|

| Production at NMMC’s Muruntau mine, one of the world’s largest open-pit gold mines, could grow by 30% to 2.5 million oz/y. |

State-owned gold miners are rebuilding old works and opening new mines to grow production in the face of retiring capacity

By Vladislav Vorotnikov

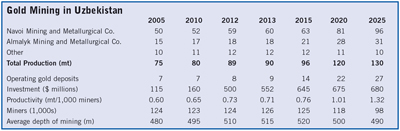

During the next 10 to 12 years, Uzbekistan will initiate mining operations at 20 new gold deposits with a record level of capital investment, according to the development programs of the country’s largest companies. The work was expected to begin in earnest by the end of 2013 with increased exploration, development and production activity. In addition to proving up gold reserves, by 2020, the volume of Uzbek gold production is expected to increase to 120 metric tons per year (mt/y) from 90 mt/y today.

Uzbekistan has the fourth largest known gold reserves and is the ninth largest gold-producing country. It should be noted that most of the information regarding gold production and reserves is classified as “gold mining along with uranium mining.” Exports of these two metals account for 25% of the country’s total exports. Gold mining accounts for almost 9% of the country’s GDP and gold-related revenues support economic stability and political balance in the region.

The two main Uzbek miners, Navoi Mining and Metallurgical Co. (NMMC) and Almalyk Mining and Metallurgical Co. (AMMC), produce 86% of gold.

According to the Uzbek State Committee, the country now has 41 gold deposits; however, only nine of them are currently developed. In the next seven years, the country plans to invest $4.5 billion in gold production, which should not only increase the volume of mining by 25%-30%, but also will improve productivity from 0.73 mt of gold per 1,000 miners in 2012 to 1.32 mt per 1,000 miners in 2020.

Geologically, mining conditions in Uzbekistan are relatively good. Many of the gold deposits are shallow, lying at depths of 50 to 100 m. Of course, that also means that Uzbekistan has a lot of artisanal gold miners. High unemployment and a poor economy has led to a lot of illegal gold mining activity, just as it does in other parts of the world. Private gold mining is officially prohibited in the country, but the government doesn’t enforce the policy.

During the next seven years, NMMC and AMMC plan to invest $4 billion in expanding production capacities. The number of mines will triple to 27 from nine now, which should move Uzbekistan into the seventh largest position, ahead of Indonesia, Ghana and perhaps Canada. According to analysts, the potential capacities of the anticipated mines could be further increased by 2025, which could push gold production to 130 mt.

The country has great potential for development and a number of Indian and Chinese companies have shown interest, although most foreign miners have abandoned positions in the country as a result of the huge scandals involving the Uzbek government, its colorful autocratic ruler and his jet-setting daughter. Alleging tax evasion and using other administrative schemes, the government expropriated assets from both Oxus Gold plc and Newmont Mining Corp.

NMMC Announces Future Expansion Plans

NMMC Announces Future Expansion Plans

NMMC is not only a large gold miner, it also holds a monopoly on uranium in Uzbekistan. Gold production at NMMC in recent years has exceeded 60 mt, and the company recently released development plans to 2020 that could increase this figure by 25%-30%. The company believes that by 2025 it will be able to reach an output of more than 90 mt/y of gold. NMMC has four metallurgical plants: Navoi (HMP-1), Zarafshan (HMP-2), Uchkuduk (HMP-3) and Zarmitane (HMP-4).

According to NMMC management, the company will invest $3.2 billion in the development of gold and uranium production between now and 2020. “This concept of development is divided between six or seven projects and the realization of each one will involve the investment of $300 to $350 million,” said Kuvondyk Sanakulov, CEO, NMMC.

In particular, the plan will implement several reconstruction projects at the Muruntau mine and rebuild mining equipment and the rail transport system. Muruntau is believed to be one of the world’s largest open-pit gold mines with a total resource base of about 170 million oz of gold (5,200 mt). The mine is located in the Kyzyl Kum Desert of Uzbekistan and the pit measures about 3.5 x 2.5 km and extends to a depth of 560 m.

According to the reconstruction program, a new mine, Bessopan, will be launched in a part of the deposit that the company has been exploring recently. The mine will be commissioned in 2016-2017, and, according to preliminary information, its capacity will be about 5 mt/y to 10 mt/y. Overall production at Muruntau will grow by 30% to 2.5 million oz/y (71 mt/y).

At the same time, the company plans to expand underground gold production at open-pit operations. The move will allow NMMC to add 250 to 300 million mt of ore at the number of deposits with an average gold content of 0.69 g/mt previously not included in the resource base. This should ensure the stable operation of the company for the next 40 years.

Furthermore, a 2013 analysis of mining waste (overburden) and processing waste (tails from hydrometallurgical plants), found that 25% to 40% of the 2 billion mt of rock contains gold in an amount sufficient for cost-effective processing. The company plans to start processing these wastes, which could add 2 mt/y to 3 mt/y of gold.

NMMC will begin exploring and exploiting a number of new deposits. The government has recently allocated $300 million to explore and mine three large gold deposits: Charmitan, Guzhumsay and Intermediate in the central part of the country. The project also includes rebuilding an existing gold mill near Mardjanbulak in the eastern part of the country, which will significantly improve its processing capacities for the new mines.

In recent years, NMMC has been actively increasing its ore processing capacities preparing to launch these new mines. In 2012, it finished the second phase of construction at HMP-4, which increased ore processing capacity by 40%, or about 1.5 million mt/y of ore.

Furthermore, NMMC established an enterprise to extract gold from carbonaceous sulfide-refractory ores in Zarmitane in the Samarkand region in the southeast. The project should be completed soon and it should reach its design capacity by the end of 2015. The complex of mines and a new gold mill will have the capacity of 1.8 milion mt of ore processing and 10 mt/y of gold production.

Also at the gold mill near Mardjanbulak, NMMC has recently invested $20 million to introduce technologies for processing refractory ores, which has not been previously done in Uzbekistan. The production line was commissioned at the end of 2013 and it is still unclear what capacity it will have. Mardjanbulak is also experimenting with gravity-flotation-kiln technology. This innovation will increase gold recovery by 12%.

According to NMMC, the development of uranium production in coming years is associated with the construction and launching of six new mines for the extraction of uranium by in situ leaching (ISL), as well as the expansion of a promising raw material base. The company is exploring nine deposits and on average it produces 2.3 mt/y of uranium. The launching of the mines—Alenda, Aulbek, North Kanimekh and a number of others—will increase uranium production by 40% to 3.3 mt/y by 2015. The total cost of the investment in the six new mines is estimated at $75 million.

|

| Government-owned mining companies will invest in replacing outdated equipment. |

AMMC Adopts Modernization Program

Accounting for 20% of the country’s gold production and 90% of its silver production, AMMC also announced an ambitious development program to increase production. The company expects to double gold production by 2025 to 34 mt from 18 mt by launching several new mines.

AMMC currently consists of two mining companies, two processing plants and two metallurgical plants. The company has the right to develop copper-molybdenum and lead-zinc ores in the area of Almalyk (Tashkent region). Its resource base includes copper-porphyry ores at Kalmakyr and Sary Cheku (Tashkent region) and a lead-zinc-barite deposit at Uch-Kulach (Djizzak).

In 2013, AMMC began construction of the Samarchuk gold mine in the Tashkent region. The project, valued at $74 million, includes the construction of an underground mine with a capacity of 200,000 mt/y of ore. Completion is scheduled for the end of 2015.

According to the “golden production” modernization program adopted to maintain the capacity and compensate for retiring enterprises, AMMC plans to intensify work on opening new horizons at operating mines, build new facilities, and reconstruct the Angren gold processing plant by 2016.

In October 2013, the company completed the modernization of the Kochbulak gold mine in the Tashkent region. The project involved the resumption of work on the Uzun open pit, as well as increasing production from an underground mine. Launching of the new production sites with the capacity of 40,000 mt/y of ore will compensate Kochbulak’s retiring capacities and maintain the current volume of gold production for the next six years. The total cost of the project was $10 million.

By 2016, the company also intends to build and launch the Kayragach mine with a total capacity of 80,000 mt/y of ore at a cost of $30 million. The construction of new mines will increase gold production for the company by 25%-30%. Actual figures are not disclosed, but it is assumed that by 2020, AMMC will produce about 28 mt of gold.

It is noteworthy that the new projects in the area of gold production are the first projects the company has implemented in almost five years. In 2007, AMMC invested $50 million in rebuilding the Kyzylolma and Kochbulak mines in the Tashkent region. That included the Angren gold processing plant, which increased ore processing capacities to 600,000 mt/y.

AMMC also has a monopoly on copper production with an annual refined output of 90,000 mt. The company currently has projects slated to further develop copper mining, which will provide a slight increase in its production until 2016. In addition, AMMC is the largest silver producer in Uzbekistan with annual output around 140,000 mt, making it one of the largest silver mining companies in Central Asia.

Gold Fever

Uzbekistan has a large number of illegal gold miners. Almost 30,000 are involved, according to local media reports. The number of gold deposits in the central regions of the country are poorly understood and are not included in the state database. However, the Uzbeks know their locations. They can work these shallow 15- to 20-m deposits without heavy equipment.

A gram of gold sells for $8-$10 ($224/oz-$280/oz) on the black market. The actual volume of illegal gold mining is unknown, but it’s believed to be 1 mt/y and continues to grow. Officials claim there is a need to contain the free gold miners as their activity hurts the “legal” gold activity in the country; however, no actual work in this area is being carried out. The NMMC said the largest gold producers usually are not interested in developing the type of deposits the illegal miners are extracting.

Interest in Tashkent Grows

Eventually, Tashkent will become the main gold mining region, while the importance of the western regions where it is currently concentrated with NMMC assets will steadily decrease. Recent geological surveys have located additional gold deposits in the Tashkent region and, in particular, the Angren River valley.

These conclusions have been partly confirmed by the State Geological Committee of Uzbekistan. According to recent reports, it is possible to bring into production a number of new fields in the Tashkent region with the total capacity of 20 to 25 mt/y of gold in the next three to five years. Thus, the gold mines in these regions will be the main driver of growth in the gold production industry of Uzbekistan in coming years.

The survey found gold reserves of 425 mt and inferred resources of 950 mt concentrated in the Angren River valley in an area of not more than 22,000 km2, which is about 17% of the Tashkent region. The experts on the State Geological Committee said this concentration within the so-called “golden ring Angren” offers very favorable mining. If the large Tashkent and Angen River reserves really exist, the country will have enough gold reserves to sustain mining for another 35 to 40 years.