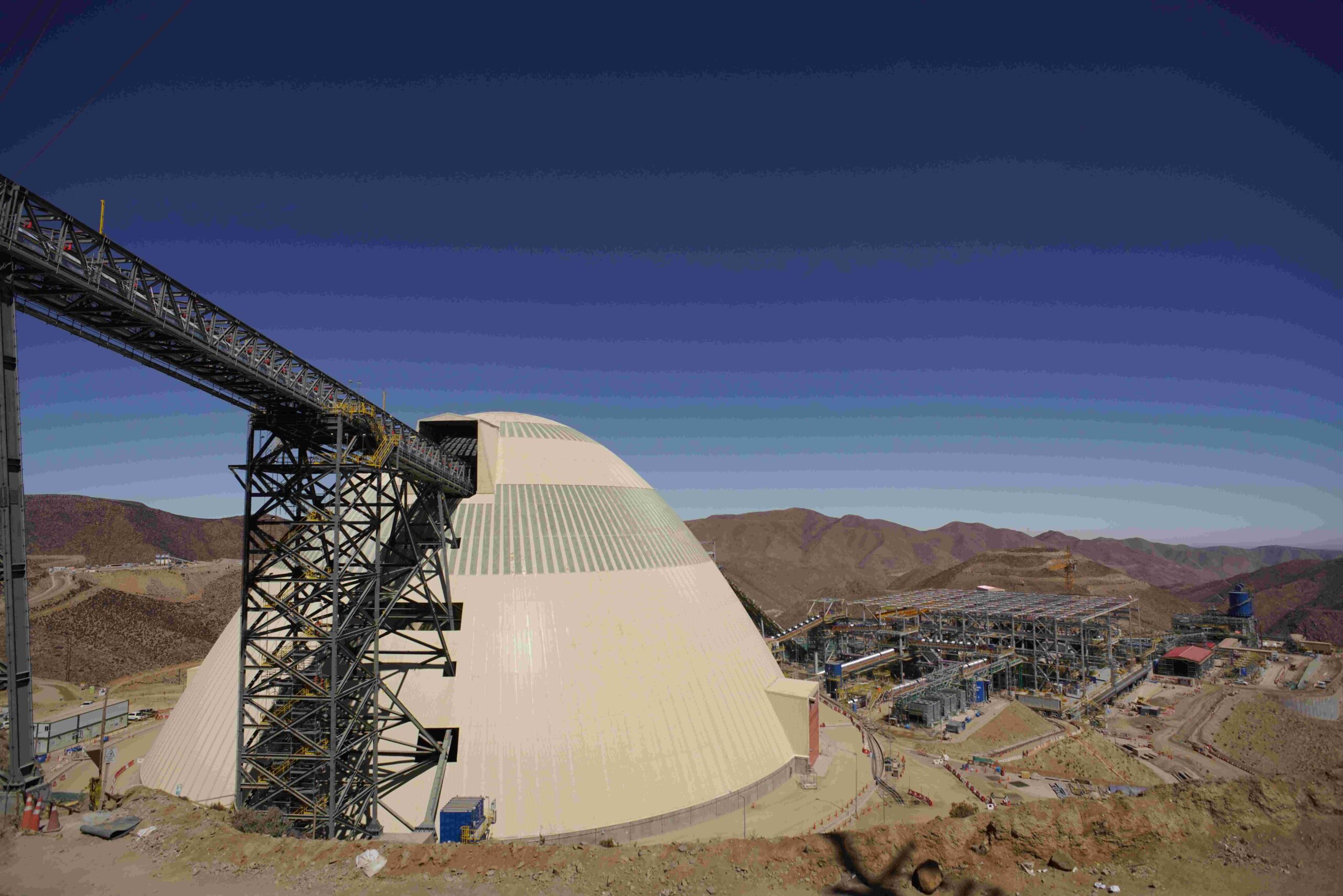

The Papujune Dome at Anglo American’s Quellaveco copper mine in Peru.

By Steve Fiscor, Editor-in-Chief, E&MJ

The world’s largest mining company by market cap, BHP, presented Anglo American with a non-binding, all-share takeover bid that values Anglo at $38.9 billion. Anglo confirmed it had received an unsolicited and highly conditional proposal, and it said it was reviewing it.

BHP offered 0.7097 of its shares for each Anglo share. One of the major conditions of the offer includes de-merging Anglo American Platinum and Kumba Iron Ore, which operates the Sishen mine in South Africa.

If the acquisition were to take place, it would propel BHP’s status as a leading miner and also as a leading copper producer with an estimated 10% of world output. With its acquisition of OZ Minerals in 2023, BHP moved ahead of Codelco as the world’s largest copper producer at 1.5 million metric tons per year (mt/y). Codelco, Chile’s national copper mining company, had held the No. 1 position for decades, probably since its inception. In 2023, Codelco produced 1.4 million mt of copper, followed by Freeport McMoRan (1.3 million mt). Anglo produced 571,000 mt of copper in 2023.

In addition to copper, platinum group metals, and iron ore, Anglo American is a multinational miner that also produces nickel, diamonds, manganese, metallurgical coal, and polyhalite.