Liebherr recently establishes a new remanufacturing facility in Panama to support a fleet of trucks at the Cobre Panama mine as well as other mining equipment operating throughout Central America.

Suppliers say reman exchange programs are on the rise primarily because the products are superior

By Jesse Morton, Technical Writer

All the suppliers that spoke to E&MJ about their reman exchange programs unabashedly declared reman parts outperform new. On the surface, the assertion seemed outrageous. How could old outdo new? Yet, they all had different explanations that satisfied that view. That is partly why they are all growing their programs due to popular demand. A glance at the latest news on the topic reveals more about the basis of that demand and why reman exchange programs could be ascendant for a while.

As-new Quality, at a Lower Price

Liebherr told E&MJ it began construction this month on a reman facility in Panama City, Panama. The facility, one of 12 in the company’s reman network, will feature 1,500 m2 of production space, is expected to cost roughly $10 million, and is calendared for completion in early 2021, Jeff Rounds, general manager, global remanufacturing and service component production, Liebherr-Mining Equipment SAS, said.

The new facility will enable the company to fully support a fleet of ultra-class haulers delivered over the course of the last two years to First Quantum Minerals’ Cobre Panama project.

That the project deployed 38 new 400-ton haulers necessitated the facility, Rounds said. “When you supply that number of machines in a relatively short period of time, you then are faced with a unique challenge that all of the machines’ components will come due for overhaul or reman in very close sequencing.”

The new reman facility will complement Liebherr Panama S.A.’s Panamerica Corporate Center administrative office, workshop and parts warehouse in the country’s special economic zone. It will enable the company to convert its Liebherr Colombia SAS reman facility in Barranquilla to a parts warehousing facility.

“It is basically replacing a facility that is a very small one,” Rounds said.

The new facility will be certified to Liebherr guidelines and standards, Round said. “All of those 12 facilities have online access to the latest factory documentation, approved remanufacturing specifications, and access to the complete range of Liebherr genuine parts. All of those operators in the network are certified to one group of unified standards,” he said. “Our philosophy is if we all share the same documentation as the OEM, and we test in the same way with the same equipment that the OEMs use, and we have the same training across the board, we should have likewise a similar and measurable quality output.”

The development is important for both the company and the country, Rounds said. Mining “is the first industry outside the Panama Canal for the Panamanian government and the people there,” he said. “It is very exciting.”

Separately, in Q4 2019, the company commissioned a diesel engine remanufacturing capability at its reman facility in Springs, Guateng, South Africa. The development doubled the size of the production space at the facility, increased staff there by 10, and was calendared for commissioning for late January.

“We knocked down walls,” Rounds said. “We repurposed space that was otherwise previously used for nonproductive activities, and we installed an engine dyno testing system.”

With that system, the facility, which previously offered component repairs services, “can now do the full process,” Rounds said. “It will allow us to repair and remanufacture mining diesel engines to the same test protocols that are done today in Europe in new-build production.”

It will enable the facility to bring existing engines to as-new or better-than-new condition. “We are consistently focused on measuring that metric,” Rounds said. “We analyze the component lifetime of new and we compare it to the lifetime achieved of the reman, and we study the reliability of both, and we are able to consistently identify where we are able to exceed the lifetime of the new component.”

Hypothetically, a reman part or component might outperform a new one because it features, for example, a new coating technology, a new type of sensor system, or because it has benefited from a technical design revision, Rounds said. “Because we have lots of cores and we are opening them every day, we also have the opportunity to introduce those technical updates in an accelerated manner compared to the serial production for the machines,” he said. “Our value proposition is centered around providing as-new quality and performance at a fraction of the price of new.”

Customers can leverage Liebherr’s reman offerings by either buying individual reman parts from the company as needed or by joining its reman parts exchange program.

In the case of the former, the customer can obtain parts sometimes for a fraction of the cost of buying new. “When we talk about basic scope of repair, that can be as low as 10% of new,” Rounds said. The downside is the price can vary as can the lead time.

With the exchange program, Liebherr owns the exchange inventory. “The customer owns the component that is on the machine. And the title is transferred when they exchange the broken core for the exchange component,” Rounds said.

In the exchange program, the customer pays a preset price on reman parts and components and gets same-day service on them. The price can range between 50% and 60% of new, Rounds said.

The set price helps ensure “you don’t have any variance in your maintenance budget,” he said.

In the exchange program, Liebherr effectively manages the inventory, Rounds said. It puts people on the mine site regularly to track plans and stay atop developments.

“We spend a lot of energy trying to understand on a continuous basis the maintenance plans our customers have for those ultra-class machines so that we can ensure that we have the materials and the capacity at the time that the customer needs the service,” Rounds said. “We offer services like machine inspections where we have technicians on the ground. They go to the machine. They understand what is happening with it, in particular the hours accumulated on all of the different components that are installed and then make recommendations based on those observations.”

Rounds said the company had a customer that was managing their maintenance via a third party that was able to reduce costs up front. “They then later encountered premature failures on some components,” Rounds said. “What we did was through the exchange program, we set up a way in which they could exchange components but at a variable price,” he said. “They still had the opportunity to win the lowest price when, at this particular time, the budget climate was very tight, and out of that came the business back to Liebherr while at the same time the reliability and the performance of those machines in that mine increased.”

Being that one out of every two Liebherr components sold is a reman, such hybrid programs are not uncommon. “We have some that will do both, depending on the cost of a given component and the size of a machine,” Rounds said. “Our mission is to offer the complete range of services, so whether you exchange or whether you repair, we want you to come to us for the genuine parts, for the quality, and we can provide the same testing whether they own the component core or Liebherr does.”

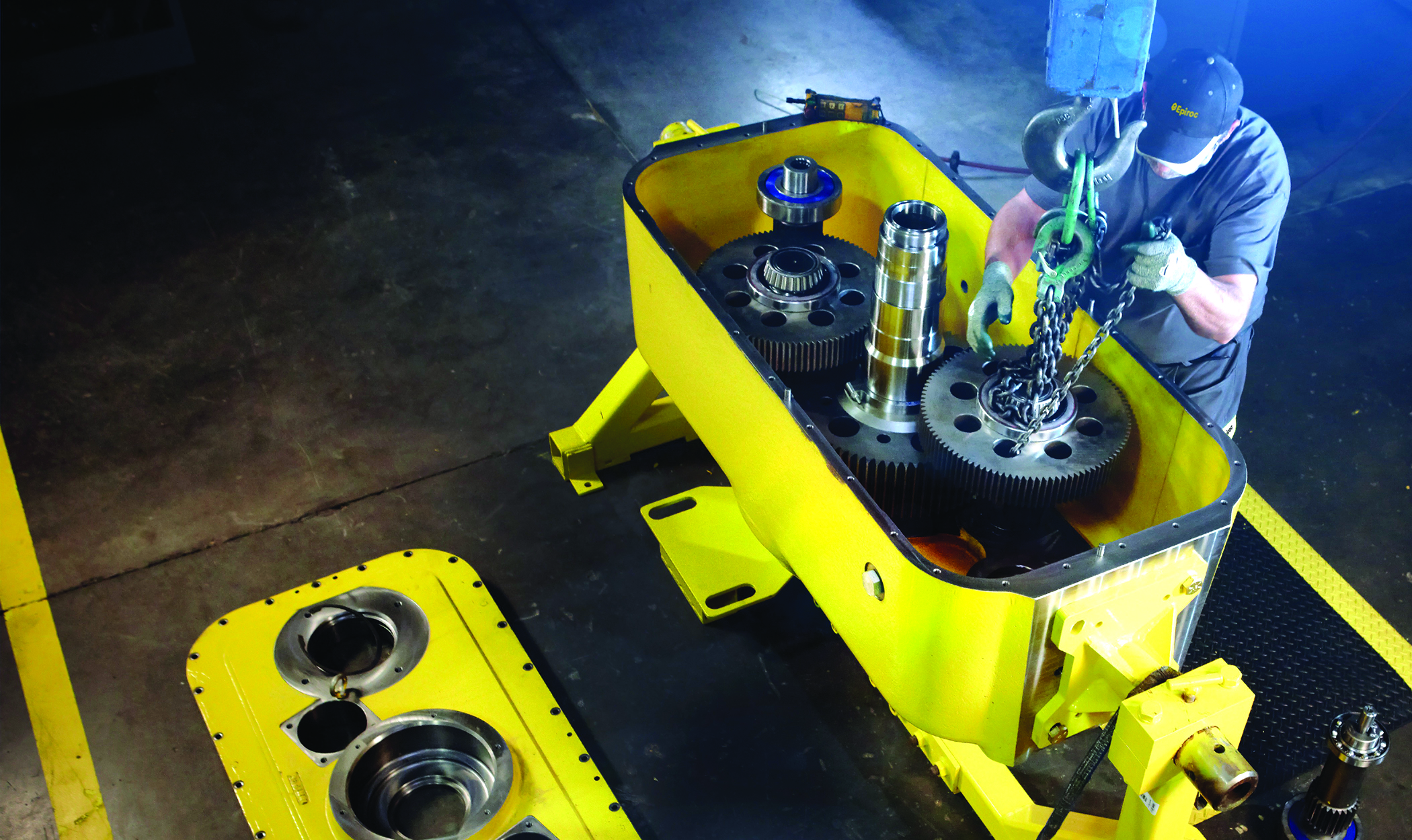

Epiroc reports it expanded its reman offering portfolio in North America and streamlined its reman product supply chain.

Growing Selection, Nimble Supply Chain

Epiroc reported it expanded its reman offering portfolio in North America and streamlined its reman product supply chain.

The program recently added eight air compressor air ends for the company’s midrange surface drills. “We had a gap in that,” Matt Cadnum, national sales and operations manager, mining service division, Epiroc USA, said. “We always had the remanufactured components for our large blasthole drills, but we never had reman offerings for the midrange. We are also expanding to include some final drive components for the large machines.”

Those additions and others bring to 87 the total number of reman components offered by the program.

Cadnum said the development was customer driven. “We have been very successful in the marketplace over the last few years. The populations are substantially higher in the last five to 10 years and now those components are requiring some replacement and the reman offers are so much more economical,” he said. “So, it is more about customer demand that we have met.”

Additionally, the company recently launched an effort to better coordinate the reman centers in North America to maximize the availability of reman products to customers there. “We’ve changed a bit,” Cadnum said. “We’re offering those reman capabilities via our global distribution network on more of a continental scale in North America. But it is also moving toward a global scale without having to reinvent those programs in the different markets.”

Part of that includes supplying the company’s Texas distribution center with reman components from its Tucson, Arizona, reman facility.

By streamlining the supply chain, the exchange process is simplified. “It flows with the spare parts, and there is a very robust, nimble process for the return of those components, as well, to be remanned again,” Cadnum said.

The desired effect is customers in North America and elsewhere should have improved access to OEM reman components, he said.

Epiroc says the costs for reman parts are roughly 70% of new with the exact same quality and warranty as a new component.

For some customers, that could mean “tremendous” cost savings, Cadnum said. “It is a very cost-advantageous option,” he said. “It is essentially 70% of new with the exact same quality and the exact same warranty as a new component.”

Reman components meet stricter standards than, and sometimes outperform, new equivalents. “We’ve developed and adjusted our processes that gives better longevity on the remanufactured item,” Cadnum said. “We put a little more cost into the testing and checking and double checking. We’ll test a component for an hour, whereas a new component might be tested for five minutes.”

If a reman part doesn’t meet specs, “we dig into it and make sure it is right, and if it is not, we replace it with one that is,” Cadnum said.

And the numbers prove the superior performance of reman components. “We track it,” he said. “We track warranty costs on new components. We track warranty costs on reman components. Our reman warranty costs are lower.”

The company offers consultative services to miners interested in the exchange program. “We have product sales and support specialists that will go in, work with the mining planners and maintenance personnel and help identify what we have available as reman and do a calculation to show them what their savings are going to be and when they should replace those components,” Cadnum said. “We work with their maintenance area and their planners to ensure we identify timeliness of when to replace those components and plan accordingly to make sure we have availability and even the service to install those components.”

The program is primarily leveraged by customers deploying Epiroc’s Pit Vipers and DML blasthole drill rigs. Typically the customer trades out a used component for a reman equivalent. “We will take that core back and provide a remanufactured one right away,” Cadnum said. “For the customers that we serve, we are there doing maintenance and service on the Epiroc equipment as it is. The planned replacement of reman components is part of our job, part of what we do every day.”

Among other things, the program allows a customer to adopt and trial Epiroc equipment at reduced costs. “We will do full-service agreements on the sale of new or existing machines,” Cadnum said.

But, ultimately, the program’s main offerings are cost savings and increased machine availability for customers deploying multiple Epiroc machines, Cadnum said.

“We can really help control that cost of ownership and understand what it is going to be at the frontside so they don’t have any surprises,” he said.

“We link that to availability,” Cadnum said. “It is all about that collaboration and planning together and providing the services and components that keep those machines up and running and keep their mines moving in a very viable manner.”

Swift Turnaround Time, Customizable Program

FLANDERS reported customer feedback on its new exchange program for electric haul truck components has been overwhelmingly positive.

The program allows customers to “have spare component coverage while reducing mine inventory and the associated costs,” Mike Casson, global business development manager, surface mining, FLANDERS, said.

With the FLANDERS exchange program, turnaround time to repair a failed unit is negligible, according to the company.

The program’s haul truck parts portfolio includes, but isn’t limited to, wheel motors, alternators, and grid blower motors for 830E and 930E trucks. The main offering, however, is “the unmatched quality of FLANDERS rebuilds and the inherent longevity of life when put into service,” Casson said. “Because we have been fortunate to have earned a leading market share in the surface mining market for many years, we have been able to see an extensive variety of failure modes to which we have applied root cause failure analysis and developed numerous upgrades in processes, materials, and re-designs to correct any weak points in a given type of motor,” he said. “This allows us to provide the longest warranties in the industry, which unlike many are non-prorated.”

One example of that quality is a Marion 8750 dragline repaired as a premium rebuild in summer 2000 that is still operating after more than 100,000 hours, Casson said. “The last time I was personally on that dragline was about two months ago,” he said. “The motor still looks great with absolutely no indication of necessary repair or replacement in the foreseeable future.”

Casson said the dragline illustrates how FLANDERS exchange program reman parts “always equal or exceed the performance and longevity of most new parts.” Which is to say over the long run, reman parts present substantial cost savings.

“Alternatively, saving dimes with low-bid, low-quality suppliers or in doing half-measure repairs can often result in wasting dollars,” Casson said. “One example of this I have seen in particular is where a mine chose to do cheap, minimum motor repairs thinking they were saving costs, but then ended up changing the same motor out three or four times over a 10-year period,” he said. “In the end, they spent many more total repair dollars than if they had done it right the first time and that additional cost does not even include the downtime and inherent risks involved with changing the unit out multiple times. Doing it right the first time is almost always the most cost-effective path.”

With the FLANDERS exchange program, turnaround time to repair a failed unit is negligible, Casson said. “When a unit does fail in-service, a FLANDERS owned replacement unit is immediately installed,” he said.

The failed unit then undergoes tests to see what it needs to get it back up to specifications. “After a repair workscope is approved by the customer, repairs are completed,” Casson said, “and the exchange unit is returned to FLANDERS inventory until needed.”

And that process is viable when a customer wants to do numerous repairs simultaneously, he said. “FLANDERS currently holds more than 500 individual components in our rotating equipment exchange program,” Casson said. “For example, if a customer wanted to rebuild all eight hoist motors on a Bucyrus 2570 during an outage, we can provide eight complete units from our inventory, above and beyond any individual FLANDERS spares that are normally dedicated to that customer.”

Inventory is accessed through a dozen hubs located in most mining regions. “Transportation times are minimal due to that local support,” Casson said.

Customers located in remote areas can negotiate an arrangement with the company to maximize parts availability and machine uptime. For example, in one instance, FLANDERS situated a customer such that they had duplicate sets of parts. “Whenever a unit is needed on-site, the spare stored in the mine warehouse is installed and they advise us of the change-out,” Casson said. “We then ship a second spare unit to the site while the failed unit is shipped to one of our regional service centers.”

The program has no core fee or flat rate consignment costs. “We set up our exchange program with mutually agreed upon pricing where the customer only pays for required repairs to get the unit back within mutually agreed upon specifications,” Casson said.

The company offers a similar program for underground mining machines.