Capex for mining projects continues to grow

Capex for mining projects continues to grow

By Joe Govreau

A sea change will envelope the mining industry as 2022 unfolds. It doesn’t feel like it, but it’s been six years since the signing of the Paris climate accord, arguably the catalyst for all this change. The global urgency to decarbonize is a game changer for the industrial market, accelerating reinvention of the mining industry, including automation, new equipment and process technology. In addition to traditional commodity-demand growth drivers like population growth and urbanization, decarbonization is adding another layer of demand growth as the technologies required to decarbonize are generally more mineral intensive than fossil fuel technology.

The impetus to decarbonize is accelerating daily, as more countries set net-zero carbon emission targets by 2050 with grandiose plans to phase out fossil fuels and ramp up electrification. Industrial companies have followed suit with their own plans. Most major automotive companies now plan to completely shift to electric vehicle manufacturing. GM, Ford, Mercedes, Volvo and Volkswagen plan to completely phase out gas and diesel vehicle production by 2035, for example.

The goal of making mining not just cleaner, but net-zero CO2 emissions clean, and at the same time accommodating a massive increase in demand for energy transition minerals, is no small task, and will require significant technological advances and substantial capital to achieve. The demand growth for energy transition minerals appears daunting with several studies, including last year’s International Energy Agency report, forecasting 4 to 6 times increases in mineral demand by 2040.

Yes, it’s a good time to be in the mining business, and an even better time to be an equipment and service provider to the mining industry, but challenges abound. Energy shortages and supply-chain issues revolving around the pandemic, along with social and resource nationalism issues, are swelling commodity prices and giving rise to inflation. Miners are facing constraints to project development from all sides; customers, financiers, regulators, stakeholders, and shareholders are demanding increased Environmental, Social and Governance requirements.

Is it even possible for the mining industry to keep up? Yes, but it will take an “all hands-on deck” mentality to achieve. First of all, governments need to recognize the importance of mining in meeting energy transition goals. More extraction and processing projects need to be developed, faster, and in geographies where traditional sources are weak and supply chains are precarious, such as the U.S., Europe and Southeast Asia. The importance of inexpensive and reliable energy cannot be overstated, accounting for up to 40% of the operational cost of a mine. This is a challenge indeed since the goal is to phase out fossil fuels, which have been our most inexpensive and reliable energy sources since the beginning of the industrial age. Due to their remote locations, many of the newer mines are off-grid and are implementing renewable energy and battery storage microgrid solutions. Globally, there are more than 800 independent power projects at mines totaling $35 billion, according to Industrial Info’s Global Market Intelligence (GMI).

Organizations like the International Council on Mining and Metals (ICMM), which includes the CEOs of 28 of the world’s leading mining companies and 19 OEMs, are making a difference, bringing together mining industry leadership to set standards and provide guidance to the industry. One of the many programs the ICMM has started is the cleaner, safer vehicles’ initiative, which has a goal of an emission-free mining fleet by 2040. They are collaborating to develop a new generation of mining vehicles and improve existing ones by implementing anti-collision technologies to make vehicles safer, and technologies to reduce greenhouse gas emissions from the mostly diesel mining fleets above ground and underground. Mining equipment supplier Sandvik said it expects the market for battery-powered mining equipment to increase significantly over the next two to three years and it will likely sell more electric than diesel-driven vehicles within 10 years.

Capex Will Increase in 2022

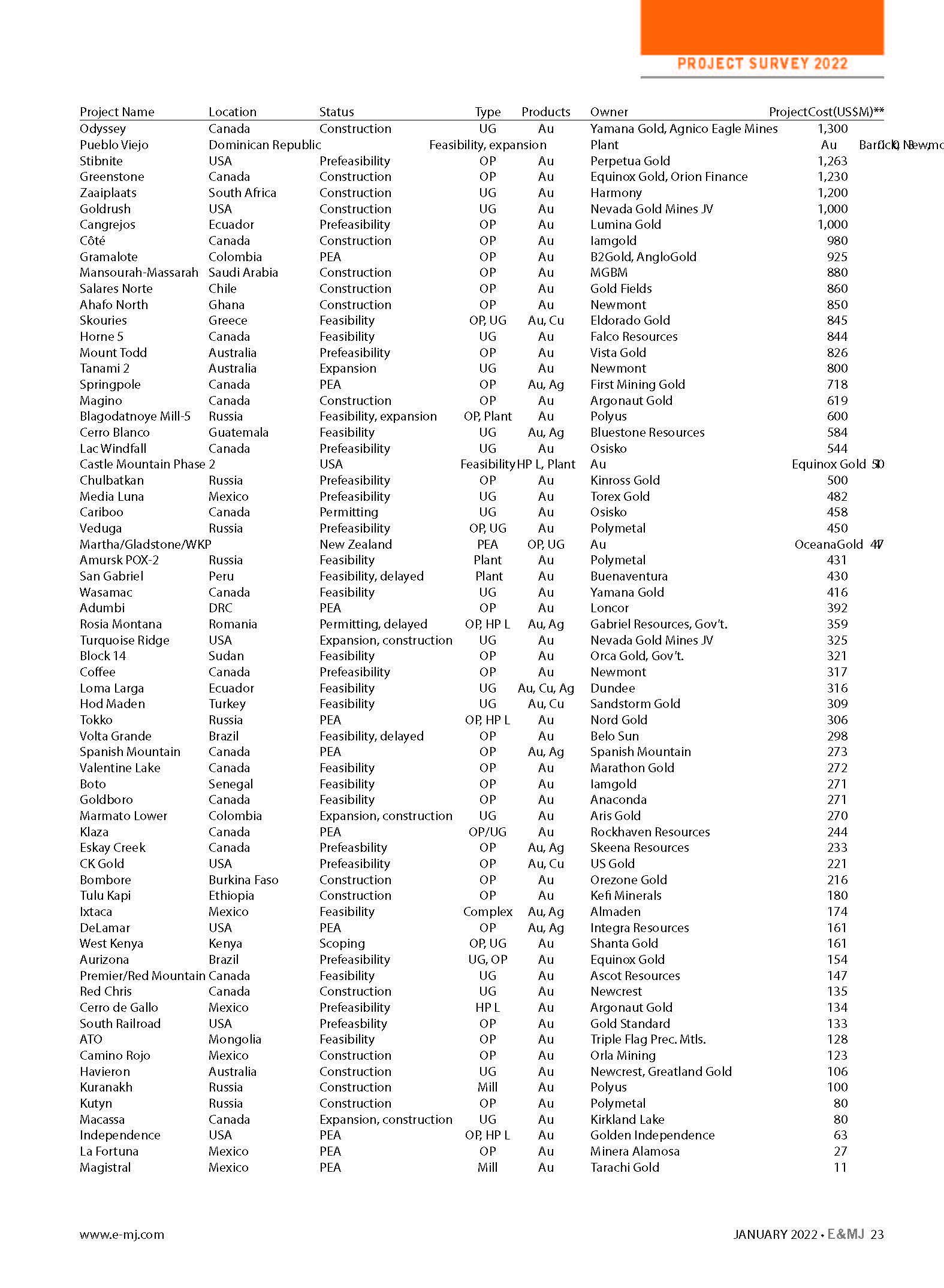

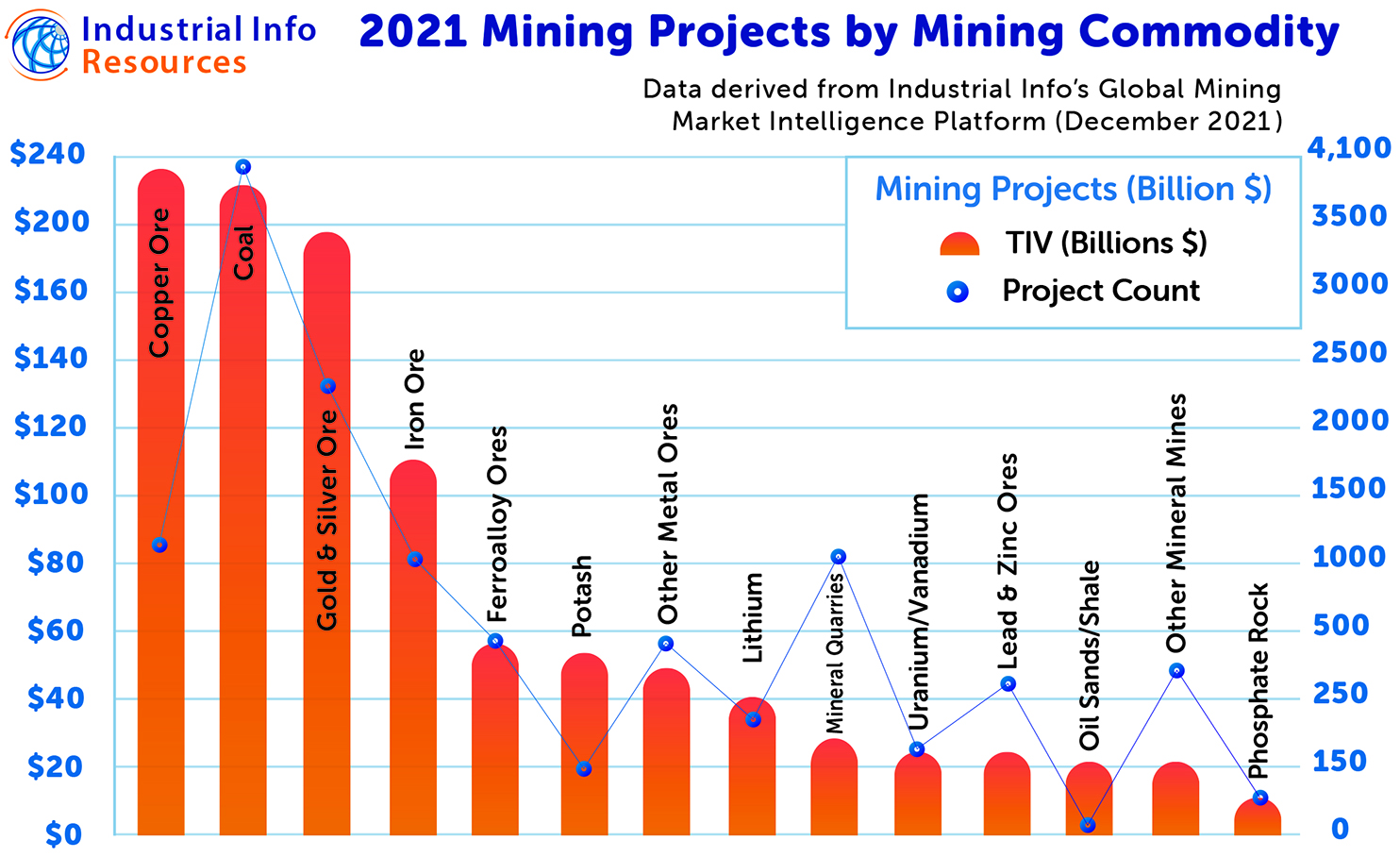

Globally, there are more than $1 trillion worth of mining projects under development, according to Industrial Info’s Business Intelligence (see Global Mining Project Development map). Projects range from those in the early exploration stages through scoping, feasibility, permitting, engineering and construction stages. Capital expenditures are on the rise and have been since the bottom of the market in 2017, with the exception of the pandemic-induced slow-down in 2020. Seven of the top global major mining companies, Anglo American, Barrick, BHP, Glencore, Newmont, Rio Tinto and Vale, have increased spending by 52% during this period, jumping from $22.5 billion in 2017 up to $34.2 billion in 2021. According to guidance from these companies, 2022 should see 6.7% growth in capital expenditures and expenditures will continue to rise for the next decade or more, as companies look to increase production to meet expected demand from the energy transition.

U.S. & Canada

U.S. & Canada

The U.S. and Canada, the world’s largest economy and 10th-largest economy, respectively, is a region rich in fossil fuels and minerals, and enjoys the world’s largest trading partnership. Canada, for example, is the largest exporter of aluminum, and cement to the U.S., supplying about 50% of U.S. aluminum imports and 33% of its cement imports, according to the U.S. Geological Survey (USGS), and 18% of iron and steel imports. As a result, Canada’s metals and minerals firms will benefit as much as U.S. firms from the recently passed $1.2 trillion U.S. infrastructure bill. The bill guarantees that federal spending on infrastructure will essentially remain elevated near 2020 stimulus year spending levels. The U.S. government spent $145.6 billion in 2020 on infrastructure. Pre-stimulus spending levels were about $100 billion per year during the 2010-2019 time period. The infrastructure bill adds about $60 billion per year to that number. Add to that Canada’s own infrastructure spending of $180 billion over 12 years and this will cause a positive impact to metals and minerals demand, especially steel, aluminum, copper and cement.

The U.S. and Canada represent the largest region in the world for planned mining projects, with more than 1,300 projects totaling $290 billion. Projects include not only grassroot mines, but expansions, life extensions, mine additions and restarts of previously

operational assets as well as other major capital expenditures such as retrofits, modernizations and automation. The U.S. is seeing increased activity for battery metals development including copper, rare earths and lithium. Canada is seeing increased activity for mining projects with oil sands, potash and gold projects leading the way. Notably, most of the oil sands mining activity is for mine extensions to maintain capacity rather than expansions or new mines due to the current demand situation for oil.

Canada has banned new or expanding thermal coal mines and is scrutinizing new coking coal mines. At the COP26 climate meeting, Prime Minister Justin Trudeau said Canada would end the export of thermal coal by 2030, and has committed to stop using coal entirely by 2040. The government has pledged C$185 million to assist coal workers and communities during the transition. Canada will also invest up to C$1 billion in a fund to assist developing the country’s transition from coal power to clean energy.

China Commands Commodity Consumption

As the largest consumer of metals and minerals, China will continue to drive project development not only domestically, but around the world, as it is dependent on imports of bauxite, copper and iron ores to feed its massive aluminum, copper and steel smelters. East Asia, which includes China, South Korea, Japan and Mongolia, is the second largest region in the world for mining projects where more than 3,100 projects totaling $208 billion are under development primarily in China. Coal continues to dominate mining expenditures in East Asia as new coal-fired power plants continue to be developed and China derives 65% of its electricity from coal. China has large reserves of coal and continues to consolidate and automate coal mines while it maintains coal production for its large power generation fleet. Coal-mining projects account for 68% of the value of all mining projects in the region.

Latin America

Latin America

Latin America has long been a destination for mining project development, especially in Brazil, Chile, Mexico and Peru. The region is currently the third-largest region for mining project development globally with $201 billion in projects under development. Social unrest and resource nationalism continue to impact project development in this important mining region. The governments of Chile and Peru, the No. 1 and No. 2 copper producers in the world, have threatened to increase mining taxation in order to support social improvement projects. Chile recently elected a new leftist president, 35-year-old Gabriel Boric, whose agenda includes rewriting the constitution, tightening environmental regulations and raising taxation of mining firms. President Boric has said he would look at creating a state-run lithium firm.

Several operations, including Chinese miner MMG’s Las Bambas mine, suspended operations due to social unrest in Peru. Nearby residents blocked the mine’s supply road. But those have recently been removed. However, supply constraints will continue to impact copper and other metal markets in 2022.

Lately, activity has picked up in Argentina, including for lithium project development where several projects have attracted foreign investment. In a move to boost its involvement in energy transition minerals, Rio Tinto recently agreed to acquire the Rincon Lithium brine project located in Argentina’s Salta province for $825 million. Construction of a commercial-scale, first-phase lithium brine extraction and processing plant could start during the second half of 2022 if approvals are received.

Africa

Africa is another important region for mining project development with significant foreign investment from China, India and other parts of the world eager to take advantage of its rich natural resources. Africa also affords logistical advantages to Asia and Europe when compared to Australia or South America. South Africa is the world’s largest producer of platinum, and is ranked as the ninth-largest country for mining project development. (See Top 20 Countries Chart). Platinum miners are planning more than $9 billion worth of projects in South Africa and Zimbabwe. Platinum is expected to get a boost from demand from hydrogen end-users. Both water electrolysis and fuel cells

require platinum; however, long-term demand could be impacted by a decline in platinum usage in catalytic convertors, as gasoline engines are replaced with hydrogen. Gold, bauxite, cobalt, manganese and titanium also are important mining production growth commodities in Africa.

Australia

The second-largest country for mining project development is Australia, which continues to benefit from being the export market of choice for much of Asia, especially for coal and iron ore. A feud with China banned imports of coal from Australia more than a year ago and this continues, but Australia has been able to find other markets for coal, so far. While coal mining projects are declining in the country, there remains considerable expenditure planned mainly for expansions and mine-life extensions in Queensland and New South Wales, where more than $19 billion worth of coal mine projects are under development.

Demand for iron ore has been strong on the pandemic recovery and most of Australia’s iron ore miners are involved in expanding production and distribution infrastructure. Australia’s iron ore miners are involved with 180 projects totaling $27.9 billion.

Australia is a proving ground for many new mining technologies aimed at optimizing productivity such as autonomous hauling and drilling equipment, hydrogen fuel cells, and electrification.

Outside of coal and iron ore, there is considerable development for gold, nickel, copper, minerals sands and rare earths in Australia.

All signs point to 2022 being another year of growth for project spending for the global mining industry. Traditional demand-growth drivers such as population growth and urbanization, coupled with new demand-growth drivers such as the energy transition, are ushering in an age of transformation and growth for the industry. Old constraints will continue supply-chain problems, boosting commodity prices; add to that inflation, which could increase mining project development costs and make some growth projects unattractive. Decarbonization will drive new technologies as companies continue to look to optimize production and produce more efficiently.

Govreau is vice president of research metals and minerals for Industrial Info Resources, based in Sugar Land, Texas. He can be reached at jgovreau@industrialinfo.com.