the local officials, including the mayor of Casa Grande, city manager, state county supervisors, and state governor’s office that we will be good neighbors,” McMullan said. “We want to be good neighbors to the community. It is a fundamental company value.”

There are a lot of considerations in the development of an ESG strategy. As an example, McMullan said ASCU secured water rights last year and plans to install technologies that will allow the mine to be a zero-discharge operator with respect to water. “As far as power is concerned, and more importantly, carbon emissions, we are working with external consultants to assess our carbon emission program including Scopes 1, 2 and 3,” McMullan said. “We’re very interested in electrifying as much of the site as we can. We’re also looking at alternate energy sources, possibly a solar facility. We have powerlines easily capable of supplying the minimum 8- to 12-MW load that the site will require.”

ASCU is currently discussing its needs with local energy providers. With its Palo Verde nuclear operating station, Arizona Public Service (APS) supplies energy that is about 50% carbon free. “As our main power supplier that gives us a leg up,” McMullan said. “We’re looking intently at how we can supplement the other 50%.”

ASCU is developing a long dormant site that could quickly become a midlevel copper producer in the next five or 10 years. Part of that strategy includes reinvigorating a brownfield and there are greenfield opportunities too, such as the Parks/Sayler orebody. “No one has ever really put a strong exploration program forward for it,” McMullan said. “That could be serious organic growth for us in the outlying years.”

The future is bright for Arizona Sonoran Copper Co. With companies like Lucid and Nikola moving into the neighborhood, there may be synergistic opportunities for a local, low-carbon copper supplier.