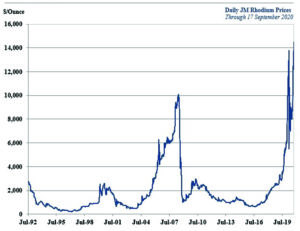

Rhodium prices rose during August and into early September, reaching a record $14,500 per ounce (oz) on September 15. The price cooled to $14,000/oz, but the rhodium market remains tight. Supply from South Africa, which accounts for 80% of global rhodium mine supply, is still recovering from shutdowns earlier this year. There also seems to be some buying ahead of the seasonally strong period of demand that is typically observed over the fourth and first quarters of the year.

Rhodium prices rose during August and into early September, reaching a record $14,500 per ounce (oz) on September 15. The price cooled to $14,000/oz, but the rhodium market remains tight. Supply from South Africa, which accounts for 80% of global rhodium mine supply, is still recovering from shutdowns earlier this year. There also seems to be some buying ahead of the seasonally strong period of demand that is typically observed over the fourth and first quarters of the year.

Passenger vehicle demand remains fairly weak in most parts of the world, which is expected to continue acting as a headwind at least in the near term. Auto makers have been buying concerned over long-term access to rhodium, using the current period of weaker auto production as a time to build rhodium inventories against anticipated shortages later. If and when the vaccine is approved for use, it will help to improve consumer sentiment, which coupled with an extremely low interest rate environment, could help demand in the coming year. The rhodium market seems to be positioning for this outcome. Price volatility should be expected in the coming months. On the downside, prices should not be expected to slip below $9,000/oz.

Sharp increases in rhodium prices in the past have accelerated reduced usage and metal substitution. The glass manufacturing industry is a good example of where shifts are made in the amount of rhodium and platinum used to make the glass manufacturing equipment, with reductions in rhodium use when prices have shot up the way they have in recent months. For many uses once ways are devised to reduce the amount of rhodium, it is unlikely that the amount of rhodium will increase back to levels before the reduction.

Scrap supply also is typically sensitive to the price of a metal. Two factors are expected to limit this typical sensitivity at this time. The first is the disruptions in scrap supply chains that have not fully allowed for scrap recovery to respond to the sharp increase in price. The other is the amount of rhodium being recovered is faced with an ongoing headwind associated with technical issues that have tied up metal at refineries.

The mine supply side is typically the slowest to respond to the gains in metals prices. That said, the sharp increase in rhodium prices coupled with several years of increases in palladium prices is already seeing South African mining companies increase their focus on UG2 ore, which is rich in palladium and rhodium.

This article was excerpted from CPM Group’s monthly Precious Metals Advisory. www.CPMGroup.com