In June 2022, Swedish engineering firm, Jama, launched the JMS 7000 — a new medium-sized rock scaling machine. (Photo: Jama)

E&MJ presents news and developments from Scandinavian mining companies and suppliers

By Carly Leonida, European Editor

Ever the innovators, Scandinavian mining companies and mining equipment, technology and services (METS) providers have not disappointed in 2022. From releasing new high-performance autonomous and battery-electric vehicles (BEVs), to testing a new mining method, and acquisitions that edge towards the creation of net-zero flowsheets, in no other geography is the pace and quality of innovation so consistently high. With this in mind, let’s look at some important projects and new products from the past 12 months.

FLS Completes TK Mining Acquisition

On September 1, 2022, FLSmidth announced the completion of its acquisition of thyssenkrupp’s Mining business (TK Mining). Speaking to the media from Essen, Germany, where they had received the keys to TK Mining just hours earlier, FLSmidth Group CEO, Mikko Keto, and Group CFO, Roland Andersen, gave some initial details on the combination.

“Today’s announcement marks a significant milestone in the history of FLSmidth,” said Keto. “We are very excited to soon welcome our ~2,000 new colleagues and TK Mining’s customers to FLSmidth. The completion of the acquisition contributes to FLSmidth’s strategic growth ambitions within mining. Our combined company will offer customers a stronger, complementary value proposition, while creating significant aftermarket opportunities, driving value creation through compelling synergies and further strengthening our sustainability and digitalization agenda.”

Having only just taken ownership, the duo was unable to give too many financial details. However, they said that FLS will release further guidance in its financial call on November 8, 2022, and more information will follow at its capital markets day which will be held on January 18, 2023, in Copenhagen.

Andersen was able to say that TK Mining’s total outstanding order backlog amounted to EUR 698m (US $676 million) at the end July. The business has a strong presence in the Russian mining market, and its outstanding order backlog from Russian activities was approximately EUR 43 million (which was less than FLS expected). The company has suspended new business in Russia, and Andersen said that contracts with non-sanctioned customers were being finalized as far as possible. TK Mining’s order intake for the first nine months of the fiscal year (October 1- September 30) stood at EUR 433 million, with services accounting for EUR 250 million and new order intake at EUR 183 million.

Keto explained that integration of the companies would begin immediately, with an exercise to assess portfolio synergies in the first 1-3 months. The FLS team will also perform a full operational and financial review of TK Mining’s activities to ensure the headline data they received aligns with the internal numbers.

“With this acquisition we’re adding some key technologies to our portfolio,” he said. “From today, we will be the global market leader in high-pressure grinding rolls (HPGR), and that is one of the key reasons for the acquisition. We can improve the business mix of TK Mining by focusing on the service and aftermarket capabilities, and we know that we can improve on the existing level of profitability. In terms of sustainability, we are also adding capabilities around tailings management and in-pit crushing and conveying (IPCC).”

The Inside Track

E&MJ caught up with Keto after the call to get some more detail. What’s the sentiment like today in Essen? E&MJ asked. Are the TK Mining employees excited to be joining the FLS family?

“They are,” Keto replied. “The TK Mining division has been in waiting mode for 2-3 years now following the company’s decision to sell it. So, the team seems happy to be joining an organization that is highly focused on mining and to have some certainty as to their future. The mood here is really positive and optimistic.”

Of course, TK Mining won’t just bring new products to the FLS portfolio, the company also has deep subject matter expertise and extensive facilities around the globe. In some cases, the companies have repairs facilities located next door to one another and Keto said that, in areas like Antofagasta, Chile, the TK Mining facility is larger and better equipped, so they are glad to be gaining access to that.

“On the other hand, FLS has a strong capability to support customers in Kazakhstan with extensive repair facilities, so the advantages will flow both ways,” he said. “TK Mining customers will benefit from the FLS service capabilities, and FLS customers will benefit from access to TK Mining facilities. It’s a win-win situation from a customer point of view.”

Prior to the acquisition, FLS had a few gaps in its pit-to-plant technology offering. The company has a strong presence in milling and grinding and, as Keto hinted in the press conference, the TK Mining HPGR range will improve that.

“We have a couple of references in HPGR but, historically, the market is dominated by TK Mining,” he told E&MJ. “We’re acquiring the best technology in the market and also the widest installed base. That’s important because installed base development is very slow in mining. Mines tend to choose one supplier and then stick with them for 10-20 years.

“We know that other companies are active in this space, and we wanted to reclaim that leadership position and gain immediate visibility, so we began marketing our expanded HPGR range on day one.”

Conveying solutions, particularly long overland conveyors and gearless drive systems, was another portfolio area that FLS was looking to boost through the acquisition. The company has an existing conveying business but is upping its competence level and capabilities. Primary gyratory crushing is another; both the FLS and TK Mining designs are highly regarded by the market, but some mines have a preference and now FLS can supply both options.

Some of the above technologies will also be strategic in speeding FLSmidth towards its Mission Zero sustainability goal of providing net-zero flowsheets by 2030.

“Our focus in creating the Mission Zero mine is on providing all the necessary technologies so that customers can reconfigure their flowsheets,” said Keto. “Technologies like HPGR and IPCC are only one piece of the puzzle. They will not be suitable for every mine or ore type. So, it’s important that we can also offer other energy-efficient technologies, to create different pathways for mines with different decarbonization challenges. We believe that we now have a full portfolio for the concentrator and the competency to design the right flowsheet for each operation. In the pit, we also have a better offering in IPCC and conveying, above and beyond what we gained from the 2018 acquisition of Sandvik Mining Systems. We took a big step forward with TK Mining in this regard.”

Following the aforementioned portfolio review, during which both the TK Mining and FLS product lines will be under scrutiny, decisions will then be made as to their combination. The aim is to implement one go-to-market strategy. The thyssenkrupp Group continues to operate in other markets, so it was a requirement of the seller that the TK Mining equipment and services be rebranded.

“We are working to combine our sales forces immediately,” said Keto. “Then, we’ll start rebranding the equipment so that there is only one face and one brand for customers. We’re currently appointing senior leaders for each product line and in key markets. Then our sales teams will look at the combined sales funnel to make sure we’re as aligned on the front end as we can possibly be. I’d be happy to give you an update in a few weeks as the integration progresses.”

Stay tuned folks.

Epiroc’s New Boltec ABR Redefines Safety and productivity

Epiroc launched its new Boltec drill rig with Auto Bolt Reload (ABR) on September 15, 2022. This is the first fully autonomous underground rock reinforcement drill rig. The ABR system is designed so that the bolt type and machine work in synergy to deliver optimal safety, performance and quality.

The project to design the Boltec ABR began in 2011 and, like many innovations, was developed at the request of Epiroc’s mining customers – in this case, Swedish miner, LKAB.

Mining operations are steadily becoming deeper as they develop existing and newly discovered orebodies. Increased depth typically corresponds to increased rock stresses. This often results in more challenging conditions with fractured rock masses, rock bursts, and squeezing ground, all of which require regular rehabilitation work. The Boltec ABR is designed specifically to deliver improved operator safety, flexibility and productivity in these conditions.

FLSmidth CEO, Mikko Keto, speaks to his new TK Mining colleagues in Essen, Germany on September 1. (Photo: FLSmidth)

The main design feature of the Boltec ABR is the fully mechanized bolt reloading system. This automatically feeds bolts from a large carrier magazine to the feed magazine while the operator remains inside the ergonomic cabin. This eliminates the need for manual reloading of the feed magazine, thereby protecting the operator from the risk of falls or trips.

The fast auto-reloading sequence speeds up the production cycle. A total of 52 bolts can be installed into a heading (the feed magazine holds eight bolts at a time, and this is reloaded automatically from the carrier magazine which holds a further 44 bolts) before reloading of the carrier magazine is necessary. The carrier magazine is mounted on a swing arm that lowers it to ground level for ergonomic reloading behind the machine’s front support jacks. This can be done during the bolting sequence to create a more continuous process.

The rig fits in the same envelope as a standard Boltec and can be used with2.4- or 3-meter (m) bolt lengths based on the size of the magazines. It’s primarily designed to be used with Epiroc’s one-step Self Drilling Anchor bolts and pumpable resin to maximize cycle efficiency but can also be used with two-step bolts and resin cartridges if the customer desires.

Epiroc said that SDA bolts are not sensitive to varying ground conditions and will achieve consistently fast installation. This gives easier scheduling accuracy for mine planning and forecasting. The pumpable resin offers fast setting times and full bolt encapsulation, ensuring speed and quality of installation. An added plus with pumpable resin is its insensitivity to wet ground conditions, which can be a desirable characteristic for many operations.

The Boltec ABR also opens the door to other safety and productivity-enhancing functionalities that were previously not compatible with underground bolting machines. Teleremote control and multi-bolt auto are now available as options that can provide bolting potential during shift changes or when conditions preclude having an operator physically on the machine. The rig is also available as a battery electric model.

Peter Bray, Global Product Manager rock reinforcement at Epiroc Underground division, presented the machine. He described the rig as “an integral tool for mining operations that are experiencing difficult conditions underground.”

The new Boltec ABR was tested at LKAB’s Kiruna operation in Sweden. The 70,000 mt/d iron ore mine is encountering enhanced seismic activity as mining operations delve deeper and was finding it particularly difficult to get bolts encased properly in concrete. The company was looking for a solution to keep its operators safe during rock reinforcement and turned to Epiroc for help. Following a significant seismic event in May 2020, the Boltec ABR proved its worth helping to secure and rehabilitate working areas that sustained damage.

Up to double productivity gains were achieved in a trial with the Boltec ABR in LKAB’s Malmberget mine when compared to LKAB’s conventional bolting fleet. Bray added that in poor-medium rock conditions, a standard Boltec could complete one round of drilling, installing three bolts in approximately 12 hours. In comparison, the Boltec ABR could complete it in 2-3 hours maximum.

LKAB has kept the prototype rig and Bray hinted that further orders may be in the pipeline later this year.

Boltec Auto Bolt Reload bolts in the carrier magazine. (Photo: Epiroc)

Scania Mining: The Future Looks Electric

At the IAA Transportation trade fair, held in Hanover, Germany, in September, Scania showcased a prototype for the Megawatt Charging System (MCS) station provided by the CharIN alliance. The MCS is designed to allow high-power charging with 1MW or more, which would make it possible to charge long-distance electric haul trucks within 45 minutes. A standard for the charging system has not yet been decided, but among the ambitions are a single conductive plug with a high factor of safety. The interface must be capable of being automated with the help of a standardized position on the vehicle and allow for bi-directional V2X communication (vehicle-to-grid etc.).

Scania said the availability of the Combined Charging System (CCS – today’s standard) and MCS charging solutions is crucial for European customers who want to start investing in BEV trucks on a bigger scale. The system has not yet been deployed. However, as it’s development is a joint venture involving some of the major e-mobility players globally (automakers, charging station manufacturers, component suppliers, energy providers, grid operators etc.), it could become a world standard for heavy vehicles, and thus of interest to mining companies who are looking to electrify their haulage fleets.

Daniel Henriksson and Christian Persson, both Regional Managers at Scania Mining, spoke to E&MJ about the shift towards electric and autonomous mine transport solutions.

“Up until 4-5 years ago, mining companies were searching for solutions to minimize fuel consumption, in order to minimize costs,” said Persson. “Today, all major mining companies are seeking electrified solutions with net-zero CO2 emissions. We also see a big demand for autonomous solutions. These two technologies are crucial for environmental and safety reasons.”

Several major mining companies have indicated that the future of mine haulage could lie with smaller vehicles, rather than traditional rigid body dump trucks. Swedish miner, LKAB is already using an electric Scania Heavy Tipper at its mine in Malmberget, alongside an electric crane truck specially adapted for mining operations. This collaboration has also given Scania a chance to test and operate its fully electric trucks in an underground mine environment. Boliden too took delivery of a 74-mt electrified truck for heavy transportation earlier this year. This investment forms part of the company’s aim to decrease its CO2-emissions by 40% by 2030.

Sleipner’s new DB series enables the speedy and safe relocation of tracked drills and bulldozers. (Photo: Sleipner)

“The average economic life of our trucks is around five years in mining, or 25-30,000 hours, without the need for a major overhaul, although the operator can opt for one if they wish to prolong the vehicle life.” Henriksson explained. “The life of a bigger machine is at least double of that of our trucks, and they require regular overhauls. However, new technology is being developed rapidly today. If mines choose to invest in large mining trucks, the scale of the investment (which includes an excavator too) means they could be stuck with a machine that is less technologically attractive for a long period of time. With our platform, mines are able to get the very latest generation of technology more frequently, including the battery packs, software, safety features and warranties.”

The team believes that, with a few design tweaks, ‘on-road style’ trucks can be very suitable for both open-pit and underground mining operations for several reasons. First, the size of the trucks means that they are easier and safer to work with. Second, they don’t require wide haul roads or ramps, leaving less terrain to be cleared and less road surface to be maintained. And third, technicians can easily exchange parts on the vehicles without having to use a gantry or a crane, and the skill sets required are more widely available.

“Our trucks also have a greater ratio between the empty weight and payload, meaning mines use less energy to haul the vehicle’s own weight,” said Persson. “The Scania Heavy Tipper takes at least double its own weight in payload. If we compare our 40-mt payload tipper with an equivalent articulated dump truck (ADT), our truck consumes roughly one third of the fuel of the ADT. So, for environmental reasons, there are solutions here and now that can make a huge difference.

“As the cost and energy density in new battery electric vehicles (BEVs) steadily improves it’s also easy to see how smaller vehicles could soon become financially more attractive than bigger vehicles.”

Aside from the MCS, the Scania team is also working on developing smaller and larger BEVs, and on implementing fatigue detection and prevention systems on its mining vehicles to increase safety further.

Jama Unveils the JMS 7000 Scaler

In June 2022, Swedish engineering firm, Jama, launched the JMS 7000 — a new medium-sized rock scaling machine.

“The size of the JMS 7000 is in high demand on the international market, and we have listened carefully to customers and operators during the development process,” said Eva Skinner, Head of Business Development at Jama.

Skinner explained that the machine was created with sustainability in mind. The drivetrain has been carefully thought out to allow the machine to run on battery power, a combination of electric and diesel power, or diesel power only. The modern diesel engine meets the latest EU Stage V emissions requirements.

“The JMS 7000 is particularly suitable for electric operation, thanks to its agility and the fact that it is usually driven short distances at a time,” said Rolf Schönfeldt, temporary CEO at Jama. “According to our calculations, the machine can manage at least 10,000 m of propulsion from a single charge, even if it is being driven up the ramp for a considerable proportion of the time.”

The battery-powered scaler is equipped with a 160-kW electric motor and is powered by a modular battery solution that is automatically charged for an output of 100 kW during scaling. Swedish battery specialist, Northvolt, is supplying the batteries which were developed in collaboration with Epiroc. This is the world’s first CE-certified battery to be adapted for the mining industry, and it also conforms to the Low Voltage Directive, the Electromagnetic Compatibility Directive (EMC) and the Radio Equipment Directive.

Jama and Epiroc have also created a service solution whereby Epiroc offers a battery subscription covering everything from certification to maintenance. The service also means that the batteries are replaced at regular intervals with newer versions and upgraded technology.

Additionally, Jama has placed considerable emphasis on the operator environment. The JMS 7000 cab has an integrated protective cage, heavy-duty protective grille for the windscreen and is ROPS and FOPS certified. The well-damped cab produces minimal low-frequency vibrations and offers good sound comfort, with documented low noise values. All ventilation air to the cab is filtered, and the machine is equipped with a heating system and A/C. The cab can be tilted backwards up to 15° to provide a better overview and comfort during scaling operations.

“The tiltable cab means that the operator can always maintain an optimum working position and visibility without straining their shoulders, back and neck. The comfortable working position reduces the risk of repetitive strain injuries and reduces operator fatigue,” explained Skinner.

The new JMS 7000 is equipped with Jama’s new mobile control system, which has been developed for harsh mining environments. It is IP rated, protected against temperatures and vibrations. The control system has smart functions and an intuitive user interface that makes things easier for the operator.

Series production of the JMS 7000 is now underway, and the model is also being adapted for the global market.

Sleipner’s DB Series Receives a Warm Welcome

Heavy machinery transport specialist, Sleipner, updated its entire DB product family last year and recently unveiled two new narrow models. The new DB80 and DB130 have a maximum payload of 80 mt and 130 mt respectively, and both are equipped with Sleipner’s patented loading ramps. The DB series enable the speedy and safe relocation of tracked drills and bulldozers, while adding flexibility to daily mine production planning.

Sleipner said the new product family received an exceptionally positive reception, and the first orders were delivered to operators in Finland and Africa at the end of 2021.

Teijo Höylä, Product Manager at Sleipner, expanded: “Our new models have been engineered in response to feedback from our customers. For example, we previously offered a 120-mt model, but customers requested a narrower version. Accordingly, our new DB130 model is less than 10 m wide and the smaller DB80 model is just over 8 m, despite offering slightly higher payloads. The new models are now suitable for use on narrower haul roads.”

Sleipner had already negotiated the delivery of previous-generation DB models to Africa before the outbreak of the pandemic. Following the resulting delivery delays, it was natural to upgrade the order to the new DB models already before their official launch.

Höylä added: “The new models also feature full remote control and telemetry. Data can be automatically collected from the machines, allowing us to respond rapidly and remotely to possible faults and even perform software updates.”

Another new feature is the patented loading ramp that follows the contours of the ground. The solution reduces service and maintenance costs compared to traditional models and minimizes stress on the loading ramp during loading.

Viewed from above, the modular load beds on the two new models are largely similar — the main differences are the payload capacity and width. The decisive factor in choosing between the two models is the type of dozers they will be used with. The DB80 model can transport dozers up to the D10T/D375 size class, and the DB130 up to D11T/D475.

An apron feeder powered by a new Hägglunds Fusion drive system. (Image: Bosch Rexroth)

LKAB Puts Raise Caving Method to the Test

From new technologies to a new mining method. In October 2021, E&MJ interviewed Dr Matthias Wimmer, Manager of Mining Technology at LKAB Kiruna mine, who is leading the company’s effort to development and prove a new mining method in collaboration with Montanuniversität Leoben (see ‘New Caving Method Sparks Raise Mining Revival,’ October 21). The project is now moving into the test phase, and E&MJ caught up with Dr. Wimmer in September to learn more.

The concept of raise caving was developed in response to increasingly difficult and complex ground conditions in the company’s deepening underground operations. LKAB uses sub-level caving (SLC) to exploit the orebody at its flagship Kiruna mine but, following increased seismic activity and a major seismic event in May 2020 which damaged underground production areas and some infrastructure, the LKAB team began to question whether SLC was the safest and most reliable method for future extensions at both Kiruna and Malmberget, and for potential new underground mines such as Svappavaara or the Per Geijer deposit.

LKAB has only once before tested a radical new mining method — slot caving was developed and tested in the Malmberget mine in the 1970s — however, it was unsuccessful due to poor test conditions. Failures such as this are not only a waste of time and resources but can also discourage further innovation efforts, so the team are approaching the raise caving proof-of-concept with due care. Planning and testing of each element is being done thoroughly and carefully to ensure the project has the best possible chance of success.

Wimmer explained: “Overall, intensive development work is underway with modelling, design and various types of analyses. Parts of the project have moved from planning to implementation, such as the test site for verification of the machine and the first machine prototype.”

He added that development of the machinery has been deliberately decoupled from the test site for the destressing element. “The construction of the test site for the machinery has just started and is being carried out at our Konsuln R&D mine, which is a satellite ore deposit, at shallow depth, in the southern part of the Kiruna mine,” Wimmer told E&MJ.

The Scania Heavy Tipper in action. (Photo: Scania)

“The principles of the mining method will be tested in a high stress environment, and we plan to accomplish this by using conventional drill and blast techniques. Two sites are currently being explored – one in Kiruna (block 8) and one in Malmberget mine (the Gunilla orebody). Geotechnical drilling campaigns are also underway, and these should deliver reliable input to model the pillar behavior.”

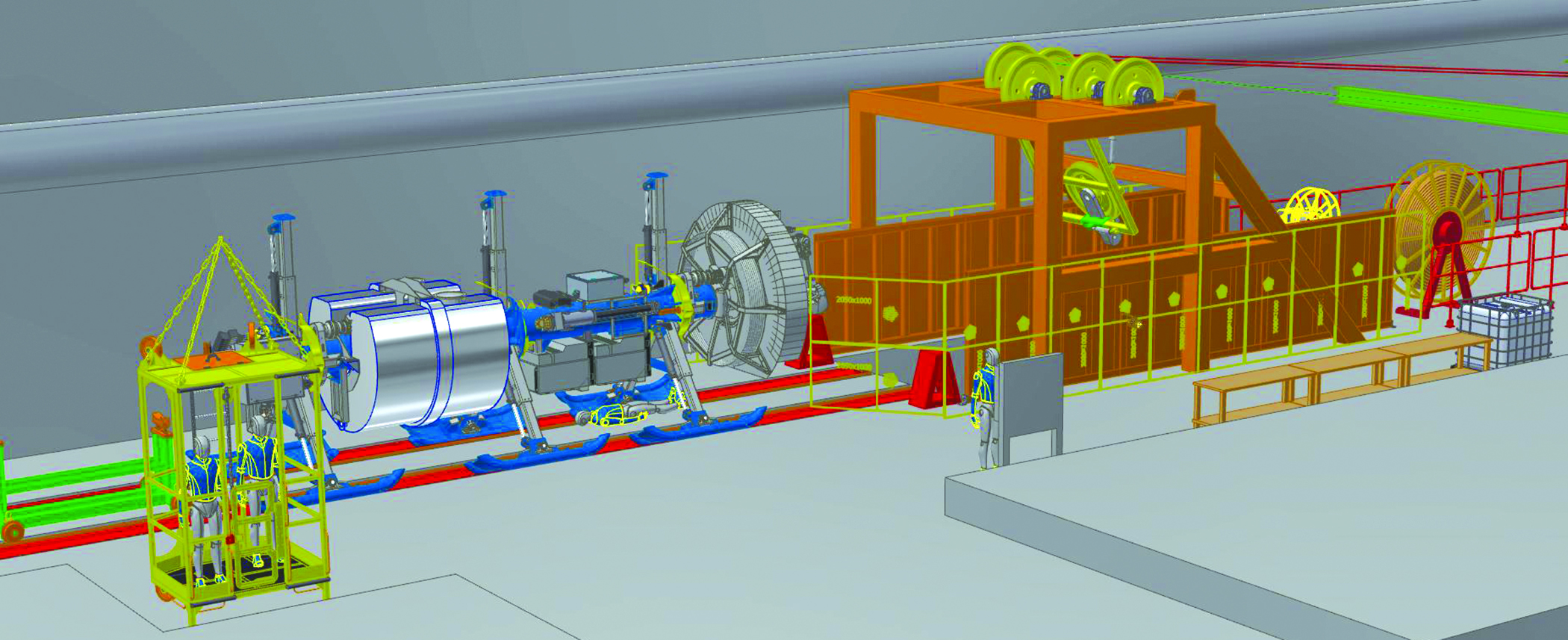

LKAB is working with industry partners to build and prove the necessary machinery. The concept, which will soon transition from design into construction, is based on a raise mining platform fitted with modules for various duties like drilling and charging and ground support.

“The design has been tweaked over the past few months following reference group feedback as well as simulations,” said Wimmer. “Production of the prototype is expected to begin shortly, and it’s scheduled to be ready for testing in Q2 2023. After basic feature testing of the ‘backbone’ is complete, then more features, such as the drill and charge unit, will be added. It’s important to highlight that the machine is dynamic — we can control it inside the shaft to compensate for the deformations that are expected in a shaft with high rock stresses.”

Senior Project Leader, Madelene Johansson, added: “This project is unique and complex in developing both a new mining method and a new machine concept. It requires many different skills in a complex environment.”

Wimmer stressed that the results from the raise caving test project can and should be compared to alternative mining approaches to ensure the optimal mining method is selected for each project. He also acknowledged that long-term development work requires perseverance, and people and organizations may change along the way which poses a further challenge.

“Our goal is to complete the project by the end of 2025,” he added. “By then, we should have verified that the method works based on its core principles. This will be an important input to our feasibility studies to develop future mines at greater depths. Obviously, the method and machinery will require further refinement also in the coming years.”

Diagram showing the set up for raise caving machinery tests at LKAB’s Konsuln R&D mine. (Image: LKAB)

New mining methods are few and far between and, given that many of the challenges LKAB faces in its deep cave mines are also encountered by other operators, there has been much interest from the global community. Wimmer said that LKAB has been approached by a couple of major mining houses with a proposal to further its development.

“There is high interest for bulk-raise mining as a competitive alternative to long hole open stoping,” he said. “We’ve started looking into this ourselves as well for the development of new projects on sensitive ground. Raise mining could be an enabling technique in that. Raise mining could be an enabling technique in that. We’ve recognized that this is of importance to other miners as well, as many have projects with similar requirements to protect the surface conditions.”

Bosch Rexroth Introduces Hägglunds Fusion Drives

In February 2022, Bosch Rexroth introduced the Hägglunds Fusion line of drive systems. These compact units means that an entire hydraulic direct drive system can now be mounted on the torque arm, making Hägglunds advantages even more attractive for a wide range of applications.

The company said that customers in mining, materials handling and other industries now have a plug-and-play answer to their drive system needs. The design puts everything on the torque arm, from the hydraulic motor and pumps to the cabinet that houses them. This makes high torque and total reliability available from a single unit in a very small footprint.

Wolfram Ulrich, Vice President of Sales for Hägglunds products and solutions explained: “Hägglunds Fusion brings everything together on the torque arm. Not only is there no gearbox or foundation, but there are also no alignments or even hydraulic pipes or hoses to consider.”

Fusion drive systems are well suited to lower power range applications, such as apron feeders, belt feeders, belt conveyors and infeed conveyors.

“These applications have much to gain from a Hägglunds hydraulic solution, due to their many starts, stops and reversals,” added Ulrich. “Choosing Hägglunds gives them maximum torque from zero speed and built-in protection from torque peaks, which ensures high productivity and low cost of ownership. Now we add easier installation to the mix.”