Explorers and developers come to grips with a new reality

By Steve Fiscor, Editor-in-Chief

Many of the delegates at this year’s Prospectors & Developers Association of Canada’s (PDAC) conference, which was held during March in Toronto, said they were trying to look past the current gloom toward future opportunities. That’s a euphemism expressed at many mining-related trade shows and conferences these days. PDAC has, however, diversified into many more areas than just mineral exploration and, despite current industry challenges, more than 22,000 people from more than 100 countries gathered at the annual event.

Despite current industry challenges, more than 22,000 people attended the annual PDAC conference in Toronto during March.

“The mineral exploration and mining industry has been facing an array of economic challenges the past several years but the sector continues to demonstrate its resiliency,” said outgoing PDAC President Rod Thomas, pointing to new money coming into the industry, favorable market trends, and a move to drive new and sustainable solutions to mining activities.

The PDAC 2016 Convention hosted its inaugural International Mines Ministers Summit (IMMS) that brought together 16 national mines ministers from around the world. Led by Canada Minister of Natural Resources the Hon. Jim Carr—who spoke at a series of PDAC functions—the IMMS provided an important setting for the international mining community to discuss and work on resolving issues affecting the industry. In addition, 25 federal parliamentarians, six provincial/territorial ministers and two premiers attended PDAC 2016. The PDAC also took time to recognize those who have served the industry at its Awards Gala.

“It is important that the PDAC builds strong working relationships not only with provincial and federal governments in Canada, but also with international governments to ensure the mineral industry continues to succeed and grow both in Canada and internationally,” said PDAC Executive Director Andrew Cheatle. “The PDAC Convention was an excellent opportunity to showcase the importance and scale of our industry to the new government of Canada, and we look forward to further building upon the constructive activities that occurred at the 2016 PDAC Convention.” For its part, the new government demonstrated an understanding of the symbiotic relationship between mining and prosperity in rural communities.

Toronto is to mining investment what PDAC is to mineral exploration and development: synonymous. Both of these areas are suffering. During the last four years, the level of capital destruction in the mining business has been immense. With all kinds of new capacity being brought online from the investments made during that period, spending for mineral exploration has dropped significantly. Looking toward the future, exploration teams will need to work smarter to prove up deposits that will make money throughout the commodity price cycle. At the same time, the methods for financing these projects will have to evolve as well. In addition to exploration investment, a few of the suppliers offered methods for exploration managers to hold costs to a minimum and work more efficiently.

The Current Situation

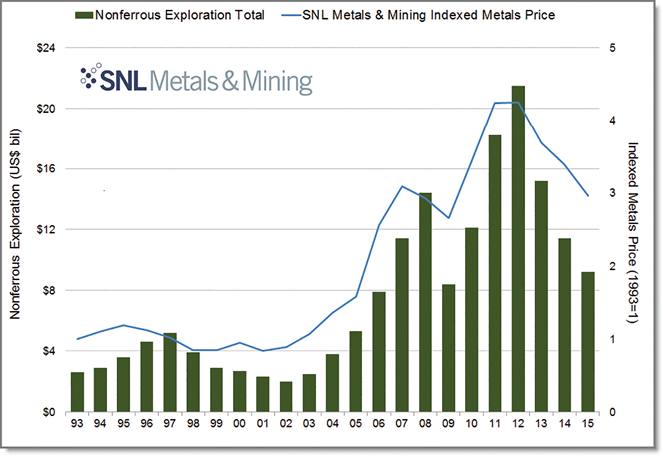

Mining companies continue to reduce exploration activities. In 2015, worldwide nonferrous metals exploration budgets declined 19%, compared with the previous year, according to SNL Metals & Mining’s 2016 World Exploration Trends. SNL released the study in advance of PDAC, confirming what most industry insiders already knew. The mining industry’s total budget for nonferrous metals exploration was $9.2 billion in 2015, according to SNL, less than half the record $21.5 billion budgeted in 2012.

SNL said the steep plunge in exploration budgets over the past few years reflects increasing investor wariness of the entire mining sector, which has made it difficult for most junior companies to raise funds, and for mining companies to justify intensive capital and exploration spending plans. Throughout 2015, negative price outlooks further forced producing companies’ hands, leading many to sell off assets, shutter operations and focus on companywide cost savings.

Marking a transformational year, 2012 began with most metals prices at or near recent highs, relatively strong investor interest in the mining sector and signs that the industry was enjoying a return to the boom times of 2007-2008. Exploration budgets increased 19% in 2012, setting a new all-time high of $20.53 billion. Beginning in April of that year, SNL explained, investors became increasingly wary of the junior sector, causing many companies to struggle to raise funds for their ongoing programs and forcing them to cut actual spending below their budgets for the year.

Throughout 2013 and 2014, markets were even less willing to support junior companies, and producers pulled back on capital and exploration spending to strengthen financial margins. As a result, the industry’s total exploration budget fell to $14.43 billion in 2013 and $10.74 billion in 2014, down almost 48% from the 2012 peak.

Unfortunately, 2015 did not see the start of the meaningful recovery that many had been hoping for, SNL said. Despite five interest-rate cuts since late 2014, and additional measures designed to stabilize domestic markets or stimulate growth, China’s economic slowdown has continued, dragging many resource-based economies down with it. Given the uncertain demand, virtually all metals prices were in full retreat throughout 2015, ensuring that the downturn in exploration continued. In 2015, companies lowered their budgets by another 18% to $8.77 billion, marking the first time aggregate budgets had fallen below $10 billion since the 2008-2009 global financial crisis.

Exploration allocations for all regions declined in 2015, with the greatest dollar reductions in Africa and Latin America. Nevertheless, the latter remained the most popular exploration destination, attracting 28% of global spending in 2015. Six countries—Chile, Peru, Mexico, Brazil, Colombia and Argentina—accounted for the lion’s share of the region’s total. Gold reclaimed its position as the top Latin American exploration target, with its share of overall budgets rising to 42% from 41% in 2014. The percentage allocated to base metals decreased to 40% from 42%.

SNL’s Rest of World regional grouping (Europe and most of Asia) had the second-largest aggregate budget, led by allocations for China and Russia, and by two other countries—Turkey and Kazakhstan—that each attracted more than $70 million in exploration budgets in 2015. For the fourth time in five years, China was in the top position with 32% of total allocations. Gold replaced base metals as the region’s top target, led by major allocations for China and Russia.

Africa remained in third place for a third year, attracting 14% of worldwide budgets; with the largest percentage decrease (30%) of all regions in 2015, the amount separating it from the Rest of World category, increased from $336 million in 2014 to $480 million. Major African exploration destinations included the Democratic Republic of Congo (DRC), South Africa, Burkina Faso, Zambia and Ghana. Allocations for gold were down 27%, raising the metal’s share of overall African budgets to 43% from 41%. Budgets for base metals fell 39%, led by lower allocations for DRC.

Canada remained in fourth place with about 14% of worldwide allocations. Ontario accounted for one-quarter of Canadian exploration budgets, followed by Quebec with 17%. Gold exploration was down by just $87 million, raising its share of total expenditure to a little more than 50% from 46%. Planned expenditures for base metals were down 26%, lowering their percentage of overall budgets to 17% from about 19%.

Australia was in fifth place, where it has been since 2004, with a 2015 budget of $1.07 billion and 12% of the total. Its allocations are down 15% (the third-largest decrease among the regions) from 2014, shrinking its distance behind Canada from $233 million to $117 million. Factor in iron ore budgets and Australia would be the top destinationby country.

Western Australia was again by far the most popular Australian state for exploration, with 60% of the country’s total. Gold remained the top exploration target, and with allocations actually rising by $400,000, its share of overall spending was up to 48% from 41% in 2014.

Gold and copper exploration in the U.S. kept the country in sixth place regionally, ahead of the Pacific Islands. The U.S. had the smallest percentage decrease (6%) of all regions in 2015, increasing the gap between it and the Pacific/Southeast Asia region to $288 million from $162 million in 2014. Nevada had the largest share (about 42%) of the country’s 2015 budget total, and three states—Nevada, Arizona and Alaska—together accounted for 67%. Gold remained the preferred exploration target; although allocations dropped just 9%, the metal’s share of overall. U.S. budgets fell slightly to 58% from 60% in 2014. Base metals allocations actually rose 5% year-on-year, increasing their share of the total to 31% from 28%.

The Exploration Aggregator Model provides a portfolio approach to greenfield exploration investment.

Future Exploration Strategies

The theme for the opening session was 2026—The Future of Exploration and Development. Jon Hronsky, principal, Western Mining Services (WMS), led the session with his presentation Exploration Strategies for the Next Decade and Beyond. Based in Perth and Denver, WMS claims to provide the best in geoscientific and risk management advice and services to mineral explorers globally. They are preparing the mining industry for the next round of growth and accompanying increase in demand for quality mineral exploration results.

With more than 30 years of experience in the global mineral exploration industry, primarily focused on project generation, technical innovation and exploration strategy development, Hronsky has worked across a diverse range of commodities and geographies, and has particular expertise in targeting for nickel sulfide and gold deposits. His targeting work led to the discovery of the West Musgrave nickel sulfide province in Western Australia. He is currently chairman of the board of the Center for Exploration Targeting in Western Australia, chairman of the Australian Geoscience Council and an adjunct professor at both the University of Western Australia and Macquarie University.

Hronsky led with what he called Exploration Strategy 101: Focus on world-class deposits; define new search spaces, aggressively collect your own primary data; and test targets and feed learnings into the next cycle. “Tier 1 deposits generate real wealth,” Hronsky said. “They can be developed and they return the cost of capital throughout the cycle. Explorers also have to look where others have not; it sounds like a basic concept, but you would be surprised at how many strategies do not take that into account. There is no point in evaluating diminishing opportunities with previous data.”

As far as testing targets and feeding lessons learned into the next cycle of testing, Hronsky said this has important implications as far as how exploration programs are structured. “Programs need to have some ‘thematic glue,’ something that links together all of the projects in the program,” he said. “Exploration portfolios need a strategic theme to drive learning.”

Explaining how the strategic landscape in the mining business is changing, he cited the failure of growth strategies driven by mergers and acquisitions (M&A) and the failure of junior exploration models funded by risk capital to sustain delivery of economic greenfield discoveries. He explained how commodity prices always revert to the mean and how explorers shouldn’t stray from that principle. He also noted a transition to under cover (or a deeper) search space. He cautioned explorers to be aware of the increasing challenges of the social license to operate (LTO) and emerging disruptive technologies for mining and exploration.

“Commodity prices always revert to mean,” Hronsky said. “We had stronger for longer, but it just wasn’t that long. Was it? The consequences of the reversion for explorers is that, for those companies that thought they had robust reserves, the inventories no longer look so robust. The imperative of new high-value greenfield discovery is important. It’s never about exploring for more ore, but exploring for better quality ore. That’s why we are in business.”

Citing the Citi report from June 2015, Hronsky reminded the audience that the world’s biggest miners have now written off about 90% of the value of the assets they have acquired via M&A since 2007. “90%!” Hronsky said. “This suggests the bulk of the deals done by big miners have been pretty much worthless for shareholders. A sea of dud deals. Billions in wasted capital. According to Citi’s numbers, miners have written down the value of assets by $85 billion in the past seven years, representing 18% of their asset base.”

Hronsky asked: What does this mean? And then answered: “Major mining companies will need to reprioritize greenfield exploration with a much sharper strategic focus than in the past few decades. They will need to pay much closer attention to the funding that is allocated to greenfield exploration programs. They need to realize that it is important.”

“A significant improvement in exploration performance will be required,” Hronsky said. “Luckily, there are massive opportunities for improvement—the successful groups will grasp these.”

Explorers now need to focus on high-margin metal throughout the entire cycle. “It’s always tempting to relax our economic criteria at the top of a cycle and invest capital on low-margin deposits,” Hronsky said. “The social LTO needs to be considered more strategically. Miners need to better understand the linkage. A low-margin deposit usually means a larger footprint, a larger pit and larger tailings dams, and greater social LTO challenges.”

For the typical 21st century exploration play, Hronsky believes the exploration segment will encounter a profound transition to deeper exploration strategies. “The implications are strategic not just project-level,” Hronsky said. “The petroleum business did this 100 years ago. There was a time when oil out-cropped on the surface and now they are drilling in deeper water and more challenging geology. That’s the reason we have never had peak oil, despite the predictions. We need to do the same.”

Accepting this new world of concealed deposits, a few more things start to become quite more important strategically than they were in the past. “Chipping off a sample and throwing it in the rock sack will no longer suffice,” Hronsky said. “First, we need mineral system-based predictive targeting, one where fertility overlaps with favorable whole-lithosphere architecture and favorable (transient) geodynamics. Organizations will need to have the capability of understanding this concept and the resources to apply these approaches.”

But, the best predictive models are useless without data to apply them to, Hronsky explained. “Data is the lifeblood of mineral exploration. In the 21st century, availability of pre-competitive geoscience data, which differs around the world with different jurisdictions, now becomes a strategic consideration in setting up an exploration strategy.”

The cover type also becomes more of a concern. “In the past, we arrived in an area and then we tried to work out what the cover might be,” Hronsky said. “The reality is that certain types of cover are relatively easy to explore. The ideal cover is a few meters of sand on top of a deeply weathered basement. Environments with barren cover hundreds of meters thick will be extremely difficult to explore. However, we have a model to follow. When the petroleum business went offshore, it didn’t start in 3,000 m of water overnight. It started at the shore and gradually worked its way out.”

Without offering answers, Hronsky posed several thought-provoking questions related to cover: Do we need to look for different deposits undercover? During the 20th century, the focus was largely on low-grade copper deposits. Are these viable under cover greater than 200 m? Those decisions influence geographies. What about the correlation between the target deposit type and likely cover environment? Do flat-lying deposits become more attractive targets?

Hronsky believes that technology and innovation could assist future exploration strategies, but the focus needs to shift from how to improve exploration activities to allowing exploration to take place in non-traditional spaces. “More efficient methods of sampling the same search space is not a dramatic change,” Hronsky said. “We can spend $30 million developing a Falcon gravity gradiometer, but it doesn’t change the search space.”

Innovation can be strategically important, but only if it changes the where and not just the how, according to Hronsky. Citing the CRC’s Deep Exploration Technologies, which has developed an innovative coiled tubing drill rig for greenfield exploration designed to drill to 500 m depth at $50/m and that weighs less than 10 metric tons for a minimum footprint, Hronsky said, “…this is technology that can change the where. The third version prototype is currently being built. It should be able to drill through deep cover for about a third of the cost of reverse circulation drilling. This allows prospecting at depth economically.”

Of course, none of this matters if these projects cannot be financed. Showing how metal price correlates with exploration expenditure indicates exploration finance is driven by sentiment, Hronsky explained that from an economic perspective, this is profoundly irrational. “No one ever questions it,” Hronsky said. “There is no correlation between today’s copper price and probability of a return on investment on an early stage exploration project. By the time that project is mining copper, 10 years down the road, there will be no correlation with today’s copper price. All of the risk associated with the investment is based on the quality of the project and the quality of the management team.”

What one would conclude is that the risk capital coming into the junior mining sector is not sophisticated. “Sophisticated risk capital is not participating in early stage exploration,” Hronsky said. “Why? It’s about trust…We have to build an interface of trust between early stage exploration and sophisticated, strategically focused risk capital. They have to trust that the capital will be allocated effectively.

Hronsky credits Mike Etheridge for the Exploration Aggregator Model (EAM), which was developed in the late 1990s, and then forgotten because there was a mining boom. The EAM provides a portfolio approach to greenfield exploration investment. “It provides trust,” Hronsky said. “It could be in the form of a direct agent. It could be a major mining company that bring its experience to the table, acting as interface of trust. Or it could represent a new niche for a specialized third party organization. These would be ways to reform exploration finance.”

Offering key actions for the future, Hronsky advised exploration managers to act like it is true. “Base the exploration strategy on the current reality; because of the lag, if you are operating in today’s world you are four to five years ahead of the competition,” Hronsky said. “Ensure your technical capability is fit for purpose to make the next generation of discoveries, not the last. Ensure your portfolio has a strong strategic theme; monitor possible disruptive technologies; and look for innovative methods of exploration finance.

PDAC Achievement Awards

During the conference, the PDAC honored individuals and companies at its Awards Gala. The Bruce Channel Discovery Team received the Bill Dennis Award. Robert Cudney, Stephen Roman and John Whitton accepted the award for their Bruce Channel gold discovery in the heart of the well-explored Red Lake gold camp in northwestern Ontario. It was discovered by Exall Resources Ltd., which later became Gold Eagle Mines Ltd. after merging with Southern Star Resources Inc. In May 2007, an internal estimate of the deposit size was 14.1 to 16.5 million metric tons (mt) of mineralized rock at a grade of roughly 20-25 g/mt gold for a total of between 9 million and 13.3 million ounces of gold.

This discovery was given the Discovery of the Year Award by the Ontario Northwestern Prospectors Association in 2008, the same year that Gold Eagle Mines was taken over by Goldcorp Inc. for $1.5 billion.

Pat Sheahan received the Distinguished Service Award. In 1972, she founded an information service for exploration companies focused on diamonds, base and precious metals and started her own consulting firm that provided a flow of information about the diamond boom in Canada, which ultimately paved the way for junior mining companies to enter the industry. By 1993, she had organized the PDAC Convention’s first short course on diamonds that attracted more than 400 people. Sheahan has been a director of seven junior companies. She has served as chairman on various committees, written five books, and contributed peer reviewed papers and articles.

Lucara Diamond Corp. received the Environmental and Social Responsibility Award for its stakeholder initiatives, community engagement, and focus on sustainable practices and long-term benefits at their Karowe mine in Botswana.

Darrell Beaulieu received the Skookum Jim Award for his innovation, hard work and dedication to the minerals industry in his community. He is a leader and highly respected member of his community who served three terms as chief of the Yellowknives Dene First Nation. His work in the mineral industry began early in exploration, staking mineral claims and working on a number of exploration projects in the Northwest Territories (NWT). In 2005, he assumed the role of president and CEO of Denendeh Investments, a Dene corporation established to create long-term economic self-sufficiency for the Dene through profitable business ventures.

The PDAC recognized the Bjorkman Family with its Special Achievement Award for their multigenerational dedication to geology, prospecting and diversity. Bjorkman Prospecting is a long-standing Ontario-based prospecting company that has worked in locations all across Canada as well as internationally. Encouraged by his father, Karl Bjorkman started prospecting around 1990 and saw his business grow to include claim staking, exploration project management and technical support. His five daughters, Jessica, Katarina, Ruth, Veronique and Karla, along with one son named Bjorn, inherited his passion for finding gold, making it the third generation to work

in the industry. Wife and mother Nikki keeps the books.

Bjorkman Family

In their time, the Bjorkmans have covered significant ground. They have staked approximately 700,000 hectares, or 1.8 million acres of land. That’s approximately 16,000 to 19,000 km and 40,000 to 50,000 claim posts. The Bjorkmans have an extensive archive of prospecting information, and in partnership with other Thunder Bay area entrepreneurs, they stake ground in anticipation of finding a senior partner to fund further and more extensive exploration.

The Bjorkman girls are credited for encouraging other women into a predominantly male dominated industry. Female prospectors are rare, let alone five sisters who feel at home in this industry.

The PDAC presented the Thayer Lindsley Award to the Cukaru Peki Discovery Team. Cukaru Peki is exceptional because it was a blind discovery in an established mining camp—it is large, of high-grade and could result in the establishment of a new geological model, providing targets for future explorers to seek.

Silver Wheaton was honored with the Viola R. MacMillan Award for developing new and innovative business strategies that are a leading example for other companies and junior miners to follow. Because their business model acquires metal in advance of production, using funds often designated to finance capital projects like mine construction, the market looked at the business mechanism employed by Silver Wheaton as a new type of project or corporate financing instrument. Since 2004, Silver Wheaton has built a strong brand and set an example of how to make their business strategy one of the preferred methods for the junior sector to finance a mine. The company is now positioned as the largest precious metal streaming company in the world.

|

|

|

|

|

| Robert Cudney | Stephen Roman | John Whitton | Pat Sheahan | Darrell Beaulieu |

Hatch Responds to a Rapidly Changing World

Hatch CEO John Bianchini, at a reception during PDAC 2016, outlined the company’s vision and strategy to a large gathering of industry leaders. He described a new era of positive change at Hatch. “In a world of perpetual change, we see emerging challenges for our clients that need action today,” Bianchini said. “Working as partners, we will develop new ideas that challenge the status quo and deliver technologies and innovations to create a better world.

“This is a defining moment in our history,” Bianchini said. “For 60 years, we’ve delivered engineering expertise and advanced technical capabilities to our clients to grow their businesses. We recognize they need even more from us today—better ideas and even better service.

“We’ll harness the knowledge of our global teams and emerging technologies to improve productivity and efficiency and deliver more sustainable outcomes.”

Hatch also unveiled its new visual identity, which is being supported by a new company video and digital campaign. Building on the theme of positive change, the campaign invites clients,

employees, and the public to tell Hatch what positive change means to them (#PositiveChange).

Drillhole Modeling

Maptek showcased solutions for modeling exploration data and mining scenarios that can be tested for different market conditions. “The crucial advantage of modeling is that you can explore ‘what-if’ options,” said Maptek North American solutions specialist Ian Lipchak. “If the model shows the deposit isn’t viable to mine, you haven’t lost anything. And maybe you have learned something.

“If you make a mistake in the real world, it quickly gets expensive,” Lipchak said. “Better to get it correct at the start, from drilling in the right place to taking account of operational safety. The new tools in Vulcan 10 allow geologists to do more analysis on their data earlier on in the process.”

The Vulcan Data Analyzer in Vulcan 10 presents a streamlined workflow. Users can easily set up and apply filters and transformations to data. A fan variogram compass allows easy testing of multiple directions for correlation of samples. Multiple models are displayed concurrently for conducting real-time, side-by-side comparisons. Processing is fast and changes to parameters are interactively displayed on relevant charts in real-time. High quality charts are easily output for incorporating into resource reports.

These modelling techniques are supported by advanced visualization platforms for communicating concepts and alternatives. With Vulcan 10, users will be able to work with regular block models containing billions of blocks. Faster viewing of areas of interest is achieved by only using necessary processing power to zoom in at greater resolution. “There’s no need to compromise on resolution or data quality due to the size of the geological model. Users can cut models into slices and toggle through sections on screen and the display is modified seamlessly,” Lipchak said.

Maptek also showcased early stage exploration tools in Eureka, which puts spatially located data into context for understanding the relationships between disparate information.

“Displaying aerial photography, terrain maps, historical plans and GIS data at different scales allows you to see the big picture as well as analyze local areas of interest,” Lipchak said. “When geophysical data such as seismic, gravity and magnetic surveys are viewed in the same space as exploration drilling data, intuitive correlations can be

confirmed.”

Optimization techniques are popular because they provide clear evidence to demonstrate the economic potential to management and investors.

“Showing a scheduling and NPV optimization tool at an investment event may seem unusual but when capital is difficult to come by people look for ways to add value to their deposit,” Lipchak said. “There is no reason why you can’t run an early-stage geological model through an optimization process to evaluate value.”

SNL’s estimate of annual nonferrous exploration allocations since the early 1990s, relative to a weighted annual metals price index.

Recognizing the Root of Rod Failure

Questions and claims frequently arise around rod failures. Drillers often believe it’s a flaw in steel. Drill string original equipment manufacturers (OEMs) understand, but they have proven the flaws are induced during the drilling process rather than the manufacturing process. By knowing what to look for and properly managing the drill rod as equipment instead of consumables, drillers could reduce downtime related to rod failures.

When it comes to exploration drilling, Boart Longyear has a lot of steel turning in both the mining and the oil and gas businesses. It often gets claims for rod fractures that appear to be a manufacturing defect but actually are not.

“With the advent of automated rod handlers, many of them grip the rods quite hard and leave indentations,” said Chris Lambert, senior product manager-coring consumables for Boart Longyear. “That is a stress concentration that could lead to a fatigue failure. Depending on how hard the rod handlers grip the rod, an indentation of more than 1/32-in. will likely lead to fatigue failure.” If it’s a deviated hole, where the rod is experiencing even more stress, the pace of the fatigue failure will accelerate, he explained.

Boart Longyear employs a more proactive approach of working with drillers on certain operational issues in order to prevent failures in the first place. “Damage from handling process, the chuck, rod handlers, foot clamps, etc., can influence the life of the rod,” Lambert said. He advises drillers to examine the rods carefully. If they see a lot of surface defects, they should discard the rod to avoid a failure in the hole. The productivity loss is a lot more expensive than retiring the rod, he explained.

Working with the mines and drill manufacturers, Boart

Longyear has reached out to correct problems when it has identified a consistent set of failures, especially when they can be tied to a certain drill model. “We have worked with drillers and the OEMs to make adjustments, such as reducing the hydraulic pressure to a point where it can still handle the rods safely

without making the indentations on the rod,” Lambert said. “There was a tendency among drill OEMs to really grip the rods

so they don’t slip, without thinking about the fact that they might be introducing a failure into the rod. They were not rod manufacturers, and they didn’t understand the defects they were introducing into the steel.”

Redrilling a hole is expensive, especially if a contractor loses a week of production. Winning and retaining projects is a very competitive process for drilling contractors, and any productivity loss is painful in this market, Lambert explained. “In an upturn it can be hard to secure a rig, but during times like these, mining and exploration companies can be much more selective and, if one contractor has a problem, they can look elsewhere.” he said.

Failures can also occur from improper operational use. Coring rod is relatively thin walled, Lambert explained, and its strength relies on the proper makeup of the joint. “To handle drilling stresses, the joint should be fully made up and under tension for all conditions,” he said. “Deeper holes need more makeup torque. If it’s insufficient, the joint will separate and the load is only carried on half of the wall thickness.”

The pin and the box must overlap to get full strength. “If the joint sees enough tension and separation, then the failure will crack through the pin,” Lambert said. “And that is another common failure that we see. Drillers should use the minimum makeup torque, and remember that hand tools are insufficient. As they go deeper, they should torque up more because the rods at the top of the hole are going to see more of the load.”

Failures can also be associated with deviation in the hole and normal wear. Deviation in the hole creates contact with the sidewall. Normally the loss of circulation or a lot of contact will generate heat on the rod, Lambert explained. “The polishing effect, combined with the heat, will change the metallurgical structure of the rod,” he said. “In a way, the action is heat-treating the steel. Because of the rapid heating and cooling cycles as it turns, the rod actually suffers from heat check cracking.”

What can operators do? Lambert advises making up the joints, ensuring proper makeup torque, keeping the rod sets together and removing damaged rods from service. “When a driller purchases a new string, they should keep those strings together, including the sub,” he said. “If you look at how threads wear, it’s all about galling. If an old rod is used with a new rod, the new threads will wear much more rapidly because of the deformation on the old rod threads.”

He thinks miners and drilling companies tend to place too much importance on the purchase price of rods. “We recommend that drillers buy the strongest rod possible,” he said. “Looking at the cost of lost productivity while drillers try to fish a string from the hole, the price of the rod becomes less significant. We encourage drillers to treat the rods just like the drills—an asset that has to be maintained to prevent problems.

“Many of these problems are preventable, but they have to know about these operational issues to prevent them. Replacing rods in these types of situations is a band-aid solution because we are not really fixing the root cause. Lost productivity cannot be offset by replacing a rod. We prefer to focus on proactively improving productivity by preventing problems in the hole.”

He cited that as the reason many drillers are using Boart Longyear’s RQ rods. “The RQ rods have the highest pin-case hardening, which makes the threads last longer,” he said. “Because of the thread design, the joints are inherently stronger. It may be a little more expensive because it’s that much stronger. Some view it as a deep-hole rod. Even in short holes that encounter a shear zone, if the driller can exert double the force they stand a much better chance of unsticking those rods.”