The BluVein infrastructure is being designed to be non-intrusive, modular and relocatable as the mine develops, so it offers plenty of flexibility. (Illustration: BluVein)

Tony Sprague, group manager for directional studies and innovation at Newcrest Mining, talks about the urgent need for battery-electric mine vehicles and some innovative projects that are accelerating their viability

By Carly Leonida, European Editor

Over the past 12 months, a tangible sense of urgency has developed around climate change mitigation. The net-zero decarbonization targets that major and midtier miners have set themselves are adding significant tailwinds to the removal of diesel engines from both underground and surface mines. The contribution that battery-electric vehicles (BEVs) could make toward reducing operational emissions is undeniable, but in the grand scheme of things, uptake is still slow.

Australia-based Newcrest Mining is currently involved in two mining company-led innovation projects — Project BluVein and the Charge on Innovation Challenge — both designed to accelerate BEV technology development and adoption. Together with its peers, the company is on a mission to break down the barriers that stand in the way of fully electric mine haulage.

“When Project BluVein was established two years ago, we didn’t talk much about the climate benefits of going electric,” Tony Sprague, group manager for directional studies and innovation at Newcrest, said in late December. “The focus was then very much on the health and safety benefits to our employees exposed to diesel emissions in underground workplaces. That’s still an incredibly important issue but, today, decarbonization has become another major driver to fully electrified mining operations.”

Health and safety factors, plus the smaller vehicle payloads mean that BEV technology for underground mines has naturally developed faster than for surface operations. In open pits, which don’t have the challenge of enclosed workplaces, decarbonization is the primary driver for fleet electrification. Many new mining projects today are starting to incorporate shadow carbon pricing in their economics — it’s not a case of if carbon emissions will be priced, but when. Eliminating diesel from haulage at all future operations will not only improve project economics, but will also demonstrate a more responsible approach to minerals extraction.

Sprague explained: “Going forward, underground and surface mines will get deeper, and more operations will transition to autonomous operation; BEVs must play a supporting role to these requirements. But still, it’s imperative that we rapidly eliminate diesel from underground mines for health and safety reasons. The mining industry knows this and, if they could, most companies would switch to BEVs today. The problem is that they’re still not available or viable for the majority of operations.”

Challenges and Opportunities

According to data from McKinsey & Co., mining accounts for up to 7% of global scope 1 and 2 greenhouse gas (GHG) emissions globally. Although most energy consumed at mine sites is in mineral processing where the crushing and grinding of rock occurs (around 70% on average), that energy tends to come from electrical sources and is, for the most part, generated as efficiently as possible, either on site or drawn from the grid.

However, the bulk of greenhouse gas emissions — around 55% — come from mobile equipment, and predominantly from load and haul fleets. That’s where the biggest challenges and opportunities lie to reduce greenhouse gas and diesel particulate emissions. Although new exhaust treatment technologies offer some respite, to get the benefits mines must upgrade their engines or replace units entirely (something they’re unlikely to do without regulatory requirement). And so, the impacts, while good, are still limited in comparison to the market size and fleet replacement schedules.

“Diesel engines in mining are very large, long-life units and they burn a lot of fuel,” explained Sprague. “Most standards are designed to manage what comes out of the engine. We can capture 90-95% of the diesel particulate matter (DPM), but we can’t capture CO2 emissions. And there is a hidden problem. Once a diesel particulate filter (DPF) gets choked, the engine management system runs a regeneration cycle, which heats up the engine and disperses the material that’s been captured. That is released as finer particles called nano-diesel particulates. Those particulates are not routinely measured, and currently there is no regulated safe limit for underground operations.

“Evidence indicates that these nano-particles are readily absorbed into the bloodstream. And since diesel particulates including nano-particulates have been classified as Class 1 carcinogens by leading health bodies including the World Health Organization, we must change our ways. We need electric mine vehicles today.”

But We Already Have Batteries…

While there are a number of different BEVs and charging systems available for underground mines today (technology for surface vehicles is still playing catch up), their applications are still constrained due to limitations on both the technology side and in mine design.

Battery-electric passenger cars have become mainstream in recent years, but it’s important to note that most are driving around relatively flat city environments. The road conditions are generally good and, even over longer distances that require charging breaks, that’s OK because human drivers also like to stop midway through long journeys.

In contrast, underground mine trucks haul payloads of 50-60 metric tons (mt) up vertical distances of 1,000 meters (m) at an average gradient of 14% (1:7). Unless driving around the Swiss or French Alps, it’s rare to find a six- or seven-kilometer-long road ascending a 14% incline outside of a mine. This is the very definition of extreme vehicle usage, and mine trucks do it many times a day on an almost continuous cycle.

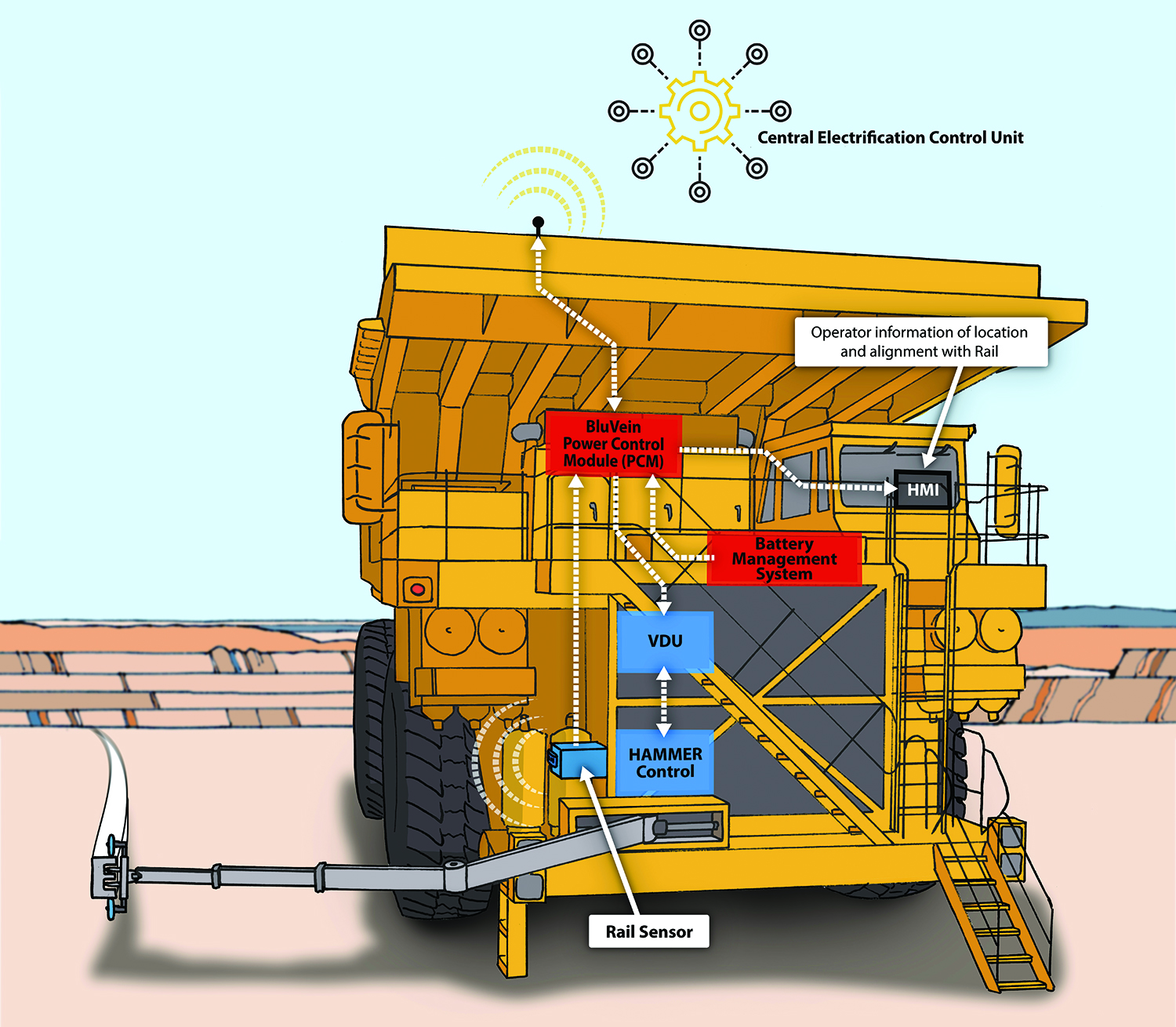

Key vehicle components for BluVein XL. (Illustration: BluVein)

“Vehicle OEMs are doing their best to develop suitable battery packs, and most are very large — each one weighs around 8-10 tons. But, in reality, no truck can get from 1,000 m below surface to the portal on one full battery charge,” Sprague said. “Part of the way up the ramp, the truck will need to stop, swap its battery and carry on.

“When it comes back down, the charging battery’s not going to be fully charged yet, so a third pack will be required and maybe even a fourth. If you’ve got a fleet of, say, 15 trucks, you could potentially have 45 to 60 batteries scattered around the mine that need to be managed and charged. If you’re trying to run an efficient operation, battery swapping just doesn’t work because there’s too much logistical complexity and human interaction needed.”

The other issue is the batteries are going from full charge to flat numerous times a day, which is detrimental to the battery’s overall lifespan. If a battery pack costs around US$1 million, and each truck requires three of them, and the battery life is decaying at the maximum rate… things are going to get very expensive very quickly. And then there’s the question of what to do with the dead batteries. There are clearly some creases in this model that need to be ironed out.

Enter Dynamic Charging

Rather than waiting for BEV technology to catch up with demand, in 2019, a group of mining companies decided to join forces to help accelerate implementation. Sprague and his team at Newcrest helped to seed Project BluVein.

“The questions I had were: why do we need to store so much energy onboard the vehicle?” he said. “Is there another way to access power when you need it, and to carry a smaller amount of battery power for when you’re away from the power source?”

The historical ABB electric haulage system developed in the 1980s called the Kiruna system used exposed conductors to power underground haul trucks. But today, more stringent health and safety regulations don’t allow mines to use exposed high-voltage conductors within close proximity of people or their vehicle, which is why most OEMs have opted for battery-only solutions.

“We started to wonder, if we can’t have exposed high-voltage conductors, what about some sort of slotted rail system that could safely power the vehicle motors and allow dynamic charging,” Sprague said.

The team began to investigate possible solutions from other industries including European highway projects such as Siemens-Scania’s eHighway project in Germany and the eRoadArlanda project by EVIAS in Sweden. The EVIAS system is based on a slotted power rail that is set down into a public highway. The conductors aren’t exposed, so it’s safe for people, animals and vehicles to pass over it.

As electric trucks drive over the rail at 80 or 100 kph, they automatically deploy an arm that connects to the rail. The truck can then draw electricity to power itself and charge its battery for later use. To the untrained eye, it looks suspiciously similar to a Scalextric track.

“It was almost exactly what we needed, we just needed to relocate the slotted rail system from the road to the roof or walls of our mine tunnels,” Sprague said. “I went to Stockholm, and visited the

EVIAS engineering team and discussed the challenges we had in mining. Together with an Australian specialty engineering design firm called Olitek, which specializes in mining robotics and electrical engineering, the BluVein partnership was formed. This has since progressed to become Project BluVein, with the financial support of eight major mining companies — BHP, Glencore, Vale, Newcrest, AngloGold Ashanti, Agnico Eagle, OZ Minerals and Northern Star.”

The BluVein engineering team is currently working on an all-terrain version of the EVIAS system for both surface and underground mining applications. In an underground mine, the system only needs to be installed along the main decline. As electric vehicles descend, they use regenerative charging to replenish their batteries. Power usage is minimal while traveling on flat production areas and then, when it’s time to ascend, the vehicle automatically connects to the slotted rail with an autonomously deployed onboard arm called the hammer. The vehicle accelerates to full speed using power drawn from the rail, and additional power is used to top up the battery during the ascent.

Sprague explained: “By the time the vehicle gets to the top of the incline, the battery will be at near full charge. The ascent is faster, the truck can use a battery half the size and weight allowing a higher payload, and there’s no need to stop and swap batteries. Overall, it’s much cheaper, simpler and more efficient than other systems requiring battery swapping.”

It’s very similar to trolley assist, E&MJ observed.

“It’s better, it’s trolley charging,” said Sprague with a smile. “Trolley assist requires trucks to have an onboard diesel engine that drives a generator to produce the electricity needed to turn the wheels. When you’re coming up a ramp in an open pit with trolley assist, the truck connects to the electric power. The diesel engine then idles, and when the truck disconnects at the top of the ramp, it switches back to the diesel engine to generate electrical power for the wheel motors. The BluVein system is all electric — the vehicle has a smaller battery, electric motors and no diesel engine.”

It’s important to note that the BluVein system doesn’t replace the battery technology offered by OEMs. It provides a complementary option for mines that struggle to see a business case for BEVs because of application limitations. For example, battery swapping might be perfectly feasible for a mine’s LHD fleet and drills that tram mainly on flatter roads on the main level, but the haulage fleet, which needs to traverse the steep ramp, could be run using BluVein. Shallow surface and underground mines are both applications where battery swapping could be viable. With technical input from the eight mining partners, BluVein’s system infrastructure is being designed to be non-intrusive, modular and relocatable as the mine develops, so it offers plenty of flexibility.

It’s important to note that the BluVein system doesn’t replace the battery technology offered by OEMs. It provides a complementary option for mines that struggle to see a business case for BEVs because of application limitations. For example, battery swapping might be perfectly feasible for a mine’s LHD fleet and drills that tram mainly on flatter roads on the main level, but the haulage fleet, which needs to traverse the steep ramp, could be run using BluVein. Shallow surface and underground mines are both applications where battery swapping could be viable. With technical input from the eight mining partners, BluVein’s system infrastructure is being designed to be non-intrusive, modular and relocatable as the mine develops, so it offers plenty of flexibility.

BluVein is currently collaborating with four partner OEMs — Epiroc, Sandvik, MacLean Engineering and Volvo — to advance BluVein1, its first-generation system focused on underground mines. BluVein integration to Sandvik Artisan’s Z50 electric truck, Epiroc’s MT42 electric truck, Volvo’s electric FMX and autonomous TARA platforms and MacLean’s support vehicles are in progress. The standardized rail means the system is vendor agnostic, so any BEV can be equipped to use it. It’s just a case of adapting the power input/output and adding a hammer to the vehicle.

“The key is having the mining companies step up and take care of the fixed infrastructure, which makes it much easier for the OEMs to focus on creating lower cost and more efficient battery packs and vehicles,” Sprague said. “It means that more of the truck’s capacity can be dedicated to hauling rocks instead of carrying oversized batteries. Above all, it brings down the cost, and fixes the productivity issues so the electric mine model works. Everyone benefits.”

From Underground to Surface Vehicles

A potential technology pilot site has now been identified for BluVein1 at an open-pit mine site in South Australia. The mine has an unusually steep ramp, similar to that of an underground decline and, all going well, the BluVein1 technology will be installed during 2022 for a six-month co-trial with the various OEMs. Commercial mine site deployments will hopefully follow soon afterward.

“Collectively, we really want the end result, and we’re sharing the load to move the system rapidly through the technology readiness levels,” Sprague said. “We want to see as many OEMs as possible integrate their BEVs and to enable deployment into our surface and underground mines.”

Which leads us nicely to the Charge on Innovation Challenge, which kicked off in 2021. Charge On is a crowdsourcing challenge established by BHP, Vale, Rio Tinto and supported by Austmine to encourage and accelerate technology developments that will help to decarbonize surface mining operations. With a focus on haul trucks of 220-t payloads and above, the challenge now has 22 mining company patrons (including Newcrest).

The challenge received hundreds of technology entries in its initial open application phase. Seventy-two were selected to progress, and these were vetted by the mining companies and whittled down to 21 in the first round of judging. Phase two of the judging had just closed when E&MJ spoke to Sprague in December, and the revised shortlist will be announced by the organizers soon.

“What’s interesting about Charge On is that the 22 patron mining companies, collectively, run a substantial proportion of all active mine trucks globally,” Sprague said. “It’s a very representative group, and they’ve clearly signaled to the market that they see electric vehicles as the best solution to open-pit decarbonization in the near term. Hydrogen could also play a role, but that will likely come much later. As with Project BluVein, we’ve decided to take our destiny into our own hands.”

Most of the applications fell into three key technology groups: fast-charging systems, trolley-charge systems and swappable batteries. Once the leading technologies have been announced, vehicle OEMs will be introduced to develop collaborations that will hopefully result in technology pilots at patron mining company sites. Interestingly, the Charge On challenge organizers are also working with a number of venture capital firms who are waiting in the wings to provide additional funding for the right projects.

“Many crowdsourcing efforts flop, because they’re not properly supported,” Sprague said. “Sometimes the winning solution has been submitted by researchers or a group of mates and there’s no firm company or product pathway behind them. Sometimes the mining company doesn’t have the funding readily available or appetite to further develop and commercialize the proposed solution.

The standardized rail means that any BEV can be equipped to use the BluVein1 system. (Photo: BluVein)

“What’s great about the Charge On Challenge is that it’s been well thought through and so far very well executed. The mining companies essentially did the due diligence on the technology solutions that came in; each company has set up a mini technical team that reviewed the applications at each stage and ran them through a standardized scoring system. That critical and impressive mass of mining companies has attracted the right level of interest from the technology providers who are there to support the successful applications. The vehicle OEMs see a potential market opportunity.

“Then there are mining companies who want to proceed to pilots and, if there’s not enough funding quickly available, there are sources to help make that happen. It will be the best crowdsourcing campaign I’ve seen and there’s a really good collaborative spirit all around. It’s been super diplomatic and super respectful. Every company has an equal vote. It’s been very well done.”

Many Hands Make Light Work

Sprague is confident that at least a couple of really good solutions will come out of the challenge and that they’ll see rapid uptake because, in assessing the various technologies as a group, the mining companies have derisked the selection process to a degree.

When submitting their proposals, the applicants had to base their solutions on a set of standardized haul profiles to ensure the technology could support hauling at industry-standard gradients and distances. This allowed them to quantify how much power needs to be transferred to the vehicle, how it will be transferred etc., all of which is required to develop the business case.

Once the shortlisted technologies are announced, the next step will be to establish collaboration groups around the technologies and proceed to pilot site demonstrations.

“There’s a rough timeline, but questions are already being asked about how we can speed that up even more,” Sprague said. “There’s a lot of value to be gained from pulling together a group of mining companies who share the workload, the risk, and ultimately, all get to the end point faster.”