INTEGRATING NEW TECHNOLOGY WITH HISTORICAL DATA, GEOLOGICAL INTUITION AND A LITTLE LUCK, COMPANIES ARE FINDING SUCCESS WHERE OTHERS HAVE NOT.

By Steve Fiscor, Editor-in-Chief

Every year the great minds in the field of geology, mineral exploration, and project development gather at the Prospectors & Developers Association of Canada’s (PDAC) convention in Toronto. With the size and scope of the convention, it’s sometimes easy to lose sight of the fact that the driving force behind the organization is mineral discoveries and project development.

During the convention, PDAC organized a Discoveries & Developments session. The session covered gold discoveries, but it also touched on other minerals, such as graphite, copper uranium and diamonds. These mineral discoveries were not necessarily new and they were worlds apart geologically. What they shared was a contrarian approach with new technology.

All of the discoveries were in the zone of other major discoveries, but most of them had been overlooked for one reason or another. The motivation could only be attributed to a geologically motivated hunch. New technology in the form of deep-penetrating airborne surveys allowed ground-based geophysical surveys to target undiscovered anomalies. Combining the new information with what they knew historically, exploration geologists were able to improve the drilling programs to quickly determine a resource.

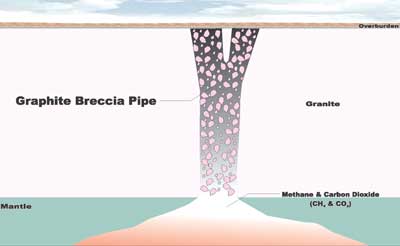

|

| Looking for copper and nickel, Zenyatta Ventures found this high-purity graphite deposit that looks much like a kimberlite pipe. |

Albany Ultra-pure Graphite

While it’s not nearly as sexy as gold and diamonds, high-purity graphite is interesting both geologically and from an emerging market standpoint. Zenyatta Ventures discovered a rare hydrothermal graphite deposit in 2011. “We found it by accident,” said Aubrey Eveleigh, president and CEO, Zenyatta Ventures Ltd. “We were looking for copper and nickel and stumbled onto this rare form of graphite.”

Now after two years of research and further exploration, since 2012, the company believes it has the largest and only high-purity hydrothermal graphite deposit being developed in the world today. Testing by SGS Minerals yielded graphite with 99.99% purity, or what they refer to as graphitic carbon (Gc). “That was the catalyst that really got things going for us,” Eveleigh said. “We were able to show that we could produce high-quality graphite from a relatively easy and inexpensive process.”

Zenyatta is targeting the clean tech sector. Graphite has unique chemical, electrical and thermal properties. It’s stable and strong in excess of 3,600°C, resistant to corrosion, a light reinforcing element, a very good lubricator and a very good conductor. It is used for making fuel cells for energy storage and electronics (tablets, smart phones, etc.). As an example, the Tesla Model S requires 100 kg of graphite for its batteries. There are also military and aerospace applications. And, of course, the Holy Grail for the tech sector, graphene, which is a 1-atom thick layer of graphite with amazing properties.

The Zenyatta Cg deposit, the Albany project, is located in northeastern Ontario, Canada, about 30 km north of the Trans-Canada Highway. It lies close to infrastructure including rail transportation, a power line, and a natural gas pipeline near the communities of Constance Lake First Nation and Hearst. Zenyatta signed an agreement with Constance Lake in 2011.

Describing the deposit, Eveleigh offered a simple geological interpretation. “The carbon comes from the mantle of the earth,” Eveleigh said. “It was probably derived from CH4 and CO2. The carbon came out of solution somehow. We are currently conducting isotope research to determine how much carbon was formed in two vertical pipes.”

Originally, Eveleigh and his team were looking for copper and nickel. They flew an airborne survey and came up with a strong electromagnetic (EM) conductor. “It was blind target—no outcrop,” Eveleigh said. “So we had to drill and determine what it was. We hit this breccia formation that turned out to be full of graphite. Since then, we have drilled 66 holes, which has been used to determine the resources reported in December.”

Technically what they had discovered was a very rare, hydrothermal, graphite mineralized breccia zone hosted within an alkalic intrusion. The deposit was overlain by at least 40 m (combined) of muskeg, glacial till and Paleozoic carbonate rocks of the James Bay Lowlands. Preliminary petrography indicates that the graphite-hosting breccias range in composition from diorite to granite, and are generally described as “syenite.” Graphite occurs both in the matrix, as disseminated crystals, clotted to radiating crystal aggregates and veins, and along crystal boundaries and as small veins within the breccia fragments.

The indicated mineral resources delineated to date total 25.1 million metric tons (mt) at an average grade of 3.89% Cg, containing 977,000 mt Cg. The mineral resources are contained within two vertical pipes spaced approximately 250 m apart. The East Pipe is approximately 300 m long (NW-SE) by 150 m wide (including lower grade overprint mineralization) by 600 m deep, where it remains open. The West Pipe is approximately 300 m long in the NE-SW direction by 175 m wide by 500 m deep, where it also remains open.

“Early indications are a big, long-life deposit that remains open at depth,” Eveleigh said. “The two vertical pipes are similar to Kimberlite pipes, but they are not Kimberlite pipes.” Eveleigh believes that the mine plan might be similar to that of the Diavik mine, where two Kimberlite pipes are mined by open pit and underground methods.

Zenyatta performed a crush-grind-float study with a caustic bake, which yielded 99.99% from a bench-scale test. “It’s a benign process that didn’t have to use aggressive acid or thermal processes,” Eveleigh said. “One of the tests was for crystallinity, which was some of the best ever seen. Good crystalline structure leads to other good properties, like conductivity and surface area.” He credits SGS Minerals for the idea of a sodium hydroxide.

SGS Minerals is currently processing two 5-mt mini bulk samples, one from the east pipe and one from the west pipe. The Canadian government gave Zenyatta a $350,000 grant and has loaned the company scientists and technicians to help work on this project. The company is currently conducting a preliminary economic assessment (PEA).

Zenyatta has some clear advantages. They are targeting the synthetic marketand Eveleigh believes they can get a price somewhere between $7,000/mt to $20,000/mt. Synthetic high-purity carbon is currently produced from petroleum coke, needle coke to be specific. A really dirty substance is processed, burning out the contaminants and rearranging the carbon in a graphite layer. “It’s an expensive process and it has a lot of environmental issues associated with the process,” Eveleigh said. “We have a natural substance that is easy and inexpensive to process.”

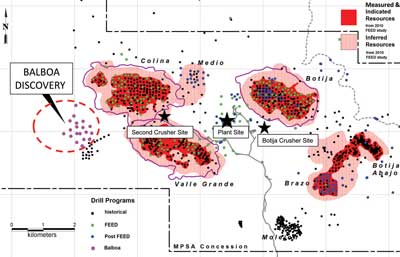

|

| Despite 40 years of exploration, geologists were unable to find Balboa until they experimented with new technology. |

The Balboa Discovery at Cobre Panama

Great explorers have visited Panama. Columbus landed there and Balboa crossed the isthmus and discovered the Pacific Ocean. A little less than 400 years later, geologists found hidden deposits of copper in a region that has been heavily explored for nearly 40 years. First Quantam’s Colin Burge, who has been working on the Cobre Panama project since Minera Panama S.A. proved it up, explained how the use of modern technology and integrated science revealed the Balboa deposit.

Modern mineral exploration in Panama began in 1966 when the United Nations initiated a development project leading to the discovery of three significant copper deposits. Definition drilling of the deposits took place during the 1970s and work intensified during the 1990s until copper prices plummeted. Burge illustrated graphically how activity on the Cobre Panama project closely followed the price of copper. In 2004, the concession was reactivated by Minera Panama S.A., which was owned 80% by Inmet Mining (in 2013 First Quantam acquired Inmet), and the Balboa deposit was discovered in 2010.

By land mass, Panama has the highest concentration of copper. The Cobre Panama project is located about 20 km from the Caribbean coast (where Columbus landed) and 220 km west of the Panama Canal. Balboa is the westernmost deposit of a cluster of six tabular shallowly dipping copper deposits. These porphyry deposits lie on the margins of a large batholith surrounded by andesite. In addition to Balboa, these include Colina, Botija, Botija Abajo, Brazo and Valle Grande.

Mineral exploration in the region faces many challenges, according to Burge, such as thick jungle cover, a 20-m-thick saprolite layer, heavy rains (4 m per year), and steeply incised terrain. “The saprolite layer dips down underneath hills and comes to surface near the creek level,” Burge said. “To find rock on the project you have to get into the creeks.”

Under the U.N. program, 25,000 stream sediment samples were collected. They followed up with some drilling, 30 holes. “They landed holes into Botija, and a few in Colina and the Valle Grande deposits,” Burge said. Fast forwarding to 2007, a major drilling campaign was further defining these deposits. The geologists discovered a number of interesting intersections, especially in the Botija-Brazo area. “We had 0.6% copper over 300 m and 0.7% over 57 m in an area known as Cuatra Crestas,” Burge said. “There was a major structure running to the northeast.” They decided to follow it. Based on geologic mapping, they believed some of the deposits were uplifted with respect to the main block. The strategy moving forward was to search for a buried enrichment blanket with higher than average grade.

In August 2010, Inmet Mining mobilized a crew from Geotech to the site to carry out a ZTEM Survey. Geotech’s ZTEM airborne system can be operated by a helicopter or a fixed wing aircraft. Using the naturally occurring (or passive) EM fields from worldwide thunderstorm activity as the source of transmitted energy, this technology has a receiver design and advanced digital electronics and signal processing, which allows for low noise levels and high resolution and depth penetration.

The ZTEM survey correlated well with the known deposits and identified something that had been overlooked near Cuatra Crestas. Magnetic anomalies correlate with the andesites, which contain primary magnetite, Burge explained, copper porphyries appear as negative magnetic anomalies, but Balboa was inconclusive. After getting the ZTEM survey, the plan was simply to drill four holes within the ZTEM negative magnetic anomaly. “On the first hole a few hundred meters down, which was deep for us, we encountered 0.3% over 200 m,” Burge said. “Then 60 m below that zone we hit a 6-m zone of sheeted quartz bornite chalcopyrite, quite spectacular. We knew we had something special going on here.” It ran 3% copper and 0.2 g/mt gold over 6 m. The second hole 400 m to the north hit a similar quartz chalcopyrite vein, 0.6% copper and 0.2 g/mt gold over 240 m, and then another with 0.9% copper and 0.4 g/mt gold over 114 m.

By the end of 2010, Burge and his team realized they had made a significant discovery. The work began to drill it out. Over the course of the next 18 months, they drilled 94 holes on 100-m centers. A long section illustrates a deposit with 0.6%-0.9% copper and 0.1-0.4 g/mt gold roughly 150 to 200 m thick of continuous mineralization. The ZTEM survey correlated directly with the higher grade zone.

The Balboa discovery is a geophysical success story. Located just 1 to 2 km from known deposits, it measures more than 1,500 x 1,000 m in surface area, yet it remained undiscovered for 40 years after a couple thousand meters of exploration drilling. Conventional soil samples failed to clearly identify it. The ZTEM successfully mapped it. Burge attributes the success to a willingness to try a new technology, a plan that integrated geochemistry and geophysics, good support from management, and optimism with everyone involved.

|

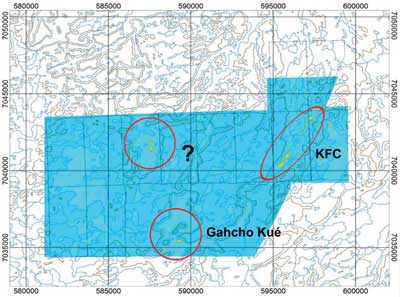

| Kennady Diamonds performed a gradiometric survey, which revealed a number of diamondiferous kimberlites in this region of the Northwest Territories. |

Kennady North Kimberlite Discoveries

Exploration over the Kennady North project (100% controlled by Kennady Diamonds), which hosts the Kelvin and Faraday kimberlites, resumed in 2011 after the company completed an airborne gravity gradiometer survey. A number of diamondiferous kimberlites have been discovered in this region of the Northwest Territories in the last 20 years. Three kimberlites are currently being developed by the Gahcho Kué JV.

The gravity survey revealed several kimberlite targets, which were followed up with ground based magnetic surveys. Examination of historical airborne magnetic and electromagnetic and ground-based magnetic, and electromagnetic and gravity geophysical surveys results was undertaken. This study indicated that resistivity is most useful in detecting kimberlites. The study also showed that the sample density for the ground gravity surveys would have to be increased to detect and model the bodies.

“Kennady North hosts four known diamond-bearing kimberlites and more than 40 geophysical targets,” said Patrick Evans, president and CEO, Kennady Diamonds. “We want to define between 5 and 8 million metric tons with more than 2 carats (ct)/mt, which would hopefully yield more than 10 million ct.”

The focus of Kennady’s exploration program is on Kennady North and more specifically, the Kelvin-Faraday Corridor (KFC), which lies about 10 km from Gahcho Kué. The company has identified a structural trend that runs SW-NE through this area and a fair amount of exploration has been completed. The first drilling took place in the late 1990s and led to the discovery of the Faraday kimberlite. “The Kelvin deposit to the south was thought originally to be a separate kimberlite, but turned out to be a wider intercept of dyke that runs to the south of the main kimberlite,” Evans said. “It’s approximately 18 to 20 m wide.”

Ground geophysics and diamond drilling at Kennady North commenced in early 2012. During this time more than 3,168 km of airborne gravity, 248 km of horizontal loop (HLEM), 2,786 ground gravity stations, 610 km of ground magnetics, and 29 km of capacitively-coupled resistivity (OhmMapper) geophysical surveys have been completed.

Diamond drilling began in July of 2012. A total of 11,138 m in 64 holes targeting two known kimberlite bodies and many newly identified targets have been completed. This work has documented potentially economic kimberlite bodies within the Kelvin-Faraday complex. There are a number of other targets still to be explored. 3-D modeling of newly acquired OhmMapper data and conductivity depth imaging of historic Dighem data over and around the Kelvin kimberlite guided the 2013 drill program to successfully intersect kimberlite at the northwest lobe of Kelvin. This new data, and the remodeling of historic data, support the interpretation that the Kelvin kimberlite body consists of an irregular shaped body and a dyke complex.

“The ground gravity results show the Kelvin and Faraday kimberlites quite clearly,” Evans said. “At Faraday, we have Faraday Nos. 1-3, and what we believe is Faraday No. 4.” Not much drilling has been done and they have not established whether these are part of a larger kimberlite.

“We have not yet found the feeder system to the main Kelvin kimberlite,” Evans said. “We have some ideas as to where it may be. We are currently drilling and hope to find the feeder system during this drilling season.”

From the spring 2013 drilling program, they recovered a 1-mt sample from the Kelvin kimberlite, which returned 8 ct/mt. A 100-kg Faraday sample had a grade of more than 11 ct/mt. “We entered the summer program with modest expectations, focusing principally on the northwest lobe,” Evans said. “With one small rig, we hit kimberlite everywhere.”

What Evans finds remarkable about the diamonds is the large number of stones without inclusions. “It’s extraordinary,” Evans said. “The population of diamonds without inclusions at Kennady North is high. We have found some nice crystals and only a small amount of yellow diamonds.” He believes Kennady’s diamonds could fetch $200/ct per ton.

Currently Kennady has a three-drill program under way. “As we complete the geophysics at KFC, we will move it to some other targets to gather data to identify any bodies large enough to consider drilling,” Evans said. “At KFC, we expect to drill more than 10,000 m this winter. We also plan to recover a 35- to 30-mt mini bulk sample from KFC, which should yield 100 ct for preliminary revenue modeling.” They are hoping to have an NI 43-101 by the end of the year.

|

| Probe Mines discovered a high-grade gold deposit in Ontario’s overlooked Borden Belt. |

Canada’s Newest Gold District: The Borden Project

Since its discovery in 2010, Probe Mines Ltd. has drilled more than 580 holes, representing more than 280,000 m, at the Borden gold project, located near Chapleau, Ontario. The company has acquired significant property along the Borden Belt and increased the potential for new discoveries. Four drills are currently turning on the project to continue to improve and expand the resource.

The Borden Gold Project is within 1 km of a major highway and close to well-developed infrastructure. “This was a surprising discovery in an area of Ontario that nobody thought was prospective,” said David Palmer, president and CEO, Probe Mines. “In less than one year our perspective on the project has changed 180°. The last 12 months have been our best months and we are looking forward to more.”

The Borden Belt is surrounded by mining activity, but no one looked at this region. “It’s a high-grade metamorphic zone formed by high temperatures and high pressures,” Palmer said. “These structures are usually more deposit destructive than deposit generative. At those high temperatures, all of the deposits normally get cooked off. We think that this deposit formed at those high temperatures and pressure and was preserved through it.”

Probe Mines drilled the first hole at the Borden project in 2010. “In the first two years, we went from 0 to 4.3 million oz in a bulk tonnage environment at a 1 g/mt average grade,” Palmer said. “A year ago, we had one high grade discovery hole. While the market could not gain perspective, it proved to be a game-changer for the project.” Since that discovery, they have outlined the Borden project as a 1-km-long high-grade zone and they believe it’s still open to expansion. This junior explorer is now looking at this as a development project. In May 2013, Agnico Eagle Mines purchased a little less than a 10% stake in the company providing third-party validation.

Palmer recalls hole No. 256 in December 2012, which hit 51 m at 10 g/mt, an order of magnitude jump in grade. “We immediately performed a large 500-m step- out drilling program,” Palmer said. “We had to answer the question of whether it was a 1-hole wonder or part of larger high-grade system. Luckily for us, the 500-, 600-, and 700-m sections that we drilled turned out to be part of a high-grade system. They have since performed 50-m infill drilling to delineate a 1-km high grade zone.

During January 2013, the company provided an NI 43-101 with a resource that currently contains 3,686,000 oz at 1.02 g/mt gold (indicated) and 625,000 oz at 1.08 g/mt (inferred) at a 0.5 g/mt gold cutoff. It does not include the new high-grade gold discovery.

A year ago, Palmer thought the Borden project would be an open-pit mine, but now he is looking at a high-grade underground mine. “The plan has now shifted from a 10,000-mt/d-bulk tonnage open-pit mine at 1 g/mt to a 2,000-mt/d-solely underground operation at a much higher grade.

Basically, the deposit is a high-grade mineralized lens, 1 km in strike length dipping at 40°-45° to the northeast. “We have a 30- to 40-m wide envelope of 5- to 6-g/mt ore and a 10-m thick core that is running 8 g/mt or more,” Palmer said. “Because it’s so thick, we can use long-hole open stoping and treat this as an underground bulk tonnage mine.”

From a geologist’s perspective, Palmer gets excited about having a new unexplored belt. “We have a lot of room to look along the eastern half of the belt,” Palmer said. “We were overwhelmed by this high-grade discovery, which required more and more drilling, and we really haven’t had a chance to look that far afield.” The company is now ramping up a regional exploration program.

|

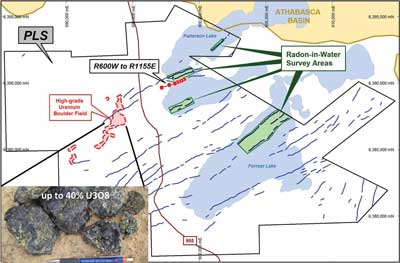

| Fission Uranium has identified a rich, shallow uranium deposit on the western side of the Athabasca Basin. |

PLS High Grade, High Techand Contrarian

Paraphrasing Canadian mining financier Rick Rule’s mantra: “You’re either a contrarian or a victim,” Ross McElroy, president and COO, Fission Uranium, aptly describes Patterson Lake South (PLS) as a contrarian’s play. In the world of finance, the contrarian invests where others do not and suggests that those who follow the masses ultimately fall victim to market swings rather than capitalizing on them.

The Athabasca Basin, Saskatchewan, is home to the world’s largest source of high-grade uranium. It is well known for high grade discoveries, such as Cigar Lake and McArthur River. Average uranium deposit grades in the Athabasca Basin are several orders of magnitude greater than the world average.

The Patterson Lake South (PLS) project is a major high-grade, shallow depth uranium discovery located in the southwest side of the Athabasca Basin. “The significant discoveries were mostly on the east side of the Athabasca Basin,” McElroy said. “Everyone ignored the western side of the basin. Geologically, there is no reason the west side would be different than the east side. People just tend to look where the main activity takes place and historically that had been the west side.”

The PLS project began with the discovery of a boulder field using airborne radio-metrics. “We developed a very high-resolution airborne radio-metric survey,” McElroy said. “We flew the ground and saw some very bright anomalies. We immediately followed up on the ground and right away found the boulder field. We had uranium assays up to 40% U3O8. We have outlined mineralization over 1.78 km of strike length, which makes it one of the largest discoveries in the Athabasca Basin.”

The contrarian PLS discovery is a large scale, shallow, high-grade mineralized trend with the bulk of mineralization found, so far, between 55 m and 250 m depth below the surface. In one year, the discovery grew from a single hole to six mineralized zones on-trend along a strike length of 1.76 km. Progress to date has been accomplished with $13 million of exploration, which enjoyed a drill hit success rate of 86% and hit grades such as hole PLS13- 075: 54.5 m at 9.08% U3O8, including 21.5 m at 21.76% U3O8.

McElroy and his team used a patent-pending high resolution airborne radiometric survey technology to identify a high-grade boulder field with pinpoint spatial accuracy, which in turn helped the team track down the discovery. Fission’s innovative use of Radon surveys has proved to be of great use in assisting drill targeting along a prospective corridor defined by geophysics. The company successfully demonstrated how this “old” technology has been made “new” again and may be a practical aid with the detection of shallow uranium targets.

|

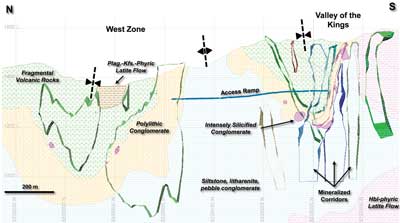

| A long section illustrates Pretium Resources’ Valley of the Kings gold deposit. |

The Brucejack High-grade Gold Project

Pretium Resources Inc.’s Brucejack gold project, which forms part of the Sulphurets Camp, is located 65 km north of Stewart in the Coast Mountains of British Columbia. The base and precious metal potential of the Sulphurets Camp has been of interest to prospectors and exploration companies since the 1880s. Although early prospecting identified quartz stockwork-hosted gold-silver mineralization in the vicinity of Brucejack Lake, it was not investigated in detail until the 1980s and 1990s. Extreme grade gold mineralization (grading up to 41.5 kg/mt gold) was first discovered in the Valley of the Kings Zone in 2009, and has formed the focus of ongoing detailed exploration by Pretium since its acquisition of the Brucejack Project in late 2010.

High-grade gold-silver mineralization at Brucejack occurs as coarse aggregates of electrum in deformed multidirectional vein stockwork zones hosted in intensely quartzsericite-pyrite altered island arc volcano-sedimentary rocks of the Lower Jurassic Hazelton Group. This mineralization is interpreted as representing a deformed transitional to intermediate sulphidation epithermal porphyry-associated, high-grade gold-silver vein stockwork and breccia system that formed between 191 to 184 million years ago, contemporaneous with island arc development.

Pretium’s exploration at Brucejack has included detailed surface and underground geological mapping and sampling, over 184,000 m of surface drilling and 38,800 m of underground drilling, and the extraction of a 10,000-mt-underground bulk sample. The current Mineral Resource for the Brucejack Project (November 2012) is estimated to contain 9.4 million oz of gold and 49 million oz of silver in the measured and indicated category, and 3.7 million oz of gold and 13 million oz of silver in the inferred category, at a 5 g/t gold equivalent cutoff.

Pretium completed a positive Feasibility Study on the Brucejack Property in late June 2013, defining probable mineral reserves of 6.6 million oz of gold (15.1 million mt grading 13.6 g/t gold). Pretium is currently conducting the necessary comprehensive assessment of mapping, drilling, and bulk sampling results, including reconciliation to previously released models, toward generating updated mineral resource and reserve estimates for the project.

Although a combination of factors including: prospective terrain, a high-quality historic database, metal prices, corporate exploration policies, and advances in deposit geology and geostatistics, contributed to Pretium’s exploration success on the Brucejack Property, having a team of dedicated and motivated professionals with a flexible approach to exploration and modeling with latitude to test alternatives is considered the most important.

|

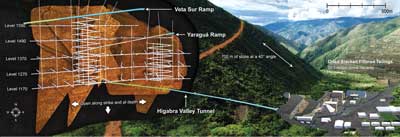

| If Continental Gold succeeds, Colombia will have a modern underground mine accessing a mountain of gold from a 1-km ramp. |

Buriticá: Colombia’s First Modern Gold Mine?

Continental Gold Ltd.’s flagship Buriticá Project contains high-grade, multimillion ounce gold resources at development stage and earlier stage prospects. Situated in an area of good infrastructure in the rugged western Cordillera of Colombia, the Buritica project hosts high-grade vein systems, breccias, and other porphyry-related styles of precious and base metal mineralization.

Gold mineralization around Buriticá was discovered in pre-Colonial times and subject to sporadic near-surface developments since then. Bob Allen, founder of Continental Gold, acquired the nucleus of the Buriticá Project in the late 1980s and developed a small underground operation on part of the Yaragua vein system in the early 1990s. It was not until 2008-2010 with the application of contemporary exploration techniques, concepts and exploration funding that the potential of the Buriticá Project began to be realized. Key factors leading to aggressive and successful drilling were the recognition from soil geochemistry programs and geological mapping that Buriticá contains large hydrothermal systems hosting high-grade carbonate-base metal-style precious metal mineralization, similar to that of Porgera in Papua New Guinea with potentially large vertical extents and tonnages.

By October 2012, Continental had reported NI 43-101 compliant mineral resources of 1.64 million oz gold at 13.6 g/mt in measured and indicated plus 3.8 million oz gold in inferred resources at 8.8 g/mt gold for the Yaragua and Veta Sur vein systems plus significant silver and zinc. All-in exploration costs were $9 per resource ounce of gold.

Exploration drilling has continued to expand the resource envelopes, demonstrating high-grade gold mineralization in the Yaragua and Veta Sur systems over 1,300 m vertical extent and, respectively, 900- and 750-m strike extents. Continental anticipates gold resources in Yargua and Veta Sur will exceed 10 million oz, down to elevations potentially developable from proposed underground infrastructure.

Underground development will be accessed from a 1-km ramp currently under way from a nearby valley, the site of proposed plant and tailings facilities. A final amendment to the Environmental Permit will complete the permitting process. Given the straight forward metallurgy of the deposits and a pre-feasibility study in 2015, Continental is aiming to develop Colombia’s first modern underground gold mine with production by 2018.

Exploration continues to unearth new prospects in the Buriticá project several of which, within 1 km of Yargua and Veta Sur, have been subject to initial drilling. Prime exploration tools are soil geochemistry, geological mapping (including LIDAR-based structural mapping), and attention to historical workings within a framework provided by an ever improving geological model and heliborne magnetics and radiometrics. Drilling of these targets will likely contribute to realizing additional multimillion ounce precious metal potential of the broader Buriticá project.