The making of the Clean Air Metals management team

By J. Kevin Palmer

It was a chilly day in January 2013 when the phone rang at the Gallagher residence in Oakville, Ontario. On the one end was a senior executive with North American Palladium (NAP) on the other, mining engineer Jim Gallagher.

It seemed the Lac des Iles mine owned at the time by NAP had fallen on difficult times. The price of palladium had reached record lows, mine productivity was hampered due to problems with new shaft development, and the mine was experiencing continual employee turnover, seemingly beyond management’s control. With a corporate debt bomb about to explode, times were quite uncertain.

The reason for NAP’s call that day to Gallagher was quite clear — Gallagher at that point had an impressive string of wins in a mining engineering career spanning more than 38 years. With mining in his blood, having been raised by a Nova Scotia coal miner, Gallagher moved to the Sudbury area as a young child. After studying mining engineering at Laurentian, he eventually landed himself an engineering role for 30 years at Falconbridge followed by eight years with Hatch Engineering, successfully building mining operations around the world. While managing many mammoth projects over the years, he was sent to the Lac des Iles mine to help with some dysfunctional construction scenarios, which he was assigned to remediate as quickly as possible.

“I can remember being sent to the Lac des Iles property while employed with Hatch Engineering. There were various issues including lack of financing, issues with construction of the shaft itself, a backfill plant undersized for the level of productivity necessary to ensure proper workflows among others. We went to work, beginning with addressing the backfill plant issue, then on to the shaft and other issues. Over several years, we slowly began to fix the project, one flaw at a time.”

In the meantime, Gallagher was approached by the NAP Board of Directors to begin as the mine’s COO. Gallagher accepted and immediately went to work further reviewing the existing scenario on a much broader scope. Key operational deficiencies were identified and a plan was drafted to alleviate and mitigate areas of identified weakness and amplifying strengths, including a team of highly talented managers with extensive track records and some sharp, entry level engineering staff. The team was set, the strategy prepared and a recovery program marched forward.

History tells us that NAP did exceedingly well in the years following, revenues soared as the price of palladium shot through the roof — and eventually a suitor was found in South Africa, Impala Platinum who bought and rebranded the operations under the name Impala Canada. Today, the mine is performing at close to 12,000 metric tons per day (mt/d) — generating significant free cash flow and returning value for its new owner company-wide.

Gallagher left the company, turning down a board seat opportunity. At the close of the acquisition by Impala, he had a chance to review a promising polymetallic project called Thunder Bay North, southeast of the Lac des Iles mine with significant untapped potential. He met the incoming management team and agreed to take on the new challenge as executive chairman of Clean Air Metals Inc. He initiated resource validation and early tradeoff studies on a very promising pre-development resource in the Current Lake deposit and a second similar ultramafic magma conduit structure with longer term advanced exploration and development potential called Escape Lake.

As Gallagher tells it, “the grade profile of the Current Lake deposit was quite stunning to me. There is nothing else like it in the area. Although it seemed an abrupt transition and upended my semi-retirement plans, I recognized the enormous potential of the resource and felt it was an opportunity not to be taken lightly.”

It was a different path to the C-Suite at Clean Air Metals for CEO Abraham Drost. Drost is a seasoned exploration geologist with a geology degree from Waterloo (1984), master of science in mineral exploration from Queen’s University (1987) and several discoveries under his belt. Starting his career with St. Joe Canada in 1985, Drost was crew chief of the discovery team at the Muskeg Lake Project, leading to development of the Golden Patricia gold mine near Dryden, Ontario, in 1985. A high-grade narrow vein, shrinkage stope operation, Golden Patricia produced 700,000 ounces (oz) of gold over an eight-year mine life. For Drost, Golden Patricia was a seminal lesson in disciplined exploration and rigorous sampling leading to discovery.

Next with the Canadian division of Gold Fields in 1987, Drost was exposed to a big-picture exploration approach. If it didn’t have 1 million ounces or more near the surface, it was not a Gold Fields prospect. Interestingly, Drost would later pay $7 million to a Timmins prospector in 2012 for a 1% net smelter royalty on the operating Timmins West deposit of Lakeshore Gold, a prospect rejected by Gold Fields in 1988.

From Gold Fields, Drost became senior geological consultant to Corona Gold Corp. in 1995 working under former Teck exploration manager and mentor Dr. Matthew Blecha. After a stint with the Ontario Geological Survey from 1999, Drost was recruited by present Clean Air Metals Board member Ewan Downie in 2004 into the role of president of Sabina Gold and Silver Corp. The duo discovered the Bonanza gold deposit in Red Lake, which became a cornerstone asset in the Red Lake Joint Venture formed between Premier Gold and Goldcorp. In 2012, Downie and Drost co-founded Premier Royalty Inc. together as chairman and CEO, respectively, finding early success in the mining royalty business and vending the company to Sandstorm Gold in 2013.

Ethan Beardy, a geologist for Clean Air Metals, logs core at Thunder Bay North. (Photo: J. Kevin Palmer)

In 2014, Drost joined Carlisle Goldfields Ltd. as CEO, a junior explorer with promising open-pit gold assets in Lynn Lake, Manitoba. The company entered into an earn-in joint venture with AuRico Gold, which subsequently merged with Alamos Gold. Alamos in turn took out Carlisle in an all-share deal in 2016. Drost went on to an engagement with a Houston-based private equity family office working in the precious metals space.

The circle closed in Thunder Bay, Ontario, in 2019 with the formation of Clean Air Metals Inc. The Thunder Bay North Project was formed as a result of the consolidation of two promising PGM-copper-nickel assets acquired from Panoramic Resources of Australia, and Rio Tinto under the auspices of the team at Benton Resources Inc., a junior mining project developer based in Thunder Bay. Steven Stares, CEO of Benton, introduced Jim Gallagher and Abraham Drost who quickly formed a bond around the Clean Air mandate.

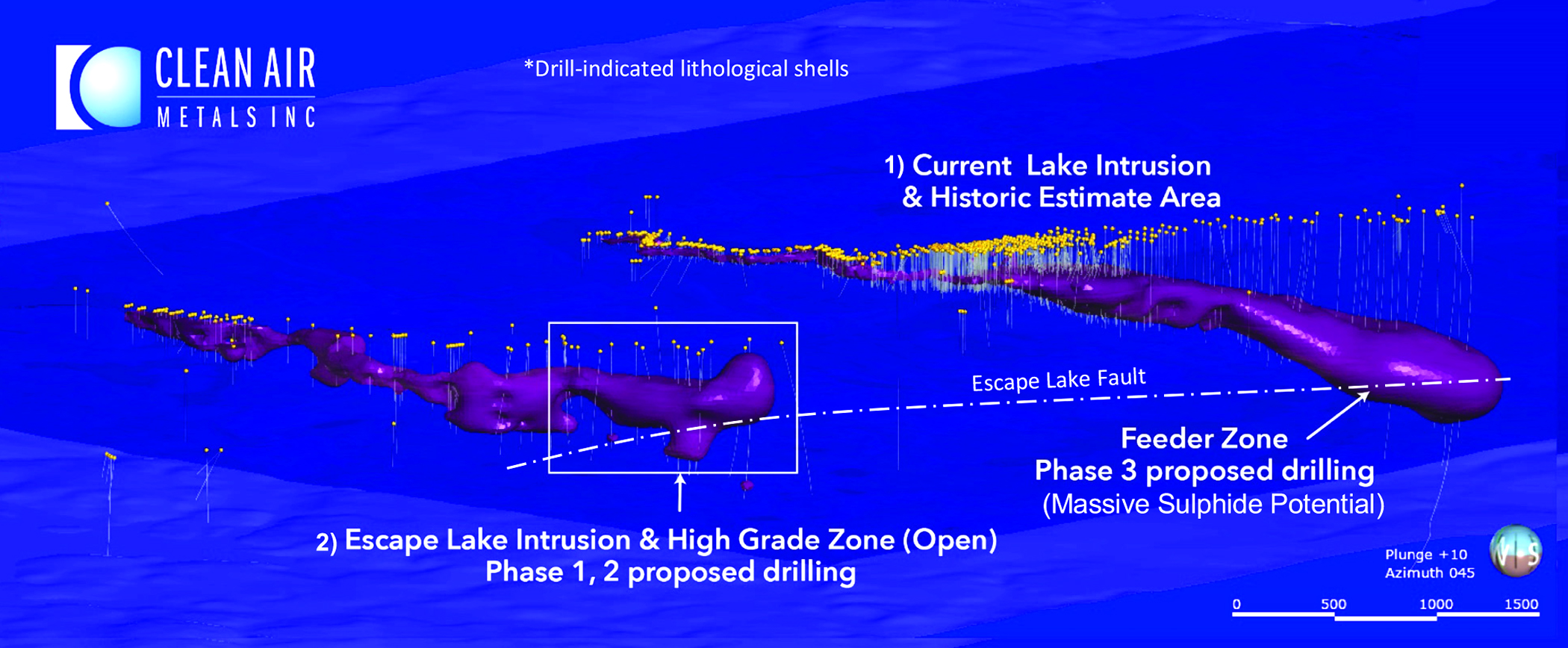

The Thunder Bay North Project is located 60 km southeast of the Lac des Iles mine. The previous operators at Thunder Bay North collectively spent C$85 million on more than 180,000 m of drilling in 800 holes, predominantly on the Current Lake magma conduit “chonolith.” Chasing the Current Lake prospect, 647 boreholes drilled between 2007 and 2011 defined the 2011 pit-constrained mineral resource by AMEC, now considered a historic estimate, in various zones totaling 741,000 oz platinum and palladium plus appreciable byproduct copper and nickel in 9.8 million mt at 2.3 g/mt platinum equivalent oz (Figure 1). For Drost and Gallagher, the presence of multiple massive sulphide intercepts in the Current Lake chonolith, are compelling.

“The Clean Air technical team is convinced that the massive sulphides are injections, transported by the original magma stream and sourced from a larger sulphide source deeper in the system,” Drost said. “They are vectors pointing to an exciting greenfield exploration target.”

Rio Tinto made a significant discovery on a twin structure at the Escape Lake magma conduit chonolith. Originally staked for diamonds as a promising kimberlite anomaly by Rio subsidiary Kennecott, the ultramafic intrusion had other secrets to bear.

Gallagher and Drost have brought their own unique perspectives to development of the Thunder Bay North Project. The lithological and stratigraphic similarities of the Current Lake and Escape Lake chonolith bodies and presence of massive sulphides highly enriched in copper, nickel, platinum and palladium mimics similar attributes of the Norilsk mineral deposits in Russia. The team’s literature review of the advanced state of development and continuing exploration at Norilsk is leading the group to mount leading-edge audio magnetotelluric geophysical methods combined with borehole EM methods to explore for deep massive sulphide deposits at Thunder Bay North.

The pit-constrained approach of previous operators at the Current Lake deposit has, under Gallagher’s review, given way to consideration of a ramp access and selective high-grade extraction.

In early February, Clean Air Metals released an updated indicated and inferred mineral resource estimate for the Thunder Bay North Project, which includes both the Current Lake and Escape Lake deposits. Indicated mineral resources are approximately 1.33 million oz of palladium equivalent for the Current Lake deposit and 500,000 oz for the Escape Lake Deposit.

Inferred mineral resources are approximately 410,000 oz palladium equivalent for the Current Lake Deposit and 250,000 oz for the Escape Lake Deposit.

The mineral resource estimate, prepared by Nordmin Engineering Ltd., is based on an underground ramp-access constrained resource model with a cutoff value equating to 1.56 g/mt palladium equivalent using three-year trailing average metal prices for all metals except cobalt, which used a two-year trailing average.