By Steve Fiscor, Editor-in-Chief

By Steve Fiscor, Editor-in-Chief

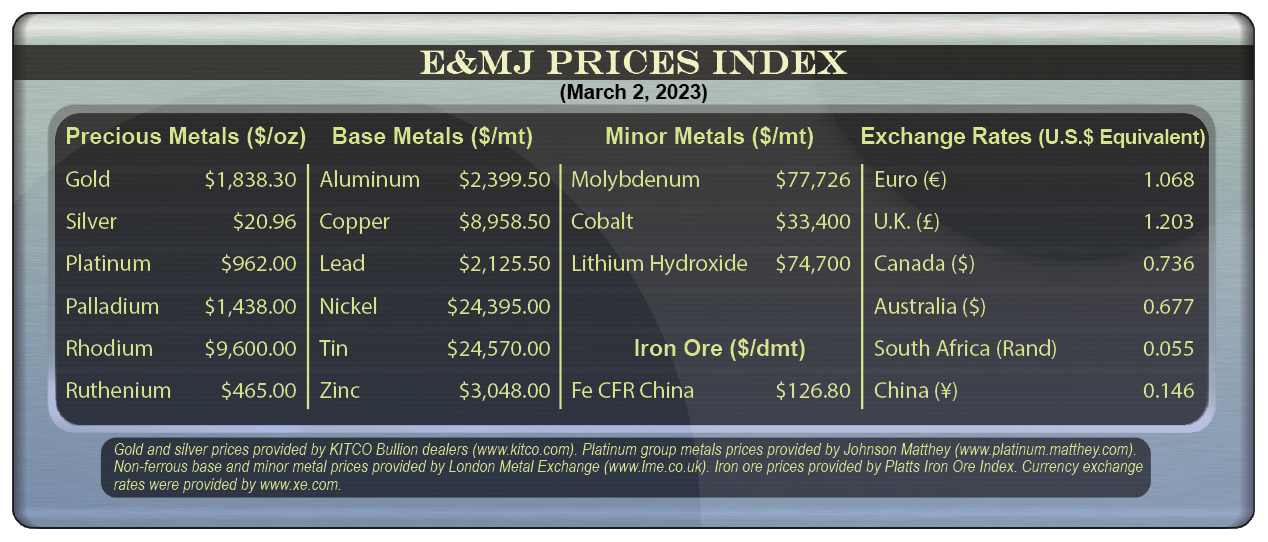

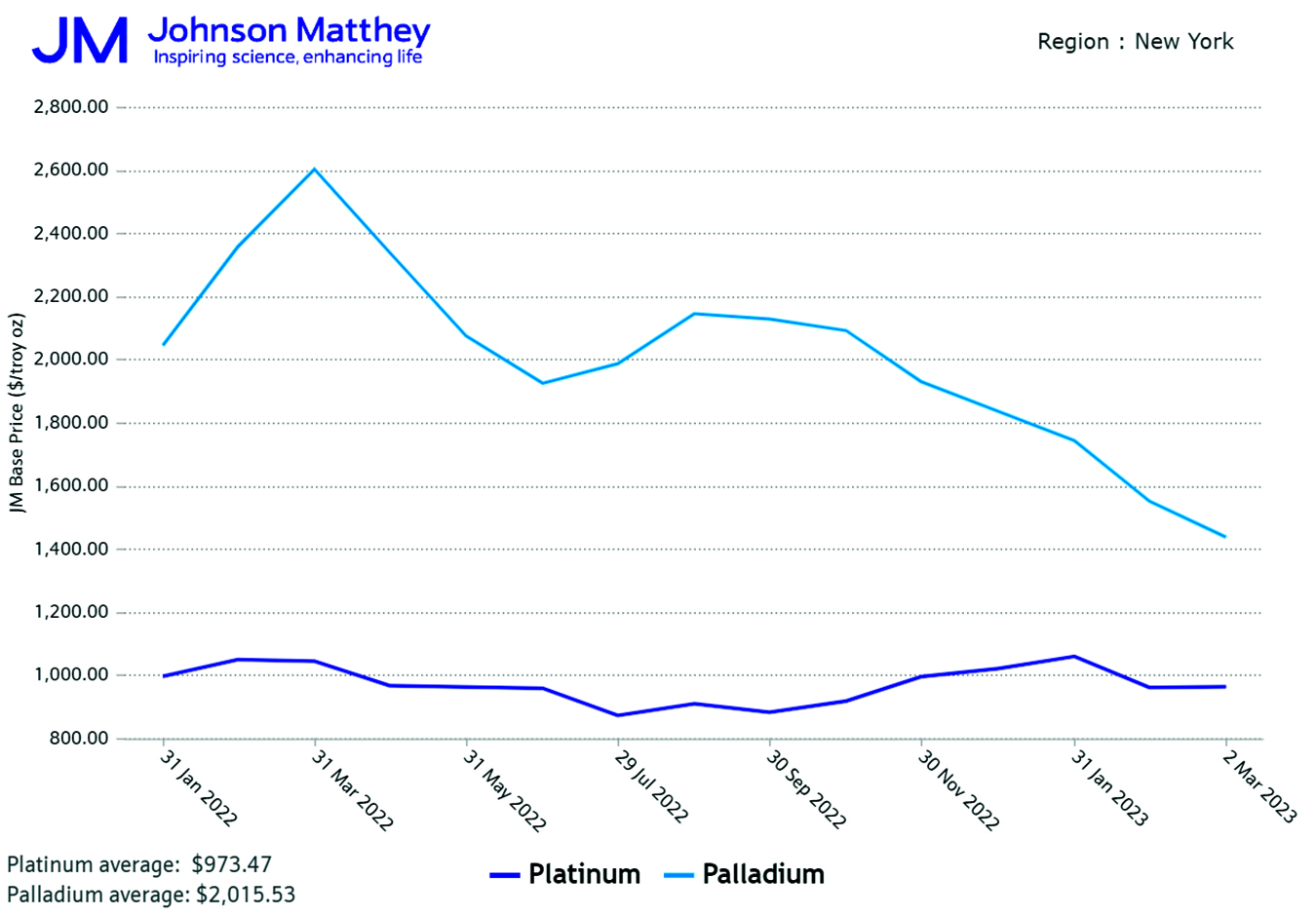

Palladium hit a record high in Q1 2022 due to supply concerns following Russia’s invasion of Ukraine, and then the price steadily declined to $1,438 per ounce (oz). The average pricing of all three major platinum group metals (PGMs) softened in 2022. Platinum closed the year higher than it opened, but palladium and rhodium finished lower.

Used in catalytic converters for emissions control, palladium demand is a function of the automotive industry, which was up 7% in 2022. So, why has the price for palladium softened? Could more automakers be substituting platinum for palladium?

South Africa’s Impala Platinum sees the markets for PGMs tightening during 2023 based on demand recovery and constrained supply. The company said palladium and rhodium markets tightened in 2022, recording deficits of 800,000 oz and 62,000 oz, respectively. Implats said its South African processing capacity was constrained by maintenance and the lack of power. Meanwhile, automotive supply-chain constraints eased and underpinned a modest recovery in light-duty vehicle production, while industrial demand remained robust.

Implats said platinum benefited from underlying auto and industrial demand growth but saw negative investor sentiment as the precious metals came under pressure and exchange-traded funds (ETFs) returned metal to the market, leading to a surplus of 336,000 oz in 2022.

Implats said palladium prices so far in 2023 have been impacted by soft physical demand due to Chinese and other consumers destocking in the opening weeks of the year.

PGM production at South Africa’s Anglo American Platinum (Amplats) decreased by 6% to a little more than 4 million oz in 2022. Production was impacted by a delay in the completion of the rebuild of the Polokwane smelter, as well as Eskom load-shedding.

Amplats believes that a combination of pent-up demand, low inventories, strong labor markets and stimulus released into the Chinese economy should help the automotive recovery rally continue through the year. Market fundamentals for PGMs should remain robust, and Amplats expects the supply/demand balances of the three main PGMs to be in small deficits in 2023.