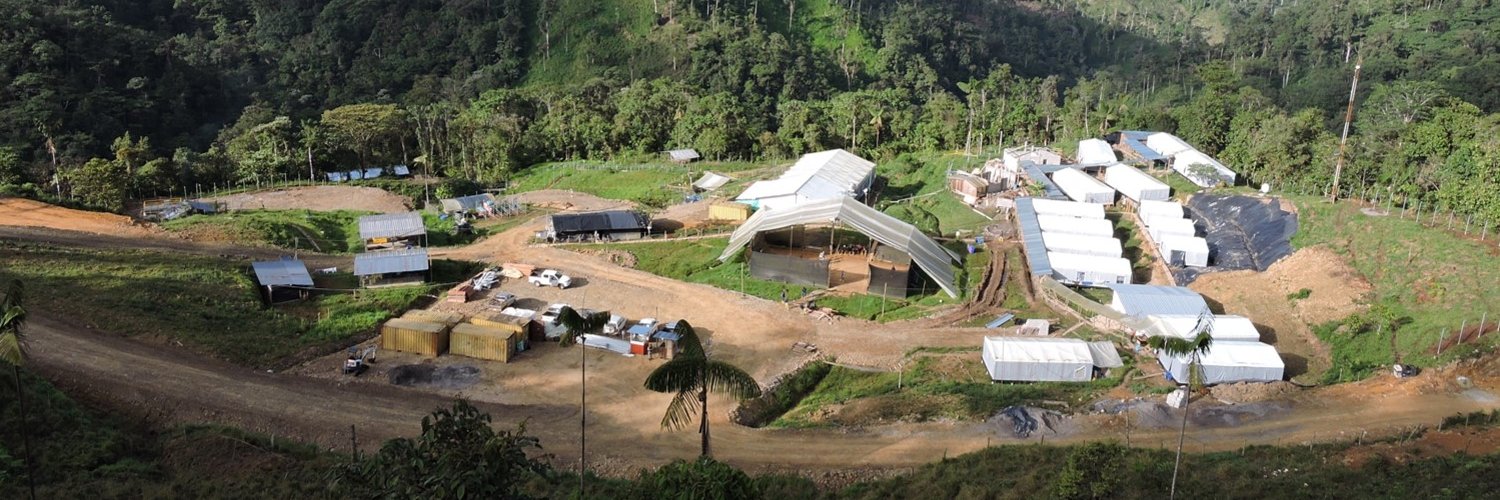

The funding will be used to get the Apala project (above) through to a final feasibility study and a development decision. (Photo: SolGold)

SolGold recently completed the US$100 million royalty financing with Franco-Nevada Corp. for the Alpala copper-gold project and remainder of the Cascabel concession in northern Ecuador. The funds will be used to progress the project through to the final feasibility study and a development decision, according to the company.

The balance of the proceeds is expected to be used for SolGold’s share of the development of Alpala pursuant to agreements with the minority shareholder of Exploraciones Novomining S.A. (ENSA), Cornerstone Capital Resources Inc.

In return, Franco-Nevada will receive a 1% royalty interest, calculated in reference to net smelter returns (NSR) from the Cascabel concession area. The NSR financing can be upsized by US$50 million at SolGold’s election to a 1.5% NSR royalty interest on or before January 11, 2021.

The Alpala deposit is the main target in the Cascabel concession, located on the northern section of the Andean Copper Belt, the entirety of which is renowned as the base for nearly half of the world’s copper production, SolGold said.