Innovation is breathing new life into diamond mining. E&MJ investigates and interviews four mining companies, big and small.

By Carly Leonida, European Editor

In a part of the mining industry that has remained steadfastly traditional — institutional even — for the past 150 years, there is big change afoot.

It may not be immediately apparent, but the in-creep of digital technology from new exploration techniques and sorting equipment, to digital selling platforms and blockchain for traceability, is slowly making over diamond supply from the ground up, disrupting age-old ways of doing business and occasionally ruffling a few feathers.

Many of these innovative tools and strategies are being introduced by midtier and junior miners; companies that are relatively agile and keen to differentiate themselves in a market consistently dominated by two or three big players.

That’s not to say that the behemoths of this sector are standing still though. In a market where a single stone can fetch millions of dollars depending on its size and quality, the stakes are high, and many of the largest companies have internal divisions and R&D programs dedicated to advancing their operations technologically.

Aside from the discovery of new deposits to bolster dwindling reserves, preservation of value is the biggest innovation driver, and this is pushing every miner regardless of size or status to rethink their extraction and sorting processes.

Lucara: Different by Design

Where better to start this exploration of the new than with Lucara Diamond Corp?

Lucara owns 100% of the Karowe diamond mine in Botswana, which has been in production since 2012 yielding three of 10 largest rough diamonds ever recovered: the 1,758-carat Sewelô, the 1,109-carat Lesedi La Rona and the 813-carat Constellation, which sold for a record US$63.1 million.

Lucara was one of the first mining companies to successfully use X-ray transmission (XRT) sorting technology in its operations and recently launched Clara Diamond Solutions, an online matchmaking tool and marketplace for buyers that allows them to bypass traditional selling routes and purchase only the stones they want directly from the miner.

E&MJ caught up with President and CEO Eira Thomas in early June to talk through some of these initiatives. But first, a history lesson…

“Back in the early 90s, diamonds were completely unknown in Canada,” she said. “Then there were discoveries from companies like BHP that ultimately led to a huge amount of investment and the creation of mines like Ekati, Diavik, Gahcho Kué, Snap Lake… and that completely changed the landscape. For the first time, Canada was an important diamond supplier.

“Since that time, we’ve seen evolution through the Kimberley Process, new production coming out of Africa, and the emergence of synthetic diamonds in the jewelry trade. There has been quite a lot of change.

“But, fundamentally, over the last 25 years, since the discoveries in Canada, we’ve not really had any world-class discoveries globally. Diamond deposits are rare. They’re getting rarer. Our long-term outlook remains positive for diamond prices, because supply is definitely going to be impacted by aging assets and the fact that we’ve got no new production on the horizon, just yet.”

Lucara was founded 13 years ago to focus on diamond exploration in Africa.

“Catherine Mcleod-Seltzer and I cofounded Stornoway Diamonds in 2001, and that company went on to develop Quebec’s first diamond mine,” Thomas said. “Throughout the evolution of that project and our work in Canada with Stornoway, we had pondered going to Africa, but our shareholders didn’t like the idea of putting African and Canadian assets together.

“So, Catherine and I got together and convinced Lukas Lundin, who was a friend, to form a company with us. That’s where the name came from — the combination of Lukas, Catherine and Eira became Lucara. We set about acquiring assets back in 2008-2009, and ultimately secured the AK6 deposit in Botswana, which was pretty transformative for the company.”

Karowe Heads Underground

Karowe is an unusual deposit, in that it has a preponderance of very large, high-value diamonds in its production profile; more than 70% of Lucara’s revenue comes from stones in excess of 10.8 carats in size.

“Prior to the Sewelô being recovered, the Lesedi La Rona was the second largest diamond in history, next to the Cullinan,” Thomas said. “We also recovered the Constellation within days of recovering the Lesedi and we now believe they were potentially part of one very large stone, which, if it was put back together, would come pretty close to the weight of the Cullinan.”

The Cullinan — the largest rough diamond ever recovered — weighed in at 3,106 carats. It was discovered in South Africa in 1905 and its magnificence has never been surpassed. However, Thomas believes Karowe has the potential to produce a 5,000-carat stone.

“Karowe is the only mine that has ever produced two diamonds in excess of 1,000 carats,” she said. “That is a distinguishing feature of this deposit. Type-two diamonds originate from deep in the lithosphere-mantle boundary, as deep as 800 km.

“Within this deposit, there is a geological unit that we refer to as ENPKS, and that has been the source of all our highest value diamonds thus far. That unit only accounts for a small volume of production in the current open pit but, as we mine deeper, it dominates production. In fact, at 800 m down, 80% of the pipe volume is ENPKS.

“That’s a very important value driver for us because ENPKS has a coarser size frequency distribution, and the grade is also higher. ENPKS is 55% richer than what we’re currently mining in the south lobe, so that’s one of the reasons we’re keen to expand the mine underground. The goal is to drive a shaft to the base of the deposit and mine it from the bottom up, because that’s where the richest store is.”

Lucara completed a feasibility study for the Karowe underground mine in late 2018 and approved a US$53 million expenditure this year funded out of cash flow.

“COVID-19 has obviously thrown a wrench into our plans,” Thomas told E&MJ. “But we’ve rescoped the underground to be more conservative for 2020, and the goal is to secure additional financing before the end of the year.

“Right now, we’re focused on early procurement. Our aim is to start sinking a shaft in 2021 and be delivering ore from the underground by 2026. We’re currently in discussions with banks, but the good thing is we started off the year strong with a healthy balance sheet and no debt.”

Using XRT to Get Ahead

Karowe was the first diamond mine to incorporate XRT as its primary recovery method.

“XRT works with non-fluorescing diamonds, which is important because very few type twos fluoresce,” Thomas explained. “It’s also a bulk sorting technology, so it allows us to put our ore through an initial coarse crush, and then it immediately goes to what we call our ‘Mega-Diamond Recovery Circuit,’ which features an XRT unit. The idea is that if we have large, high-value diamonds, they will be liberated in that first coarse crush and recovered before the feed is subjected to successive stages of crushing, concentration and XRT sorting.”

The main purpose of the Mega-Diamond Recovery Circuit is to prevent very large, potentially high-value stones, from being broken.

“It’s critical because we know we broke the Lesedi,” Thomas said. “You think about the value of that stone. At 1,109 carats, we sold it for $53 million. If we hadn’t have broken it, it could have been an order of magnitude more valuable. That’s why we put in the Mega-Diamond Recovery Circuit. We can now recover diamonds up to, potentially, 5,000 carats in size. Because we believe that Karowe has the potential to yield diamonds that large.

“XRT is very important for us and it has become our main recovery method. The rock at Karowe is high yielding and also extremely hard, unusually hard for kimberlite, and that became quite problematic for us. In the fine diamond recovery circuit, we found that there was a bottleneck with our DMS [dense medium separation] and introducing XRT in the middling circuit has helped us to deal with that issue. It means we can continue with the same production throughput as we had when we were dealing with weathered ore near the surface.”

Typically, XRT is set up to look for a specific element — in Karowe’s case it’s carbon — as opposed to traditional diamond recovery technologies that focus on the properties of diamonds, like fluorescence, density or hydrophobicity, to recover them. Those processes are not nearly as efficient as carbon detection and that is why, since Lucara’s success at Karowe, other miners, particularly those with a high percentage of type-two diamonds in their deposits, have opted to introduce XRT in their own operations.

Expanding Exploration

“We are continuously looking at ways to make our overall recovery more efficient,” said Thomas. “Diamond damage is something we’re extremely focused on because it’s a big value loss for us, and for every diamond mine. We’re currently tagging diamonds using tracers or RFID technology to look at different parts of our mill and where improvements can be made.

“We’re also looking at technologies to liberate embedded diamonds, and we’ve recently partnered with a Botswanan company called Sunbird to help advance our exploration efforts.

“Sunbird uses a UAV to fly very high-quality, airborne magnetic surveys for very low cost. The difference between Sunbird’s technology, and what you’d see in a traditional magnetic survey, is that the platform itself is completely silent so the equipment doesn’t interfere with the magnetic signal collection. It allows us to run surveys around the clock with multiple orientations. We collect the data and then we’ve got a portable drilling rig in the field that follows along, identifies targets and drills holes. We’re covering vast amounts of ground and reducing the time to evaluate a prospective piece of ground, using this technology.”

The low cost is particularly important because, as Thomas pointed out, there is very little investment going on in diamond exploration at present globally.

“It’s a tough market at the moment and it’s very hard to attract capital to the space,” she said. “There have been a couple of announcements recently from a group out of Australia that is investing in two exploration projects and that’s the first public money we’ve seen going into this space in quite a long time, other than very small projects in Australia and Canada.

“What we need to see is stabilization in diamond prices of the existing publicly traded producers. And that, in turn, will help generate more interest and hopefully attract more capital into exploration again.”

Clara Disrupts Diamond Trade

In keeping with its approach to innovation, Lucara also set about creating its own selling platform, ultimately acquiring and commercializing Clara Diamond Solutions in 2018.

Thomas explained why. “We’ve had one full year of sales through Clara. It was established in recognition that the current supply chain is antiquated and inefficient,” she said. “We now have technology to completely disrupt the status quo and unlock significant value for all participants.”

To understand Clara requires an understanding of how the current sales paradigm works. Many mining companies sell their run-of-the-mill diamonds in the same way; by building up an inventory of diamonds that are, by nature, heterogenous, until they have enough product to divide up into broad classifications based on size, color and quality.

These assortments, or buckets of diamonds, are then sold as homogenous parcels. Customers buy an assortment, which they then sort through, and the stones they don’t want are sold on with some being re-traded up to 10 times before they reach a polishing wheel.

Of course, this does not apply to all companies or all stones. Some groups offer arrangements such as buybacks and bespoking options. And exceptional diamonds, which are of higher value, are frequently sold as individual items.

“With Clara, we use scanning technology, which has been around for almost a decade — we partnered with a company called Sarine Technologies, out of Israel, to develop it,” said Thomas. “At the mine site, we recover and clean our rough diamonds, then scan them to see what can be made using them. This creates a 3D tomographic image that we upload to a secure web-based server in the cloud.

“Then, we ask our customers what it is that they want to make. They give us, essentially, a blueprint of the polished diamond that they want including the size, cut and color, facet angles… We upload that order to the platform and then Clara uses a matching algorithm to sort through our inventory and find the best stone to manufacture into that polished product.”

This approach benefits everyone: manufacturers no longer have to carry unwanted inventory, or re-trade in secondary markets. The buyer can specify how much they wanted to pay when they upload the blueprint, and Clara also provides assurance on provenance using blockchain technology.

Once the platform matures, buyers will be able to filter diamonds from around the world and, even state which mine they want their stone to originate from.

A number of producers have started trading online in recent years. This has made the buying process more convenient, provenance easier to determine and has certainly helped with regard to recent travel restrictions, but many still sell the product in bulk.

Lucara has patented Clara’s technology worldwide and the company has an exclusive arrangement with Sarine that restricts it from engaging with any other sales platforms of this nature, it is unlikely there will be similar platforms springing up in the future.

Thomas explained: “The goal is to open Clara up and have other producers sell their diamonds through the platform. Trials were set to begin in March, but those were delayed. Our aim now is to have third-party sales on the platform before the end of year. We’re hoping that the market will open up sufficiently to allow that. I think it’s a very clear business case in a post-COVID world. Our customer base has increased by 20% through the crisis.”

Currently, only traders can make purchases through Clara, but Thomas would eventually like to open it up to everyone.

“Ultimately, that’s where we’re going,” she said. “That will probably be version 7.0. But we envisage a day where you, as a customer, can log on to Clara and bid for a diamond from to create a bespoke piece of jewelry. The platform will also be able to help you select a manufacturer to polish the stone and a designer to set it according to your design ideas.”

The 1,758-carat Sewelô: the second largest rough diamond ever recovered. (Photo: Louis Vuitton/Lucara Diamonds)

Letšeng Leads on Technology

Another small company that is making big strides using technology is Gem Diamonds.

In 2006, Gem acquired a 70% share in the Letšeng mine in Lesotho, with the Government of the Kingdom of Lesotho owning the remaining 30%. Letšeng is famous for the production of large, exceptional white diamonds. It is the highest dollar per carat kimberlite mine in the world and has grown to be one of the largest open-pit diamond operations globally.

Since 2006, Letšeng has produced more than 60 white diamonds larger than 100 carats in size, including the 910-carat Lesotho Legend, the 603-carat Lesotho Promise, and the 550-carat Letšeng Star, as well as multiple high-quality pink and blue diamonds. An exceptional 13.32-carat pink diamond achieved a Letšeng record price of US$656,934 per carat in 2019.

Brandon de Bruin, operations and business transformation executive at Gem Diamonds, spoke to E&MJ about the company’s approach to R&D.

“We regard technology and innovation as a critical means of improving operational performance and unlocking value,” he said. “Letšeng unearths some of the highest quality and largest diamonds anywhere on the planet, and the potential for and impact of diamond damage during crushing and extraction often adversely affects the prices received for these diamonds.

“In 2019, we commissioned a pilot plant to further test new technology that, if successful, could significantly reduce diamond damage, improve yield and reduce operating costs. Letšeng has a unique diamond distribution within its orebody and a significant portion of its revenue is held in large, high-value, type-two diamonds, which can be more susceptible to damage in mining and treatment. Therefore, reducing diamond damage is a key focus of Gem Diamonds’ strategy.”

Following a successful proof-of-concept in factory and laboratory conditions, the group’s wholly owned subsidiary, Gem Diamonds Innovation Solutions, constructed a pilot plant at Letšeng to test the recovery system under challenging operating conditions. The pilot plant uses scanning technology in conjunction with proprietary imaging and sorting algorithms to detect diamonds within kimberlite. Once a diamond has been identified, the next step is to liberate it without causing damage. A non-mechanical liberation unit was developed in-house, and this utilizes high-voltage pulse power for the selective non-mechanical fragmentation of composite materials to liberate the encapsulated diamonds.

“The pilot project is progressing well,” de Bruin said. “The plant was completed and commissioned during 2019. Ramp-up and ongoing testing of the efficiency of the technology continues. Once proven, the next step will be to viably scale up the project for full production capacity.”

Like Lucara, Gem Diamonds is also in the process of incorporating blockchain technology into its business to create greater transparency in the supply chain and to bring retail customers closer to the source of their diamonds.

“While the short-term outlook for the diamond market is unclear as we navigate through the global impact of COVID-19, we believe that in the medium to long-term, demand for the unique high-value diamonds produced at Letšeng will remain firm,” said de Bruin. “The mine is a well-established operation. It has a strong relationship with the local communities and we’re looking confidently to the future now that an agreement has been reached with the Government of Lesotho on the lease extension to 2039.”

De Beers: Technology Titan

At the opposite end of the enterprise spectrum sits De Beers, the world’s largest diamond mining company. Established in 1888, the group has operations that cover the full value chain from exploration and production to rough diamond sales and diamond jewelry retail.

“Whilst we are involved in almost every part of the pipeline, the majority of our workforce remains involved with our upstream operations,” explained David Petrie, trade communications manager. “With our partners, we mine for rough diamonds in Botswana, Canada, South Africa and Namibia. In Botswana, we mine via our 50/50 joint venture with the Government of the Republic of Botswana under the name Debswana. In Namibia, we work in a 50/50 joint venture with the Namibian Government called Namdeb Holdings — recovering rough diamonds offshore through Debmarine Namibia and on land through Namdeb.”

Technology plays a key role in all aspects of De Beers’ business and the group has dedicated facilities for innovation and technology development. Exploration has been a particular focus in recent years. The group is prioritizing greenfield areas in Canada, Botswana and South Africa, and interested parties can read more about the group’s application of full tensor magnetic super conductive quantum interference devices (SQUIDs) in E&MJ’s February 2020 Exploration Game Changers feature.

The group is also working on developing new rough diamond sorting technology, synthetic diamond detection instruments, and technology for its offshore diamond recovery vessels used in Namibia.

Petrie said: “Technology will play an increasingly important role in mines of the future as they become more remote, more challenging to run and more costly. A good example is the Chidliak property we have on Canada’s Baffin Island. This deposit would be extremely challenging to develop and run using conventional approaches. We are therefore looking at a range of technologies that will enable us to run it in a different way so that it is economically sustainable, safer and has a lower environmental footprint. With the remaining diamond deposits around the world being in such challenging locations, it’s likely that we will see these kinds of technologies play a greater role in the sector’s future.”

Potential solutions could include carbon capture and storage, renewable energy technologies and alternative fuel sources like hydrogen fuel cells for truck fleets, to mitigate, not just reduce carbon emissions.

Advances in ESG

De Beers has also been rolling out technology to support its ESG efforts.

In 2018, the group launched GemFair, a pilot project that creates a secure and transparent route to market for ethically sourced artisanal and small-scale mined (ASM) diamonds. Artisanal miners at participating sites can use a digital toolkit to register the location in which their diamonds were discovered, providing a record of assurance regarding the responsible sourcing of the diamond. The group also uses apps on tablets to offer training on diamond valuation to ASM workers.

For the pilot run in Sierra Leone, GemFair is partnering with the Diamond Development Initiative (DDI) to ensure that participating mine sites abide by a set of audited ethical standards known as the Maendeleo Diamond Standards (MDS), as well as additional standards specific to the GemFair business model.

Gem Diamonds is piloting scanning technology in conjunction with proprietary imaging and sorting algorithms to detect diamonds within kimberlite. (Photo: Gem Diamonds)

The aim is to support the ASM sector’s drive for formalization and contribute to its development.

Another exciting project involves the development of carbon capture technology that uses mine waste to absorb C02 from the atmosphere. Known as project “CarbonVault,” the technology uses kimberlite to naturally capture large amounts of carbon dioxide from the atmosphere through a process called mineral carbonation.

“Through CarbonVault, we are working in partnership with a team of leading experts from universities around the world to explore how this natural process can be accelerated, to soak up more carbon from the atmosphere, locking it away for millions of years,” Petrie said. “This is the first time such extensive research has been undertaken to assess the carbonation potential of kimberlite and the project has the potential to transform parts of the mining sector as a whole in terms of carbon emissions.”

Traceability and Trading Post-COVID

De Beers pioneered the use of blockchain technology for diamond supply chain traceability through its Tracr platform, which was launched in 2018. This combines blockchain technology, artificial intelligence, the Internet of Things, and state-of-the-art security and privacy to enable diamonds to be identified and traced from mine to retail.

“Tracr is designed to be an inclusive platform built by the industry, for the industry, to accommodate the full diamond value chain, from large producers to family-owned businesses,” Petrie said. “Tracr is making excellent progress, both in terms of platform development and industry adoption. A beta platform was launched in the fourth quarter of 2019, followed by an enhanced application interface that was launched earlier this year, working toward a full platform launch later in 2020.

“With COVID-19 having a significant impact on retail activities across a range of sectors, we envisage that more and more retail will be conducted online, and this will also be true for the diamond industry.

“Longer term, we see being able to demonstrate transparency and provenance growing in importance, and this is reflected by all the work we’re doing to be able to demonstrate this beyond doubt through platforms like Tracr.”

ALROSA has applied various digital technologies to improve the efficiency and productivity of its fleets. (Photo: ALROSA)

ALROSA Homes in on Efficiency

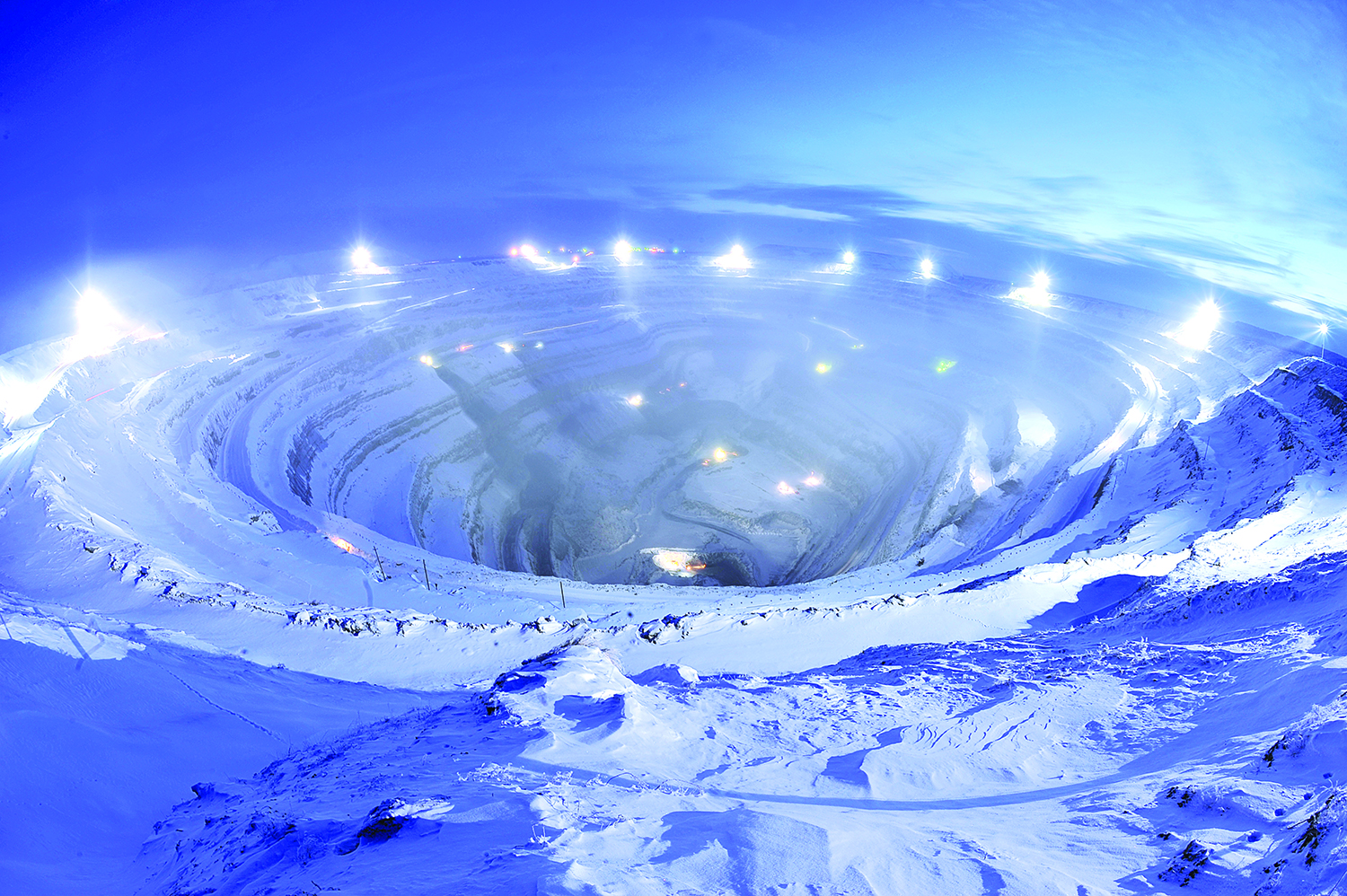

ALROSA is looking to digital technology to boost the operational efficiency and productivity of its mines. The Russian firm is partially state-owned and boasts the title of the highest number of carats produced globally last year. Today, it operates 12 kimberlite pipes and 16 alluvial deposits, mostly in Yakutia, as well as in the Arkhangelsk region, where Europe’s largest diamond deposit is located.

The group has recently succeeded in increasing the volume of ore mined by 11% and diamond output by 33% at its Nyurba mining and processing division. Part of this involved implementing and refining what ALROSA calls the “Perfect Shift” system aimed at reducing downtime in its mining fleet.

“Our specialists succeeded in creating a dynamic dispatching system and achieved a 7% increase in mining fleet daily capacity,” Jane Kozenko, ALROSA head of communications, said. “Maintenance of dump trucks and excavators is performed in a Formula 1-like pit stop mode with simultaneous maintenance and refueling. All our dumpers stay in constant operation thanks to the Hot Seat mode — when one driver needs to leave the workplace for lunch, a substitute driver replaces him.”

ALROSA has also improved its preventative maintenance activities and has reduced the yearly maintenance shutdown period for its Nyurba processing plant from 26 to 17 days.

“Additionally, we have built a model that allows us to predict grinding mill productivity depending on the characteristics of the ore and, as a result, we succeeded in increasing the processing capacity from 220 to 245 tons of ore per hour,” Kozenko said. “Moreover, we designed a specific burdening planner to calculate the processing plan depending on ore characteristics and to get the highest hourly capacity of the plant.”

Today, 86% of the group’s energy consumption is from renewable sources, and ALROSA is implementing a special program to improve the energy efficiency of its fleets, including switching some of its vehicles to run on natural gas.