Australian mining contractor Macmahon announced it will acquire the key contracts of the Pit n Portal (PnP) underground services business from Emeco Holdings Ltd. Concurrently, Macmahon and Emeco have entered a rental partnership where Emeco is the preferred supplier of rental equipment to Macmahon in Australia for applications in surface mining, underground mining and civil infrastructure projects.

Australian mining contractor Macmahon announced it will acquire the key contracts of the Pit n Portal (PnP) underground services business from Emeco Holdings Ltd. Concurrently, Macmahon and Emeco have entered a rental partnership where Emeco is the preferred supplier of rental equipment to Macmahon in Australia for applications in surface mining, underground mining and civil infrastructure projects.

The acquisition includes the contracts, inventory, site fixed infrastructure assets and light vehicles of certain PnP projects and brings additional skilled employees to Macmahon’s workforce. The roughly $10 million consideration payable will be satisfied by an asset sale and offset arrangement. The transaction is expected to add more than $140 million to Macmahon’s order book.

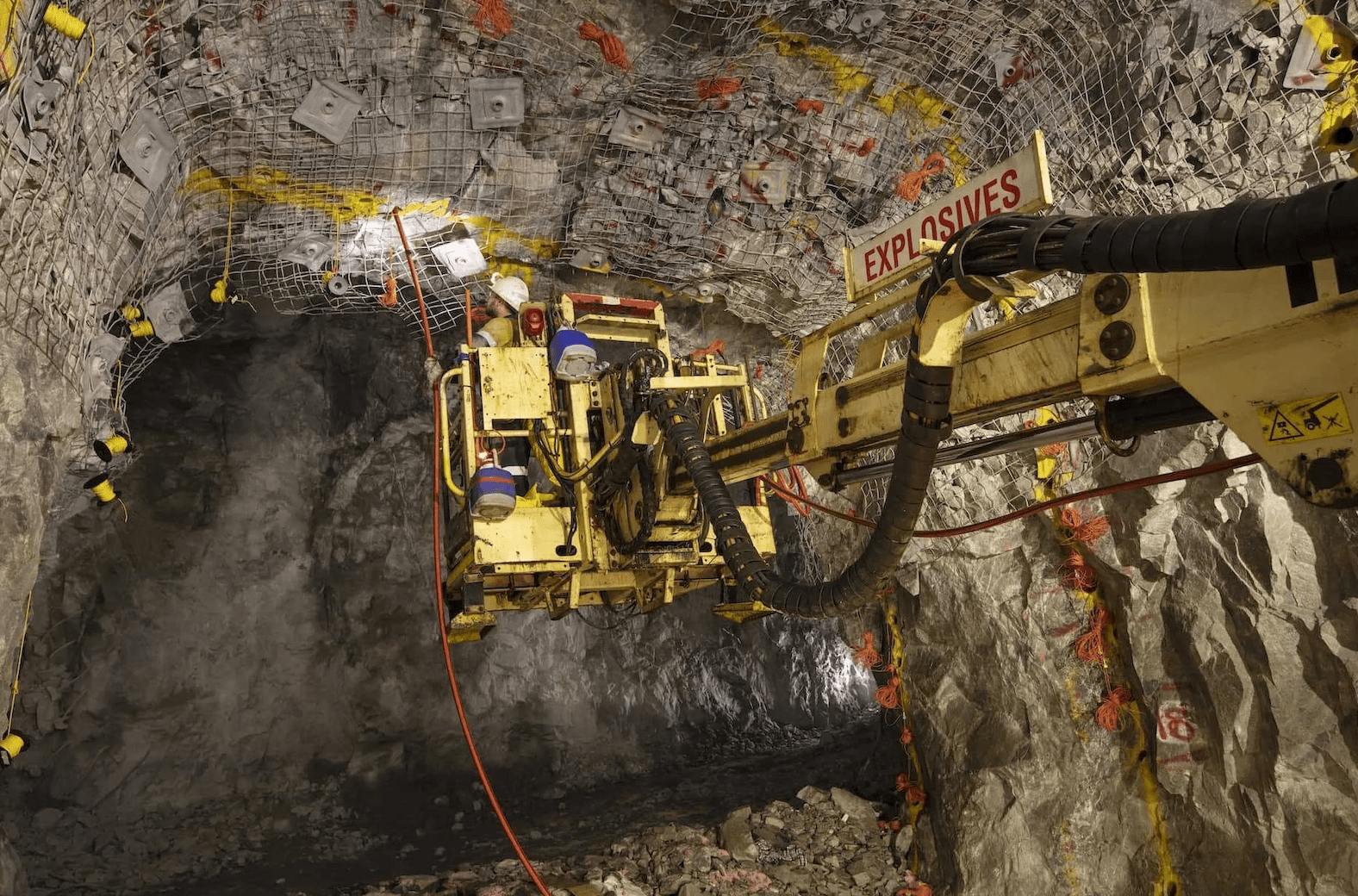

PnP provides hard-rock underground mining equipment and services to the Australian underground mining sector. The business was established in 2002 and was acquired by Emeco in 2020. Core activities include mining services and maintenance solutions for underground mines in Australia.

“A key driver of Macmahon’s recent growth has been the underground mining division which has grown to approximately 25% of the company’s revenue, facilitated by the acquisition of GBF in 2019,” said Michael Finnegan, managing director and CEO, Macmahon. “Our strategic objective has been to continue building scale in underground to diversify earnings and operations and the acquisition of these PNP contracts and assets is 100% consistent with this. It adds significant capability to our underground business with the addition of around 260 skilled employees and builds on our existing client relationships. We look forward to working with PNP’s customers and strengthening our relationships with them.

“The rental partnership allows Emeco to exit from its underground contracting portfolio and to focus on its core rental business while building a long-term relationship with Macmahon with increased fleet rental opportunities in open-pit, underground and civil operations,” Finnegan said.