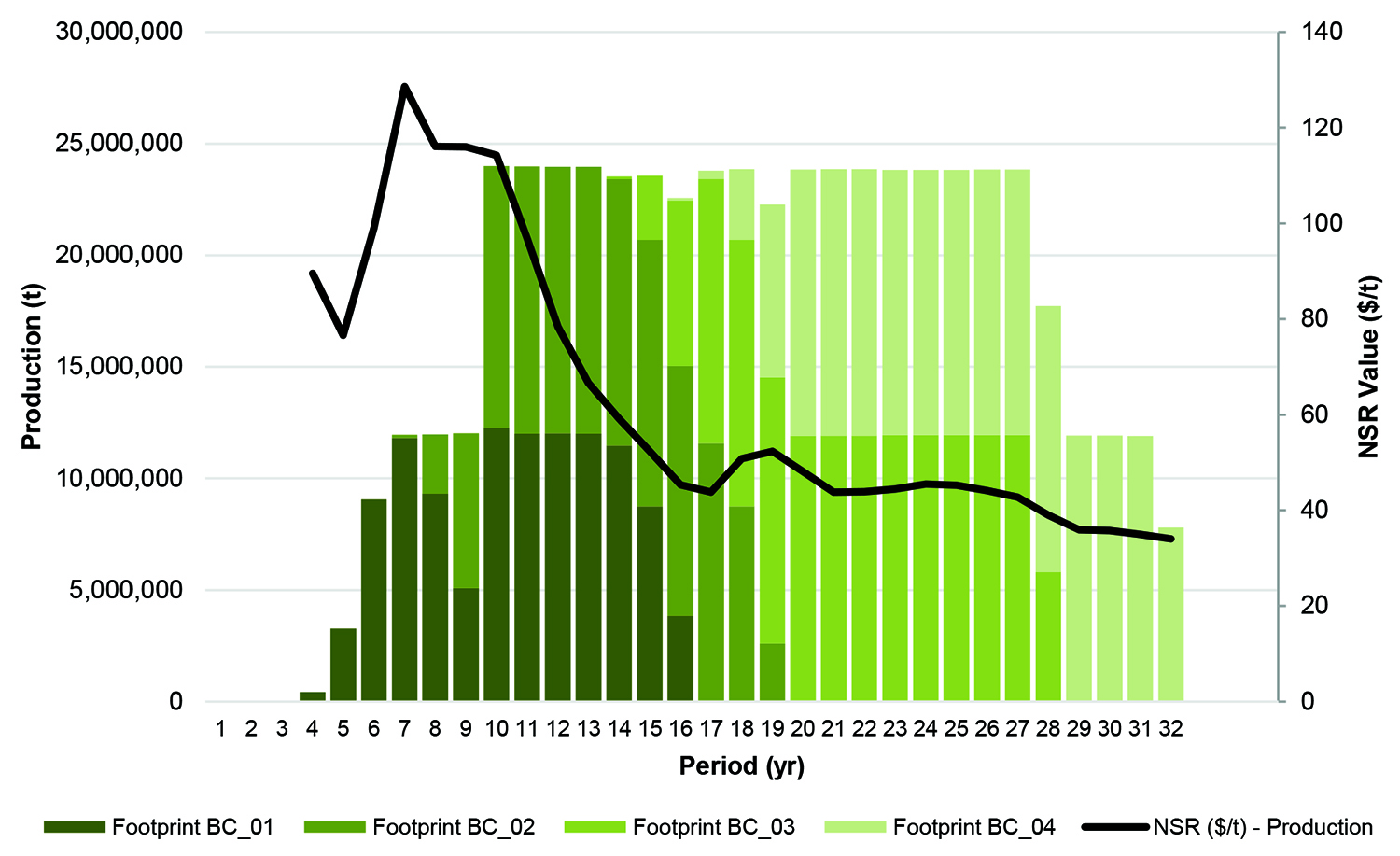

With a 28-year mine plan, Cascabel would mine copper, gold and silver from four block caves. (Chart: SolGold)

SolGold recently announced the results of the prefeasibility study for its flagship Cascabel concession, near Ibarra, Ecuador. The company said the results reaffirm the deposit’s world-class potential as a significant South American copper and gold mine.

Located in the Ecuadorian Andes, the Cascabel concession lies on the margin of the Eocene and Miocene metallogenic belts, which are renowned for hosting some of the world’s largest porphyry copper-gold deposits. It contains two deposits, the Alpala deposit and the Tandayama-America deposit, which lies approximately 3 km north of the Alpala deposit. The measured and indicated resources for the Alpala deposit are estimated at 3 billion metric tons (mt) with a grade of 0.35% copper, 0.28 grams per mt (g/mt) gold and 0.94 g/mt silver, which amounts to 10.7 million mt of copper, 26.8 million oz of gold and 91 million oz of silver.

The PFS estimates pre-production capital of $1.55 billion for the initial Cascabel mine development, first processing module and supporting infrastructure. With a 28-year mine plan, the block cave operation would produce on average 123,000 mt/y of copper, 277,000 oz/y of gold and 794,000/oz of silver.

Assuming prices of $3.85/lb for copper, $1,750/oz for gold and $22.50/oz for silver, the Cascabel PFS calculates a net present value (after tax) of $3.2 billion with a 24% IRR and 4-year payback period after processing begins.

The Cascabel underground mine would be accessed by twin declines from a box cut on the surface leading to the undercut development level for the first block cave on the 360 level. One decline will be used for the conveyor system, and the other decline will be used for equipment and logistics. All horizontal development will be undertaken using conventional drill and blast practices. The vertical development for the main ventilation raises will be excavated using raisebore methods.

The block cave layout includes four development levels: undercut, extraction, ventilation, and truck haulage. The mine plan calls for four block caves with footprints that range from 67,400 m2 to 103,500 m2.

Block caving is a non-selective mining method, meaning that all the rock extracted is treated as mill feed. Five single-stage jaw crushers will be installed underground to reduce the rock to a manageable size before its fed onto the main conveyor network to the surface. The inclined conveyors will be installed in 850- to 890-m lifts and maintain a nominal 4,600 mt/h production capacity (or 24 million mt/y).

The ore from the Cascabel mine will be processed using a conventional copper-gold flotation method. The ore reclaimed from the coarse ore stockpile will be conveyed to a grinding circuit consisting of a SAG mill, pebble crusher and ball mill in a closed circuit with classifying cyclones.

The study recommends securing surface rights for the proposed Cascabel mine, process plant and infrastructure ($23 million). It also recommends the $410 million Early Mine Access project to advance the development of the decline to support technical investigations for the feasibility study.