Crater Gold delivers the first new gold mine in the country in eight years

By John Miller, Australian Editor

The Crater Mountain gold project is in Papua New Guinea’s Eastern Highlands province, 50 km from Goroka.

The Crater Mountain gold project is in Papua New Guinea’s Eastern Highlands province, 50 km from Goroka.Under an impressive pedigree of gold exploration in Papua New Guinea (PNG), including one of the region’s most successful gold prospectors in Peter Macnab, Crater Gold Mining has emerged as a triumphant junior after seven years in the island nation. Crater Gold has delivered the first new gold mine in the country in eight years.

Crater Gold’s director of exploration, Macnab, has worked in PNG for more than 40 years and is a widely respected expert in the country’s geology. He was a co‐discoverer of the giant Lihir deposit and was involved in the discovery of several other world-class deposits in PNG, including Wafi, Frieda River, Misima and Simberi. Also adding to the pedigree is the company’s PNG General Manager Richard Johnson, who previously ran the successful Tolukuma gold mine.

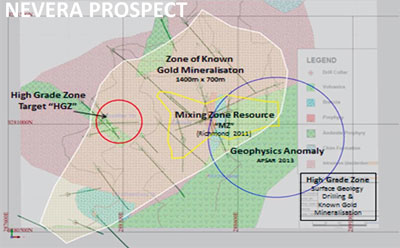

Led on the ground by Macnab and Johnson, Crater Gold’s flagship is the Crater Mountain project located in PNG’s Eastern Highlands province, some 50 km from Goroka. Considered a Tier 1 (highest level of prospectivity) by former owner BHP, Crater Mountain comprises four prospects, with most work focusing on the Nevera prospect where three mineralized zones, including a 790,000-oz gold resource, have been identified to date.

The island of New Guinea remains one of the world’s richest gold and copper provinces. It boasts a number of world-class copper and gold deposits including Grasberg, Ok Tedi, Porgera, Wafi-Golpu, Hidden Valley and Lihir, as well as a number of smaller deposits. Yet by international standards, the nation has only been lightly explored.

Despite being a developing nation, PNG has modern sophisticated mining legislation and supporting administrative infrastructure including a freely available database of all previous exploration activities. The government is highly supportive of the mining industry and sovereign risk is very low compared to other developing nations.

|

|

| The island of New Guinea is one of the world’s richest gold and copper provinces. | The various zones at the Nevera prospect. |

A Different Approach

Crater Gold CEO Greg Starr explained that upon embarking on its exploration in PNG in 2008, the company was initially targeting a very large scale, open-cut deposit of low-grade gold, in the style of Newcrest and Harmony’s Wafi-Golpu deposit.

At that time, the market wanted explorers to spend big money drilling deep holes looking for porphyry systems and bulk tonnage, low-grade deposits. However, that has all changed in recent times, and to survive, the company followed a route to exploit a small high-grade deposit, to do what Johnson refers to as sustainable exploration through development.

“Unfortunately, the market changed in 2012, and nobody was interested in looking for large-scale, low-grade gold deposits anymore,” Starr said. “However, during that time, we identified at Crater Mountain a high grade area, which we called the High Grade Zone (HGZ), about 300 m from the Mixing Zone, which contains the 790,000-oz gold resource.”

It is thought that some 15,000 oz of gold was produced by local miners at the HGZ from 2005 to 2012, largely from shallow underground workings and simple gravity processing. Their work highlighted the quickest path to generating cash flow for Crater Gold.

“We’ve been focusing on the HGZ since 2012 when Johnson became involved with the company, to a point where we secured a mining lease on November 5, 2014. This has enabled us to commence mining, generate revenue, and an overall operating cash flow in a short timeframe using a very simple and relatively inexpensive mining method,” Starr said.

Crater Gold’s Director of Exploration Peter Macnab inspects core along with other company team members.

Crater Gold’s Director of Exploration Peter Macnab inspects core along with other company team members.Crater Gold began mining at the HGZ in mid-December after concluding a compensation agreement with landowners and formally registering it with the PNG Mineral Resources Authority.

“In the space of two years, we have gone underground, but have done so without the expensive underground infrastructure now commonplace in mining,” Johnson said. “We have developed an adit into the side of the mountain enabling us to map the geology, sample the structures we were inspecting, and understand what was controlling the mineralization. From that adit, we drilled 2,500 m in total, to confirm the continuity of the structures, which we’ve successfully done.

“What we found was the gold was occurring in multiple very narrow structures, which may only be 10 to 20 cm wide. Where you get the confluence of various structures, the veins flow out a little bit, to maybe half a meter or sometimes even a meter, and you tend to get bonanza grades. The highest we’ve had is about 900 [grams per metric ton (g/mt)]. And most of it is coarse free gold, so you can actually see the gold in the rock,” Johnson said. In simple terms, the gold in the HGZ was easy to identify and extract.

|

|

| A view of Crater Mountain showing the location of various zones. | Crater Gold’s camp at the Nevera prospect on the side of Crater Mountain. |

Focus on HGZ

“During the past two years, two key things happened,” Starr said. “Firstly, we focused only on the HGZ and generating cash flow. Secondly and importantly, we found a cornerstone investor who was willing to back the strategy and has put in more than $11 million in the last couple of years.” That cornerstone investor is successful Hong Kong textiles entrepreneur and gold bull Sam Chan of Freefire Technology, who is now the company’s chairman.

“Sam understands and really likes the Crater Gold story, building his stake in the company to more than 50% and enabling us to progress to mining. Importantly, and consistent with many shareholders of gold companies, he is now looking for a return on his investment, which is what we’re focusing on doing. Once we get into production, we intend to use the cash flow for ongoing development and exploration, as well as paying a dividend to shareholders.”

Following a rigorous environmental and social impact assessment process involving the PNG Department of Environment and Conservation and the Mining Advisory Council, the country’s Minister for Mining Byron Chan issued the mining lease for the HGZ project in November 2014. This was a watershed milestone for Crater Gold as it enables the company to transition from explorer and developer to gold producer, and provides a license to mine for the next five years.

After commissioning a mill and gravity concentration circuit, the company began commercial mining in mid-March and made its first gold sale in May. Crater Gold believes that production of 10,000 oz of gold is achievable in HGZ’s first year.

“We’re talking about a very small underground operation where we’re looking at producing approximately 10,000 oz of gold in the first year or so, but from a very small tonnage,” Johnson said. “We anticipate that the average grade we’ll be mining will be approximately 1 oz/metric ton (mt). We have a basic plant on site that can process about 1.5 mt/h. We’ll be duplicating that to double its size, which will not require complex civil engineering or structural steel work or anything like that. It’s so basic that you simply plonk it on the ground, a level piece of ground, and off you go.”

Drilling in the rugged terrain of the Crater Mountain project in PNG’s Eastern Highlands.

Drilling in the rugged terrain of the Crater Mountain project in PNG’s Eastern Highlands.Future Targets

Although Crater Gold has focused entirely on the HGZ for the last two years, the company has future exploration targets mapped out in the area. Expected cash flows generated from the HGZ operation will be put back into further exploration.

“The Mixing Zone was the primary focus of exploration three years ago and a number of deep holes were put in at significant expense, with the resource calculated and published,” Johnson said. “But by going underground now in the HGZ, we can develop tunnels toward the Mixing Zone and can continue exploration of this by drilling from underground. That will become something that we expect will happen in about a year’s time.

“If we continue development from where we are already underground for about 600 or 700 m, we might see daylight on the other side of the hill and we’ll pass right through the heart of the Mixing Zone.

“Last year, we undertook a comprehensive aerial magnetic survey of the tenements and from interpretation of the geophysics, a number of significant targets have been identified, which will in due course be followed up, dependent on cash flow from the HGZ operations.”

Crater Gold currently has enough data to justify an operation for approximately five years within the HGZ, but has not yet been able to delineate the zone’s limits. Macnab has postulated that this zone could extend to approximately 600 m below its current depth.

The road to success in new mining endeavors doesn’t come easy, but Starr has attributed the company’s success thus far to the area’s geology, along with its competent management team and extensive community relations in PNG.

“Geology is key, you can’t mine successfully if you don’t have an ore weight,” Starr said. “Fortunately, the area we are in is a good geological address, but that alone is no guarantee of success. We were fortunate in that the area we are in has a high grade zone and we fortunately found a zone that could be put into production quickly and relatively inexpensively.

“Our success has been due to the luck of having the right geology and, from a management point of view, being nimble enough to change strategy to go from an explorer searching for something large and low grade to a company focusing on the geology we were given and putting that into production as soon as possible.”

Mineralized rocks at Crater Gold’s Crater Mountain project.

Mineralized rocks at Crater Gold’s Crater Mountain project.Working With Community

“At a local level, we have effective community relations officers, we have a good relationship with the local province and with the authorities there as well,” Starr said. “We have had to spend time with the government and the local government officials, and the last two years in particular has been a process of maybe 10% to 20% of time spent on development and strategy associated with the mine, while 80% to 90% of the time has been associated with government, land owners and ensuring the long term through the setting in place of long-term processes.”

Starr explained despite being a resource-rich country with sophisticated mining legislation and a supportive government, PNG under Prime Minister Peter O’Neill is still on a cautious road to improvement in its dealings with the mining industry. “I think it’s fair to say that in more recent times PNG has recognized that they have had to improve and that’s why we are only the second mining lease to be granted in eight years. That is a sign that: (a) their system is evolving and you can deal with it; and (b) that they’ve been quite selective in the groups that are going to be operating in PNG as well.

“I think with Prime Minister O’Neill, there’s clear evidence that they are putting a focus on land owners, they’re putting a focus on the environment, and they’re putting a focus on ensuring that PNG citizens are getting the best out of the resource that is there.”

“The projects that have been developed in PNG tend to have had to be large scale, because of the difficulties in building mines there, because of lack of infrastructure, logistics and so on,” Johnson said. “And, it’s always been perceived that there’s a minimum scale that you have to justify to be able to spend the capital to build a mine. That’s why you’ve got the major projects like Ok Tedi, Lihir, Porgera and Hidden Valley.

Construction of a road within the Crater Mountain project.

Construction of a road within the Crater Mountain project.“We have come in from a completely different angle. While we don’t have the infrastructure and we have to fly equipment in, we’ve gone back in terms of technology. We’re using technology that was in vogue 50, 60, 70 years ago, which is much simpler. It doesn’t require complex machinery, it doesn’t require highly skilled operators and mechanics, and those sorts of things. What we’re doing is, I believe, creating a possible template for other projects in Papua New Guinea that can be developed on the sense of scale that we’re developing currently.”

While the journey to success has only just begun for Crater Gold, the company is upbeat about the opportunity the High Grade Zone will bring, and its future.

“It’s very positive that we’re about to get into production at 10,000 oz/y, and we’re going to generate a cash flow because we’re one of the few listed companies on the ASX that have transitioned to that point at the moment,” Starr said. “The hard thing to get across is that we’re just starting. There is the opportunity for duplications of this HGZ. There is opportunity for significantly greater production in the medium term where we are, but our focus has been to get into production—at the expense of ongoing exploration, so we see real upside.

“We can’t demonstrate that in a resource estimate at the moment, but fundamentally, given the geological environment there, we know that we’re going to see this project set us on the road to success.”