Magna Mining Inc. has entered a share purchase agreement to acquire Lonmin Canada Inc., including the Denison Project and the Crean Hill mine, a past producer of nickel, copper, and platinum group metals (PGMs).

Magna Mining Inc. has entered a share purchase agreement to acquire Lonmin Canada Inc., including the Denison Project and the Crean Hill mine, a past producer of nickel, copper, and platinum group metals (PGMs).

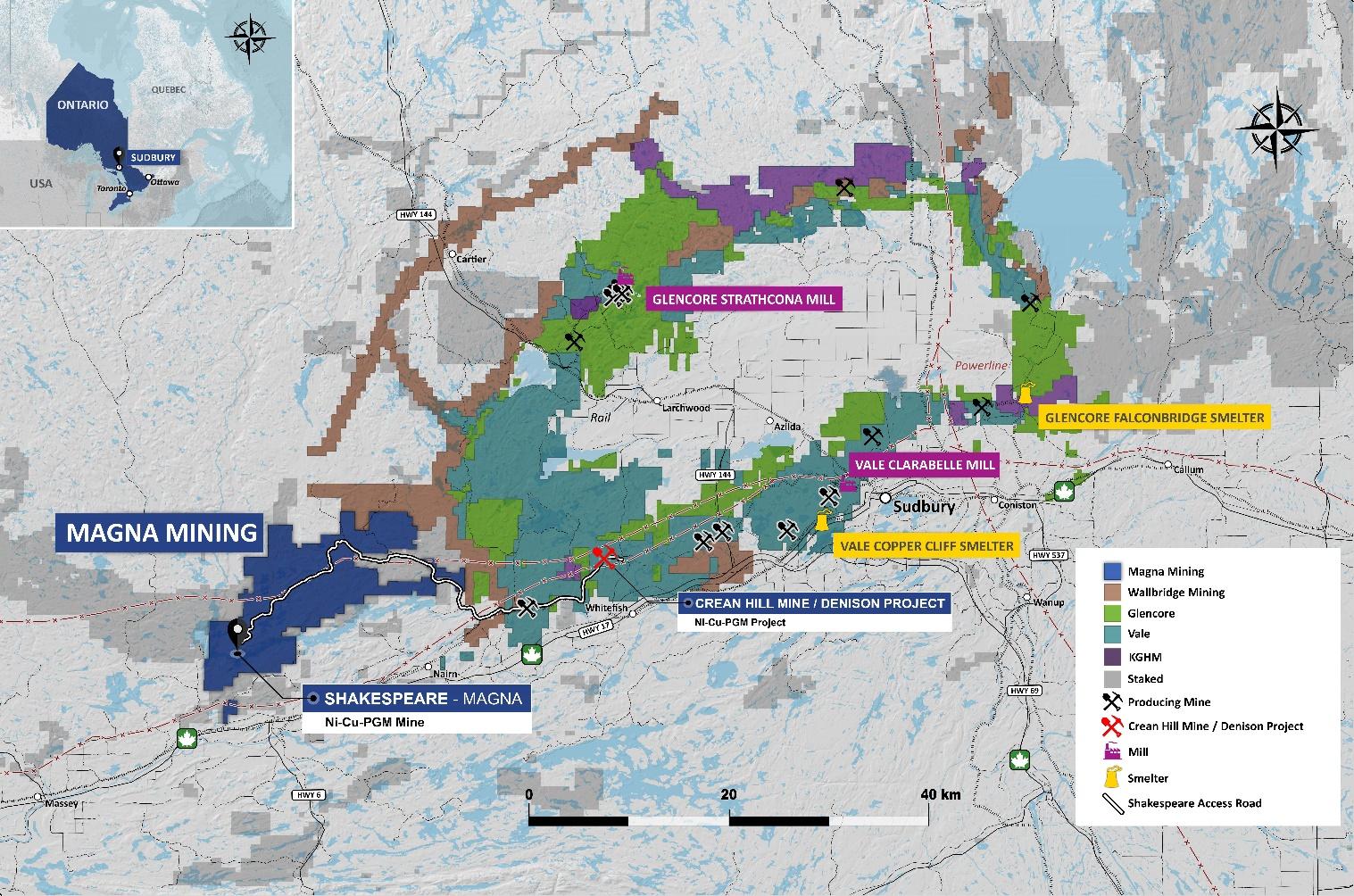

“The Crean Hill mine was a significant producer in the Sudbury Basin for more than 80 years and we believe the Denison Project has potential to add tremendous value through development of the remaining historical mineral resources and additional exploration on the property,” said Magna CEO Jason Jessup. “The successful closing of this transaction will be transformative for Magna and has several potential synergies with Magna’s fully permitted, advanced stage Shakespeare Project.”

Located 37 km east of the Shakespeare Project, Crean Hill operated during three separate periods, from 1906 to 2002, with past production totaling 20.3 million metric tons (mt) grading 1.3% nickel, 1.1% copper, 1.6 g/mt PGM (and gold). It has significant existing infrastructure including a 4,000 ft shaft. The deposit was originally discovered by Sir Francis Charles Crean in 1885. In 2018, subsequent to the mine closing, Lonmin Canada entered into an agreement with Vale Canada Ltd. regarding the transfer and development of the Denison Project and Crean Hill.

Magna is an exploration and development company focused on nickel, copper and PGM projects in the Sudbury Basin. Its flagship asset is the past producing Shakespeare mine, which has major permits for the construction of a 4,500 mt/d open-pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180 km2 prospective land package. Magna believes the Denison Project has potential to provide feed to extend the life of the Shakespeare mine or operate in the near-term through toll milling or a combination of both.

Magna Mining entered the agreement with Lonmin Canada and its current shareholders, Sibanye UK Ltd., Wallbridge Mining Co. Ltd. and certain other minority shareholders, also known as the vendors. The aggregate purchase price for the outstanding shares of Lonmin Canada is $16 million, comprised of a closing payment of $13 million in cash and a deferred payment of $3 million, payable pro rata to the vendors. The deferred payment is payable on or before the 12-month anniversary of the closing of the acquisition.

The company will inherit Lonmin Canada’s existing commercial arrangements with Vale, including access rights and a net smelter return royalty. Certain other arrangements including Lonmin Canada’s joint venture arrangements with Wallbridge will terminate concurrently with the closing. To fund the cash component of the purchase price, as well as ongoing exploration and development activities at the Denison Project, Magna is proposing to undertake a private placement of up to $20 million in subscription receipts.