Industry leaders discuss the current situation in the copper market and possible solutions to meet future demand growth

By Steve Fiscor, Editor-in-Chief

Those who follow the copper business are well aware of the situation the sector faces. Soft prices are forcing miners to cut costs per pound while they simultaneously grow production to maintain copper output in the face of declining ore grades. That’s a tough assignment considering that many of the inputs are beyond the mine’s control, such as power, water, labor, regulatory compliance, etc., and are increasing as well. In addition, the annual growth levels associated with the industry’s largest customer, China, have diminished.

Consumption Growth in the Medium and Long Term Requires the Materialization of Most Probable and/or Possible Projects

Consumption Growth in the Medium and Long Term Requires the Materialization of Most Probable and/or Possible ProjectsFortunately, the copper mining business does not make decisions based on a snapshot of today’s situation. They have a long-term vision and they are bullish on copper. And, the good news is that prices and profit margins will improve in the medium term. There will be casualties and market shifts along this path to recovery as the mines fine tune optimization plans and decide which projects to pursue and postpone.

During March, CRU hosted its 14th World Copper Conference in Santiago, Chile. It’s an annual event and the venue is a great setting. After all, Chile is the world’s largest copper producing country, accounting for roughly 30% of world copper production. Santiago is home to Corporación Nacional del Cobre de Chile (the National Copper Corp. of Chile) or Codelco, the largest copper mining company.

Despite today’s difficult market conditions, more than 400 delegates from 29 countries gathered to listen to presentations from senior executives, who discussed key issues affecting copper production and provided insight into the future. Low copper prices were at the forefront of everyone’s mind. Copper reached a multiyear low when prices dropped below $5,400 per metric ton (mt) at the end of January. With a modest recovery since, current copper remains 40% below the record levels attained in February 2011.

Meanwhile, the Chinese economy has slowed quicker than expected. Copper demand increased by less than 1% during the first quarter and inventories at exchanges doubled during the same period. Other factors, like a stronger U.S. dollar, have acted as a drag on commodity prices including copper, explained Robert Perlman, chairman and founder of CRU Copper, in his opening remarks. “Over successive years now, a supposed wave of forthcoming copper projects have acted to help depress copper prices,” Perlman said. “That future supply, however, continues to fall short of expectations. In the last six months, mining companies have reduced production guidelines for the next couple of years. While many projects planned for later in this decade have been delayed until after 2020 or tabled indefinitely.” In light of this situation, CRU has forecast substantial market deficits emerging in less than five years, possibly raising prices to those lofty levels once again.

To get from here to there, copper miners are scrutinizing operating costs, second guessing future decisions, and considering wholesale changes as to how they do business even though most of their balance sheets are cash flow positive. It’s becoming more apparent that several issues, such as electrical infrastructure, the scarcity of water, regulatory burdens, increasing labor costs, and community resistance, will impact future growth in established copper mining districts.

Power Cost in Copper Mining

Power Cost in Copper MiningKeeping an Eye on the Horizon

The 2015 CRU Copper Conference opened with a presentation from Nelson Pizarro, CEO of Codelco. Speaking about the market in general, he explained that the falling prices for copper and other commodities since 2011 has caused mining investment to decrease and delayed several projects two to four years. “The long-term demand fundamentals for copper are very good,” Pizarro said. “Regardless of unforeseen situations or delays, and assuming copper consumption continues to grow as expected, by the beginning of next decade, the market would need all known most probable projects to materialize to satisfy demand.” Basically, future growth in demand will devour all of the copper that could be produced from all of the projects that the industry has publicly considered today.

As of today, a large part of the projected investment, estimated at $227 billion, is still subject to approval. Roughly 60% of that figure corresponds to possible projects, Pizarro explained. Chile represents 25% of that investment and Codelco is 9%.

Pizarro attached real numbers to the often cited issues facing the industry. Between 2015 and 2040, a 33% drop in grade is projected from 0.55% copper today to below 0.4% copper by 2030. Similarly, copper production costs are expected to increase 30% from 2015 to 2040. Cash costs will increase from $1.10/lb today to more than $1.40/lb starting in 2029.

The regulatory burden in Chile is increasing just as it is in other countries. Pizarro cited new regulations: the New Environmental Law 20,417 (January 2010), the effectiveness of Convention 169, SEIA Regulation (December 2013) and the startup of SMA (Environmental Superintendence). “New mines and projects in Chile require lots of permits and the review and approval times are excessive,” Pizarro said. “There are different criteria for environmental assessment. Communities are placing more pressure on the government and sectorial authorities. There is an active, negative reaction from the community to large scale projects.” In a veiled reference to the Pascua Lama project, he talked about the lack of predictability when it comes to project judicialization.

Human resources has become an issue for Chile. Pizarro estimated that between 2017 and 2020, the workers needed to construct Codelco’s projects will reach a peak of more than 40,000. “There will be a big demand for equipment operators and maintenance technicians,” Pizarro said. “Without a healthy supply of these people, Codelco will not be able to increase copper production.”

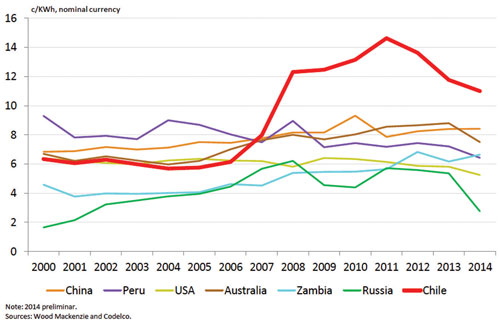

The crushers, conveyors and mills used to process ore run on electricity. During the next 10 years, energy demand for copper mining worldwide will increase by 80%. While prices for electricity have retreated from 2012 highs (more than $0.14/kW/hr), Chilean copper miners pay more for electricity ($0.11/kW-hr) today than all of their contemporaries ($0.06-$0.09/kW-hr). Pizarro was also unhappy with a lack of direction for carbon policies.

Pizarro created a stir when he called for mine owners to return to an active role in project management. “Risk management belongs to the owner,” Pizarro said. “It should not be outsourced. The evolution of legal, labor and environmental institutions requires significant strengthening of the owner role in project development. Learning from recent Engineering Procurement Construction Management (EPCM) contracting schemes, he said projects could have been managed better, particularly when it came to cost control.

Advocating for owners to take the lead again on the development of new projects, he suggested the use of new agreements, which integrate the role of the owner more heavily in project management. The business for EPCM contractors has slowed as more projects were delayed. For future projects, Pizarro talked about possible EP+C arrangements with mining companies taking over the management role.

Codelco’s board recently approved a four-year development plan (2015-2019) and they have authorized the capital to move forward with a number of investment plans. The object is to maintain an annual production of 1.7 million mt of copper from 2015-2019. “We will capture the potential value of Chile’s enormous resources and reserves,” Pizarro said. “Codelco has access to the best market conditions as far as sales and supply and it will secure the cash flows for the state of Chile.”

Without production from new projects, Codelco’s copper would fall below 1 million mt copper by 2022. If projects come online as planned, the company will maintain copper production above 1.5 million mt to 2022 and then it could ramp up to as much as 2.3 million mt by 2027. “The projects that will propel Codelco’s future copper production represent an opportunity for innovation and technological changes,” Pizarro said. These include plant automation at Ministro Hales, the Chuqui Underground project (see p. 90), Radomiro Tomic Sulphides, a new mine level at El Teniente, and an expansion at Andina.

Pizarro has to guide Codelco as it advances these mega projects. The large underground projects at Chuquicamata and El Teniente have already undergone revisions and independent audits. Going forward, he plans to optimize execution plans, strengthen the organization, and implement more rigorous control systems. Over the next five years, Codelco will invest on average $5 billion per year just to maintain an average production of 1.7 million mt/y of copper. Profits are expected to average $2 billion per year at an average cash cost of $1.51/lb.

Chilean Copper Production and Productivity1

Chilean Copper Production and Productivity1Chilean Productivity Challenges

Diego Hernandez, CEO, Antofagasta Minerals, is a senior executive that knows the issues facing Chile firsthand. Prior to his position with Antofagsta Minerals, he was CEO of Codelco. In his presentation, he talked about sensitive issues for Chile, labor and productivity.

Antofagasta Minerals has four operating assets in Chile: Los Pelambres, Centinela, Michilla and Autocoya, which the company was commissioning as Hernandez made his presentation. The company produces 704,800 mt/y of copper in concentrate and cathode, 270,900 oz/y of gold and 7,900 mt/y of molybdenum.

In addition to focusing on its core business, Hernandez explained Antofagasta Minerals is looking at several growth projects, which include the startup of Autocoya on time and under budget, completing a 105,000-mt/d expansion at Centinela, progressing the Encuentro Oxides and Los Pelambres incremental expansion projects, and completing a prefeasibility study for a second concentrator at Centinela. “During these periods of lower prices and increasing capital intensity, the focus remains on cost control and operational efficiency,” Hernandez said.

Between 1990 and 2004, Chilean copper production increased significantly. Since 2004, Hernandez explained, the industry has experienced production stagnation and productivity losses. “While declining ore grades forced the mines to produce more tons and increase processing capacity to maintain copper production levels, the workforce increased to a much greater extent,” Hernandez said. “From 2004-2013, the average ore grade decreased by 30% and production increased by 7%, which meant that the amount of rock mined increased 49% and the amount of ore processed increased 32%. During that same period, the workforce increased 74%.”

Chile has a shortage of qualified labor. “During the boom period, many mines brought operators onboard that lacked training and experience,” Hernandez said. “Now industry, universities and authorities need to work together to strengthen technical training for future growth without impacting productivity.”

Increases in operational support areas and a decrease in working hours has had a negative impact on productivity in Chile. In 1990, labor worked 211 hours per month and in 2013 that figure has dropped to 172 hours. The increase of the size of the workforce has had the greatest impact on productivity, which has declined from 61.6 mt of copper per worker in 2004 to 34.9 mt of copper per worker in 2013.

Salaries in the Chilean mining industry have grown more than the national average in recent years. The average mining sector salary in Chile is similar to the U.S. and Canada. Both the shortage of qualified workforce and strong unions increased salaries and benefits. Labor costs have increased from $0.16/lb in 2004 to $0.21 in 2013. “In 2009, a shovel operator received an average annual wage of $47,000 and by 2014 that figure had grown to $69,000/y, a 47% increase,” Hernandez said. He also acknowledged that these numbers may have been tempered more recently by the depreciation of the Chilean peso against the U.S. dollar.

The Chilean government recently proposed a labor reform package that does not address many of the mining industry needs, Hernandez explained. Several proposed measures could negatively impact a company’s ability to negotiate by giving more power to unions. Currently, about 60% of the Chilean workforce is unionized. In addition to assigning government authorities as arbitrators, some of the government’s proposed measures imply compulsory union membership and encourage one-off bonuses rather than productivity incentives.

Shortages of Concentrate Will Become Acute

Shortages of Concentrate Will Become AcuteBeyond the Trough

CRU’s Director of Copper Research and Strategy Vanessa Davidson tried to answer several questions as far as what the copper business can expect for the near term. Will the market be over supplied? To what extent was the recent price decline driven by market fundamentals? Chinese demand has clearly weakened, but by how much and will it improve? In addition to addressing these questions, she spoke about global supply and the extent to which project delays are becoming critical for medium-term supply volumes. She also described how some key cost drivers had fallen, such as oil, but have not fully fed through into lower production costs for producers. Looking toward the future, Davidson gave her thoughts on copper pricing and potential profit margins.

The rapid first quarter copper price decline was overdone with respect to the fundamentals, Davidson explained. “It is clear that price was reacting to drivers other than those pertaining to the physical market alone,” Davidson said. “The slump in oil prices and the strengthening U.S. dollar were among the key influences that drove copper prices lower. That being said, there were some important developments in the physical market, which also contributed to the decline in price.”

Growth in copper demand dropped sharply in the first quarter, much more than would be expected for seasonal reasons alone, Davidson explained. “China has been the biggest concern given its size, but it’s not the only country to consume less copper,” Davidson said. “The outcome is a market surplus of 160,000 mt of copper for the first quarter. That has been accompanied by a solid rise in LME and SHFE stocks to 300,000 mt, which indicates excess copper already existed.

“Looking at the visible stocks, the absolute volume of stock is not excessive in comparison to historical levels and that’s why we feel the price decline was overdone,” Davidson said. “Although we have suffered a weak first quarter, stocks are not excessive at this stage and do not signal the start of a period of heavy oversupply.”

Davidson also framed the effect of purchases made by China’s State Reserve Bureau (SRB), which acquires copper for strategic reasons. The SRB purchases copper when prices are low and effectively takes copper out of circulation. “Over the last couple of years, the SRB has been a very active purchaser of copper cathode,” Davidson said. “We estimate they bought 250,000 mt in 2013, 360,000 mt in 2014, 5,000 mt during the first quarter of 2015, which amounts to more than 700,000 mt. This is not insignificant. The market would have been in much worse shape had the SRB not made these purchases and withdrew the copper from the market.”

During the first quarter, Chinese demand grew by 0.7%. Even though demand was weak, Davidson believes that Chinese demand will improve from June onward. “For the year, CRU expects Chinese demand will increase by 4% in 2015,” Davidson said. “It may feel much weaker. Imports of cathode have fallen by 20% year-on-year, but this isn’t an accurate reflection of Chinese consumption alone. Financing activity, which generated additional demand for cathode in the past year, has contracted significantly this year and this is a key factor behind the reduced level of imports.

“While demand has slowed, we continue to believe that peak copper is still some ways off,” Davidson said. “It’s true that overall economic growth is slowing and the mix of growth drivers is changing. The Chinese economy is in transition. Overall, we do expect growth in Chinese consumption of refined copper to continue to be slow, but we do not expect demand in volume terms to reach a peak until well into the next decade. By then, growth in other countries could offset that decline in demand.”

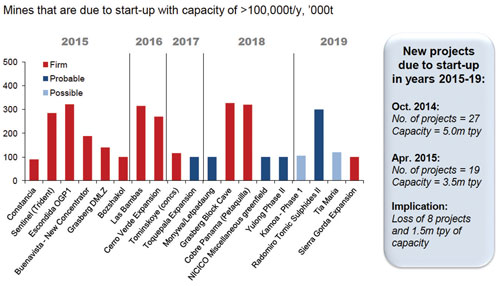

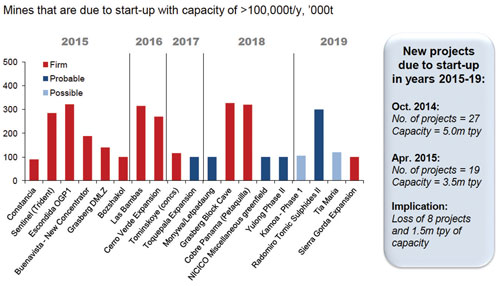

How critical has the supply situation become? Low prices have led to a series of delays for new projects, downsizing of others and phased development of others. “As far as mine output through 2019, we expect weak growth this year of 0.7%,” Davidson said. “Looking ahead, we expect 2016 to be the peak growth year due to a recovery of production at existing operations after a weak 2015, as well as the effect of numerous projects ramping up production and the startup of several committed mines and expansions too. However, as we move further along, the timeline to 2017 and beyond, we see a sharp slowdown in mine production growth as the project pipeline has thinned. During the last six months, future output has been downgraded by almost 2 million mt.

“Mine output continues to disappoint,” Davidson said. “The pipeline of new projects has shrunk and shortages of concentrate will become acute by 2019-2020.”

Of the projects expected to start in the next five years, several greenfield projects will play a major role in the 6.3% increase in production expected for next year. However, between 2017-2019, project pipeline thins out and the size of the projects are smaller with fewer of the projects are categorized as firm, Davidson explained.

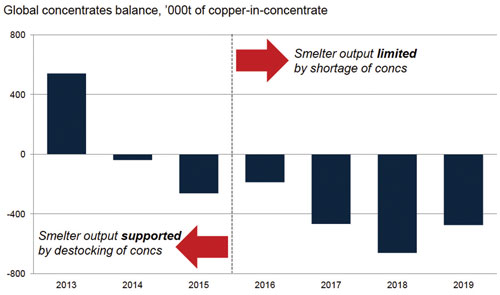

The slowdown in mine production from 2017-2019 will have severe repercussions for the concentrate balance. “The market is expected to be in deficit this year and the size of the deficit is expected to widen with time,” Davidson said. “In the short term, there are sufficient stocks of concentrate to enable smelter output to rise more than mine production. However, by next year, smelter output will start to be constrained by a shortage of concentrate and the extent to which smelter output is constrained will increase progressively in each year of the forecast period.”

Moving to operating costs, the industry has seen oil prices slump and stage a modest recovery. The U.S. dollar has appreciated significantly against most of the key copper producing country exchange rates. “The U.S. dollar has appreciated by about 12% on trade-rated basis since mid-2014, but by almost 17% against the copper producing countries on a production weighted basis,” Davidson said. “The other key development of importance is the movement of byproducts, which have not been favorable for copper producers. Molybdenum prices have fallen rapidly since the middle of last year, registering a decline of 40%. Prices for all of the byproducts have weakened.

The ability for producers to reduce operating costs has been limited. “Costs are expected to decrease by a modest 6% in 2015 compared to last year,” Davidson said. “There are a number of reasons why the decrease is so modest. First, there is not a 100% pass through from weaker domestic exchange rates and lower input costs. As an example, labor is denominated in local currency, but might be offset by higher domestic inflation. In addition, the link between oil and diesel might be blurred if the government has taken the opportunity to reduce subsidies. The reduction in byproduct revenue offsets gains in other areas.” This explains why companies operating at the top of the cost curve are seeing the greatest reduction in costs. Many of them do not produce byproducts and they are reaping the full benefits of lower oil prices and weaker currencies.

“Cost inflation will return in 2016, probably 2%,” Davidson said. “Then we expect costs to grow by 5% per year going forward. This is a higher rate than inflation due to the fact that oil prices will increase in real terms. While some byproduct prices are expected to improve, molybdenum prices will not recover until 2020.”

With copper prices cutting into the top portion of the cost curve, producers have been under pressure to find ways to cut costs, such as scaling back of labor and outside services, the centralization of procurement and the optimization of working capital. “We do not see these initiatives having a dramatic impact on copper mining costs,” Davidson said. “It’s difficult for the copper industry to reduce operating costs. The key volume metrics, such as ore grades, stripping ratios and recovery rates are outside the control of the mining companies.”

High prices will return again in this decade. “This year, the market should be balanced,” Davidson said. “Next year, the market moves into surplus. In 2018, project delays and postponements really start to bite. At that time, the market will shift into deficit and the deficit will widen with each year. In terms of prices, we believe the worst is over and the low point was January. However, the recovery from here is unlikely to be swift and dramatic. We anticipate a slow upward climb as demand picks up and headwinds dissipate. A more significant rally in prices is a few years away. In 2017, prices should return to 2013 levels and upward momentum going forward should be strong.

Even though copper prices will rise, so too will operating costs. Margins should improve during the next five years, but CRU is not forecasting a return to the super profits of the recent commodity boom. Producer margins should start to recover in 2016.

Pipeline of New Projects Has Shrunk

Pipeline of New Projects Has ShrunkProducing More Safely With Less

Recognizing a need, mining suppliers have been working with mining companies to reduce operating costs. Obviously mills will be processing more rock to produce more copper and Pertti Korhonen, CEO, Outotec, offered some ideas they are considering to help copper miners produce more safely with less.

Over the year, Outotec has contributed many innovations, such as HIGMills that have reduced energy consumption 30%-60%; the TankCell, which simplifies plant layout and consumes less electricity; and other options that improve mineral selectivity and recovery. “Today, Outotec strives to help the industry to be more productive while also addressing environmental sustainability,” Korhonen said.

One area where Outotec has been successful is dewatering and water reuse using advanced process technology. “In addition to the amount and availability of water, mills are also faced with more complex liquid/solid separations,” Korhonen said. “Declining grades equate to greater tailings. This means more water is lost in the process and costs increase for maintaining tailings storage facilities, not to mention the risk of environmental incidents. Water efficient concentrator solutions can improve water reuse to as high as 90%.”

Complex ores often contain environmentally harmful impurities. Smelters cannot allow these impurities to be emitted into the environment. The impurities also decrease the quality of the anode copper. “We have found that partial roasting removes 90% of the arsenic in the concentrate, producing clean calcined concentrate for smelting and environmentally stable arsenic,” Korhonen said. “Fire refining in anode furnaces reduces impurities in anode copper. Hydrometallurgical treatment of copper arsenide precipitate can also stabilize arsenic.”

The need to control emissions continues to increase. Air and water emissions are a challenge for both hydrometallurgical and pyrometallurgical production of copper (SO2, dusts, heavy metal emissions, etc.). “Emissions management is one of the most important issues to obtain and maintain the social license to operate,” Korhonen said. “Some of the best smelters capture 99% of the SO2 they generate using continuous flash smelting processes.”

New lines have to process more ore to produce the same copper and larger processing lines cost more to build. Outotec recently introduced the VSFX plant, a modular solvent extraction plant assembled from prefabricated and transportable settler modules, which are entirely reusable: They can be installed and operated quickly and safely, Korhonen explained. The investment is relatively low and the concept is scalable. “VSFX could reduce the implementation time 30%-50% and it can reduce the capex by 30%-40%,” Korhonen said. “This is out of the box innovation that can result in huge improvements for productivity and asset utilization.”

Korhonen also sees opportunities to reduce operational costs in solvent extraction. Chemical degradation of extractant has a negative impact on plant performance and operating costs. Outotec’s Extractant Maintenance Technology (EMT) service is based on the regeneration of degraded extractant reagent in solvent extraction plants. “The use of EMT also decreased normal plant residues and inorganic entrainments,” Korhonen said.

As far as the costs associated with electro-winning, Korhonen suggested replacing conventional alloyed lead anodes with coated titanium anodes. “This reduces cell voltage and power consumption by 15%,” Korhonen said. The new anodes eliminate lead and the handling of the lead sludge from the cellhouse.

Outotec’s VSFX plant offers a modular approach for solvent extraction.

Outotec’s VSFX plant offers a modular approach for solvent extraction.The EPCM Perspective on Cost Overruns

Addressing a crowd at a lunch sponsored by Fluor, Joseph Tis talked about some of the issues he sees when it comes to project execution. While it seemed at first he might be taking exception with Pizarro’s hands-on approach, in the end he actually offered the same solution: getting the owner involved in project management. In fact, Tis wants to get everyone involved in project management.

One of the biggest problems is the level of completeness with basic engineering at the time that engineering has declared the project complete, Tis explained. “This leaves us with a great deal of doubt regarding accuracy,” Tis said. “Projects can suffer a 50% overrun in quantities between basic engineering and the completion of detailed engineering. This is occurring due to incomplete or inadequate vendor information.”

The problem boils down to an insufficient amount of attention provided during basic engineering and the primary execution of the project. “If we could integrate all of the key project team members in the preparation of the plant, we could get the whole project and our clients aligned in the execution of the project and its objectives,” Tis said. “As an example, we experience a lot of delays with noncompliance with the delivery sequence for the materials. All of these problems prevent projects from being delivered within the schedules sold to the owners.”

This problem is so serious that Fluor has taken the initiative to reorganize its approach. This new approach is called the Integral Approach. “The Integral Approach includes the participation of all key members of the project teams in the very early phase of the project,” Tis said. “During basic engineering, we need to have procurement, construction, preconditioning and the client heavily involved to make sure that cost saving ideas are being communicated clearly and accurately to the engineering organization.”

With this approach, a plan is prepared that maximizes preassembly and seriously considers pre-modularization of facilities to move man-hours off the site and into fabrication shops. “We have better control of the quality and the execution phase of the work,” Tis said. “It’s quite different, when you are working on-site with 8,000 to 10,000 people and when you are working in a shop with 800 people. Obviously managing 800 people is a lot easier.”

Part of the process involves getting total buy-in from all of the organizations participating on the project, from the project manager down to the procurement group, the contractor group or the engineering group. “Today, on many of the projects at Fluor, construction and procurement is being heavily introduced into the basic engineering phase,” Tis said. “We make sure that everyone fully understands every aspect of the project and the way it’s approached and executed.”

“This is critical to make sure that the deliverables from engineering are provided in a timely fashion,” Tis said. “We build the plant the way it was supposed to be built. We introduce the way we need the materials delivered into the purchasing plan. How many times have we seen the structural steel for the roof arriving before the columns? What good is that? It costs more money to re-handle the steel. We have to change erection plans and on these mega projects that’s a disaster.”

The other area where Fluor is seeing a high degree of success is the modularization of plants. “We keep an open mind and we invite our clients to consider changes to the layout of the facility to incorporate modularization,” Tis said. “On a recent concentrator project in Australia, an EPCM contractor was able to deliver 20 or 30 modules in 12 shifts and performed the assembly work at the site. Imagine how that would drive down labor costs. To do that, it would take heavy involvement from the operation teams from the mining companies. They would need to have a vision for the plant and the assembly process.”

Another consideration of the Integral Approach is the independent verification of quantities. “Using this type of arrangement, we can provide competitive pricing to our clients and maximize the preassembly,” Tis said. “It gives us more control ultimately in meeting deadlines set forward in the construction schedule.”

“One of the issues we have been focusing on in the U.S. is the training of craft personnel,” Tis said. “It’s no secret here in Chile that productivity has not improved. If anything, it has gotten worse. In addition to the craft, we train them to understand the methodologies of construction and the importance of avoiding delays.” Today, Fluor has 20,000 people working in different parts of the world building large industrial projects. The company establishes joint ventures with local companies to be able to meet a clients’ requirements and position the company to take on more risk with the projects.