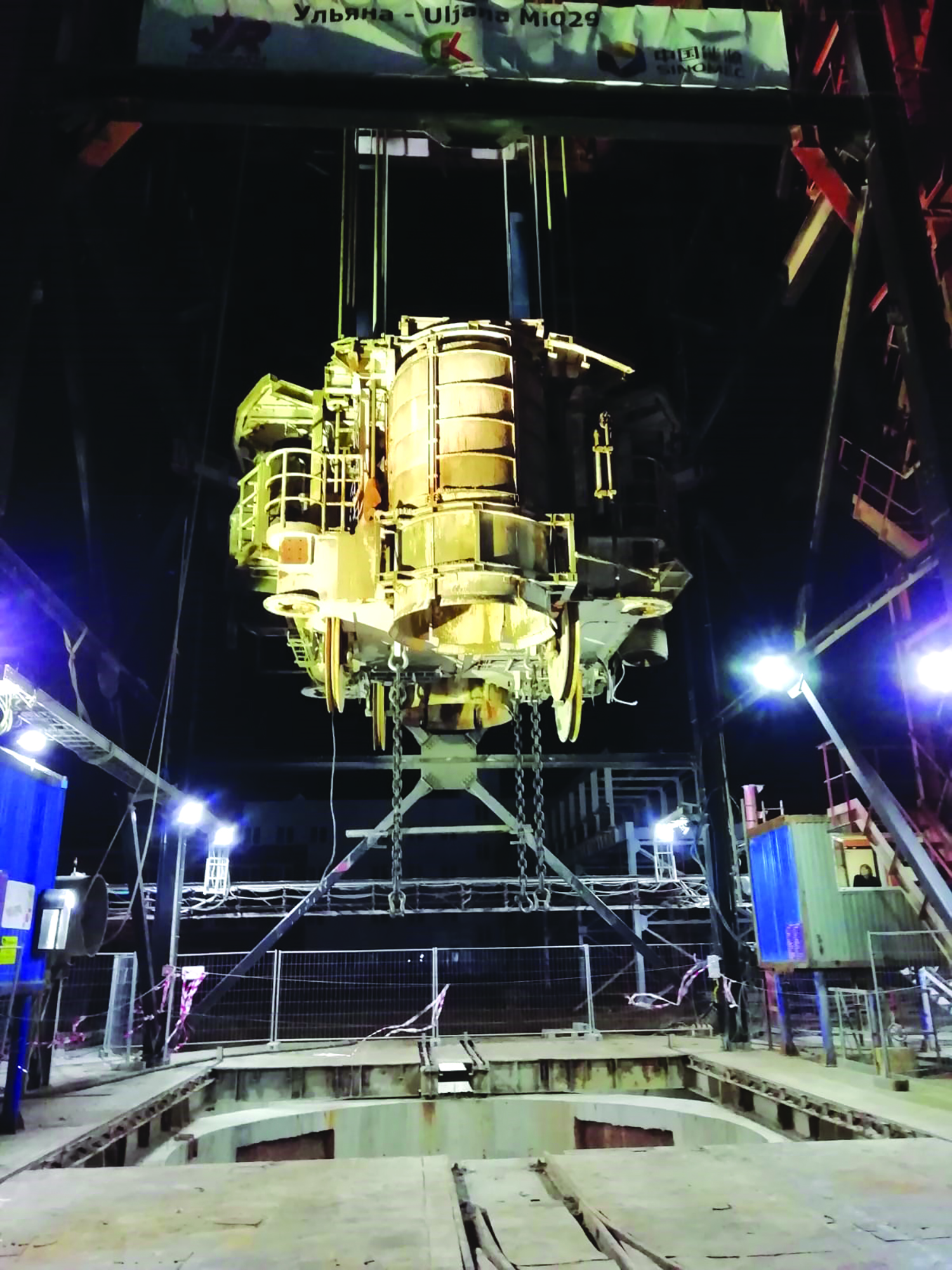

The two shafts at Nezhinsky mine in Belarus are more than 700 m deep and 8 m in diameter. Herrenknecht Shaft Boring Roadheaders do the boring while Redpath manages the project. It is completed fast and with a perfect safety record. (Photo: Redpath Deilmann)

Boring solutions have been breaking records, improving safety, gaining acceptance, and ultimately changing the suppliers that offer them

By Jesse Morton, Technical Writer

Boring is faster and safer. A couple of smashed records that date back to when life was cheaper, and at least one recent successful shaft-sinking project, stand as evidence.

Beyond the speed and safety offered, the newest boring solutions require comparatively fewer personnel. They improve project feasibility at a time when miners are launching expansion projects. And increasingly, they are field proven.

The testimony, the headlines, the project milestones, the corporate literature, and the social media posts all point to a future where boring machines transform worksites and processes, cut costs, improve safety records, make previously unobtainable ore obtainable, and even increase production.

Experts say the hype is substantiated. They also say it will require more than favorable anecdotal evidence to convince customers. A combination of timely, convincing case studies and a subtle shift in priorities may be required to tip the scales.

“Boring machines have been utilized in hard rock with raisebore machines, but the application of drilling larger-diameter blind holes for use as shafts and blind raises are a change in methodology,” said Bracken Spencer, principal engineer, Alpine Consulting and Mining Engineering. “With increasing demand for higher efficiency solutions, which also limit or altogether remove the miners’ exposure to risk, shaft boring will be recognized as a viable option. As successful case studies come out, the general acceptance of shaft boring within the underground hard rock mining industry will not only increase but could conceivably become a preferred method.”

Several miners have recently adopted boring as a preferred method. According to the supplier partners, they have been, or will be, richly rewarded for it.

South African Mine Adopts Disruptive System

Master Drilling reported its new Shaft Boring System (SBS) was adopted by a South African mine for a possibly 1,000-m shaft. The miner adopted the innovative system for the efficiency and safety gains it offered, the company said.

SBS is described as an integrated shaft-sinking system. “It is more than just a machine,” said Koos Jordaan, executive director, Master Drilling. “It includes indirect associated equipment such as the headgear, winders, winches and conveyances, as well as processes such as pre-sink, cementation, station breakaways and equipping.”

Master Drilling’s new Shaft Boring System covers boring, mucking, reinforcing and lining. After a successful field trial, it is recently adopted for a mine in South Africa. (Photo: Master Drilling)

The system covers boring, mucking, reinforcing and lining, and has been hailed as disruptive to the shaft-sinking industry.

The offered benefits include reduced costs and improved productivity. SBS also dramatically drops the number of personnel in the work area. “There have been shaft-sinking projects using conventional methods with 350 personnel working. More common right now is between 80 to 180 persons,” Jordaan said. “We believe that this number could be reduced to as low as 20 personnel.”

The miner adopted an SBS design for a 4- to 5-m-diameter, 500- to 1,000-m-deep shaft. The miner saw the advantage in SBS limiting the scope of work and the amount of personnel in the work area. Currently, the project is in the approval phase.

Upon completion of the shaft, the offering is expected to see wider adoption, Jordaan said. “The concept is scalable,” he said. “The real value for clients is this solution on larger scale projects.”

The sale follows a successful field trial of an SBS design for 4- to 11.5-m-diameter shafts with depths of up to 2,000 m. The design uses “a pilot and ream configuration in the front part of the machine,” Jordaan said. “This allows for a smaller volume of rock to be lifted from the shaft bottom at a smaller diameter and the enlargement at a larger diameter to be done by reaming a larger-diameter shaft.”

The larger-reamed volume of rock is removed by gravity, while the smaller pilot-face rock is removed by “a more complex method,” he said. “This significantly reduces the complexity, weight, power and cost of the machine that is within the shaft barrel.”

The configuration proved viable during the first stage of an multistage project that was otherwise using conventional methods in 300-MPa norite.

“We were following a staged approach to deal with risk, and had completed Stage 1 with a very good performance of just under 1 m/h instantaneous advance rate,” Jordaan said. The opportunity presented to test out the SBS design. “We reviewed various designs before we concluded on the W-head design that is a novel and registered feature,” Jordaan said. “We then did a successful experimental sink 10 m deep at 4 m diameter.”

Herrenknecht’s SBR is proven at Nezhinsky mine, where it broke records for speed. Above, the team that built the first unit for factory acceptance testing in 2018. (Photo: Herrenknecht AG)

By offering improvements in productivity and safety, SBS speaks to the needs of aging mines to pursue new orebodies in more challenging geologies and in sensitive and remote locations, he said.

“This offering will provide much value to the industry through higher project feasibilities and performance for our clients,” Jordaan said. “Master Drilling has a diversified and sustainable solution for modernizing shaft sinking in hard rock.”

The release of SBS capped an evolutionary process that redefined the supplier over many years.

Master Drilling started as a raise boring service company. As it increasingly took on projects located in remote or harsh environments, it became more of a solution-based service company.

“We soon realized the benefits of boring shafts verses conventional methods during our raise bore operations,” Jordaan said. “Some shafts do not have bottom access, are too deep, too large in diameter or have geological instability, and need to be constructed by shaft sinking methodology.”

Over the years, the costs, safety record and productivity numbers of conventional methods prompted the supplier to innovate in boring solutions, he said. “So, we set upon a journey to build capability at shaft sinking by rock boring in hard rock in the hope that in the future we will be able to offer clients value in better safety and project financial performance.”

That journey seems a natural progression for a company with a deep history in raise boring. Like the new SBS, the raise boring services offered by Master Drilling add value by prioritizing accuracy, safety, sustainability and efficiency, said Izak Bredenkamp, manager, new business development, Master Drilling.

“We offer a safe and efficient method of mechanically excavating between two levels or from surface to underground,” he said. “Compared to conventional methods of excavation, raise boring is safer, does less damage to surrounding rocks, involves greater automation, and is more cost-effective.”

Those benefits arise from the company’s blast-free approach. “Hence, this is all mechanical excavation. The no-blast is safer, quicker and has less impact on the environment,” Bredenkamp said.

“In addition, Master Drilling has released a new user interface with the machines, enabling some autonomous functions up to full remote control of operations,” he said. “We therefore reduce the head count at the machine to ensure that there is less risk and more commercial viability.”

The supplier is currently developing a large raise boring machine for the excavation of large and deep-diameter shafts. It will best the capacity offered by predecessor competition, Bredenkamp said.

“We have a business model that allows for research and development and to ensure we can respond quickly and give a solution for requirements that are increasingly becoming more challenging and complex,” he said. “We are pushing the envelope of disruptive technologies to ensure that previous projects that may not have been feasible are now feasible.”

For example, as part of a sustainability focus, the supplier is developing ways to reduce power consumption and recycle the water used, Bredenkamp said.

Targeting improved efficiency, machine monitoring capabilities are offered, he said. “Our onboard machine technology allows for an interface with the client’s management system, and the machine metrics enable real-time analyzes and decision making to optimize production.”

That supports “horizontal and vertical elevation that is quicker and safer than conventional methods,” he said.

In 2020, Master Drilling completed a 1,377-m pilot hole for raise boring at Northam Platinum’s Zondereinde mine. “Our team used ground-breaking directional drilling technology and also our flagship RD8 machine,” Bredenkamp said.

“Our skilled operators ensured that we achieved the level of accuracy required in order to create a shaft that can be equipped for both man and material hoisting,” he said. Reaming is currently under way.

That level of accuracy stems from superior equipment, methods and teamwork, Bredenkamp said. “It’s a partnership between the client and the contractors to ensure success,” he said. “We are eager to partner with clients to unlock more value.”

Shaft Borers Break Records in Belarus

In July 2020, one of two Shaft Boring Roadheaders (SBRs) reached the final target depth at Nezhinsky mine in Lyuban, Belarus. The development was the climax of a project that quickly became a major success story.

It has since been trumpeted by both the shaft-sinking solutions suppliers involved for proving the viability of boring machines in soft-rock shaft-sinking projects. Redpath, which ran the project, described it as precedent setting. Herrenknecht, which supplied the SBRs, described it as a top performance with a perfect safety record.

Project milestones included a month that saw a combined total of more than 280 m of advance. Ultimately, the shafts were completed in half the time it would have taken were conventional methods used, Herrenknecht reported.

“In April 2020, both shafts broke Redpath Deilmann’s company records from 1938, which was achieved at the time thanks to practically nonexistent safety regulations,” it said.

Jochen Greinacher, managing director of Redpath Deilmann, said he considered the project a game changer. “The combination of reliable and proven SBRs, the newly developed and patented Redpath DH hydraulic curb ring, the adapted hoisting systems all played significant roles in the success of these shafts,” he said.

“To anyone involved, it is clear that the most critical aspect to the overall success was the knowledgeable and experienced team,” Greinacher said. “The team executed at an average advance rate of 3 m of finished shaft per day, with peak performance of more than 7 m per day and, admittedly, in favorable rock conditions, advancing each shaft more than 140 m in one month, thus taking the burden from future clients to rely on a prototype rather than a proven system.”

For perspective, that performance should be compared to the average rate for traditional shaft-sinking methods of roughly 2.4 m per day, Kevin Melong, vice president, shafts and technical services, Redpath, said.

Herrenknecht’s SBR is based on its Vertical Shaft-sinking Machine. The roadheader is telescopic. “The method has now been modified for mining with a hydraulically driven rotating cutting drum and an adapted backup area,” Herrenknecht reported.

The SBR cuts the ground and pneumatically loads material into the bucket for hoisting to surface, Melong said.

Redpath shaft-sinking specialists worked closely with Herrenknecht engineers “to ensure the SBRs not only had capabilities to efficiently and safely cut and move the broken ground, but ensured all aspects of the sinking cycle were incorporated in the design of the machines,” Redpath said in a statement.

The SBRs and processes were developed as the shafts progressed. “With the help of a data acquisition system, the advance rates were recorded, processes precisely analyzed, and initial weaknesses rectified,” Herrenknecht reported. Improvements led to significant time savings.

Other project deliverables managed by Redpath included the installation of the shaft lining elements, temporary and permanent shaft furnishings and services, and installation of the ventilation system.

Both suppliers said the safety record of the project reflected the capabilities of the SBRs.

“No people at the face means less exposure of our crew to potential hazards,” Redpath reported. “Redpath Deilmann is very proud of not a single lost-time incident during sinking, including construction of the stations and the loading pockets.”

The noteworthy challenges faced included drilling through an aquifer. “Due to a water-bearing layer of earth, the ground was frozen to a depth of 165 m,” Herrenknecht reported. “A breach with a water ingress at the end of the freezing depth was the greatest challenge in the project.”

The measure did not prevent the shaft from being completed in record time. Upon completion, the two shafts were 750 and 697 m deep and 8 m in diameter.

Nezhinsky, owned by IOOO Slavkaliy, is a 2-million-metric-ton-per-year (mt/y) potassium salt mine.

Redpath will soon test its fourth-generation stage-mounted hydraulic mucker, which is a ‘complete rethink’ of the earlier models. One is pictured here in Oyu Tolgoi in Mongolia. (Photo: Redpath Deilmann)

During the course of the project, Redpath identified many areas of potential incremental improvements. They will be applied on future projects and in the development of Herrenknecht’s Shaft Boring Cutterhead for hard rock shaft sinking, Redpath reported.

“On the heels of the success with the Herrenknecht SBR program, the teams are busy developing a prototype hard-rock sinking machine, capable of handling much harder rock formations, in the range of 200 mpa,” Redpath reported. “The approach requires disk cutting as opposed to the use of road header picks, and has progressed to the trial stage later in the year.”

Other innovations from Redpath include a hydraulic curb ring for securing the bottom of the concrete liner pour versus traditional scribing, and a hydraulic key door for opening and closing of the shaft forms, adding to the overall safety and efficiency in the concrete cycle.

Typical curb rings are used with scribing pins that run from the curb out to the excavated wall, with sheeting laid on top to act as the floor for the concrete pour, Melong said. “The hydraulic curb does not require any of that extensive scribing work, and closes that gap with a proprietary design, which takes a fraction of the time of the manual scribing or false floor work.”

The main forms or shutters have a key door running the length of the sections to allow the release of the forms from the previous concrete pour, he said. “The door is normally a mechanical bolted design with the requirement to pry open, and force shut the key door within the ring of form panels when in the next position,” Melong said. “The hydraulic key doors remove this challenging task from the cycle without any manual work, in a fraction of the time required.”

Separately, Redpath will launch its fourth-generation stage-mounted hydraulic excavator shaft-mucking unit, currently nearing testing. “With a complete rethink of the original hydraulic mucker, which was successfully used on shafts in Canada and Mongolia, engineers have come up with a unit that will allow for concurrent tasks in the sinking cycle to be executed,” Redpath reported.

The unit can be lowered from the main galloway, and operated remotely, with no workers below the galloway. “Not only will the overall sinking cycle be reduced drastically by allowing safer concurrent work, but the customary concerns around the availability of skilled operators on traditional shaft-mucking units will be eliminated,” Redpath reported.

With the mucking unit detached, the ability to be lowered independent of the galloway position, and the ability to operate without workers below, the mucker “offers the potential to conduct concrete pouring concurrent with shaft bottom mucking, the two lengthiest tasks in the complete sinking cycle,” Melong said.

Redpath has also developed a high-speed shaft signaling system network that supports smart stages in shaft construction, and can be used to monitor shaft conditions and mitigate risks in real time.

“Redpath has developed its own collection of technologies, equipment and in-house designs that have been tested or adapted for the unique and harsh environments related to mineshaft construction,” Melong said. “Assembling the right collection of technologies and protocols for each unique construction project enables the Redpath Shaft Control System to reliably and instantly collect and distribute information from sensors, controllers, cameras, computers, phones and virtually any type of electronic device available on the market.”

Upon completion of the shaft, the networks have been used by the clients in the routine shaft operations. “Of particular interest has been the application of real-time shaft-guide alignment monitoring, which trends multi-axis acceleration and vibration of the conveyances running on the complete length of the guide string,” Redpath reported. “The sensing unit is mounted to each conveyance and sends data immediately to surface where it is combined with other winder parameters and shaft sensors to provide a comprehensive account of system conditions throughout the shaft.”

The data can be referenced by maintenance teams as needed to asses guide string conditions over time and detect potential problem areas before they become critical, the supplier reported.

More recently, Redpath made headlines for the sale of six Redbore raise drills to a customer in Chile. Among the machines was a Redbore 60 UR, designed specifically for the Chilean market. It has a capacity range of up to 2 m in diameter.

The order reflects growing demand resulting from the ongoing revival of new mine projects around the globe. Many of those projects will require shafts that go below traditional depths, Redpath reported.

In response, the supplier will seize on the opportunities available to offer state-of-the-art boring solutions. However, “we recognize that there will continue to be the majority of shafts sunk using conventional drill and blast techniques for some time,” Redpath reported. “We are therefore also focused on making the traditional methods safer and more productive.”

Game-changing Raise Borer Smashes Records

In August 2020, Byrnecut’s Raising Australia raise bored two 0.75-m-diameter boxholes for a total of 50.88 m in 24 hours at Paddy’s Flat gold mine using a Rhino 100 raise borer made by TRB-Raise Borers and sold by Sandvik. The feat included setup, drilling and demobilization. The mining contractor dubbed it a “fantastic achievement.” Sandvik said it was a possible world record.

The next month, underground mining services supplier Barminco announced that in about a year, one Rhino 100 had drilled a total of 3,843 m at four Goldfields mines. To cap the winning spree, the supplier had just purchased another rig for use at a Regis Resources mine.

These results and others outright prove the raise borer is nothing short of a game changer for underground production drilling, according to Jarko Salo, managing director, TRB-Raise Borers.

That’s no misprint. The raise boring rig takes production drilling to the next level, he said.

For example, after Fazenda Brasileiro commissioned a Rhino 100 in Q3 2018 to drill slot raises, it reported a gain of a whopping 6.6% in ore recovery. The rig is credited with allowing the recovery of ore that was previously considered out of play, Sandvik reported.

Nimble and manageable by one operator, the Rhino 100 inspires a revolution in thinking about production drilling. With record-breaking speed, it can raise bore slot raises to serve as void spaces for blasting for improved fragmentation and the many downstream benefits. (Photo: Sandvik)

Previously, raise boring as part of production drilling was considered out of play too, for good reason. “Historically, the prevailing opinion has been lack of mobility makes raise boring an unattractive alternative for drilling slot raises in production drilling applications,” Salo said.

“These are rigs traditionally associated with terms like ‘bulky’ and ‘extremely heavy.’ The opinions come from experience: Hauling all this equipment is a cumbersome project, underground even more so, with careful scheduling included,” he said. “Making it a daily or even weekly chore? No, thanks!”

The Rhino 100 changes all that because it is nimbler, easier to operate and safer than conventional solutions, Salo said.

“It pushes the envelope: No more concrete pads, 15-minute setup times and safer operation,” he said.

The rig “allows larger holes and shafts to be drilled quickly, easily, cheaply,” he said. “This was previously unheard of. Still today many conservative miners do not believe me when I tell them about the rig. It is true, a raise borer can be a production drilling rig.”

Several capabilities allow the rig to shatter norms. Compared to competing solutions, it is highly mobile and can be set up and shut down quickly, Salo said. The controls allow for it to be managed by a single operator, without additional resources or other dedicated equipment.

“This means all the necessary tools are carried with the rig to simplify underground logistics,” he said.

Improved mobility supports a “revolution in thinking” about production drilling using a boring solution, he said.

Byrnecut saw the possibilities offered. More importantly, it was able to get its ducks in a row to act on those possibilities, Salo said. The stars aligned, and then the rig accomplished the truly remarkable as if it were just another day at work.

“The real story behind their achievement is the fact that the drill sites were available, the mining plan was calling for drilling, they were using the Rhino, and the operators were probably paid a per-meter salary,” Salo said. “It was really just another day at the office: Nothing special except everything was ready for them to perform.”

Similar unexceptional days at the office have occurred at several other mine sites using a Rhino. For example, in September 2018, an Agnico Eagle Kittilä operator did 29.4 m of downreaming in one shift. To any other site, that would be a major flex. For Kittilä, it was just another day using the Rhino, Salo said.

“We have seen customers achieve more than 400 m per month regularly. Agnico Eagle Kittilä mine is one of the pioneers in fast-track underground benching,” Salo said. “Their record month of drilling is nearly 500 m in 18 slot raises, yet for a lion’s share of that month, the rig was idle.”

Similarly, Byrnecut boring records included 365 m for the third month after commissioning, and 410 m for the next month. That with the rig sitting “idle at times because the mine had troubles providing drill sites,” Salo said.

As mine, company, and other records for m/shift and m/month fall, so tumble production records.

Raise-bored slot raises provide void space for blasting, which translates to improved fragmentation. It also translates to lower production costs with fewer blasting holes, smaller and cheaper blasts, lowered ventilation requirements, improved blast control in poor rock conditions, and quicker stope turnaround time, Salo said.

“The slots are straight and predictable,” he said. That creates the opportunity to maximize long hole rig efficiency and minimize rework.

“The high-capacity Rhino 100 allows drilling of two (round 0.66/0.75-m-diameter) slot raises in a stope to ensure blasting success, if there were any doubts,” Salo said. “Slots can be developed well in advance, making planning easier and more flexible. Safety is improved by eliminating redrilling of blast holes.”

Productivity increases of a mind-boggling 60% are attainable, he said. Operating costs per meter can be reduced by as much as 30%. The mining cycle for each stope can be shortened by up to 14 days.

“Raise boring will facilitate the process and turn other rigs working in the same ore more efficient and productive,” Salo said. “Rework, rescheduling, and hang-ups are not on the agenda as they were in the past.”

“As a result, we engage mining operations differently. We can be discussing their production capacities and targets rather than single rigs,” Salo said. “We can point out bottlenecks and improve rig utilization.”

The rig is capable of supporting teleoperation, which is gaining interest, he said.

“Another one is the plug-and-drill concept, where one rig can use optimized drilling technology in both directions of drilling with a number of benefits,” Salo said, “including higher reliability, lower maintenance requirements, and versatility in drilling diameters and applications.”

Further, the safety, productivity and efficiency gains have “many people very interested,” Salo said. “Just one rig can bring a huge change in underground mining operation.”