Alcoa and the government of Suriname have agreed to pursue a transaction for a government-owned entity to acquire Suralco. In October 2014, the government and Alcoa signed a Memorandum of Understanding reflecting both parties’ intent to find a solution for the future of Suralco, which has limited bauxite reserves and lacks a long-term energy solution. They now intend to pursue a transaction where a government-owned entity would acquire Suralco, including its mining, refining, and Afobaka hydroelectric operations and are targeting July 1 for reaching an agreement on the proposed transaction.

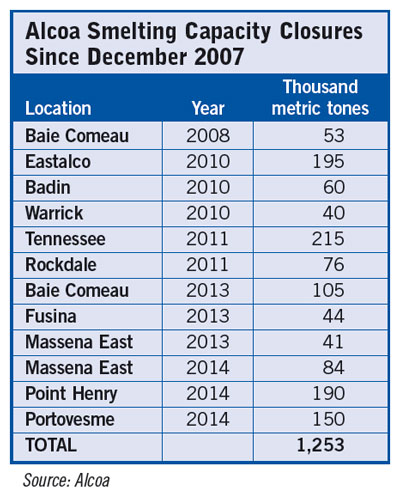

The Suralco curtailment and potential transaction are in line with a March 6 Alcoa announcement that it is reviewing 500,000 metric tons (mt) of smelting capacity and 2.8 million mt of alumina refining capacity for possible partial to full plant curtailments, permanent shutdowns or divestitures. The company has curtailed, closed or sold 1.3 million mt, or 31%, of its highest-cost global smelting capacity since 2007. The current review could affect 14% of Alcoa’s global smelting capacity and 16% of its global refining capacity. Currently, 19%, or 665,000 mt, of the company’s smelting capacity and 7%, or 1.2 million mt, of its refining capacity is idle.

The Suralco curtailment and potential transaction are in line with a March 6 Alcoa announcement that it is reviewing 500,000 metric tons (mt) of smelting capacity and 2.8 million mt of alumina refining capacity for possible partial to full plant curtailments, permanent shutdowns or divestitures. The company has curtailed, closed or sold 1.3 million mt, or 31%, of its highest-cost global smelting capacity since 2007. The current review could affect 14% of Alcoa’s global smelting capacity and 16% of its global refining capacity. Currently, 19%, or 665,000 mt, of the company’s smelting capacity and 7%, or 1.2 million mt, of its refining capacity is idle.

Alcoa’s production cuts have accompanied a general down trend in aluminum prices, which hit their most recent peak of about $1.20/lb in June 2011. Throughout early March, aluminum was trading at around $0.80/lb.

Bob Wilt, president of Alcoa’s Global Primary Products group, said. “Our goal is to move down the global aluminum cost curve to the 38th percentile and the global alumina cost curve to the 21st percentile by 2016. The results from this review will help achieve those goals.”

Alcoa also announced in March that it and its joint-venture partner Rio Tinto have agreed to terminate a long-standing agreement with the government of Western Australia intended to facilitate mining of bauxite and development of an alumina refinery in the north Kimberley region of Western Australia. The area is internationally recognized for its rich flora and fauna, tourist attractions such as the spectacular Mitchell Falls, and indigenous rock art dating back more than 40,000 years. Termination of the agreement clears the way for a proposed national park.

“The Kimberley National Park can now include the Mitchell Plateau area, where Rio Tinto and other mining companies have undertaken exploration since the early 1970s. More than 175,000 ha of land on the Mitchell Plateau will become part of what is intended to be Australia’s largest national park, covering more than 2 million ha across the Kimberley,” Rio Tinto Chief Executive Sam Walsh said.

“While the Mitchell Plateau bauxite resource is likely to hold value in the future, the State Agreement Act required the development of an alumina refinery, which has always proven to be economically challenging. Premier Barnett has made it a priority to preserve the environmental and cultural heritage values of this area as an asset for the people of Western Australia and visitors to the state,” Walsh explained.

The Rio Tinto/Alcoa joint venture has actively evaluated the development of an integrated bauxite mine and alumina refinery project on the Mitchell Plateau since the State Agreement was established more than 40 years ago.