|

| Underground development at Driefontein. Sibanye Gold is investing in development to secure its future. |

With the gold price having slumped from its recent highs, producers worldwide are having to come to terms with a new economic framework. Rationalization and cost-trimming are key tools to keeping operations afloat

By Simon Walker, European Editor

For anyone who has invested in physical gold, gold-related stocks or other financial vehicles, the past two or three years must have been somewhat depressing. As the gold price slid from its peak of around $1,883/oz in August 2011, its decline was echoed by the value of producer shares. And, as the price continued downhill, companies with higher-cost operations found themselves in the unenviable position of seeing margins squeezed tighter and tighter as production costs continued to climb.

As the world’s iron-ore producers have also discovered, widespread investment in new capacity is all well and good so long as the market is there and the commodity price remains high enough. Thankfully for the gold industry, recent price falls—although painful—have not been on the same scale proportionately as for iron ore; had that been the case, precious few operations would now be viable. So, faced with reduced income and a rising cost-base, the general approach worldwide has been to retrench to core strengths while divesting assets that do not fit the template. At the London Bullion Market Association’s 2014 Precious Metals Conference, held in Lima, Peru, in November, the title for the mining and production session was apt indeed: “When in a hole, stop digging.”

In point of fact, it would be untrue to say that most of the major gold-producing companies have followed this advice to the letter, but they have done the next-best thing by focusing on how to trim fat from their costs. Indeed, taking a handful of the world’s leading producers as examples, Newmont’s output in the first nine months of 2014 fell by just 1% from 2013, while Kinross’s production year-on-year was almost identical. Barrick, by contrast, produced 4.7 million oz in the first nine months of 2014, compared to 5.5 million oz in the comparable period in 2013.

In terms of third-quarter output alone, Kinross reported an increase for the period compared with 2013, while production at both Barrick and Newmont was down about 10% as the companies focused on resources with better viability. However, all three companies reported all-in sustaining costs reduced from third-quarter 2013, responding to the need to weed out unnecessary expenditure and streamline their operations.

Each April, Thomson Reuters GFMS (GFMS) publishes its Gold Survey, analyzing the previous year’s production, markets and holdings, with updates issued in September to cover the first half of the next year, and in late January to provide an overview of the 12 months before the new edition comes out. E&MJ acknowledges the company’s role in this respect as a leading source of information for this article. In addition, since most companies will have issued their fourth-quarter reports only after this edition of E&MJ has gone to press, much of the data included here are based on third-quarter reports, together with individual companies’ market guidance relating to predicted full-year output and costs.

A SAFE HAVEN?

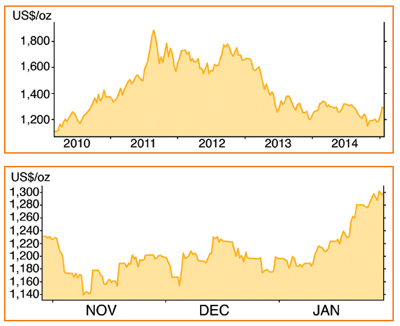

Even before the announcement on January 22 by the European Central Bank (ECB) of its €1.1 trillion quantitative easing (QE) program, gold had begun to climb from the floor at or below $1,200/oz that it had maintained since October. Starting at $1,183 on January 3, the price briefly breached $1,300 on January 22, while in euro terms, it rose to its highest level in nearly two years as the European currency dropped in value against the dollar. Aside from anticipation over the strategy to be adopted by the ECB, another factor in the increase was the Swiss National Bank’s decision to allow the currency to float—which triggered a 5% rise in spot gold prices.

So what is the longer-term impact of the Eurozone QE program likely to be on gold? “If successful, QE could restore some calm and dent gold’s appeal. However, the positive economic impact of QE is unlikely to be seen for many months and while confidence can increase immediately, it is a fragile thing,” Australia’s Macquarie Bank was quoted as saying at the time. “There’s a possibility that Eurozone QE won’t work, that the economy will get worse and breakup fears will reignite,” added Macquarie analyst Matthew Turner. “QE has always been seen as the backstop—after that, who knows? Gold benefits when it looks like central banks are losing control.”

|

| Five-year (upper) and last-quarter (lower) gold price movements. Source: BullionVault |

Both high inflation and deflation can be positive factors, Macquarie said, pointing out that the Eurozone’s biggest impact on gold thus far was in 2012, when the possibility of a breakup became increasingly real. “That is probably why gold has done well in January,” the firm added, “because some of the central bank decisions have at times smacked of panic.

“The gold price has rallied 10% to $1,300 and that’s in a U.S. dollar, which is firming thanks to the Federal Reserve now being seen as a model of sobriety compared with its peers. Measured in euros, gold is up 15% year-to-date as markets have dumped the single currency in anticipation of further monetary policy easing,” Macquarie said, noting that investors had bought more gold in the first three weeks of January via ETFs than in any month since August 2012.

However, in a note posted on Bullion-Vault, analyst Adrian Ash quoted a reality check from the U.K.-based consultancy, Capital Economics. “We are still wary of getting carried away,” the firm said. “The recent gains are small compared to the much bigger declines that have gone before,” referring to gold’s near 40% slide from its mid-2011 peak.”

Ash also quoted Standard Chartered Bank senior investment strategist Manpreet Gill as saying, “We expect the fed to begin raising rates this year. That is negative for gold because it begins to reduce the excess supply of dollars that we have seen in the past few years.”

|

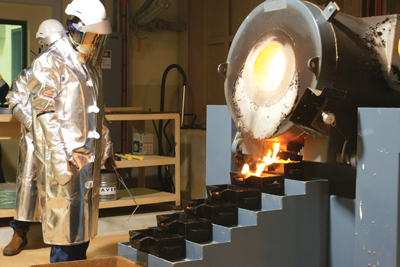

| Pouring gold at Newmont’s Akyem mine in Ghana, which is expected to produce up to 450,000 oz/y. |

MARKET OVERVIEW

According to data compiled by GFMS, new-mined production totaled 1,481 metric tons (mt) in the first six months of 2014, 4% higher than in the corresponding period in 2013. On that basis, GFMS predicted 2014 full-year production of more than 3,100 mt, compared with 3,054 mt for 2013 and 2,870 mt in 2012.

“This continuing upward trend is chiefly the result of a number of large new mines ramping up to full capacity,” the company explained, “reflecting the realization of earlier investments, which in the most part had been made prior to gold’s dramatic price falls. This has been combined with an industry-wide drive to optimize operations to a position of improved revenue (per tonne of ore), which as a result has seen many producers sustain the high production levels achieved last year [2013].”

The main problem for producers, however, is that output is continuing to rise while demand seems to be slackening, and while the market was in physical deficit by some 684 mt in 2013, midway through 2014, GFMS expected there to be a surplus in both physical and net (taking ETF and exchange inventory builds) terms. And that, of course, is not a positive augury for prices going forward.

Indeed, in late January, Goldman Sachs downgraded its price projections for the next three years from a level of $1,200/oz to $1,262 in 2015, $1,089 in 2016 and $1,050 in 2017. “In our view, the macro environment, primarily a stronger U.S. dollar, continues to provide a headwind for the gold price,” analyst Andrew Quail was reported as saying.

And Goldman Sachs is not alone in its bearish perspective for the future. A recent article on BullionVault noted that the majority of precious-metals analysts questioned envisage a flat or falling price, with predictions for 2015 ranging from $1,255/oz down as low as $1,025. Few bulls could be found in the paddock, although Frederic Panizzutti, CEO of Switzerland-based MKS, and the winner of the London Bullion Market Association’s 2014 gold forecast competition, believes that a $25 rise this year is justifiable. Panizzutti’s prediction is for a high of $1,390 and a low of $1,150/oz, with the year average at $1,292.

“Persistent talks about interest rate hikes for the second or third quarter and a strong U.S. dollar will prevent gold from significantly rallying in the first half,” Panizzutti was quoted by Bloomberg as saying. “The official sector shall continue to be increasingly on the buying side,” with the potential for a “stock market correction” in the second half of the year then spurring prices higher.

|

| The processing plant at Kibali in the DRC, opened by Randgold Resources, AngloGold Ashanti and Sokimo last September. |

THE WORLD’S GOLD LEADERS

In its September update report, GFMS listed the world’s top 10 gold producers as being Barrick Gold, Newmont, AngloGold Ashanti, Goldcorp, Kinross Gold, Newcrest Mining, Navoi MMC, Gold Fields, Polyus Gold International and Sibanye Gold, in that order. Reliable data are available for all of them apart from Navoi, the Uzbek state uranium and gold company, for which GFMS estimated its probable output at around 1.16 million oz for the first half of 2014.

In the absence of full-year production figures ahead of this edition of E&MJ going to press, the table above shows production and all-in sustaining cost data for the other nine companies.

With the exception of Sibanye Gold, which has only existed as a separate company since 2013, the last few years have played havoc with the major gold producers’ share prices. As an example, Barrick was trading in late January at $12.20; at its peak in April 2011, investors valued each share at $55.60. AngloGold Ashanti’s decline has been even more severe, from $51 to $10.60 over the same timeframe.

By contrast, shareholders in Goldcorp have done somewhat better, if only in relative terms, since the price has merely halved. Whatever the fall, the message is clearly the same: profitability has been squeezed, the capacity to pay dividends has reduced, and investors have lost confidence in the gold sector. And a knock-on to that, of course, is that even the big producers are now finding it more difficult, and more expensive, to find financing.

THE DEAL THAT DIDN’T GET DONE

Yet again, initial good intentions failed to get beyond the discussion stage, with early 2014 marking the third time in seven years that Barrick and Newmont had investigated merger opportunities. By April, it was all off, with both parties suggesting that the other was to blame, although midyear noises from both boardrooms indicated that the concept remains open for revisiting in the future. Analyst views suggest that there could be billion-dollar savings to be made by combining the two companies’ Nevada operations at least.

Meanwhile, Barrick has had its own problems continuing at Pascua Lama on the Argentina-Chile border, with the company saying that it remains committed to advancing the project in an environmentally responsible manner, respecting legal and regulatory requirements. In September, Barrick predicted full-year production of 6.1-6.4 million oz at an AISC of $880-920/oz, having achieved 7.16 million oz at an AISC of $915/oz in 2013.

Newmont has continued its policy of divesting non-core operations, with its Midas mine in Nevada the first to go in 2014. This was followed by Jundee in Western Australia, and the company’s 44% holding in the Penmont joint venture in Mexico, which Newmont sold to Fresnillo for $450 million in September. That brought the company’s total revenue from noncore sales to nearly $1.4 billion in 18 months.

These divestments followed the successful opening of the Akyem open-pit mine in Ghana, which came on stream in late 2013 at a development cost of $950 million. Output is scheduled to be 350,000-450,000 oz/y at an AISC of $750-850/oz for the first five years of an estimated 16-year life. The company’s next overseas project, Merian in Suriname, which carries a $950 million to $1 billion capex requirement, received a boost in November with the government taking up its 25% equity stake. Construction is under way, with Newmont predicting production of 400,000-500,000 oz/y from a 4.2-million-oz reserve base.

In its third-quarter report, AngloGold Ashanti noted that it had cut its AISC by 10% year-on-year, albeit to $1,036/oz. The company sold its Navachab mine in Namibia in midyear, and has now cut back production from its historic Obuasi mine in Ghana pending the completion of a study into reopening it as a fully mechanized operation. Obuasi still holds 8.14 million oz in proved and probable reserves within a 27.4-million-oz resource.

However, the highlight for AngloGold Ashanti recently was the commissioning of its joint-venture Kibali mine in the DRC in September 2013. Operated by Randgold Resources, Kibali is currently an open-pit operation with underground mining scheduled this year. Within days, the company had also achieved the first pour at its new Tropicana mine in Western Australia, the ramp-up of both operations helping it to 8% higher production for the September 2014 quarter than in the previous year. AngloGold Ashanti has also announced a maiden resource estimate for Nuevo Chaquiro at its Quebradona project in Colombia, which it describes as being “not only an excellent addition to its long-term pipeline, but is also an eminently marketable asset.”

|

| Headframe construction at Goldcorp’s Éléonore mine in northern Québec, which came on stream in October. |

ÉLÉONORE STARS FOR GOLDCORP

Goldcorp’s red-letter day for 2014 came with the opening in October of its Éléonore underground mine in the James Bay region of northern Québec. Built at a cost of between $1.8 and $1.9 billion, the mine is scheduled to ramp-up to design throughput of 7,000 mt/d by 2018.

Three months earlier, Goldcorp had also brought its Cerro Negro mine in Argentina into initial production, with construction completion expected this year. Capex has totaled $1.65-1.7 billion. Noncore assets divested during 2014 included the Wharf mine in South Dakota and Marigold in Nevada; in January, Goldcorp reinvested its returns from these sales on buying Probe Mines, whose principal asset is the Borden project located around 160 km west of Goldcorp’s Porcupine mine in Ontario.

One of the few main producers to have published preliminary data for full-year 2014 during January, Goldcorp reported total production of 2.86 million oz, 11% higher than in 2013 while its AISC was cut by 6% to $950/oz. The company is predicting output of 3.3-3.6 million oz this year.

Having come unstuck over Fruta del Norte in Ecuador, Kinross Gold closed the sale of the project to Fortress Minerals in December, realizing $240 million. The company is now focusing on whether to spend some $1.6 billion on expanding its Tasiast mine in Mauritania, with the aim of achieving nearly 850,000 oz/y from the operation during 2018-2022. One of the few Western companies with operations in Russia, Kinross opened its newest mine there, Dvoinoye, in October 2013.

In May, the premier of New South Wales was on hand to officially open Newcrest Mining’s Cadia East block-cave mine, the latest addition to the company’s Cadia Valley production portfolio. By October, the first panel cave had propagated through to surface, significantly ahead of expectations. Developing Cadia East required an expansion to the Cadia Valley processing plant from 24 to 26 million mt/y, with capex of some A$2 billion in all.

In December, Newcrest announced that its Golpu prospect in Papua New Guinea, in joint venture with Harmony, has reached feasibility study. Now split into two stages, each involving the development of block-cave mines, Golpu has some 20 million oz in gold resources, plus 9 million mt of copper. Capex estimates are $2.3 billion for stage 1, and a total of $3.1 billion.

SIBANYE LOOKS TO THE FUTURE

Listed in February 2013 following Gold Fields’ spin-off of most of its remaining South African gold mines, Sibanye Gold now has a four-strong portfolio of operations: Kloof, Driefontein, Beatrix and Cooke, which the company acquired from Gold One in 2013. It is now the leading South African gold producer.

Sibanye reported record output of 424,700 oz during the September quarter, with output from Cooke—which also has significant uranium co-production—boosting the total, then broke this record again in the last three months of the year, to end 2014 with full-year production of 1.59 million oz. Its full-year AISC of $1,080/oz reflected higher expenditure on underground development, the company noted, as it continues to invest in its future.

In January, before its official results were presented, Gold Fields predicted attributable production of some 2.22 million oz for 2014, at an AISC of $1,060/oz—6% lower than previously estimated. The only operation it retained in South Africa following the formation of Sibanye was South Deep, where it is working on an extensive ground-support remediation program that has had a significant impact on the mine’s output. It has also used a team from Australia to help train the workforce at the mine and develop what it refers to as “a true mechanized mining culture” there.

The largest individual Russian gold producer, Polyus Gold International, is currently undertaking a major pit-wall push-back at its Olimpiada mine, and has slowed construction at its major development project, Natalka, over resource data concerns. Commissioning has been put back from mid-2015, with new geological interpretation of the deposit indicating a 55%–65% cut in the reserve estimates.

Finally, Navoi. Subject to strict state secrecy, very little data are available about the company’s gold operations, which are centered on the huge Muruntau open-pit mine. The article by Vladislav Vorotnikov in E&MJ (June 2014, pp.82-87) gives an insight into the scale of operations there.

DID 2014 SEE PEAK PRODUCTION?

In the face of indifferent demand from traditional sectors such as jewelry, and from consumers in China and India, can the gold industry sustain the current level of production? No, according to a number of analysts, who are of the opinion that new-mined production may, in fact, have peaked last year. The new, low cost-engineered mines that have come on stream recently will only serve to replace high-cost capacity that is forced out of business, they say, rather than adding to the production total in a low-price environment.

So, what might change the situation, for better or for worse? Speaking at a forum organized in mid-January by Thomson Reuters, INTL FCStone analyst Ed Meir predicted a trading range of $1,100 to $1,400/oz during 2015. “The low side of the range could be reached in the wake of continued strength in the dollar, a recovery in global equity markets, and a march toward higher interest rates in the U.S.,” he said. “Conversely, we could see rallies toward $1,400 on account of economic dislocations, which we suspect will be the primary upside drivers for gold (and not inflation fears) going forward.

“These will include such possible events as another euro crisis, Russian banks experiencing credit problems, defaults taking place among high-yielding energy junk bonds, or a rash of credit defaults in China,” he said. “These are the various ‘push-and-pull’ themes we see playing on gold over the course of the year.”

MINE PRODUCTION REACHES NEW RECORD; DEMAND SLUMPS; DOLLAR PRICE SLIDE CONTINUES IN 2014

Published on January 29, the second update to the GFMS Gold Report painted a mixed picture on the supply side, and a somber one in respect of demand. While GFMS estimated new mine production of 3,109 mt during 2014, scrap supply fell sharply in response to lower prices, meaning that total annual supply was essentially unchanged at 4,273 mt. At 4,041-mt demand, by contrast, was 18.7% down year-on-year, reversing a 695-mt deficit in 2013 to a 232-mt surplus. Jewelry demand was 11% lower overall; in China, it was 33% down.

On a country basis, China again topped the producer list at 465.7 mt, followed by Russia (272 mt), Australia (269.7 mt), the USA (200.4 mt) and Peru (169.3 mt). Production in both Canada and Argentina grew by 15%, while the USA saw a 12% decline. Barrick, Newmont, Newcrest and Polyus all produced less gold in 2014 than in 2013, whereas the other companies on the top-10 list posted production increases.

Following last year’s price fall, GFMS expects many producers to be recalculating their reserves and maybe revising their mine plans with the possibility of further impairments. However, all may not be lost. “We expect fresh pent-up demand later this year to give price support and start to reverse the prevailing bear market,” the company said.