The team is evaluating combinations of technologies for different haulage segments to give mines the best possible integrated solution. (Photo: CMIC)

E&MJ speaks to Trevor Kelly about the Canada Mining Innovation Council’s Alternative Haulage Project

By Carly Leonida, European Editor

In May 2018, the Canada Mining Innovation Council (CMIC) together with its mining company members, held a workshop at the CIM convention in Vancouver to discuss its roadmaps for the future of both surface and underground mining.

“The two are very similar and we may eventually combine them to create a single mining roadmap,” said Trevor Kelly, innovation manager for mining at CMIC. “Our member companies operate across a variety of commodities including oil sands, base metals and gold, but there are common threads and there are lots of opportunities for these companies to learn from one another.

“We use our strategic planning workshops to help mining companies communicate the work that they are doing and thinking of doing around innovation, and identify potential areas for collaboration. We then narrow those down to the greatest synergistic opportunities for improvement and that informs our projects going forward.”

In surface mining, the five projects selected are based around alternative haulage; sensor-based ore sorting; fully autonomous mining; fully electric mining; and predictive analytics.

“The mining companies identified haulage as being one of their biggest cost drivers and also once of the biggest opportunities to potentially do better regardless of the commodities they operated in,” Kelly said. “So, that’s where we started.”

Identify, Assess, Model

The Alternative Haulage Project kicked off in 2018, and the first step was a technology scan with support from an engineering consulting firm.

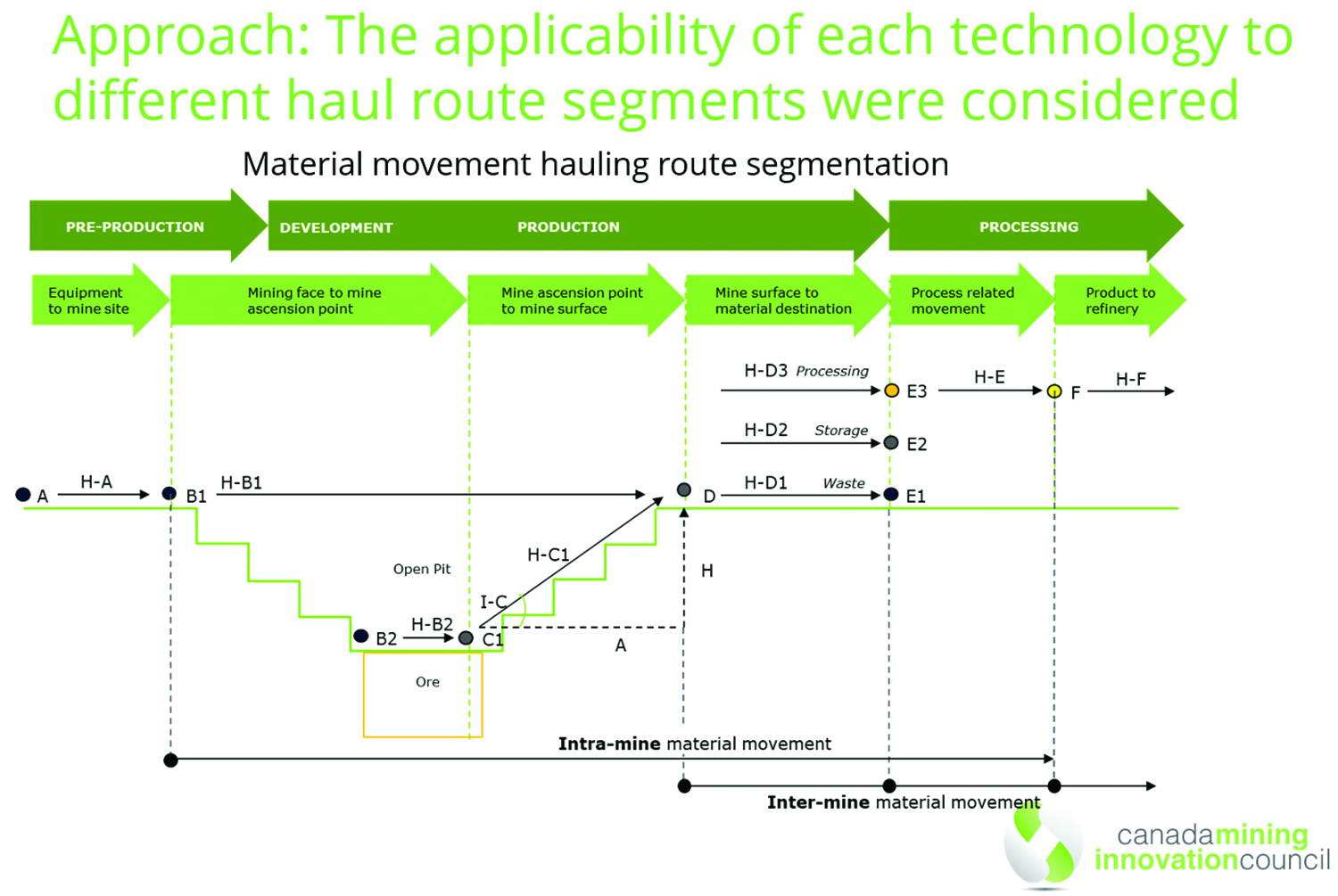

“We identified, both inside and outside of the industry, around 30 alternative haulage technologies and groups of technologies that we were interested in learning more about,” Kelly explained. “The focus is on building a transportation system for ore or waste that is optimal for different terrain/slope and haulage distances and different haulage segments.

“Trucks may very well be a piece of that, but right now we use trucks for everything. So, what we want to do is evaluate different combinations of technologies to give mines the best possible integrated haulage solution from an economic and environmental perspective.”

Phase one completed in early 2019, and the project is currently in the second phase. Kelly refers to this as the “socialization and alignment phase.”

“We are developing a process to model and evaluate the technologies,” he said. “At this stage, it’s more about the methodology than it is about selecting the right ones. We’re working through modelling of both the mine planning and technology elements.

“It’s a little bit different to the way the mining industry currently does technology adoption. Usually, we’ll do analysis and a trade-off on a spreadsheet, but modelling on a spreadsheet will only take you so far. With today’s technologies for modeling and simulation, a more integrated approach can be taken with multiple scenarios run in much shorter times.

“This new methodology we’re working on with Deloitte is designed to utilize the software and computing power that’s available today. It will cost significantly less money than a full-blown trial and will help to narrow down three or four technologies that we want to investigate per base case mine.

“After that, we can move to phase three, which is dynamic simulation and make a recommendation. And then phase four is about piloting. Phase five would be looking at doing a full-on demonstration.”

As Kelly mentioned, the project is currently in phase two and, as part of that, the team has identified three mines from consortium member portfolios to model: a large, shallow, high-volume mine; a deep high-volume mine; and one that falls somewhere in the middle.

“This modelling is a change from the usual processes, and there is a great deal of work under way to make sure there is a clear picture of the mining companies’ requirements for information and data, site-based mining expertise and the benefits from undertaking the next phase of the project,” he said. “There are both technical and cultural elements that must be addressed for the next phases of the project to be successful.

“What we’re looking for are not necessarily incremental changes or improvements to trucks. We’re looking for large opportunities to make it interesting enough for people to commit to a new way of evaluating technology and, ultimately, transforming haulage.

“Eventually, we’d like to build models of various different technologies, like Lego blocks, in collaboration with the OEMs and mine planning people. The assumptions will be validated and scrutinized, so that each of the mining companies can then take that process that we’ve built and use those Lego blocks and the modelling approach that we’ve worked through to optimize their mines, both from a greenfield and brownfield perspective.”

Moving in the Right Direction

So far, progress is slow but positive.

“There’s a lot of discussion and we’re walking a bit of a journey with the mining companies,” Kelly said. “The process is a little confrontational in that it challenges how we’ve done things for a long time. It’s not so much the technology piece, it’s the cultural piece that’s the sticking point. So, we’re really putting emphasis on the methodology, and using the technology of the day to show senior management and other people in the industry that this is likely to work.”

Currently, the project is focusing only on the haulage piece of the puzzle. Kelly added that if, in time, the project is a success, then it might be possible to create a more holistic model that incorporates front-end and back-end processes as well. But, for now, the focus is haulage.

“This is not about seeing the impact of haulage on your cut-off grade,” he said. “This is purely a capital and operating discussion around haulage processes and systems.

What sort of concepts or technologies are we talking about?

“One of the members said, ‘we want to do a relatively wide and deep look at what technologies are out there,’” Kelly said. “That doesn’t mean that we’re going to utilize them all or that they’re a possibility, but that’s exactly what we did.

“The technology scan looked at everything from airships to rail haulage, battery electric vehicles to trolley assist, rope conveyors, modular trucks, rail-based haulage… Some could potentially be supplied by three or four different OEMs, while others are unique. When we get to the actual modelling, we’re going to go through a triage approach on how these technologies will or will not fit.

“We’re working through that now. When people ask, ‘why didn’t you use this or why didn’t you use that?’ we need to have a rationale for each technology that we park, criteria that it didn’t meet to move forward.”

Why Do We Need Alternatives to Trucks?

Kelly was very clear that this is not an exercise in replacing trucks; it’s about finding haulage methods that complement trucks to build the best possible haulage model for each mine and allow operations to address whatever cost/operational/environmental concerns they might be facing in the future.

“Culturally, trucks are very flexible,” he said. “They allow us significant freedom with regards to mine planning and they provide the ability to make changes quickly and easily if we need to. That flexibility is fantastic, but with flexibility comes some inefficiencies.

“There are obvious concerns around diesel emissions and most mining companies have greenhouse gas (GHG) reduction targets so naturally, there is a lot of interest in moving to electric or autonomous mines. These kinds of discussions are evolutionary with regards to why we’re having them. It’s not that trucks are bad, it’s just a matter of understanding the best method for different haulage segments.

“We all know that conveyor belts are more efficient than trucks for moving material in a straight line. However, there are challenges associated with those, too. In certain elements, you’re probably not going to beat trucks. Now, is that truck going to be diesel or battery-electric? Will it be battery on the bench and trolley-assisted to get out of the pit? This discussion is currently taking place.

“And we haven’t even taken on the discussion yet about mining methods, sequencing and the impact of the haulage system on the wider mining operation — that will come later in phase three. We haven’t looked at how we might be able to do mining differently using different technologies to make things easier on ourselves yet. It’s like peeling back the layers of an onion.

“The main considerations for all of the companies that we’re working with are reducing GHG emissions and diesel usage to meet and exceed their targets.”

The Next Steps

Originally, phase two of the Alternative Mine Haulage Project was only set to last a few months. However, when E&MJ spoke to Kelly in February, the team was six months into it, with another three or four months to go.

“The socialization piece has been a little more confronting for the people than expected, but we appreciate the importance of this process and are willing to take the time needed,” Kelly said. “So, we’ve been allowing people to hear things and sleep on it. The goal is to start the physical modelling by the end of this year but, at this point, it’s still hard to say for sure because we’re not sure what the overall cost is. We’re still working on some estimates.

“I would think that the modelling phase, phase three, will probably start in 2022 and that will take six months or more.”

The team is aiming to have a pilot ready for 2024 to trial certain system components, or material transfer from one technology to another. Although there may be some design work involved.

“At the moment, it’s hard to say because we don’t know which technologies will be combined together,” Kelly said. “It’s hard to predesign any of these things or get work going in advance because we’re curating as we go.”

Funding is the other piece of the puzzle… “CMIC is industry funded,” Kelly said. “We are always open to having more companies participate in this and other projects and we continue to investigate government funding and other opportunities to supplement this.

“We’re looking for funding to help offset the requirements of mining companies to pay the full price and see what we can do to help them share some of the cost burden and risk. That’s an ongoing challenge….”