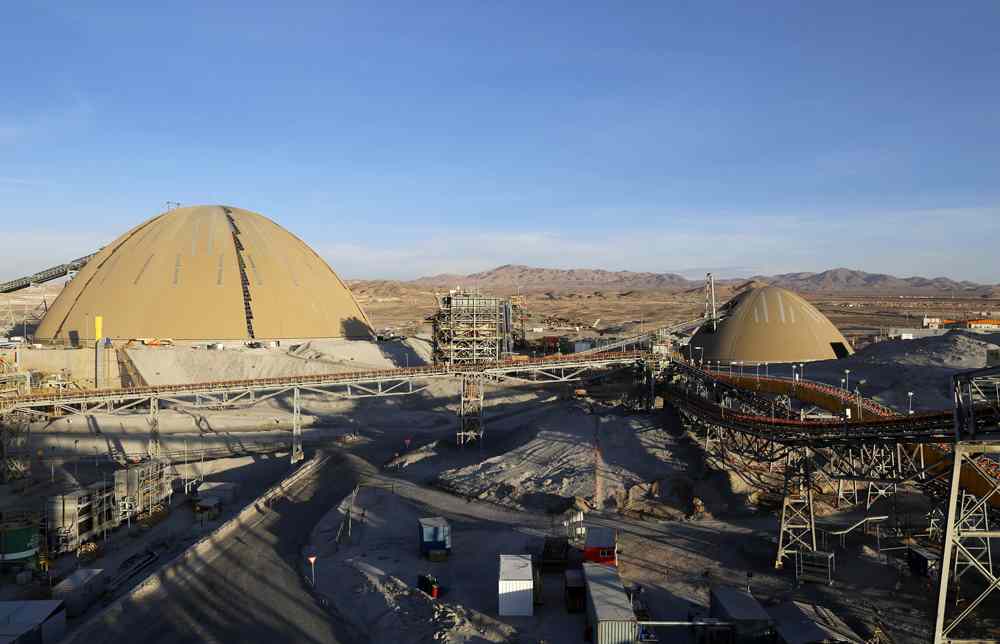

The second concentrator is expected to add 170,000 mt/d of copper capacity to the exisiting Centinela operations (above). (Photo: Antofagasta plc)

Antofagasta plc announced that Minera Centinela signed agreements with a group of international lenders to finance the $2.5 billion Centinela Second Concentrator Project. Minera Centinela, located near Antofagasta, Chile, is owned by Antofagasta (70%) and Marubeni Corp. (30%).

“We have agreed on competitive financing terms with strong international lenders, which is a testament to the high-quality nature of this project,” Antofagasta’s CEO, Iván Arriagada said. “The project is a prime example of how Antofagasta can unlock value from its portfolio and our dedication to sustainable and responsible copper production.”

The $2.5 billion term loan facility has a 4-year drawdown period and a term of approximately 12 years. The financing has been provided by a group of international lenders, including the Japan Bank for International Cooperation, Export Development Canada, the Export-Import Bank of Korea and several commercial banks (Crédit Agricole Corporate and Investment Bank, KfW IPEX-Bank, Natixis Corporate & Investment Banking, Societe Generale and Sumitomo Mitsui Banking Corp.).

Separately, Centinela has entered an agreement that provides it with the option to receive water for its current and future operations from an experienced international consortium who would acquire Centinela’s existing water supply system and build an expansion of this system to supply the Centinela Second Concentrator Project. To complete this agreement, the international consortium is required to close its financing, which is expected to be finalized this year.

Under the terms of this agreement, Centinela would transfer its existing water transportation assets and rights for an estimated $600 million to be received in 2024. In addition, the construction and associated capital expenditure for the planned expansion of the $380 million water transportation system would be undertaken by the consortium.

The Centinela Second Concentrator Project will add 170,000 metric tons per year (mt/y) of copper-equivalent production, comprising 144,000 mt/y of copper production and associated gold and molybdenum by-products. Through this expansion, it is expected that Centinela will improve its cost competitiveness through an increased focus on concentrator capacity that incorporates modern technologies, increased by-products and greater economies of scale. First copper production from the project is expected in 2027.