A significant investment in the Haile processing plant is expected to improve capacity by 40% and increase gold recovery rates to the mid-80% range.

OceanaGold makes major capex investments in South Carolina gold mine and mill

By Jesse Morton, Technical Writer

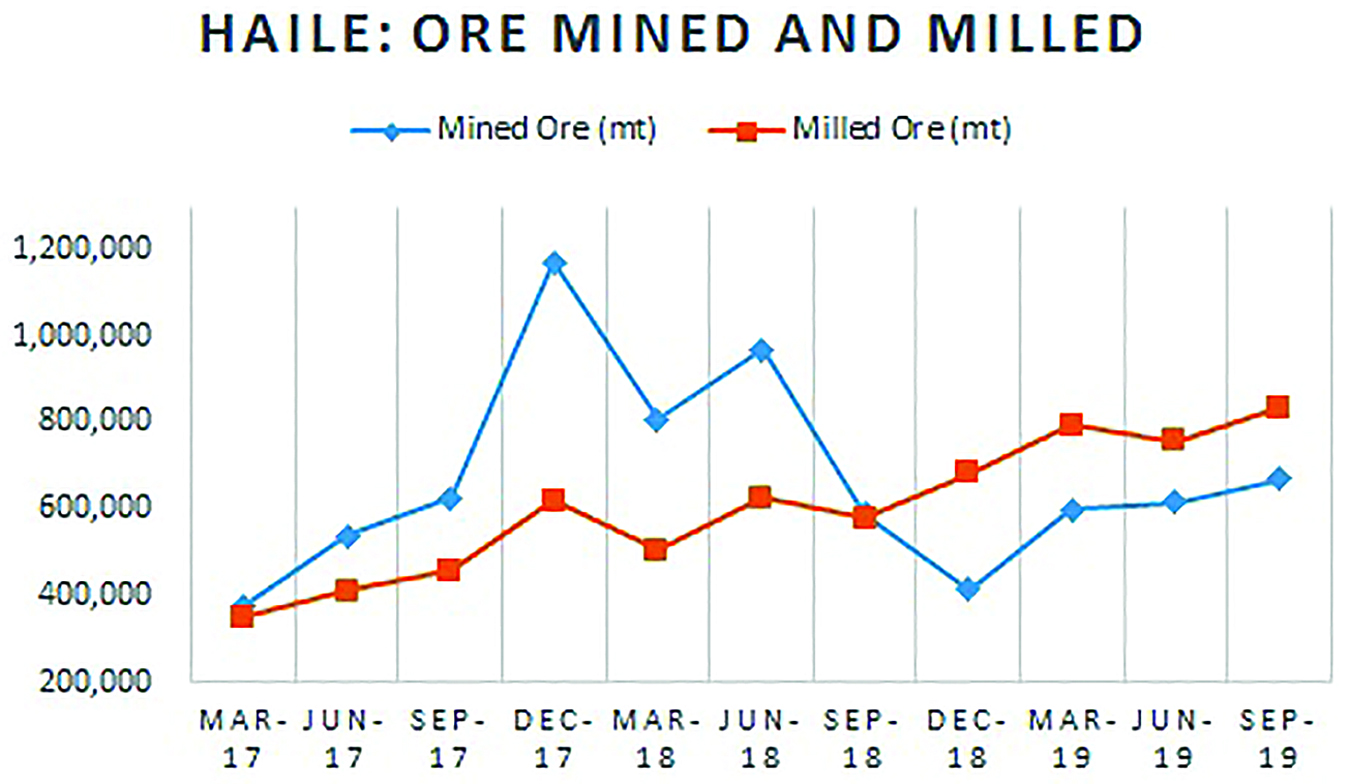

For OceanaGold’s Haile Gold Operation, the numbers from the last two years reveal a major milestone was hit in the second and third quarters of 2018 that launched a trend that continues today.

In Q1 2018, the total ore milled was down 12% from the average for 2017. Then it spiked. In Q2, it was up more than 8% over the 2017 average. It never retreated. The average total ore milled for H2 2018 through Q3 2019 was up a whopping 26% over the average for 2017.

The numbers also reveal that upward trend in ore milled resulted from substantial planned investments. Going by total sustaining and non-sustaining expenditure numbers, Haile went from being the company’s least expensive mine in 2017 to being its most expensive mine in 2018. In 2018, Haile accounted for 40% of what the company refers to as growth capital, with the rest divided between the company’s other three mines.

The numbers show that the mine is trending differently than the plant. In 2018, the company reported that total ore mined at Haile in Q3 dipped below the average for 2017. Afterward, it climbed steadily, but didn’t reach the 2017 average.

Significantly, in Q3 2018, the operation for the first time milled as much ore as it mined, and then, starting in Q4, it milled more than it mined. For the duration of 2019, the mill at Haile outpaced the mine, a trend and a challenge that the executive manager at the mine, James Whittaker, said the mine was eager to field. “There was a specific debottlenecking investment plan to take the plant from 3.5 million metric tons per year (mt/y) up to 4 million mt/y. That is the process that we have been going through this past year,” he said. “Right now, the plant is hitting all their targets, and the mine is chasing the plant.”

The plant has benefitted from a long-planned expansion program that has spanned more than two years, has seen the installation of top tier solutions, is expected to increase annual throughput by more than 40% over the 2017 average, and will provide a recovery rate in the mid-80% range.

With the construction of the final addition to the plant calendared for completion in Q4 2019, the wind-down of the plant expansion project amounts to a “major milestone” for the minesite, which started commercial production in Q3 2017, Whittaker said. “We have already hit record months in the plant,” he said. “We are well-positioned to beat our original budget and our forecasts on mill throughput.”

According to quarterly reports, the mine faced challenges in late 2018 and intermittently through 2019. Hurricane-level rainstorms, slow development of dewatering efforts, and limited access to higher grades impacted numbers for the period. Those numbers shouldn’t remain down for long as water management and mining rates improve, Whittaker said.

With the capacity of the mill almost optimized, the company is rolling out the plan to enable the mine to catch up. OceanaGold and Haile invited E&MJ to the site to demo the new plant and to showcase pieces of the effort to upscale the mining ops. What was revealed was easily one of the better equipped, more innovative operations in the U.S. and the world. What was also revealed are the challenges of running an open-pit mine in subtropical South Carolina, USA, far away from any other large-scale gold mining operations, in a tight labor market that is generally unaccustomed to the demands of continuous operations.

Mill Expansion Project

Ultimately a total investment of roughly $50 million will have gone to debottlenecking the mill, Whittaker told E&MJ. Per the 2017 technical report, the optimized mill was to be “on stream in 2021 at 10,959 mt/d.”

Most of the adjustments, additions and upgrades were envisioned as early as the planning stages of the mine, with some launching in the initial ramp up of operations. “There has been constant construction in the plant since it started,” Whittaker said.

Such an expansion program is standard for the industry, Curtis Cadwell, director of operations, Haile Gold Operations, said. “You start out at some set tonnage, and then add equipment and ramp up.”

And nothing about the geology mandated particularly unique equipment or processes, Whittaker said. “It is really a standard circuit: a primary jaw crusher, SAG and ball milling circuit, froth flotation with carbin in leach (CIL) and stripping circuit.”

Nonetheless, the upgrades and additions were numerous, were partly driven by discoveries about the geology made in the ramp up, and were executed incrementally and with substantial overlap. The attempt was to debottleneck without impeding plant operations while doing it.

With only one rebuild left to commission, Whittaker said the attempt has been successful. “The original primary grinding circuit seemed to have a lot of capacity,” Whittaker said. “Then you go to the next logical question, how can I increase the throughput of this total site?” he said. “The bottlenecks were identified. The capital was raised during last year’s process and then it was slowly but surely executed.”

The first bottleneck resolved in 2018 centered on oversize coming from the original primary crusher, new secondary crushers and the stockpile. From the stockpile, the feed went to a SAG mill and onto a screen. An influx of oversize resulting from mining harder ore at the main pit, Red Hill, developed, was anticipated in the planning stages of the plant. The need for the pebble crusher was described as a “key weakness in the design and plans” in a 2017 technical paper on the mine.

In 2018, a pebble crusher was installed to crush “the oversize down to 0.25 in. and put it back in the SAG mill,” Jason Garrick, process control engineer, Haile Gold Operation, said.

The underflow from the SAG mill goes to primary and secondary cyclones.

The underflow from the cyclones now goes to a new flash flotation cell. Ore from Haile was tested for flash flotation as early as 2010. According to the technical report, flash flotation “was shown to recover 62% to 66% of the gold in two minutes of flotation time.”

Cadwell said the flash float unit was not part of the original design, but was injected into the plan and stowed on site before plant startup.

Whittaker described it as a small, high-performance unit. “It enables you to offload concentrate very quickly and allows the rest of the flotation cells to work more efficiently.”

Garrick said OceanaGold added it because this process model is known at a couple of the company’s other sites where it performs well. “Flash float will float just as much as the four rougher float cells. They doubled our capacity at being able to float concentrate.”

Feed from the flash float cell goes to four rougher float cells. From there, the concentrate originally went to stirred media detritors (SMDs), which are now used for backup. Instead, it now goes into a new regrinding circuit, comprised of a tower mill and an IsaMill.

Installed in H2 2018 and Q1 2019, and commissioned in Q2 2019, the tower mill grinding circuit, as planned out in 2017, operates in reverse closed circuit with its own hydrocyclone cluster.

“We’ve set the circuits up so that the feed to the tower mill comes from the surge tank, and the discharge from the tower mill goes back to the cyclone feed box and back through the cyclones,” Garrick said. “It is in a constant sizing. Only the right size goes to the IsaMill. The target here is roughly 20 microns. We’ve been achieving between 20 and 35.”

Overflow goes to the cyclones. Underflow goes to the IsaMill if it is available. If unavailable, it drops to a discharge box and is close-circuited in the cyclones for further sizing until the IsaMill is available. “It is very sensitive with densities, but when you get it balanced, it works well,” Garrick said.

Once sized below 20 microns, the feed goes to a regrind discharge box and on to the pre-aeration thickener. “The original pre-aeration thickener was too small for the original design,” Garrick said. Currently, the mill runs two pumps “almost wide open to keep up with the concentrate going through it,” he said. “We are getting a new one built now.”

The plans for the addition were summarized in the technical report. “Oxygen will be added to the slurry using a closed circuit, pumped flow, high-shear oxygenation device to enhance passivation of reactive metal sulphide mineral surfaces.”

Design and concrete work for the new thickener was completed in Q3 2019, with construction completion and commissioning calendared for year-end 2019, the company reported.

The new pre-aeration tank will oxidize the concentrate before it goes to the first leach tank, Garrick said. “We’ve done quite a few pH studies for the pre-aeration and we’re looking at a goldilocks scenario that will improve oxidization and also will improve leaching,” he said. “We haven’t quite put our foot down on whether we are going to do it or not because we haven’t seen enough testing to come back to say that it is worth it. It looks like what we are doing now is probably the best.”

From the pre-aeration thickener, the concentrate moves to the Concentrate CIL Tanks 1 through 8. Historically, it spent up to 24 hours in CIL 1. “From CIL 2 to 8 was another 24 hours,” Garrick said. “With the increased throughput, we are down to a total of 24 to 28 hours total in the CIL circuit. We still get most of our leaching in eight hours in Tank 1.”

For the CIL tanks, the mill recently deployed a carbon scout, which samples and measures activated carbon densities online. “We are going to use that as part of our automation process here in the future for carbon movement so that we can make sure that we’ve got enough carbon, so we don’t have any solution loss,” Garrick said.

Automation means a “fuzzy logic predictive mill control system,” Whittaker said.

The mill also recently installed a mercury capture system downstream of the carbon regeneration kiln. “Somewhere in the ore, somewhere in the process we are picking up mercury. We don’t know where,” Garrick said. “It is real low concentrations, but it is enough to raise concern. To stay in permit compliance we’ve added that system just to make sure that we’re not emitting anything.”

The carbon is pulled from CIL Tank 1 and moved through an acid wash and on to a strip vessel, which brings it up to pressure and temperature. “On average, we run at temperature for four hours,” Garrick said. “That will strip all the gold off the carbon. Then we will move it to the kiln.”

The carbon goes through the regenerating kiln and then back into CIL.

The thickener underflow slurry moves through a series of destruct tanks, one of which is new. “To increase throughput, we had to increase residence on the back end so that we’ve got enough time to destroy the cyanide,” Garrick said. “We are still in commissioning.” Commissioning was calendared for completion in Q4 2019, the company reported.

The 2017 technical report listed nine expected post-startup additions to the plant. Whittaker said additional debottlenecking measures included upgrades and upscales to the pumps and lines. “What we found very quickly is some of the pumps, lines and auxiliary equipment around the grinding circuit were holding back capacity,” he said. “All of this year, there have been a lot of these types of small investment projects.”

Garrick said the constant construction has added a layer of responsibility and complexity to the routine operations of the mill. “It has been one thing after another after another,” he added.

Whittaker agreed. “It makes it hard to operate.” Being at the far end of the expansion program allows the plant to phase into optimization and continuous improvement programs. “It will be nice to get out of the expansion and construction business and get into the efficiency business,” he said. “That is what we are getting to very quickly.”

For Q4 2019, the company calendared optimizing the regrinding circuit, which would allow the plant to “maintain steady-state grind sizes and recoveries” and achieve a throughput rate up 40% year over year.

That rate, while representing a major milestone for the operation, presents challenges to a mine that has otherwise struggled to hit its numbers this year.

Feed from the rougher float cells now reports to a new re-grinding circuit, which includes a tower mill and the first IsaMill (above) installed in the USA.

Upscaling the Mine

According to the mine’s technical report, Haile consists of 11 named gold deposits within a 3.5-km x 1-km area. Once completed, the pit will span 2.5 km from east to west, 1.25 km from north to south, and to a depth of 370 m. To get there, the plan is to work eight historic pits, some of which date back more than a century. Three will become pit lakes. Ultimately, the mine will graduate to an underground operation, which is still in the permitting phases.

Currently, the mine looks like a couple of quarries side by side. The main pit, Red Hill, was being fast tracked in Q1 2019. There the sediment layers include purple and white bands of cerussites and red and orange clays. A smudge of black basalt defines a contour of the tallest ridge, roughly 150 m above sea level.

At a shovel roughly 50 m beneath it, a Caterpillar 777, one of a dozen in the fleet, pulls away. For it, the cycle time from the tip site and back is short. The road out climbs maybe 25 m. “We’re not real deep here. We’re just barely to the horizon,” Cadwell said. “Here you don’t see a lot of real competent rock yet.” Yet is the key word.

Equipped with Cat’s GNSS-based MineStar Fleet tech, the hauler is roughly equidistant from those in front of and behind it. It crests a hill, descends and disappears. Its usage in Red Hill is almost at an end.

With the plant expansion program nearing completion, a new fleet is coming online to move the additional ore. Haile is deploying 15 new 180-mt Komatsu 730E-10 electric haulers, a PC3000 excavator and a PC4000 hydraulic shovel.

Cadwell said the original plan contemplated graduating from the 777s. “A 777 is not a high-duty truck,” he said. “We always knew we were going to go from 100-ton trucks to something bigger.”

Decision time hit at year-end 2018. The idea was to adopt haulers in the 150- to 200-mt range, Cadwell said. “You do the evaluation. You do total cost of ownership. That is the cost of the machine. The cost to run it. The cost to maintain it over a 60,000-hour life,” he said. “You say at 60,000 hours, I’m going to replace all these parts, everything else. What is the total cost of ownership over the total tons I am going to move with that machine?”

Other factors include vendor support and ease of maintenance.

“With the Komatsu electric drive truck, the wheel motors bolt on and then you connect cables to them,” Cadwell said. “You’ve got a diesel motor, a generator, and cables running from that generator to the two-wheel motors on the back end.”

Thus, it is simpler to maintain than a mechanical drive truck “where you’ve got final drive differentials, you’ve got a lot of fluids, and other things,” Cadwell said. “The other thing is on rough surfaces, with an electric drive truck, the engine doesn’t feel the road like a mechanical drive truck does because it is just electrons moving from the generator to the wheels.”

On a mechanical drive, the entire drive train up to the engine can be damaged in a single incident, Cadwell said. “On an electric drive truck, if you have an incident with one of the wheel motors, you take it off and put on another one and that is kind of the end of it,” he said. “It is very a very simple maintenance model.”

Whittaker agreed. “You don’t have the linkage,” he said. “So the road conditions can be less forgiving.”

Part of the decision to go to the electric drive haulers was diesel costs, Sam Murphy, group commercial manager, Haile Gold Operation, OceanaGold, said. Yet the big picture was more complex, he said. “Total burn rates are very similar between Cat and KOM via various offsetting factors.”

Komatsu leadership told E&MJ the standard 730E-10 features the company’s Fuel Saver Technology. “We have seen fuel reduction of 5% or more by utilizing Fuel Saver II combined with Tier 4 Technology,” Brian Yureskes, director, sales and business development, Komatsu, said. “In addition to fuel economy, components are designed more durable and less complicated for longer life expectancy and ease of maintenance to reduce replacement parts cost and maintenance downtime,” he said. “The total cost of ownership advantage of the 730E-10 is the result of intense product testing to ensure robust product quality, customer feedback on service and performance, and a complete understanding of the major cost drivers faced by mining operations today.”

Ultimately, the primary factors in the decision were the initial capital costs and projected operating costs, Whittaker said. It hinged on long-term projections of both, he said. “As the mine gets deeper, the haulage cycle times and the uphill climb gets longer,” he said. “OceanaGold keeps the view on the long game and so a lot of the decisions are not made on a quarter-to-quarter basis.”

It was not an easy decision, Cadwell said. “It was close,” he said. “Dollar-wise it was pretty even.”

Whittaker said the discussion of whether to go with hydraulic or rope shovels was similar. “When you look 10 years down the road, which one actually works better?” he said. “What is the fit for purpose for this type of mine and which gives you the better long-term cost structure?”

Within earshot of Red Hill is the laydown yard, where the new haulers and shovels are being built. Part of the original mine plan, it is a couple acres of leveled hilltop. In one corner, an arching tent referred to as a temporary maintenance facility provides shelter from the mist. Covered with plastic and scattered strategically are various parts and components. A half-built 730E occupies the center. Behind it, the second PC4000 takes shape.

By mid-October 2019, nine 730E haulers were complete. The remaining six were expected to be completed by May. The project has continued apace despite the Lowland summer weather. “As long as these guys have space and you don’t have lightning, they are fine,” Whittaker said.

The big issues thus far have related to logistics, he said. “These parts come from different places in the U.S., from different ports,” Whittaker said. “Different states have different logistics,” he said. “We are on top of it now, but at first it was a bit of a surprise. One state would have one way of looking at it and another would have another.”

By mid-October 2019, nine Komatsu 730E-10 haulers had been assembled at the laydown yard near the Red Hill pit. The remaining six were expected to be completed by May 2020.

Each state would have its own limits on width of loads. One solution was to, for example, cut the truck boxes in half. “It has been kind of unique here, getting truck parts in pieces,” Whittaker said. In other countries, he said, the norm would be for it to be brought in complete on the back of a large flat deck. “We are basically bringing them in in small parts and putting them together,” he added.

The fleet was purchased from Linder Industrial Machinery, in Columbia, South Carolina. Handling the logistics and building the units was farmed out to J.P. Technical Services Inc. of Kentucky.

Leadership at the latter told E&MJ the project plan, site and management is perhaps the best it has seen. “I’ve got 34 years of mining experience and I would put theirs at the top of the ladder in terms of how the job is laid out,” Jonathan Pruitt, owner, J.P. Tech Services, said.

Being currently ahead of schedule is due to Komatsu, Linder, Haile and J.P. Tech communicating and coordinating effectively, Pruitt said. “The three parties working together has been very beneficial in the productivity and the safety record we’ve achieved, communication is key,” Pruitt added.

However, most critical to the success of the project was “having one vendor in control of the transportation, the assembly, the welding, the lifting, negated having so many different possible problems,” he said. “Our company has worked hard at achieving these goals.”

Pruitt said the biggest challenge is balancing employee personal time with productivity at a seven-day-per-week jobsite. “On a job of this scope and size, if you don’t balance manpower, personal time, and productivity carefully, you could have men getting burned out or injured due to fatigue,” he said. “We met the challenge by putting teams in place, a red team and a blue team, and we worked a six-four rotation with 11-hour shifts. They work six and they are off four.”

Finding that balance “was a small learning curve for us and we’ve adapted and done well,” he said.

Whittaker said that with each new hauler build, the teams involved discover “a few more things about signals, cables and connections.” That knowledge is then leveraged with the next build. “The only thing I can assure you is we are getting better at building them,” he said. “Each is built more efficiently than the last.”

The mine is considering deploying teleremote drills in H1 2020, including the Sandvik DR410i rotary drill. The model is calendared to be released to the market in Q1 2020. Sandvik leadership told E&MJ the rig will provide best-in-class machine efficiency and hole quality. “The automation-capable, midsize drill will provide a powerful, productive solution for their blast hole drilling needs,” said Matt Chorley, vice president, global product management and sales, Rotary Drill Division, Sandvik Mining and Rock Technology.

Until then, the focus is maximum productivity with the resources available, including the human resources.

Staffing Innovations

The upscaling projects at Haile pushed the company to add staff. The resulting effort was two-pronged. The company took measures to retain people and recruit. To lower turnover rate, the mine modified its shift schedules.

In the first couple of years, the mine ran a seven-by-seven rotation. The worker would be on seven days and then off

seven days. “That is effective when you have a camp operation and you need to move people over large distances,” Whittaker said. “But most of our people are local, within a short drive from the mine. Almost everybody here lives within almost an hour from the site.”

The rotation schedule was highly unpopular. “People just couldn’t handle the long schedule,” Whittaker said. “It was something that was not very normal here to say you are going to work seven days, 12 hours per day, and then you get seven off. Locally, it just didn’t fit.”

In Q1 2019, the mine switched to four-by-four and four-by-five schemes. “So, shorter schedules, more rotation,” Whittaker said. “That went over really well. That immediately started to drop the turnover rate.”

Cadwell described the new rotation scheme as more balanced. “It is even time,” he said. “In a 36-day cycle, you work 18 and you are off 18, but it is five and four and you go nights for half the time and days for the other half.”

To add staff, the mine recruited in coal country, Cadwell said. “The tight labor market is a challenge,” he said. “Coal mining has been good because we’ve been able to pick up coal miners. That works well on the mine side because you can find experienced people from coal mines.”

Finding skilled personnel for the plant is a different story. “Gold mining is pretty hot right now” and so experienced plant workers are hard to come by, Cadwell said. “We’ve done career fairs in the West, in Nevada, Arizona and Wyoming.”

The plant therefore employs more locals who have prior experience in the power space. “Maintaining a power plant, operating a power plant, when compared to operating a gold processing plant, you get enough similarities that it transfers alright,” Cadwell said. “But we spend a lot of time training.”

In Q1 2019, the operation was onboarding as many as 15 new hires per week, Whittaker said. At the time, turnover at the mine was close to 40% and 30% at the plant.

Since then it has leveled out, Cadwell said. “It seems like we are headed toward 20%, which is pretty healthy.”

The new Komatsu fleet requires the mine to bring on experts who are increasingly hard to find, Whittaker said. “There is a serious shortage in the eastern U.S. of heavy-duty mechanics who have even seen this type of equipment,” he said. “The issue about finding good talented mechanical electrical technicians to work on this class of equipment has been a challenge, and will continue to be a challenge.”

Finding and training them may be difficult, but keeping them shouldn’t be, Whittaker said. “Haile offers a unique combination of professional and lifestyle opportunities. Located between the sea and the mountains, it offers great choices in both city and country living,” he said. “It is extremely hard to find a project of this caliber, with varied mining and technological challenges, in a great lifestyle setting.”