Nevada leads the way in mining investment attractiveness according to Fraser Institute’s 2020 annual survey of mining and exploration companies. (Image: Fraser Institute)

Nevada ranks as the top jurisdiction in the world for mining investment based on the Fraser Institute’s 2020 annual survey of mining and exploration companies. The least attractive mining jurisdiction was Venezuela.

The report is the result of a survey sent to individuals in the industry to assess how mineral endowments and public policy factors such as taxation and regulatory uncertainty affect exploration investment. Responses are tallied to rank provinces, states, and countries according to the extent that public policy factors encourage or discourage mining investment.

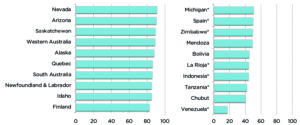

The top jurisdiction in the world for investment based on the Investment Attractiveness Index is Nevada, which moved up from its third-place ranking in 2019. Arizona followed in second, which ranked ninth in 2019. Saskatchewan climbed eight spots from 11th in 2019 to third in 2020. Western Australia ranked fourth this year after topping the ranking last year, and Alaska dropped a spot from fourth in 2019 to fifth in 2020. Rounding out the top 10 are Quebec, South Australia, Newfoundland and Labrador, Idaho, and Finland.

When considering both policy and mineral potential in the Investment Attractiveness Index, Venezuela ranks as the least attractive mining jurisdictions in the world for investment followed by Chubut, Argentina, and Tanzania. Also, in the bottom 10 (beginning with the worst) are Indonesia, La Rioja, Argentina, Bolivia, Mendoza, Argentina, Zimbabwe, Spain, and Michigan.

While geologic and economic considerations are important factors in mineral exploration, a region’s policy climate is also an important investment consideration.

An overall Investment Attractiveness Index is constructed by combining the Best Practices Mineral Potential index, which rates regions based on their geologic attractiveness, and the Policy Perception Index, a composite index that measures the effects of government policy on attitudes toward exploration investment. The Policy Perception Index alone does not recognize the fact that investment decisions are often sizeable based on the pure mineral potential of a jurisdiction. Respondents consistently indicate that approximately 40% of their investment decision is determined by policy factors, according to the report.

The companies that participated in the survey reported exploration spending of US$1.51 billion in 2020 and US$1.53 billion in 2019.

The report received a total of 276 responses out of 2,200, and it evaluated 77 jurisdictions. In 2019, 76 jurisdictions were evaluated, 83 in 2018, 91 in 2017, and 104 in 2016. This year’s survey also includes an analysis of permit times.