Despite rapidly increasing demand for food production around the world, fertilizer minerals have been hit by falling prices and weak markets.

By Simon Walker, European Editor

Of the four key fertilizer raw materials, two—potash and phosphate rock—are mined, while the production of both sulphur and ammonia is closely linked to the oil and gas industry. And, while slowing consumer demand has been one of the main drivers for price falls in the major industrial metals and minerals, the need for ever-greater food production should mean that the companies producing potash and phosphates are in financial clover.

Increasing use of fertilizers in developing countries will be a key driver for feedstock production. (Photo: Yara International)

Yet a quick skim through the crop of 2015 annual reports that have sprouted over the past few months clearly shows that this is, in fact, far from the case. Now faced with global overcapacity as the latest tranche of investment comes to fruition, as well as increased competition following the collapse in July 2013 of the BPC marketing agreement between Belaruskali and Uralkali, potash producers have been doing the same as every other mining company—cutting costs and, in some cases, mothballing mines.

On a year-by-year basis, fertilizer demand is driven not only by the desire to increase crop yields, but also by the climate. As an example, if it is too wet when fertilizer should be spread on farmland, farmers hold off on buying it. And, of course, finance comes in to play: a succession of years with good harvests can hit agricultural commodity prices and farming cashflow, while a recession often means that credit is less readily available. In both cases, farmers cut their fertilizer budgets to suit. Less fertilizer bought means less raw material needed, and those over-optimistic forecasts for future demand that were made just a few years ago have now come back to haunt corporate balance sheets.

Figure 1—World potash production (K2O content), 1999-2014. (Source: BGS)

Production and Pricing

Production and Pricing

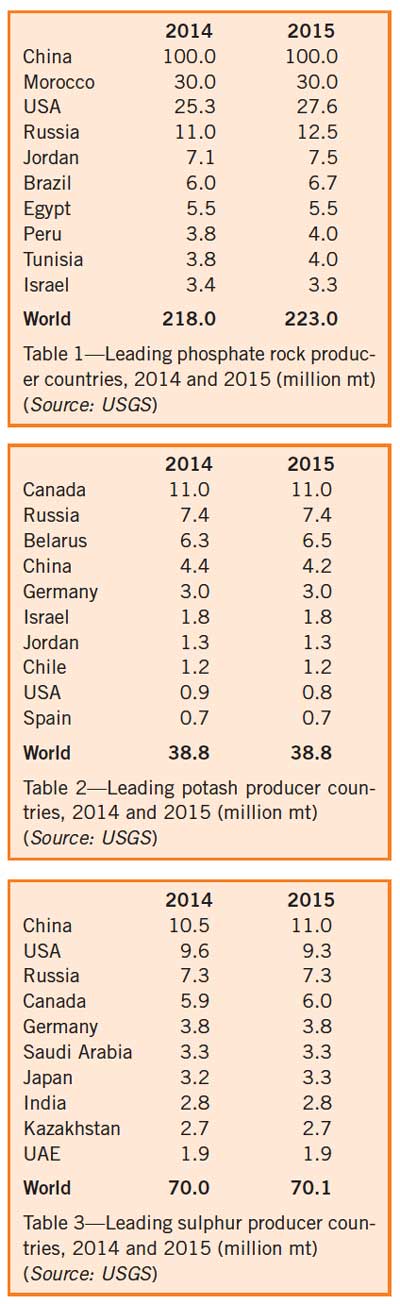

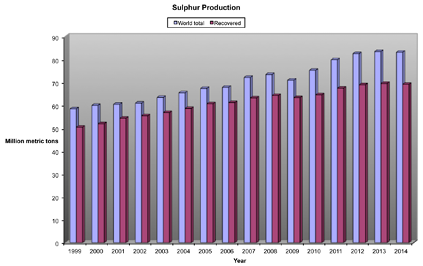

Provisional figures from the U.S. Geological Survey (USGS) indicate that, of the three principal fertilizer ingredients, world phosphate rock production rose slightly from 2014 to 2015, to reach 223 million mt, while the output of both potash and sulphur remained essentially static at 38.8 million mt and 70.1 million mt, respectively. Taking a longer perspective, world potash production has grown from around 27 million mt in 2000, as shown in Figure 1; the sudden dip in output in 2009 reflected the global recession that affected agriculture as well as the wider economy.

Figure 2 illustrates the longer-term trend in phosphate rock production, which was less affected by the global economic recession, since when output has risen sharply. The picture for sulphur is more complicated, however, given the various sources available. By far the greatest proportion comes from stripping sulphur from sour gas and oil, so output is closely aligned to both overall oil and gas demand as well as the quality of the feedstock being treated.

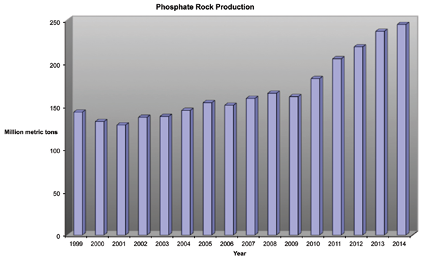

Sulphur is also recovered from smelting metal sulphide concentrates, while additional production comes from a few Frasch operations, and from natural sulphur ore. With mining involved directly in both pyrite and sulphur ore production and in smelter recovery, these sources are significant to the industry, although their contribution to world sulphur output is overshadowed by that from the hydrocarbons sector. Figure 3 shows production trends for total and recovered sulphur production since 2000, where “recovered” includes byproduct sulphur from both hydrocarbons and metallurgical sources.

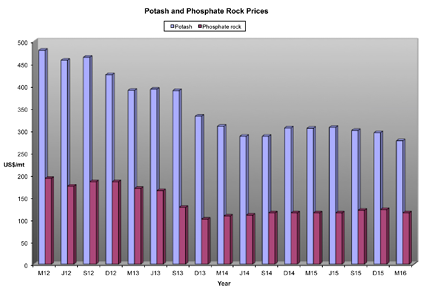

In terms of pricing, potash (measured as muriate of potash—KCl) has overall been on a downward trend over much of the past four years, as shown in Figure 4 on p. 42. From more than $480/metric ton (mt) at the beginning of 2012, the price headed downhill to a little more than $300/mt by early 2014, then managed to hold its own until the end of last year. By April, producers were looking at less than $270/mt for their output, leading to production cutbacks and predictions of a tough year ahead.

The lower line on Figure 4 illustrates Morocco export phosphate rock prices on a quarterly basis over the same period. That the trend is comparable to that for potash should not come as much of a surprise, given the common end usage. In summary, Office Chérifien de Phosphates (OCP)—Morocco’s state-owned producer and world’s leading exporter—is today receiving 40% less for its output than it did four years ago.

However, that is nothing when compared to the slump in sulphur prices that has occurred over the past two years.

According to data compiled by U.K.-based Integer Research, and presented earlier this year at The Sulphur Institute (TSI) Sulphur World Symposium by the company’s research manager for sulphur and sulphuric acid, Meena Chauhan, where FOB prices in early 2014 were in the range of $175–190/mt (depending on the geographical source), today $80/mt is typical.

As Peter Harrisson, senior consultant for sulphur and sulphuric acid at commodities analysts CRU, noted in March, “Prices have weakened much faster than was previously expected. The rapid drop in phosphate price levels was the key driver for the weakening sulphur market.” Which, if nothing else, just goes to illustrate how closely these commodities are interconnected.

Fertilizer specialist Fertecon added some background. “The sulphur market has its own dynamics, different from the rest of the fertilizer market,” the company said. “With this market structure, price dynamics are often confusing. Supply is overwhelmingly an involuntary byproduct of oil and gas processing, and demand is driven primarily by the phosphate market.”

Figure 2—World phosphate rock production, 1999-2014. (Source: BGS)

Potash: Projects and Pauses

On the corporate level, the main non-event of 2015 was PotashCorp’s abortive attempt to buy German potash and salt producer, Kali und Salz (K+S). Remember, of course, that PotashCorp itself was the target of a $40 billion takeover proposal by BHP Billiton in 2010, with Canadian government objections leading to BHP Billiton subsequently withdrawing.

As far as PotashCorp’s pursuit of K+S was concerned, its outlay would have been somewhat less eye-watering—just €7.9 billion (then about $8.8 billion). However, after four months, PotashCorp thought better of its plans and backed out.

The company’s president and CEO, Jochen Tilk, noted at the time that since PotashCorp had tabled its offer, challenging macroeconomic conditions had contributed to a significant decline of global commodity and equity markets, with potash peer stocks down almost 40%. “In light of these market conditions and a lack of engagement by K+S management, we have concluded that continued pursuit of a combination is no longer in the best interests of our shareholders,” he said. Or, to put it another way, the original offer was now too high and K+S did not want to play ball in any case.

On a purely historical note, this was not the first time that PotashCorp had attempted to gain control of K+S. In late 1996, the company agreed to pay DM250 million (then €128 million) for a 51% stake in K+S, only for its plans to be thwarted by the German government.

Meanwhile, PotashCorp has reacted to current market conditions by cutting production. Its Piccadilly (New Brunswick) operations were put on care-and-maintenance in January, and the company then announced four-week production breaks at both Allan and Lanigan in Saskatchewan. The company produced 9.1 million mt of KCl in 2015, with its cutbacks this year totaling 2.4 million mt in nameplate capacity.

K+S, by contrast, is focusing on its C$4.1 billion Legacy solution mine in Saskatchewan, with plant commissioning scheduled for midyear. K+S expects the first production toward the year-end, when its new product storage and export facility at Port Moody, near Vancouver, will also be ready for use. Legacy will add around 2.9 million mt of annual capacity to the company’s existing 7 million mt.

Back in Germany, however, the company’s potash operations have been affected by environmental constraints placed on their saline wastewater disposal systems. Since 2011, K+S has halved the volume of wastewater at its Werra operations, and is building a kainite crystallization and flotation plant at Hattorf with the same intention. Its stated aim is both to reduce the salt burden on the environment and to recover additional fertilizer feed material.

As for BHP Billiton, development of its Jansen project in Saskatchewan continues, albeit at a slower pace than before. The company has allocated some $200 million to the project this financial year, $130 million less than in 2014–2015, with $2.6 billion having been budgeted for surface work and shaft construction. Recent analyst comment has suggested a $14 billion bill to bring the mine into production at a rate of some 8 million mt/y.

With the capacity to convert 6 million mt/y of phosphate rock into phosphoric acid and fertilizers, Aurora in North Carolina is PotashCorp’s largest individual phosphate plant.

Due to come on stream later this year, K+S’s Legacy solution mine in Saskatchewan will add around 2.9 million mt/y of potash capacity.

Potash: Other Moves

With Mosaic still on course to bring the expansion to 6.3 million mt/y at its Esterhazy mine on stream next year, the company has cut production at Colonsay. Its potash sales last year totalled 7.9 million mt, with its potash operations working at just 70% of their 10.5-million-mt/y nameplate capacity during the last quarter.

The response of the other main U.S.-based potash producer, Intrepid, to weak markets has been to stop potash production from its East mine in New Mexico, and to focus on the output of its Trio (sulphate of potash magnesia) product there. The company is also evaluating the long-term viability of its West operation.

Israel Chemicals noted in its 2015 annual report that potash reserves are close to exhaustion at its Boulby operation in England, with potash production to end in 2018. It plans to counter this by increasing its output of directapplication polysulphate (polyhalite) to some 1 million mt/y by 2020. It is also facing operational challenges caused by the accumulation of salt in its main evaporation ponds in the Dead Sea, and from the falling water level in the Dead Sea itself. During 2015, the company bought out Allana Potash, which had been developing the Danakhil potash resource in Ethiopia, where it intends to produce both potassium chloride and potassium sulphate.

In Russia, EuroChem is continuing with the development of its Verkhnekamskoe and Gremyachinskoe potash projects that will provide more than 8 million mt/y of new capacity. By the end of 2015, the company had invested $2.8 billion in the projects, with $446 million being spent last year.

Meanwhile, Uralkali produced 11.2 million mt of potash in 2015, 6% lower than in 2014 with its Solikamsk-2 operations having been affected by flooding. As noted previously in E&MJ (December 2015, pp.38-43), the company has revised its development strategy as a result, with capex of some $4.5 billion now planned for 2015-2020 “in order to sustain Uralkali’s industry leadership.”

And in Belarus, the state-owned potash producer has been adopting the supermarket approach to its sales, focusing on volume over price in a successful strategy to undercut its major competitors. The challenge, however, is that the state is effectively using the company as a foreign-exchange cash cow to subsidize other loss-making enterprises, with concerns already being expressed that increased production will quicken resource depletion at the Salihorsk operations. To counter this, Belaruskali is developing its 3 million mt/y Petrikov mine, with commissioning currently planned for 2024.

Phosphate Rock

A key element in OCP’s plans to expand its phosphate rock mining capacity from 30 million to 55 million mt/y has been the construction of the 187-km-long pipeline from Khourigba, inland, to the port and fertilizer-production complex at Jorf Lasfar. Capable of handling 38 million mt/y of phosphate rock slurry, the pipeline has cut the company’s logistics costs by 90% while saving some 3 million m3 of water a year.

Indeed, that OCP reported EBITDA up from $1.4 billion to $1.8 billion for the year was due in no small part to the ramp-up of pipeline operations. The pipeline handled 6.5 million mt during 2015, more than double that in 2014, and provided $80 million in transport cost savings.

During the presentation for its annual results, the company highlighted China’s increasing level of phosphate-based fertilizer exports to the world market.

Between 2011 and 2015, these rose from 1.3 million to 10.7 million mt, with a coincident increase in imports of these fertilizers into India. However, China’s extensive phosphate rock resources are predominantly used domestically, with exports only of higher-value processed products.

In October, Israel’s ICL announced a joint venture with the largest Chinese phosphate-rock producer, Yunnan Phosphate Chemicals Group, with the intention of modernizing and expanding the existing mines and fertilizer plants there. The move gives ICL better access to China’s domestic market for both rock and fertilizers.

In Saudi Arabia, Mosaic has a 25% stake in Ma’aden Wa’ad Al Shamal Phosphate Co., which is spending $8 billion to develop the country’s largest phosphate-based integrated project. The mine at Al Jalamid will produce some 11.6 million mt/y of rock and 5 million mt/y of flotation concentrate, with the Ras Al Khair fertilizer plants designed for an output of 3 million mt/y of diammonium phosphate fertilizer plus an extra 400,000 mt/y of ammonia for export. Ammonia opera-

tions are due to begin later this year, with finished phosphate products available in 2017.

Figure 3—World sulphur production (total and recovered), 1999-2014. (Source: BGS)

Sulphur: The Hidden Link

Not only critical to the production of phosphate fertilizers, sulphur is also an important crop nutrient in its own right. According to The Sulphur Institute, agricultural land around the world is becoming increasingly depleted in sulphur, while dressing at levels significantly lower than those needed for conventional fertilizers can produce major crop yield benefits.

However, direct application is only a minor component of annual sulphur use. Integer Research’s Meena Chauhan told E&MJ that around 90% of world sulphur production is converted to sulphuric acid—and of that, maybe 60% is used in the production of phosphate-based fertilizers. Hence the intimate (and usually unrecognized) relationship between phosphate rock and sulphur, with sulphur demand—and therefore pricing—inextricably linked to the fortunes of phosphates and the usage of fertilizers.

In her presentation to The Sulphur Institute conference, held in Vancouver in April, Chauhan explained that future growth in sulphur production will come largely from gas developments in the Middle East, replacing the treatment of sour crude oil that has been the principal source up to now. This will also increase, she added, but not as fast as sulphur stripping from natural gas, with new projects expected in Saudi Arabia, Qatar and Iran.

From a mining perspective, there is not much news there, although there is one major mining-sector sulphur stockpile. By the end of 2015, Syncrude’s sulphur mountain at its Mildred Lake operations had grown to hold nearly 10 million mt, 500,000 mt more than in 2013. While this represents a major resource, the problem for Syncrude is geographical; moving the material to market is simply uneconomic.

Demand for fertilizer will be the driver for future demand growth for sulphur, Chauhan explained, illustrating the point by looking at Africa. Between 2011 and 2025, African sulphur demand will have more than doubled to more than 15 million mt/y, with more than 90% of this growth coming from fertilizer producers in Morocco and Tunisia.

Figure 4—Potash (KCl) and phosphate rock quarterly price trends, 2011-2016. (Source: YCharts)

Surplus or Deficit?

A common thread running through all of the major potash and phosphate producers’ annual reports for 2015 is their caution for the short term at least.

In February, Mosaic brought in a 400,000-mt reduction in phosphate production for 2016, albeit with a more positive future in sight. “Today’s crop nutrient prices, including phosphates, are attractive to farmers globally and we expect a strong demand response after this seasonally slow period,” said senior vice president, Rick McLellan. President and CEO Joc O’Rourke added,” The long-term positive outlook for phosphates has not changed, but we are adjusting our production levels to match immediate demand.”

K+S is anticipating lower potash sales this year as the market downturn continues. “Along with intense competition, an ongoing difficult economic situation in the emerging market countries is expected, continued low agricultural prices, and less availability of credit for farmers, particularly in Latin America,” the company explained.

Commenting on its annual results, Uralkali CEO Dmitry Osipov noted that 2015 was a challenging year for the potash industry, with significantly weaker demand in key markets in the fourth quarter of 2015. “However, in the long term, we remain optimistic on potash industry fundamentals,” he said.

Whether that optimism is justified remains to be seen, however. Demand for both potash and phosphate rock hinges on factors beyond ordinary commodity market mechanisms, and with significant new capacity now under development when demand is already weak, it is difficult to foresee improvements forthcoming any time soon. The world needs food, and crops need fertilizers; the challenge will be to achieve a new market balance.

Hard-rock phosphate production at EuroChem’s Kovdorskiy apatite mine in northern Russia. The operation is also the world’s sole producer of baddeleyite concentrate.

Sulphur stacked at a gas-treatment plant in Alberta, ready for shipment to Vancouver for export. (Photo: Gord McKenna)

OCP Invests in Technology

Two papers presented at SYMPHOS 2015, the third International Symposium on Innovation and Technology in the Phosphate Industry, focused on aspects of the technology being introduced to OCP’s operations.

The pipeline that carries phosphate slurry from the mines to the coast, buried to minimize its environmental and social impact, can handle up to 4,400 mt/h, depending on the slurry properties. The entire network encompasses 227 km of pipe, including feeder and other systems, and can handle different grades of phosphate; individual batches are separated by plugs of water to minimize intermixing. Utilizing 36-in. pipe for the main run, this is the largest-diameter slurry pipeline ever to be built, with an overall fall along the 187-km length from 775 m to 66 m above sea level. Thus, gravity is the main driver for the system, with pumps only used over the first 30 km.

Raw ore is crushed and processed by flotation to produce a concentrate for transport. At the Jorf Lasfar plants on the coast, export-grade material is filtered, dried and granulated, while lower-quality concentrate is further upgraded to form fertilizer-production feed.

The second paper, presented by authors from FLSmidth, described OCP’s use of the company’s deep cone thickeners. The slurry arriving at Jorf Lasfar, containing around 50% solids by weight, is handled in a 20-m-diameter-deep cone thickener to produce a 63% solids pulp. This then forms the feed for reaction with sulphuric acid to produce phosphoric acid—the main intermediate for high-grade phosphate fertilizer production.

According to FLSmidth, using this technology has allowed OCP to optimize its sulphuric acid consumption during the leaching process, while giving a better attack reaction by using a thicker pulp than was previously the case.