Olimpiada processes lower grade in 2020. Polyus again has the lowest AISC of the group. (Photo: Polyus)

Gold prices climbed in 2020 and the top miners again processed more ore and produced substantially less gold, while aligning with U.N. guidelines

By Jesse Morton, Technical Writer

Total gold output for 2020 from the miners tracked for this article was about 27.2 million ounces (oz), down 7% yoy. It was off 3% from the average for the previous five years.

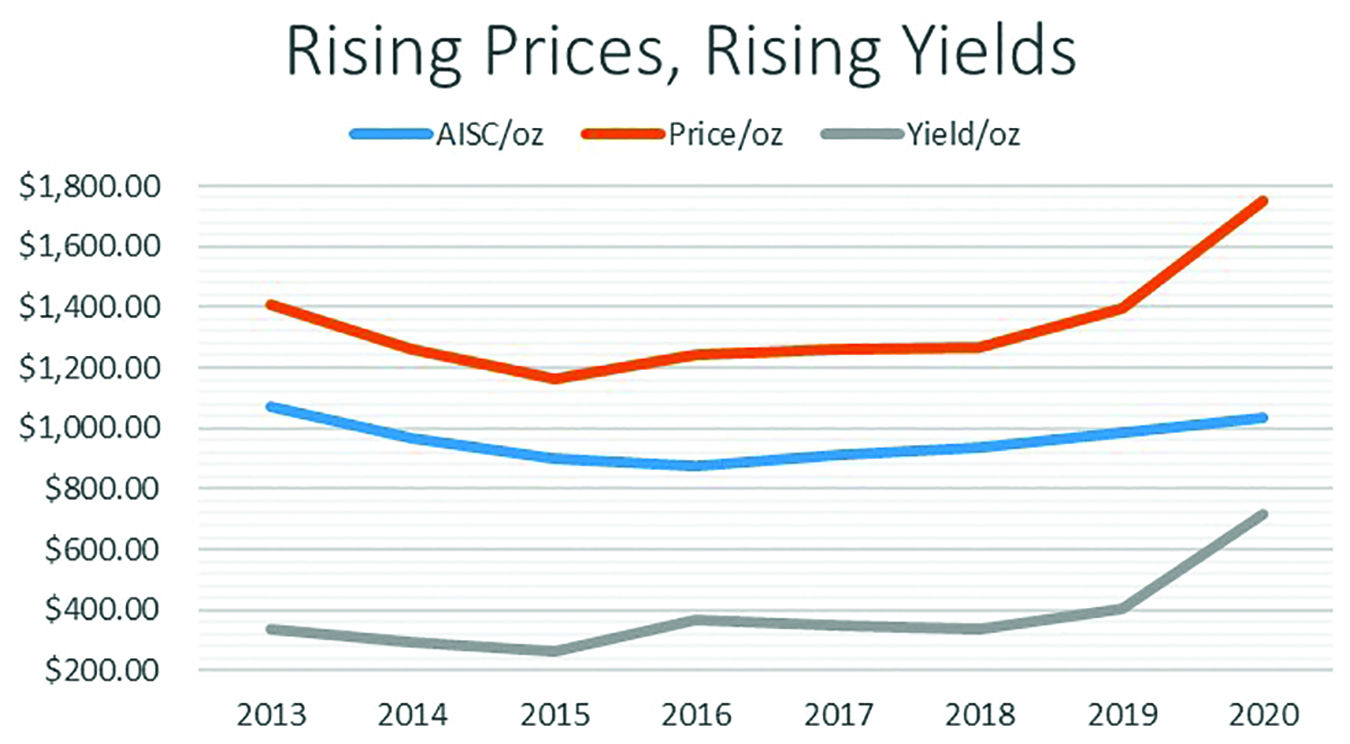

Also in 2020, after rising steadily for four straight years, the average realized price was up 38% over the average for the previous five years. For Gold Fields, Agnico Eagle, AngloGold Ashanti and Newmont, it was up 41%.

Meanwhile, despite rising oil prices, the average all-in sustaining cost (AISC/oz) was up only 5% yoy. It was up 11% over the average for the previous five years.

This means the yield (average received price minus average AISC) was up 76% yoy. It was, in fact, more than double the average for the preceding five years.

The miners technically processed (or milled) 2% more ore yoy in 2020. (Exclude Harmony for their size relative to the others, and Gold Fields for being an outlier because it brought a new major mine and mill online, the remaining miners milled 0.4% more ore yoy.)

The six miners that report it logged an average increase of 5% more ore mined yoy.

Indeed, the data shows that the years-long trend of miners moving and processing more ore yoy and producing less gold yoy continued in 2020.

In H2 2020, at the height of the lockdowns, Klaus Schwab, founder of

the World Economic Forum (WEF), made news for promoting his new book, COVID-19: The Great Reset. The book popularized the term.

Schwab was quoted as saying that with the Great Reset, by roughly 2030, you will “own nothing” and “be happy about it.” Schwab previously said that by then you will be microchipped. His The Future of Jobs Report 2020 repeatedly labels mining jobs as “redundant,” and said a staggering 20% of mining workers are now at risk of displacement by 2025.

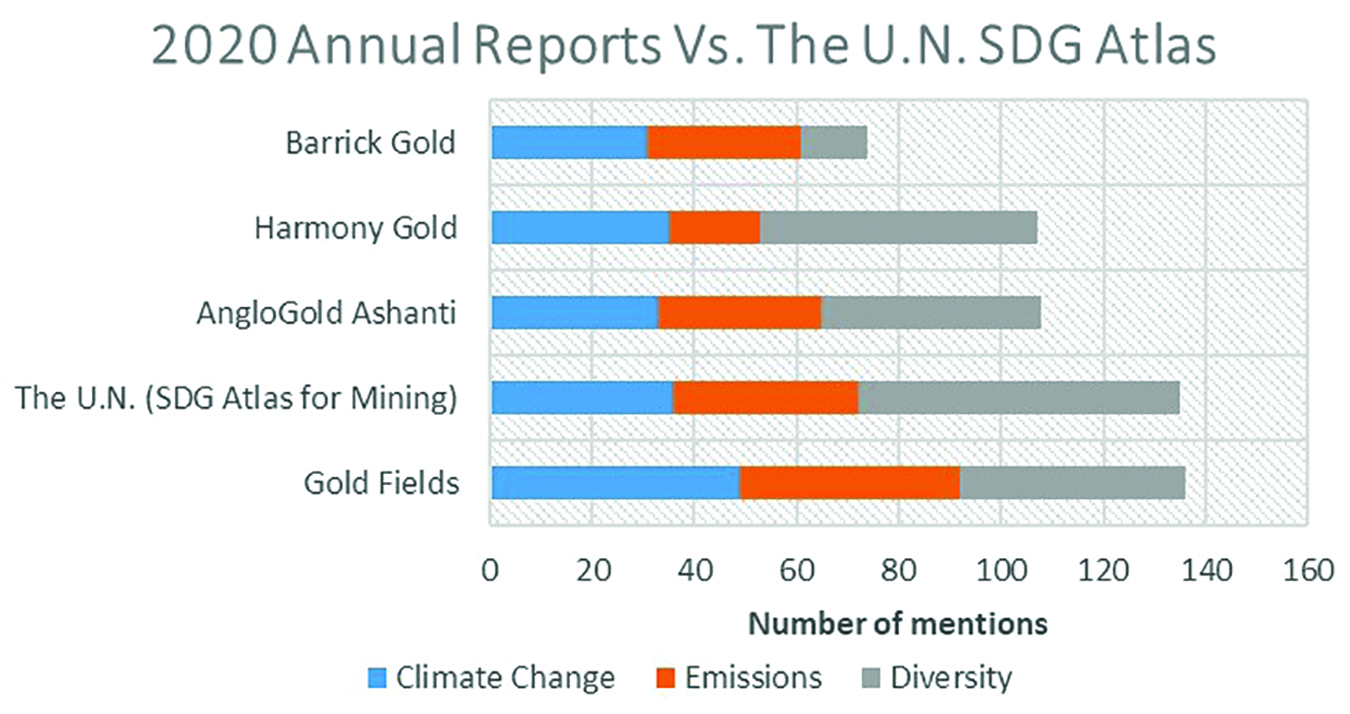

Schwab’s WEF is the lead author of the white paper, Mapping Mining to the Sustainable Development Goals: An Atlas, edited and published by the United Nations (U.N.) Development Program. The paper maps the U.N.’s sustainable development agenda as it applies to mining.

That agenda is formally titled the “2030 Agenda for Sustainable Development,” or the 2030 Agenda. (It effectively replaced Agenda 2021.) Its foremost goal is to “end poverty.”

The white paper itemizes the most basic rules from the U.N. for mining on everything from traceable metals to carbon pricing to tribes to diversity.

More so than ever before, the world’s top gold miners infused their 2020 integrated annual reports and other corporate reports with declarations of support for the 2030 Agenda.

In 2020, most of the world’s biggest gold miners dutifully scored themselves on how well they conformed to U.N. sustainable development goals for the industry.

And critically, in 2020, most stated explicit support for “carbon prices” or “carbon taxes.”

“Carbon prices” are basically a tax on a company’s or operation’s estimated carbon footprint, which is an amorphous concept, as miners in South Africa have discovered. The tax is paid to a governing body committed to the 2030 Agenda. “Carbon prices” are typically accounted for as capital expenditures, and factor into future business and operating decisions.

For example, hypothetically, when the U.N. declares a month to be another record scorcher, climate change to be worsening, and climate doom to be nigh, carbon prices could go up; then capital expenditures go up, AISC/oz goes up, yield/oz goes down, and then certain projects become simply cost-prohibitive and get mothballed.

The numbers and the verbiage in the corporate reports show that, today, the biggest gold miners want investors to know they are participants in the U.S. Sustainable Development Program and Agenda 2030.

Newmont Produces 5.8M oz

Newmont mined 9% more ore yoy, processed 2% less ore yoy, and produced 9% less gold yoy. (Attributable gold production fell 6% yoy.) The average realized price for the company rose 27% yoy (to $1,775/oz), and was up 41% over the average for the previous five years. Meanwhile, AISC rose 8% yoy (to $1,045/oz) and was up 13% over the average for the previous five years.

The company reported a net income of $2.7 billion and paid dividends.

For 2020, Newmont reported sustaining capital expenditures of roughly $900 million and development project expenditures of roughly $400 million.

Newmont achieved its 2020 guidance on production. “(W)e implemented industry-leading technological improvements with the launch of our autonomous haulage fleet at Boddington mine in Australia, and completed the conveyor and materials management projects at Musselwhite mine in Canada,” the CEO reported in the annual report. “We have continued key growth projects at Tanami Expansion 2 in Australia, which will extend mine life and decrease costs.”

In 2020, Newmont sold its interests in Kalgoorlie, Red Lake and Continental Gold.

In its first full year of production, Nevada Gold Mines produced 1.3 million oz (attributable to Newmont, and 2.1 million oz total with Barrick Gold). Merian (Suriname) produced 460,000 oz, besting Yanacocha for the second time in three years. Production at Boddington fell for the third year, to 670,000 oz. Peñasquito produced 500,000 oz.

In response to COVID-19 and to meet WHO guidelines, the company changed “shift patterns, required mask usage, and increased health screenings and testing.” The miner temporarily suspended operations at Musselwhite, Éléonore, Peñasquito, Yanacocha and Cerro Negro.

In 2021, the company will celebrate its 100th year. Newmont projects sustaining capital expenditures of roughly $1 billion and development capital expenditures of $850 million. Newmont expects to get full financial approval for Ahafo North and Yanacocha Sulfides in 2021. It expects to produce 6.5 million oz gold at an AISC of $970.

Newmont joined the U.N. Global Compact in 2004. It “committed” to a 30% carbon reduction emission by 2030. “Newmont supports the U.N.’s Framework Convention on Climate Change goal of limiting global warming to well below 2°C and plans to transition its operations to beat this goal by 2030, with an aspiration of carbon neutrality by 2050.”

Importantly, “we support a market-based price on carbon and employ an internal cost of carbon in our investment system to help drive sustainable energy choices,” Newmont reported in its sustainability policy.

Newmont is also aligned with the 2030 Agenda when it comes to tribes and social justice. In its annual report, it said it is an active participant in the “Paradigm for Parity framework, a coalition of business leaders committed to a workplace where women and men have equal power, status and opportunity in senior leadership by 2030, and we are committed to advancing the U.N. Sustainable Development Goal to achieve gender equality.”

Klaus Schwab, founder of the WEF, speaks at the 2020 annual meeting, attended by executives from Newmont and AngloGold Ashanti. The WEF authored the white paper published by the United Nations that maps the 2030 Agenda as it applies to mining. (Photo: WEF)

Barrick Gold Produces 4.8M oz

Barrick Gold mined about 1.5% more ore and processed about the same amount of ore yoy. The total ore processed was up substantially over the average for the previous five years. Total gold output was down 13% yoy, and off 12% from the average for the previous five years.

In 2020, the average received price rose 27% yoy (to $1,778/oz). It was up 40% over the average for the previous five years.

Meanwhile, AISC rose 8% yoy (to $967/oz). It was up about 21% over the average for the previous five years.

The miner reported net earnings of $2.3 billion for 2020, and paid a dividend each quarter.

Barrick logged sustaining capital expenditures of $1.6 billion and project capital expenditures of $471 billion.

The Pueblo Viejo expansion project received approval for its environmental impact assessment. The miner sold its interest in four projects/mines (Eskay Creek, Massawa, Morila and Bullfrog). Mining resumed at Bulyanhulu in Tanzania, which was on care and maintenance since 2017, after the miner settled legacy disputes in that country.

The Carlin Complex produced 1.7 million oz gold and Pueblo Viejo produced 1 million oz.

The miner did its part in fighting the invisible enemy in 2020. “Across the world, our mine teams joined forces with local authorities, medical agencies, national governments and other partners to implement strict protocols around access, screening, sanitation and isolation at all our mines.”

Barrick joined the U.N. Global Compact in 2005. In its sustainability report, Barrick scores itself on how it is furthering the 2030 Agenda. It draws its performance indicators from investors, leadership and the “expectations of the U.N.’s Global Compact.”

In 2020, Barrick “set a target to reduce its greenhouse gas emissions by 10% (from a 2017 baseline) by 2030.” That number was ratcheted up later to 30% (from a 2018 baseline).

Also in 2020, Barrick updated its global scenario analysis of the potential impacts of climate change on the business. It analyzed scenarios provided by the U.N. and WEF and envisions two worlds to which it will conform, one where the target is a 2°C or 3°C increase in global temperatures, and one where the target is a smaller increase. For the former, “carbon prices range between $20 to $52/metric ton (mt).” For the latter, “the carbon price ranges between $125 and $140/mt.”

For 2021, the miner expects to produce less gold while furthering the 2030 Agenda.

Barrick’s 2021 guidance predicts an AISC of between $970/oz and $1,020/oz. It will reportedly produce as much as 4.7 million oz. It anticipates total capital expenditures of up to $2.1 billion.

The company reported Porgera, which has legacy issues and was on care and maintenance for most of 2020, was excluded from 2021 guidance estimates. Bulyanhulu is expected to be in full production in H2. A water treatment plant will be commissioned at Goukoto mine, which will deliver first ore by the end of Q2.

In 2021, the company will implement a goal of having women represent 30% of the board by 2023. The company will “identify Climate Change Champions at each site during 2021.” Natural-gas-fired kilns will go in at Pueblo Viejo. The miner is evaluating suppliers on how they help or hurt it attain carbon emissions goals aligned with guidelines from the U.N.

AngloGold Ashanti Produces 3M oz

AngloGold Ashanti processed about 6% more ore yoy in 2020. It produced about 7% less gold yoy, roughly 3 million oz. Total gold production was off by 15% from the average for the preceding five years.

Average realized price was 41% above the average for the previous five years. AISC rose 6% yoy (to $1,045/oz).

In 2020, the miner sold its operating assets in South Africa (to Harmony) and Mali (to Firefinch and IAMGOLD). It reported sustaining capital expenditures of roughly $500 million, and made progress on redevelopment at Obuasi, where commercial production was achieved, and on feasibility studies for its two Colombian projects (Quebradona and Gramalote).

Meliadine produces 320,000 oz in 2020. Agnico Eagle produces 3% less gold yoy. (Photo: Agnico Eagle)

Greita had a banner year due to higher grade ore. Iduapriem also had a “solid performance” due to higher grades. Siquiri increased production yoy. The mill at Kibali had a “steady performance,” but processed lower grade ore. Production at Cerro Vanguardia and Serra Grande fell in part due to lower grade ore, the company reported.

The miner reported a profit of roughly $1 billion for the year and delivered “improved dividends to shareholders.”

AngloGold Ashanti described 2020 as “the most challenging year ever due to COVID-19.” Lockdowns were “enforced” and certain operations were temporarily suspended.

In 2021, the miner expects sustaining capital expenditures of up to $820 million. Phase 2 redevelopment at Obuasi will continue and capacity there will hit 4,000 mt per day (mt/d) during H2. The company expects to produce as much as 2.9 million oz at an AISC of as low as $1,130/oz.

AngloGold Ashanti plans to review and update its climate change strategy in 2021 with new emissions targets. It joined the U.N. Global Compact in 2011. It “is committed to the U.N.’s Sustainable Development Goals to support its 2030 Agenda to end poverty and inequality, protect the planet, and ensure prosperity for all,” it reported. “Our sustainable development strategy, which supports our overall business strategy, is aligned with the SDGs.”

AngloGold Ashanti Chairman Sipho Pityana and Vice President Chris Nthite attended the WEF’s 2020 annual meeting. Pityana had a speaking role.

The average AISC and price received for the group show the miners enjoyed a substantial yoy yield increase. Despite that, total gold output sank yoy again.

Polyus Produces 2.8M oz

Russia’s Polyus processed 2% more ore yoy, and 39% more than the average for the previous five years. It mined 24% more ore yoy. Polyus produced 3% less gold yoy.

Polyus consistently has the lowest AISC of the group. In 2020, its AISC rose 2% yoy (to $604/oz), and was up 1% over the average for the previous five years.

Polyus reported a profit of roughly $1.6 billion for 2020. Dividends were paid. The miner logged sustaining

capital expenditures of $218 million. It mined higher-grade ore at Blagodatnoye and Natalka, and lower-grade ore at Olimpiada.

The company reported $100 million in COVID-19-related expenses for 2020. “These include salary increases paid to staff working extended shifts, procurement of medical and personal protection equipment, as all preventative measures remain in place at all sites.”

Polyus expects to produce 2.7 million oz in 2021 due, in part, to lower head grades at Olimpiada.

The Polyus annual sustainability reports reveal that in 2019 it joined as a “participant in the United Nations Global Compact and looks forward to promoting sustainable development under the U.N.’s leadership.”

Kinross Gold Produces 2.4M oz

Kinross Gold mined 9% more ore yoy. The average price received was up 27% yoy, while AISC was basically unchanged yoy (at $987/oz). Total gold production fell 6% yoy, and was off 9% from the average for the preceding five years.

For 2020, the miner logged net earnings of $1.3 billion. It reported capital expenditures of roughly $1 billion.

Tasiast achieved record production in 2020. “The Tasiast 24k project advanced on budget and on schedule.”

Paracatu produced 542,000 oz in 2020.

Across its operations, mill grade decreased by 3% yoy “primarily due to lower grades at Kupol.”

In 2020, the miner acquired Chulbatkan, in Russia; and a 70% stake in the Manh Choh project, formerly known as the Peak project, at Fort Knox mine.

The company met its 2020 guidance for the ninth consecutive year despite implementing “rigorous safety protocols” in response to COVID-19.

By the end of 2021, Tasiast is expected to reach throughput capacity of 21,000 mt/d. A prefeasibility study for Chulbatkan will be completed in Q4 2021, the company reported. Stripping started in January 2021 at the La Coipa Restart project.

The feasibility study for Lobo-Marte is expected to be completed in Q4 2021. The Fort Knox Gilmore project was calendared to achieve first gold pour in January 2021. And a scoping study on Manh Choh will be completed in 2021, the miner reported.

Kinross Gold anticipates producing 2.4 million oz gold in 2021 at an AISC of roughly $1,025/oz. It expects capital expenditures of roughly $900 million.

According to the company, Kinross Gold’s “first priority” is “responsible mining,” which translates to the 2030 Agenda. The miner celebrates its “long-standing participation” in the U.N. Global Compact. It joined the compact in 2010.

Second from left, Sipho Pityana, AngloGold Ashanti’s chairman, in a press conference at the WEF Annual Meeting 2020 on January 21. The miner supports carbon pricing. (Photo: WEF)

“In 2020, we improved disclosure on climate, including benchmarking against the recommendations made by the (U.N.’s Environment Program) Task Force on Climate-related Financial Disclosures (UNEPTFCFD), and conducted a climate risk and opportunity assessment across all sites,” CEO J. Paul Rollinson said.

That means Kinross is in the process of onboarding carbon pricing, and currently “carbon price is selectively applied on major strategic energy-related project evaluations.”

Meanwhile, in 2020, the miner “continued to advance our goals by achieving 33% female representation on the board and committed to Canada’s BlackNorth Initiative and its anti-racism pledge.”

Gold Fields Produces 2.2M oz

With Guyere completing its first year of commercial production in 2020, Gold Fields processed 31% more ore to get 2% more gold yoy. The received price was up 41% while AISC (at $977/oz) was up only 1% over the average for the preceding five years.

Gold Fields reported an after-taxes profit of $745 million for 2020, which led to a dividend payment total three times that of 2019.

The company lowered guidance in May 2020 due to COVID-19-related shutdowns at South Deep and Cerro Corona. It logged capital expenditures of $584 million for the year.

Damang began mining high-grade ore in H2, launching an expected three-year trend of improving production, the miner reported. Construction and development at Salares Norte was approved by the board.

South Deep bested most of its production metrics for 2019, producing 227,000 oz. St. Ives produced 385,000 oz. Tarkwa produced 526,000 oz.

Exploration significantly bumped up reserves at St. Ives and Agnew.

For 2021, the miner expects capital expenditures of $1.2 billion. Attributable gold production is projected to hit 2.3 million oz at an AISC of as low as $1,020/oz.

In 2020, Gold Fields updated its climate policy, which has it “pursuing decarbonization and building resilience to climate change” per its “commitment to the Paris Agreement.”

In 2020, total energy consumption increased by 5% yoy, the miner reported. “Total CO2e emissions during 2020 amounted to 1.97 million mt, an increase from 1.94 million mt in 2019.” (A growing company cannot help but produce more carbon.)

Those numbers are reported in accords with “the recommendations of the (UNEPTFCFD),” Gold Fields said. Accordingly, the miner “factors in a regional carbon price for both costing and as potential revenue streams.”

In 2021, the miner will finalize its policy regarding climate change and diversity, to include “time-bound” targets with a 2030 deadline. “We aim to be the global leader in sustainable gold mining,” Gold Fields reported. “In pursuit of this vision, Gold Fields positively contributes to the U.N. Sustainable Development Goals.”

More than ever before, in 2020, the group signals compliance with the WEF and the U.N.

Newcrest Mining Produces 2.1M oz

In 2020, Newcrest Mining mined 9% and processed 6% more ore to produce 9% less gold yoy. Total gold output was off 11% from the average for the preceding five years.

The average price received rose 27% and AISC rose 13% yoy (to $911/oz).

For fiscal year 2020, the company logged a “statutory profit” of $647 million. It paid out more in dividends than it did in fiscal year 2019.

For fiscal year 2020, it logged capital expenditures of $695 million.

The company took “early and considered actions” and “precautionary measures” against the virus.

In fiscal year 2020, Lihir produced 776,000 oz despite lower grades. Telfer produced 393,000 oz. The miner sold its interest in Gosowong mine, and gained a 40% interest in the Havieron project, near Telfer.

In 2020, Newcrest’s Telfer mine in Western Australia produces 393,000 oz of gold.

Newcrest anticipates capital expenditures up to $1.2 billion for fiscal year 2021. It could produce up to 2.2 million oz.

In fiscal year 2020, the company “progressed the implementation of our sustainability-related Climate Change, Water Stewardship, Biodiversity and

Social Performance policies.” It is implementing the UNEPTFCFD framework for reporting on climate-related perform-

ance metrics.

For example, it “adopted a protocol for applying shadow carbon prices of $25/mt and $50/mt CO2-e in the period to 2030 for jurisdictions where there are no regulated carbon prices.”

In other words, Newcrest has calculated what the “carbon price” would be for operations at places where there are, in fact, right now no requirements to do such. The two prices “will enable a range of sensitivities to be considered for future investments,” the miner reported.

In fiscal year 2020, the company met 11 out of 13 sustainability and climate change targets, which are to become more rigorous over time. “To reduce our carbon footprint, we have set a target of 30% reduction in greenhouse gas emissions intensity by 2030.”

The company also launched a “refreshed” diversity strategy in July 2020. “Newcrest is committed to increasing female representation in Australia to 21% by FY23.”

Agnico Eagle Produces 1.7M oz

Agnico Eagle Mines processed 3% less ore and produced 3% less gold yoy.

At one point in H1 2020, seven of eight of the company’s mines were effectively shuttered. “Despite this rocky beginning, 2020 was another record year for Agnico Eagle,” Agnico Eagle CEO Sean Boyd reported. “For the first time in our company’s history, we produced more than 500,000 oz in a quarter.”

The Meliadine mine produced 320,000 oz. LaRonde Complex produced 350,000 oz.

Agnico Eagle logged a $500 million net income for the year and declared a cash dividend.

The miner reported it expects capital expenditures of $740 million in 2021. It reportedly could produce roughly 2.1 million oz at an AISC as low as $950/oz.

In 2020, the company went beyond the normal COVID protocols enacted by the others in the group, and developed a special logo and slogan incorporating social distancing. “Another way to measure it? Keep one Golden Eagle wingspan apart.”

“Agnico Eagle is working to support progress on the U.N. Sustainable Development Goals,” the company reported. In 2020, the company initiated its climate action plan strategy. It updated its diversity plan, and implemented a tribes-engagement strategy. Currently, it builds carbon pricing into its global warming risk-mitigation strategy.

South Deep bested most of its production metrics for 2019, producing 227,000 oz.

Harmony Gold Produces 1.3M oz

Harmony Gold produced a little more than 1 million oz/year.

In 2020, Harmony Gold’s numbers are skewed by those from three months of milling at the newly acquired Mponeng and Mine Waste Solutions. Thus, while it substantially increased total ore processed, total gold output fell 7% yoy.

COVID-19 lockdowns were blamed for a decline in gold production in H1 2020.

In fiscal year 2020, total gold output at Hidden Valley, in Papau New Guinea, was 22% lower, Harmony reported. Production there “continued to be affected by the planned move from stage 5 to stage 6 mining in the pit during the year,” it said. “The mine imposed its own site-lockdown for several weeks from the onset of the pandemic, but was able to maintain production at a reduced rate.”

The miner expects Mponeng (and Mine Waste Solutions) to produce 350,000 oz/y. It describes Wafi-Golpu, a joint venture with Newcrest, to be a “game changer.” It is “committed to progressing negotiations on a special mining lease for Wafi-Golpu.

For fiscal year 2021, the miner expects to produce as much as 1.6 million oz at an AISC as low as $1,370/oz.

Harmony Gold “adopted” the U.N.’s 2030 sustainable development goals in 2018.

In fiscal year 2020, it produced its first-ever UNEPTFCFD-compliant report.

The miner anticipates its “direct carbon tax liability is likely to range between $21 million and $35 million by 2030 under a high-cost scenario.” That is in addition to the carbon taxes it will pay on the products it buys, like machines and cement, and on the electricity it uses.

Perhaps because it operates in South Africa, Harmony is a top-tier virtue signaler.