High-pressure grinding rolls offer potential energy, media-wear and extraction gains that producers find increasingly hard to resist

By Russell A. Carter, Contributing Editor

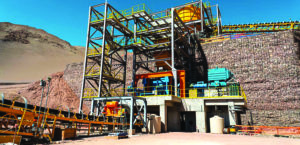

Fortuna Silver Mines, which recently began commissioning and ramp-up at its $320 million Lindero gold project in Argentina, included HPGRs in its tertiary ore crushing circuit, based on testwork that indicated HPGR-processed ore would provide higher extraction rates than that obtained using conventional cone crushers or a vertical shaft impactor (VSI).

On the evolutionary timeline of mineral processing technology, high-pressure grinding rolls (HPGRs) are neither a newcomer nor a relic of the past. Used commonly in cement production since the 1980s, HPGR technology was applied to iron ore and diamond processing in the following decade, and after the turn of the century established a firm foothold in nonferrous ore operations as well, with HPGR circuit installations in large concentrators at the Cerro Verde, Boddington and Morenci mines validating the technology for use in high-volume copper/moly and gold ore comminution.

The strong points of HPGR technology — lower specific energy consumption, reduced grinding media consumption, smaller machine footprint, higher availability — fit with current mineral producer initiatives to reduce overall comminution energy demand, accommodate harder and/or variable ore types, and streamline process circuit layout. A quick review of recent HPGR-related project announcements provides a yardstick for measuring the widening scope of interest and confidence process-plant operators have in regard to the technology.

For example, Lumina Gold Corp. recently completed two trade-off studies the company said will help form the basis of an updated Preliminary Economic Assessment for its Cangrejos gold-copper project in southwest Ecuador. One of the studies evaluated the addition of secondary crushing and HPGR to replace the SAG mills that were contemplated in the company’s June 2018 PEA. The second study evaluated the addition of a Carbon-in-Leach circuit to enhance recoveries and allow for the production of doré on site.

Based on the latest study, comminution operating costs for the HPGR circuit are estimated to be $3.75 per metric ton (mt) processed compared to $5.62 per mt for the SAG milling circuit that was used in the 2018 PEA.

Lumina said FLSmidth tested a master composite made from four PQ drill holes to evaluate the viability of HPGR. Testing included JKTech Drop Weight tests, Unconfined Compressive Strength tests, Bond Low Energy Crusher Work Index tests, Bond Abrasion Index tests, Bond Rod Work Index tests, Bond Ball Work Index tests and HPGR testing. The average Bond Ball Work Index for the 2019 master composite was 17.1 kWh per mt.

The study showed that on a per-ton basis, comminution circuit operating costs could be reduced by approximately 30%. Savings are driven by reduced costs for steel and lower power consumption. The study also showed that the HPGR circuit could be implemented for slightly less initial capital and equipment costs versus the conventional SAG mill circuit. The new circuit requires a lower connected power load, with an approximate 4-MW hour reduction at a 40,000-mt/d throughput.

Both studies, according to the company, showed potential for enhancements to recoveries and operating cost reductions. Lumina said it intends to integrate the addition of a CIL circuit and HPGR into its updated PEA, which it expects to release in the second quarter of 2020.

NLMK Group, a steelmaking company with operations in Russia, USA and the European Union, commissioned four additional HPGR units to boost productivity at its Stoilensky beneficiation plant in Russia by 800,000 mt of iron ore concentrate to 17.4 million mt/y. As a result, the plant can now cover 100% of the group’s blast furnace needs for iron ore concentrate with Fe content higher than 65%.

NLMK began implementing HPGR technology in each of the plant’s four process lines in 2016. The first four grinding rolls supplemented traditional cone crushers and ball mills, and enabled the plant to boost the productivity of the sections by 12.5% and to grow iron ore concentrate output by 1 million mt to 16.6 million mt/y. The plant also was able to significantly decrease the consumption of energy and grinding media required to process the ore.

Konstantin Lagutin, NLMK group vice president of investment projects, said, “Over 1.5 years of operation, the HPGR technology proved to be efficient and reliable. We have now launched HPGRs at Sections 2 and 3, completing the upgrade of the entire beneficiation plant. This will enable us to increase primary iron ore processing up to 37 million mt/y, up by 5 million mt/y in 2013, and become 100% self-sufficient in iron ore feedstock.”

Each HPGR unit replaced two conventional crushers. As explained by NMLK, because HPGR units not only crush the ore, but also break up its crystalline structure, the downstream stages at Stoilensky receive ore that is more ductile for further grinding, which delivers an increase in overall end-to-end productivity.

The company said its total cost to install HPGR technology at Sections 2 and 3 was 4.5 billion rubles ($58.9 million).

Eldorado Gold Corp. recently predicted a 15-year mine life for its Kışladağ operation in Turkey, based on long-cycle heap-leach testwork and the replacement of the tertiary crushing circuit with a $35.8 million HPGR circuit. The company said the addition of the circuit has increased expected recoveries to around 56%, and it believes there is potential for further increases in recovery with optimization of the HPGR circuit, which could lead to higher gold production.

Los Andes Copper, in an update on work conducted to progress a prefeasibility study on the company’s Vizcachitas project copper-molybdenum porphyry deposit in central Chile, said studies on the feasibility of using an HPGR circuit are progressing and show the potential for enhanced project economics, lower energy consumption, reduced maintenance and increased operational flexibility. HPGR technology has been identified as the most attractive grinding alternative, given the data obtained from the preliminary testwork conducted to date.

The Weir Group recently won a £100 million ($128 million) order to provide process equipment to the Iron Bridge magnetite project, a joint venture between Fortescue Metals Group subsidiary FMG Magnetite and Taiwan-based Formosa Steel. The order includes Weir’s Enduron HPGRs and GEHO pumps. According to Weir, the equipment will allow the customer to reduce energy consumption by more than 30% compared to traditional mining technologies.

The $2.6 billion project is located 145 km south of Port Hedland in the Pilbara region of Western Australia. When fully operational, annual production for the project is targeted at 22 million wet mt/y. Delivery of the first ore is expected in 2022.

Ten thousand miles away in the Iron Range district of Minnesota, USA, Weir joined with the Natural Resources Research Institute of the University of Minnesota in a project to expand testing and knowledge of HPGR applicability to the taconite mining and processing sites in the region, where it’s not uncommon to see concentrators with as many as 18 rod mills — comprising the type of highly energy- and consumables-hungry operation that iron-ore companies would like to replace with more efficient processes. However, the scope of the project extends beyond the Iron Range as well.

“NRRI has done a lot of testing for many of our projects,” said Tim Lundquist, Weir HPGR manager for North America, speaking to June Breneman, a communications specialist at NRRI. “The proximity to the Iron Range is key, but we’ll also bring in material from all over the U.S., Canada, and elsewhere when it makes sense. Our preference is to work with NRRI whenever possible due to their flexibility, expediency and expertise.”

NRRI acquired the HPGR via Weir Minerals from the shuttered Magnetation iron ore tailings recovery operation in Grand Rapids, Minnesota. Both organizations are sharing the cost of maintenance.

thyssenkrupp’s new HPGR Pro model uses rotating sideplates on the fixed grinding roll — a design innovation claimed to enable improved material feed and up to 20% more throughput compared with conventional HPGR designs.

New in the Market

New-generation HPGR models are starting to enter the market, claiming to offer performance improvements that will increase throughput and reduce energy and maintenance costs even further. The most recent new-gen version is thyssenkrupp’s HPGR Pro, which the company said draws upon operational knowledge gathered from 40 years of mineral-processing experience and more than 150 HPGR installations worldwide.

The new HPGR offers more throughput from the same-sized machine: according to the company, this results from using rotating side-plates on the fixed grinding roll. The rotating plates enable improved material feed and up to 20% more throughput compared with conventional HPGRs. At the same time, the specific energy consumption of the HPGR Pro is reduced by around 15%.

The uniform pressure profile in the milling gap results in better grinding and more even roller wear, improving the service life of the rolls by up to 30%. By reducing the so-called bathtub effect —accelerated wear in the center zone of the roll surface — the rolls can last longer before replacement is required.

Thyssenkrupp said a certain amount of roller skew, or uneven gap, is beneficial as it ensures uniform grinding, and the HPGR Pro provides a unique control feature that prevents excessive skew.

HPGR Pro rolls are lubricated with oil, not grease. This, according to thyssenkrupp, prevents excessive temperatures from developing during high machine usage and provides for easier cleaning. Optimized bearing seals, oil quality monitoring, and continual filtering also reduce contamination and environmental impact, while continual filtering allows the oil to be used longer.

The HPGR Pro also offers a stud detection system, automatically monitoring and measuring the condition of the studs and rolls by laser. The operator is kept constantly informed about the state of the studs and the rolls. “In this way, the stud detection system can predict the best possible time for roller replacement. Our customers no longer need to stop the machine as a precautionary measure, which saves them valuable time and money,” said HPGR Global Product Manager Frank Schroers. “As our specialists collect and process machine data, our customers can continually improve their HPGR’s operation and optimize throughput, energy consumption or machine availability in line with their specific targets.”

As mentioned in the September issue, Metso Outotec will introduce the next generation of its HRC HPGR technology, plus a retrofit kit that allows HRC technology to be applied to competitive HPGRs. Although details haven’t been released, major features anticipated for the new version include a smaller physical footprint and revised foundation requirements, lower machine height, a high level of component commonality with existing machines, and lower capex through elimination of items such as the transport cart and stabilizing hydraulic cylinder.

The company has strongly promoted the benefits of using larger HPGR models, such as its HRC3000, in high-capacity applications. Claimed advantages range from higher machine availability due to less ancillary equipment, such as conveyors, chutes, bins and transfer points, to reduced capex and opex resulting from the ability to buy, operate and maintain fewer HPGRs when a single machine can process 70,000 t/d or more of fresh feed.

Metso Outotec’s HRC machines were the first to offer flanged rolls in combination with an anti-skew system optimized for this type of roll design, with the objective to reduce “edge effect” comminution-performance falloff near the sides of the HPGR rolls, while protecting the rolls from uneven wear pattern and tramp metal damage.

Weir Minerals, noting that segregated feed problems can result in highly uneven particle sizes across the width of the feed — and consequently, strong abrasive pressure on one side of the roll and insufficient pressure on the other — strongly endorses the concept of dynamic skewing for HPGRs. Weir claims its unique HPGR bearing design, in combination with effective edge guards, reduce wear and promote better grinding. In a white paper released in October 2019, the company explained that to accommodate uneven pressure conditions, its Enduron HPGRs use a unique spring-loaded lateral wall that reduces the edge effect (maintaining a gap of as little as 1 mm) and is specifically designed to facilitate roll skew.

Henning Knapp, HPGR process team leader for Weir Minerals, explained: “The degree to which the Enduron HPGRs skew is largely dependent on the width of the roll, with longer rolls skewing about 5 mm for every meter the roll is wide. However, the effect of even small changes can be significant on local pressure peaks.” Knapp also emphasized that skewing must be managed by an advanced control system that guides the rolls to meet desired output pressure. “This system also ensures the skew isn’t too great or maintained for too long, which both disrupt the compressive bed,” he added.

Examining Energy Efficiency

As HPGRs continue to be applied more widely in mainstream process-circuit design, their economy of operation, reliability and ease-of-maintenance features will gain additional importance — along with closer scrutiny. For example, while HPGR energy efficiency when compared with conventional ball and rod mills has been a selling point, at least one industry expert recommends taking a wider look at potential energy-reduction benefits.

A paper* presented by Grant Ballantyne, Ausenco’s director–technical solutions, at the 2019 SAG conference held in Vancouver, British Columbia, reported on studies that looked at not just the comminution energy intensity associated with grinding-mill motor power, but also at the power demands from ancillary equipment such as conveyors and pumps. According to the paper “…dry comminution circuits, such as those incorporating high pressure grinding rolls (HPGR), may have a power advantage in rock breakage but use more power in material transport as they typically require an extensive conveyor system.”

One case study examined the trade-off between a SAG mill and HPGRs at a gold mine where HPGRs are operated dry and, therefore, the material is transported on conveyor belts, which can require additional power in comparison to SAG-based circuits. Additionally, HPGR circuits still require similar sized pumps to feed the hydrocyclones in the wet ball milling circuit. This ancillary power “…is not always considered in trade-off studies and has the potential to erode some of the energy benefit of HPGRs,” according to the author, who also noted that updated circuit design and other process-line innovations can preserve the comminution energy efficiency benefits of HPGRs even when ancillary energy is included.

Another approach for ensuring HPGR energy efficiency is recommended by lubricant supplier Klueber, which pointed out that when choosing the optimum gear oil for an HPGR application, determining the best balance of lubricant characteristics can be a challenge. Selecting a base oil with a high viscosity maintains thick oil films at higher temperatures. This lowers the coefficient of friction between metal-to-metal surfaces and enables high gear efficiency. On the other hand, selecting a highly viscous oil produces energy losses due to the hydrodynamics of moving mechanical components through a thick fluid.

To assist customers in making the right choice of lubricant for their HPGRs, Klüber Lubrication offers a free program called KlüberEnergy, a service that measures the energy efficiency contribution of lubricants in specific applications, with the purchase of oil. Using a detailed methodology to measure power consumption of a system before and after a lubricant “retrofit,” KlüberEnergy technicians measure baseline energy consumption and other critical parameters over a month’s period to determine the kWh per ton with the existing oil under typical loads. This measurement provides a key performance indicator (KPI). The gearbox is retrofitted with the recommended gear oil from Klüber, and the KlüberEnergy team then waits several weeks for the new oil to circulate and react to gear surfaces before performing post-retrofit measurements. Comparing the performance of the two lubricants provides positive proof of kWh, cost and greenhouse gas reductions.

In one notable application, KlüberEnergy was called to monitor an HPGR installation at a South American iron ore producer. For both the baseline lubricant and the Klübersynth GH 6-320 that was recommended to replace it, KlüberEnergy recorded three variables every 10 minutes for over a month: power consumption, distance between rollers and in-feed rate. Once this vast volume of data was collected, KlüberEnergy experts calculated the pressure based on roller distance and in-feed rate measurements. They then analyzed the pressure in relation to power consumption.

The pressure and power consumption were then charted to compare the performance of the baseline lubricant and Klübersynth GH 6-320. KlüberEnergy used the median of all measurement values to calculate the company’s savings percentage. When KlüberEnergy compared measurements between the two oils, Klübersynth GH 6-320 saved more than 68.4 MWh per month in electricity. This reduced costs by $40,284 per year, yielding a simple payback in four months. When calculated over a full year, the oil saves 820.8 MWh in electricity use, which reduces greenhouse gas emissions by 580 mt, according to the company.

Meanwhile, other well-known industry suppliers have developed solutions designed to support HPGR power efficiency and minimize the duration of maintenance and repair shutdowns. For example, Siemens has extended its Simine digital-solutions portfolio for HPGRs to include a new controller with plug-and-play functionality which, the company said, makes the load share controller immediately useful.

According to Siemens, the new load share controller follows a proven control scheme: At HPGR startup the controller is inactive, but when a specific torque level is reached the unit assumes load-share control. If the controller is not available — such as in the event of an operational disruption — the drives do not start. Operation without load sharing is available, however; in that case, the drives take the speed reference from the mill automation.

This custom Turning and Locking (TL) system is designed by Twiflex to allow operators at a Turkish gold mine to slowly and safely turn and lock the twin grinding rolls of a large HPGR for repairs or maintenance shutdowns.

Noting that load distribution between the rolls in an HPGR is generally 50-50, Siemens said the master follows the speed command and the slave follows the torque of the master. If an alternative load distribution is required, it is possible to change the load distribution between the drives using the load distribution factor. The reference torque on the slave drive is then decreased or increased compared to the reference torque of the master drive. At the same time, the load share controller maintains the speed difference between the rolls within given limits. A process engineer can, via a web server-based operator interface, adjust the load share factor and limitation for speed difference at any time, even during the grinding operation.

In another example — a case history provided by Brunel Corp. — the company sought a reliable power transmission solution involving an HPGR custom gear Turning and Locking (TL) system for process equipment supplier FLSmidth.

It was needed for a new dual-drive, 2,000-kW HPGR going into service at a gold mine in Turkey. TL systems are designed to slowly turn and lock the twin grinding rolls, allowing for safe repair/replacement of worn tires during scheduled maintenance shutdowns. A chain/sprocket inching drive — slow to install and cumbersome to operate — was previously used to perform this task.

Based on prior successful project collaborations, Brunel contacted Twiflex, part of Altra Industrial Motion, for assistance. Twiflex supplied a TL system comprising a turning gear which engages with a 1,000-mm-diameter (39.3-in.) gearwheel mounted on the output flange of a Brunel torque limiter. The turning gear includes a 1.5-kW motor with a gearbox to produce breakaway torque of 3,760 Nm (2,773 lb-ft) and output torque (continuous turning, bidirectional) of 1,580 Nm (1,165 lb-ft) at a nominal turning speed of 5.2 rpm. A frequency converter was included to allow the turning speed to be controlled between 1.3 rpm and 5 rpm.

The bidirectional turning gear is designed to turn the grinding rolls clockwise or counter-clockwise and is rated for continuous operation. A hand-operated clutch mechanism is used to engage and disengage the drive with a limit switch fitted to indicate its position. The system includes a manually operated tooth-locking device with a rated torque of 52,000 Nm (38,353 lb-ft), that locks the gearwheel in place. The status of the locking device is monitored using limit switches (i.e., lock on/lock off).

The Twiflex TL system also included an operation panel for local control of the turning gear. A plug-in handheld corded pendant was supplied for remote control of the turning gear close to the equipment. Brunel engineered and delivered a neatly packaged solution that incorporated all the components into a compact footprint assembly.

*Quantifying the Additional Energy Consumed by Ancillary Equipment and Embodied in Grinding Media in Comminution Circuits, G. Ballantyne, and University of Queensland, Sustainable Minerals Institute, Julius Kruttschnitt Mineral Research Centre.