Hatch provides detailed engineering to enable the Sierra Gorda molybdenum flotation plant in Chile to integrate smoothly into the main concentrator plant. (Photo: Hatch)

E&MJ explores the sustainability of a time-honored beneficiation technique

By Carly Leonida, European Editor

As we look to the future, the mining industry faces a myriad of challenges. While demand for metals like copper, cobalt, lithium and iron ore is projected to reach record highs by 2050, ore grades are decreasing, orebodies are becoming more complex, and fewer tier 1 deposits are being discovered.

As metal prices increase, lower-grade orebodies are becoming economically feasible. But, with lower grades come higher tonnages to sustain production. Processing these deposits requires ever finer grinding for mineral liberation and significant flotation residence times. Lower grades mean that quantities of tailings and mine waste generated are also increasing. And, for many operations, their management is now a significant liability.

In many countries, water scarcity is a big constraint, and specific energy consumption and carbon emissions are rising as grades decrease; points that are at growing odds with mining companies’ efforts in improving their environmental, social and governance (ESG).

Given this backdrop, it’s pertinent to ask whether traditional beneficiation techniques like flotation, which have been a staple part of mineral processing circuits for more than 100 years and can, in some instances, be water, energy and time intensive, still serve the industry’s needs?

Is it time to rethink flotation’s place in flowsheets, or can new technologies allow us to pivot and harness this time-honored technique in new and innovative ways?

Engineering in Efficiency

“It’s not just flotation; mineral processing as a whole faces increased challenges,” said Paolo Donnini, principal process engineer at SNC-Lavalin. “We need to be smarter in how we go about extracting metals and minerals using less energy, smaller equipment, lesser footprints, less concrete… everything really,” he said.

Dr. Chris Anderson, specialist process engineer, and Marc Richter, AEM regional director for minerals processing at Hatch, agreed. “Sustainable and effective changes in mining practices are essential to enable progress in value chain efficiencies, while recognizing the obligations to other important factors such as climate change,” Richter said.

At a macro-level, efficiency in flotation can be driven using holistic engineering approaches. For example, Hatch offers two solutions — Mine to Mill and Grade Engineering — that aim to increase the overall efficiency of mineral processing operations, inclusive of flotation.

Richter explained: “Mine to Mill is a consolidated approach focusing on optimizing mining operations across the value chain with a specific focus on mining (run-of-mine fragmentation), comminution and separation. Optimizing each stage in isolation can result in sub-optimal performance of the overall operation and reduce profitability. To get the best results, each stage is optimized considering the preceding and subsequent stages.”

This approach increases plant throughput, reduces energy consumption and operating costs, and improves process efficiency. It can be applied to greenfield projects or business improvement initiatives on existing assets. Typical projects see noticeable throughput benefits with a short payback time.

In December 2020, Hatch announced it would commercialize Grade Engineering, an integrated and methodical approach for assessing the viability and implementation of coarse separation options in preconcentration.

“Grade Engineering is designed to reject low-value material early in the extraction value chain to provide high-quality feed,” Richter said. “By reducing uneconomical material early in the process and improving the quality of the processed ore, Grade Engineering improves overall metal production and reduces water and energy intensities, while minimizing wet tailings.”

Anderson added: “Through Grade Engineering, we have worked with several clients to develop coarse particle flotation (CPF) circuits aimed at reducing energy consumption in comminution, while ensuring liberation of the valuable metals in the deposit. These projects included evaluating options for the recovery of coarse valuable-bearing composites in the primary grinding circuit and early gangue rejection; and recovery of coarse value-bearing composites lost to conventional flotation tailings.”

In the right applications, CPF can offer a reduction in energy demand in preceding comminution stages, increased production rates, and result in coarser tailings streams, which are easier to handle and more geotechnically stable.

The limitations of conventional flotation cells can be overcome through the use of fluidized-bed flotation machines, like Eriez’s HydroFloat, which are specifically engineered for the selective recovery of feeds containing very coarse particles. However, the coarsest particle size that can be floated will depend on the liberation of the valuable mineral.

“We’re also currently implementing a project in North America to install Woodgrove Staged Flotation Reactors (SFR) in a cleaner-scalper application, and several projects looking at Eriez StackCells as a retrofit to either a pre-rougher or rougher application where the client is seeking additional residence time in a constrained footprint,” Anderson said.

Dissecting the Flotation Process

Conventional flotation cells are known to be relatively inefficient in terms of promoting particle-bubble contacting. However, the historical approach is to compensate by adding a scale-up factor to the residence time obtained through bench-scale tests. This approach is increasingly limited in circuits, which are fine grained, requiring long residence times and complex cleaning circuits to achieve the necessary grade.

Technologies such as the Jameson cell and column cell have been substantially improved over the past 20 to 30 years and are increasingly viewed as mature technologies. The Jameson cell in particular can be used to develop compact full-plant solutions, which offer some attractive advantages. Newer technologies such as the Woodgrove SFR and Direct Flotation Reactor (DFR) cell are also gaining interest in large-scale installations.

The Eriez HydroFloat cell is seeing significant interest in coarse particle rejection applications in copper and PGMs (more on this later). If successful, CPF may eventually become a standard in flotation applications where gangue can be liberated at coarse sizes (~500 microns). Other technologies such as the NovaCell are also gaining traction in this space.

Anderson explained: “Our role is to help the client through the process development and bring newer technologies into consideration as early as possible, particularly in the conceptual and prefeasibility phases.

“Columns and Jameson cells can be simulated using traditional batch flotation tests and HydroFloat performance can be inferred based on mineralogy and liberation information. Ultimately, pilot-scale test work must be performed. However, the information derived from early mineralogy and bench-scale tests can be used for trade-off studies to focus in on high-value alternatives.

“I think low-footprint technologies such as Jameson cells and Woodgrove cells may prove disruptive as they allow substantial throughputs with a low footprint. In the long term, these technologies may find applications closer to the mining face, especially for underground applications.”

Like Richter and Anderson, Donnini has noticed a growing interest in novel flotation technologies over the past five years and, more importantly, a willingness from mining companies to consider their applicability and economic feasibility.

“We’re starting to dissect flotation,” he said. “Rather than trying to create huge cells of 500 cubic meters (m3) or more, vendors like Woodgrove and Eriez are trying to get greater efficiencies from smaller cells. And they’re doing that by looking at the fundamentals of flotation. For example, Woodgrove’s SFR splits the flotation process into three stages — contacting, separation, and then removal of the froth and tails. Rather than looking at flotation as a macro process, it’s being looked at more closely as a micro process.

“Likewise, classically in flotation, we try to embrace the whole particle size distribution of the feed material. But with technologies like Eriez’s HydroFloat, they’re suggesting that we narrow the particle-size distribution to create more efficiency. It’s a much more elegant, accurate and precise approach to the process.”

Embracing Coarse Particle Flotation

To dig a little deeper into some of these “elegant and precise” technologies, E&MJ turned to Eric Wasmund, global managing director at Eriez Flotation.

“With CPF, you don’t have to grind the ore to the fine endpoint that’s required for conventional flotation technology,” he explained. “You can separate ore from gangue at a size that is roughly twice the size of conventional technology. Which means you don’t have to over grind and you don’t have to waste any energy, which is very expensive. Also, mines don’t have to worry about storing tailings that are very fine and unstable — the material can be easily dewatered — and you can reduce conventional flotation capacity as well.

“It depends upon the ore and its density but, for copper, which we’re really focusing on, you get an acceptable recovery in conventional flotation up to about 120 or 130 microns. Certainly, it drops off before 200 microns.

“With CPF, you can usually take that up to 400 microns, which reduces the amount of grinding needed by half. In grinding, the amount of energy required increases disproportionately as the material becomes finer — the finer the material being ground, the more energy is required — which is why ultra-fine grinding mills use a lot of energy.”

According to a new report from Weir Group, Mining Energy Consumption 2021, comminution accounts for 25% of final energy consumption at the average mine site. Across the hard-rock mining sector, this equates to around 1% of total global energy consumption every year. The report author, Marc Allen, stated that a 5% incremental improvement in energy efficiency across comminution could result in GHG emission reductions of more than 30 million metric tons (mt) of CO2e. To put that into perspective, New Zealand’s total emissions stand at around 35 million mt of CO2e.

If grinding requirements could be reduced by half at some mine sites through the use of CPF, that would have a massive impact on global GHG emissions.

CPF is not a new concept. However, what is new is its application at a commercial scale in base metals. Eriez has been applying CPF in phosphate and potash for 20 years and, in the past eight years, has been working to bring the benefits into base metals operations, particularly copper.

“We did a lot of pilot work at Rio Tinto Kennecott Utah Copper in the U.S.,” Wasmund said. “And we discovered that CPF really suits tails scavenging. When we started looking at the tails of conventional plants, we realized the material being lost to tails wasn’t spread across the entire size distribution. It was actually very low in the size distribution where conventional flotation is effective, which makes sense.

“Where we see a big drop-off is where the material is too coarse, or where it’s too fine. And we found that it’s very easy to develop a business case for reprocessing tails from a conventional plant using the HydroFloat. You can make money just by reprocessing and treating the material that conventional flotation isn’t good at recovering.”

The StackCell 200 utilizes staged flotation to increase metal recovery and drive down resource consumption in the flotation process. (Photo: Eriez)

Coarse Gangue Rejection for Preconcentration

Tails scavenging provided a jumping point to prove that the HydroFloat technology was robust, reliable and economical, and Eriez is now looking to expand its applications.

“Conventional flotation is not efficient for coarse particles,” explained Wasmund. “But what if we put [these new flotation technologies] right into the mill circuit and remove a coarse product before we overgrind it? Then you’d get all the benefits of having a coarse tail, a reduction in energy requirements, and you can reduce the size of your plant. That’s what we’re calling ‘coarse gangue rejection’ and it’s being worked on by a number of mining companies right now.”

Coarse gangue rejection essentially uses flotation cells as an ore sorting technology.

“It’s an ore sorting technology, except it sorts material at maybe half a millimeter, as opposed to conventional sensor-based ore sorting, which decides whether a 6-in. rock can be differentiated and disposed of before it goes through the plant,” Wasmund explained.

This is ore sorting on a much finer scale, and the benefit is that it produces a much higher recovery rate. Sensor-based ore sorting uses blasts of air to shoot rocks containing a certain percentage of gangue off of a conveyor belt. The cut-off grade means that a certain amount of ore is lost along the way. Whereas in coarse gangue rejection, because the material is much finer, the margin of recovery is that much higher.

Anglo American is trialing the use of “coarse particle recovery” or rejection at Mogalakwena in South Africa as part of its FutureSmart Mining program. The company is also using it in tails scavenging applications at mines like Quellaveco in Peru and El Soldado in Chile, and to generate coarse tails that can be co-deposited with fine material in a dry facility, without a water impoundment.

In a previous interview (Copper processing: the quest for efficiency at scale, December 2020), a spokesperson for Anglo said CPF is a key technology in closing the loop on its water usage too — an initial step toward the company’s goal of dry processing.

Newcrest has also demonstrated CPF in tails scavenging at its Cadia Valley Plant in New South Wales and is now expanding the operation to treat all of its tails.

The potential benefits of this concept are staggering…

“We did a study with Capstone Mining based on their Cozamin site using coarse gangue rejection. And found that we could reduce the ball mill requirement by 30%-50%, convert 30% of the tails to a coarse size (instead of 200 microns, they were 600 microns) and reduce the amount of conventional flotation by 40%,” said Wasmund, proudly. “All of these benefits are site specific. But CPF, as a tool, can be used in so many different ways. There could be exciting applications that we don’t even know about yet!”

Staged Flotation: Higher Recovery, Lower Footprint

Another concept that Eriez and others like Woodgrove are working on is staged flotation. Again, the technology is not new — Eriez has been running it’s StackCell in coal applications for 15 years — but the company has recently redesigned it to handle base metals.

“We have a couple of base metal installations in Australia, and we think the StackCell can potentially take a big part of the market share from stirred-tank conventional flotation,” Wasmund said.

In staged flotation, smaller mechanical cells are used to divide the flotation process into two or more steps.

“People have known about this for a long time, but still prefer to do everything in a single stirred tank,” Wasmund said. “If you break the flotation process down into two steps, as with the StackCell, then you can reduce the amount of working volume needed by a factor of four to five. That’s been validated at a number of sites.”

The StackCell, which is much smaller than a traditional flotation cell, can shrink the size of a flotation plant by 50%. The knock-on effect is that it also requires less concrete (smaller carbon footprint), less piping to connect the units, and fewer electrical connections and cable trays and pipe racks, thus reducing CAPEX and engineering times too. This makes it ideal for use in plant expansions or at projects where a minimal footprint is important.

“We’re working on an application now in Canada, where we’re retrofitting a plant with two new StackCells,” Wasmund said. “They’re 50 m3 in size, replacing units that are 200 m3.”

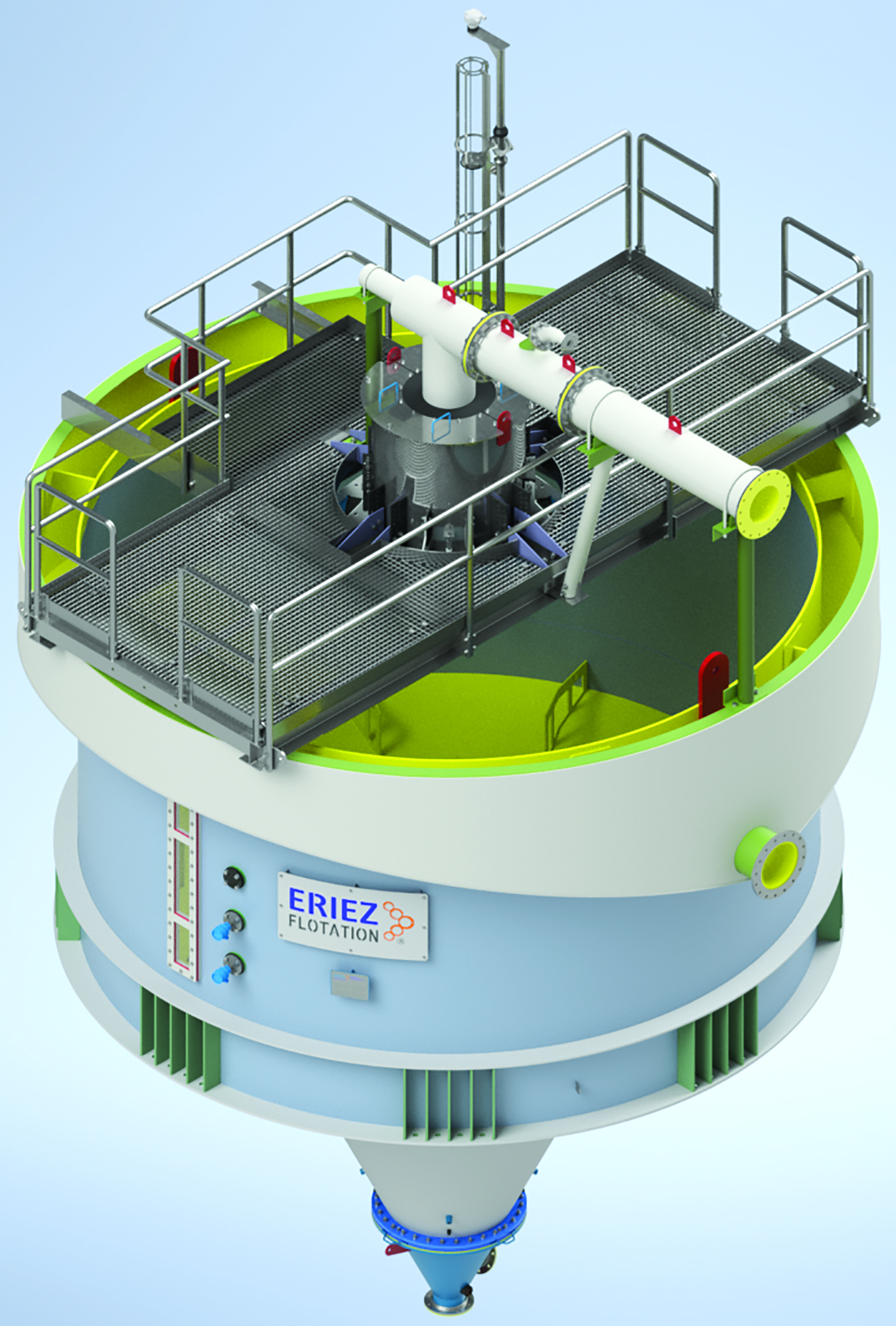

The HydroFloat cell is Eriez’s solution for coarse particle flotation. (Photo: Eriez)

Better Controlling the Process

Continuing with the micro-scale theme, it’s impossible to overlook the benefits that optimized reagents and digital process technologies can bring to the table too.

In metal mines, orebody characteristics can vary significantly throughout the life of mine. Initial and ongoing test work are crucial to optimizing the reagents used in flotation circuits. Donnini believes there is much to be learned from the industrial minerals market in this regard.

“We just finished an expansion study for an open-pit mine,” he explained. “They’re looking at the material they’re going to be mining for the next 10 years, and it’s very different to what they have been mining for the past 15.

“The challenge that creates in flotation is that a lot of factors can interfere with the surface chemistry; I’ve known of flotation plants that were upset for weeks due to something that was present in the parts-per-million range. It’s a continuously changing environment, and often chemicals are an afterthought.

“If we look at the work that Chinese phosphate manufacturers have done to develop reagent packages that are optimized for low-grade minerals… they are developing the reagent package and then developing the flotation train based around that. The Phosphate Institute in Florida, which is largely supported by Mosaic, has done lots of work on this too.

“I think one of the approaches that is necessary in the future is to identify the reagent package and how we want to use it in the process, and then build the flotation circuit around that package. I’m sure others will say they do that already, but we’re not taking full advantage of the opportunity because most mines are using standard reagents.

“I understand it’s expensive to do investigations and to invest in customized reagents. But at the same time, because of the challenges that are coming our way — and they’re not coming, they are here already — it makes total sense.”

Digital tools also offer the chance to fine-tune existing flotation circuits without making significant changes to the flowsheet.

These provide mines with options to reactively as well as proactively change flotation parameters in response to or anticipation of changes in the plant feed.

Dr. Kevin Brooks, APC global lead at Hatch, has pioneered the use of model predictive control (MPC) on flotation plants worldwide. Work with Anglo Platinum, FQML and Glencore has demonstrated that the combination of linear models derived from plant testing, and feedback from machine vision applications and/or online grade measurements yields significant benefits in grade, recovery and reagent usage.

Brooks explained: “MPC is a technology developed in the oil refining industry more than 30 years ago. Its uptake in the minerals industry has been slow but has accelerated over the last five to 10 years. The technology slots right into the current thinking around Industry 4.0 and machine learning. The ability to optimize a unit in real-time yields paybacks in order of months leads to more consistent operation across shifts and allows plant operators to concentrate on the more manual areas of the unit.”

Comminution is also an area where MPC yield benefits. Brooks sees a time when milling and flotation MPCs will be combined using a coordination model. “This is the route to online control and optimization embracing the mine to mill concept,” he said. Work is already being done to combine scheduling models with MPC to provide this wide scope of optimization and its associated benefits.

Donnini believes that, going forward, a more proactive approach is needed, one that encompasses prediction and automatic adjustment of plant parameters. “Advanced process control and statistical process control will allow us to do a much better job of controlling the flotation process than we do today,” he said.

“I have yet to see a mineral processing operation that uses statistical process control; it’s difficult to apply to continuous processes. But mines can use it, and they should.

“In an operating environment, for a model to be useful, it must be able to accurately predict — a reactive model is no use,” Donnini said. “That is a key element of the Industry 4.0 concept; mines need to be able to simulate their processes accurately enough so that they can predict what’s going to happen in their processes, based on what’s coming in.”

Donnini believes advanced process control and neural networks offer a timely solution to predicting flotation performance today. The mathematical algorithms “learn” how a process operates and, using a certain number of inputs, take corrective action based upon experience.

“To me, that is the solution to advanced process control in flotation,” he said. “I struggle to imagine somebody developing a model, being willing to spend the amount of money that it would take to collect all the data on factors that are likely to affect a flotation process. The alternative is that we learn (the machine learns). The more that machine is exposed to certain events, then the more accurately it can predict conditions.

“Companies like Metso Outotec and FLSmidth have technologies that watch and measure froth properties, but I don’t think anyone has closed the loop yet to allow those systems to initiate corrective action. That’s still left to the operator to do. But that will be an important step forward in controlling the flotation process.”

Another important aspect, one that will be crucial to achieving all of the above, is continuous feed monitoring and particle size analysis. Today, this tends to be done in batches and the tests can take hours to return results. To install a laser scanner over a conveyor would provide a partial solution. However, the accuracy depends heavily on how a particle presents to the laser at a specific point in time.

Most particles are not spherical, but most models are created based on the assumption of spherical particles… Again, in time, accurate, real time particle size analysis will improve our modelling capabilities as well.

Flotation for Future Challenges

What this article has shown is that flotation, as a technology, is not going anywhere. In fact, rather than being a limiting aspect of future flowsheets, one that could potentially be phased out over time, it’s going in quite the opposite direction.

Novel flotation technologies applied in new ways throughout flowsheets will prove invaluable in enabling ESG-conscious mining companies to meet future market demands while minding their resource consumption.

“Flotation is going to be with us for some time,” Donnini said. “So, we need to develop our understanding and get smarter at designing and operating these technologies.”

Anderson and Richter agreed. “Flotation will remain a necessary portion of the flowsheet for the foreseeable future as a means of concentrating prior to roasting and leaching or even smelting,” Anderson said. “Dry technologies such as gravity, magnetic separation and electrostatic separation are unable to exploit the differences in surface characteristics which is a key separation method in mineral processing. However, it’s application may move closer to the mining face as time goes on.”

Wasmund was pragmatic. “It’s important to put flotation into perspective with other extraction processes,” he said. “It’s actually a very green technology, because it allows mines to separate valuable material from waste right after mining. If you compare that to other technologies…

“For instance, there’s a big debate in the nickel market about where nickel’s going to come from for future electric vehicles. There are two main types of nickel resources: sulphides and laterites (oxides). Flotation can be used to concentrate sulphide nickels up to 30%, whereas laterites cannot be preconcentrated. The whole feed must be treated through high-pressure acid leaching (HPAL) or an electric arc furnace. And that increases the cost of production significantly, as well as the environmental footprint.

“When we’re all driving electric vehicles and charging our cars at home with massive copper wires that connect up to our houses… to get that copper and nickel we’re going to have to mine deposits that are much lower grade than those mined today. And the best way to do that is using more efficient forms of flotation.”

So, there you have it. Flotation is and will continue to be, a powerful tool in helping mines conquer their challenges going forward, from the processing plant to the boardroom.