Thomson Reuters recently published the GFMS Platinum & Palladium Survey 2015, which offers an in-depth review of market fundamentals for platinum group metals (PGMs) and an outlook for the future.

The platinum market ended last year with a deficit of 1.02 million oz due to major strike-related production stoppages in South Africa. Both the miners and consumers entered the strike well positioned to handle lower refinery output. The deficit in 2014 follows seven years of market surplus and is expected to be sustained, albeit at lower levels, in 2015.

Palladium, on the other hand, has been a market in deficit since 2007. The GFMS team estimated the palladium market deficit last year at 1.58 million oz, representing the most severe market imbalance for more than a decade.

The average platinum price is forecast to fall by 16% year-on-year, averaging $1,170/oz. The average palladium price is forecast to be broadly flat year-on-year at $800/oz, modestly above current spot prices.

“Without enduring production cuts to be achieved, by permanently closing high cost mines, the platinum market is expected to return to surplus next year,” said William Tankard, research director-mining for Thomson Reuters.

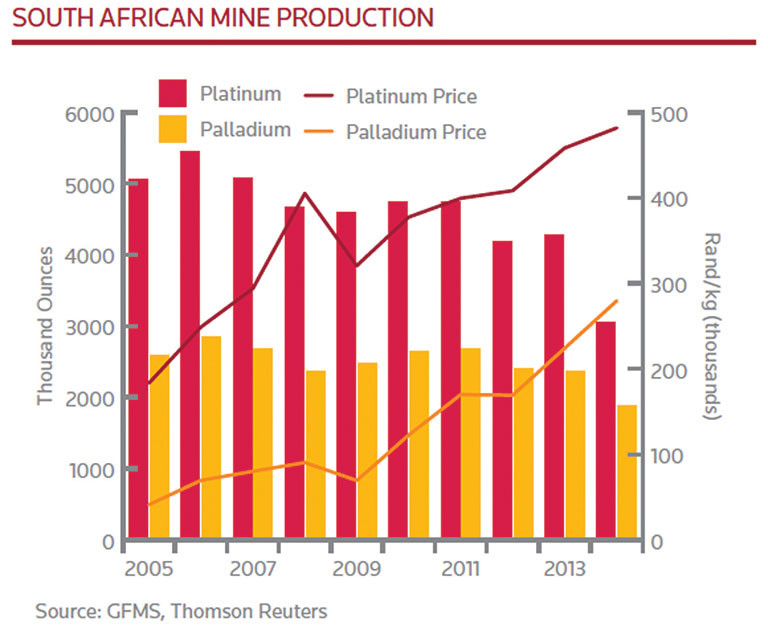

Platinum mine production fell sharply in 2014, by 21%, to at least a 15-year low of 4.7 million oz. Strike actions in South Africa led to the idling of 60% of the South African industry for a period of 22 weeks. GFMS estimated that losses over that period, including the ramp up of operations, totaled 1.4 million oz. South African platinum miners did, however, benefit from a 13% depreciation of the rand against the dollar. Nevertheless, costs in South Africa grew by 5% last year.

Turning to demand, global vehicle production rose by 2% in 2014. This was coupled with a continued tightening of emissions legislation in many countries. These factors pushed demand for platinum in autocatalyst applications up by 4% to 3 million oz, the fastest rate of growth since 2011. However, total consumption remained 26% below 2007’s all-time high.

Jewelry fabrication retreated for the first time in three years, slipping by 3% to 2.57 million oz. The decline came mainly from the two largest markets, China and Japan, where offtake contracted by 5% and 2%, respectively. In contrast, platinum jewelry demand in North America increased by 3%.

Mine production of palladium posted a more robust outcome than platinum, yet nevertheless fell by 7% to 6.04 million oz, a 12-year low. Again, the main driver was heavy strike-related losses in South Africa, although the decline there was dampened somewhat by pipeline timing effects and from a shift in mined ore mineralogy to more palladium-rich sources at the expense of platinum. Russian production provided a partial offset, growing by 3% due to the release of in-process palladium inventory, while production in Zimbabwe also grew by 3%.

Palladium demand in autocatalysts grew by 5% to 6.61 million oz with growth in China leading the way in percentage terms and bringing the country’s market share to 23%, up from 11% six years ago. Positive vehicle sales and continuing after-treatment installations in emerging markets played a key role, as emissions regulations tightened around the globe. While substitution of platinum to palladium remained a feature of the sector in autocatalysts, the rate slowed.

Thomson Reuters GFMS Surveys can be downloaded from Thomson Reuters Eikon.