By Vladislav Vorotnikov

Although it stands to lose production from one of its best-producing deposits, Russia has hopes of soon increasing its diamond production.

The future of the Russian diamond industry is closely tied to Alrosa, the Russian mining company that accounts for 97% of diamond mining in Russia and 24% of world production.

Surface production at Russia’s Udachni mine will soon cease. Even though it will lose 13 million ct in current capacity, Alrosa plans to maintain and eventually increase production.

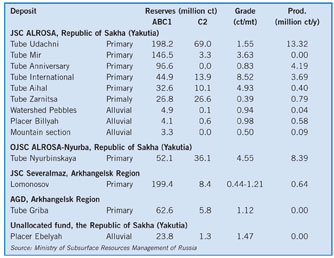

Russia is believed to have the world’s largest diamond resources, exceeding 3.6 billion ct. Most of its explored resources are in the P1 category* and are concentrated mainly in the Republic of Sakha (Yakutia) and the Arkhangelsk Oblast, both located in the northern part of the country. Yakutia accounts for 80% of total Russian reserves while Arkhangelsk Oblast has 18%. The remaining 2% are concentrated in the Perm Oblast. According to estimates from the Russian Ministry of Subsurface Resources Management, these three regions account for 60% of world diamond reserves.

The main Russian diamond deposits and operating companies.

The main Russian diamond deposits and operating companies.

Almost all Russian diamond reserves are concentrated in Kimberlitic pipes, placer formations account for less than 7% of its proven reserves. Russia’s diamond-bearing ores have an above-average grade and the quality of the stones is comparable to similar deposits found in South Africa, for example. However, mining conditions in the northern part of Russia can be characterized as severe.

Covering more than 3 million km2, Yakutia is slightly smaller than India, but its population only totals 900,000 people. There is no infrastructure. Roughly 40% of its territory is located above the Arctic Circle where winter temperatures routinely dip to -50°C. Miners working in this region are familiar with these conditions and they know that prospecting for diamond deposits and developing mines requires a significant investment.

The Russian Federation officially lists about 60 known diamond deposits. Of those, 40 are considered economically viable and are currently being mined or there are future plans to do so. Ever since the fall of the Soviet Union, analysts have noted Russia’s large diamond reserves, and its inability to capitalize on them. More than 77% of balance sheet reserves and almost 88% of inferred resources for P3* category diamonds lie in Yakutia’s Central Siberian and Lena-Anabar subprovinces.

Yakutia is Russia’s diamond mining territory, and includes the largest deposit, Tube Udachni (“tube” is a rough translation of “pipe,” as in Kimberlitic pipe). The average diamond content in its ores is 1.55 ct per metric ton (ct/mt), which is comparable with Jwaneng ores in Botswana (1.55 ct/mt) and Gahcho Kyue deposit in Canada (1.57 ct/mt). Other pipes in the region include International, Mir, Botuobinskaya Ayhan and Nyurbinskaya, among others. The diamonds found in the Mir and International deposits are the highest in quality among the Russian primary deposits. Ores grades average 8.8 ct/mt, the richest in the world.

Yakutia is Russia’s diamond mining territory, and includes the largest deposit, Tube Udachni (“tube” is a rough translation of “pipe,” as in Kimberlitic pipe). The average diamond content in its ores is 1.55 ct per metric ton (ct/mt), which is comparable with Jwaneng ores in Botswana (1.55 ct/mt) and Gahcho Kyue deposit in Canada (1.57 ct/mt). Other pipes in the region include International, Mir, Botuobinskaya Ayhan and Nyurbinskaya, among others. The diamonds found in the Mir and International deposits are the highest in quality among the Russian primary deposits. Ores grades average 8.8 ct/mt, the richest in the world.

Diamond reserves in the territory are expected to increase with further exploration, especially to the north where weather conditions are even more extreme than in the rest of the region.

Stagnating Production

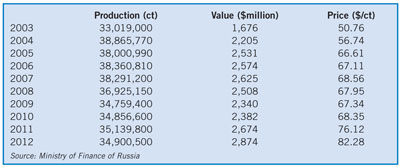

According to the Russian Ministry of Finance, total diamond production in 2012 decreased by 0.6% to 34.9 million ct on year-to-year comparison. In fact, the volume of diamond mining has steadily decreased since 2004, when it reached a historic high of 38.8 million ct. Similarly, exports of rough diamonds decreased by 7.9% in 2012 to 29.8 million ct, which had an estimated value of $3.9 billion (down 2.3%).

Total Russian diamond production.

Total Russian diamond production.

At the same time, imports of rough diamonds in 2012 amounted to 141,430 ct, with a total value of $151.2 million. As for export destinations, Belgium accounted for slightly less than 18 million ct ($2.4 billion), followed by India, 6.9 million ct ($692 million); United Arab Emirates, 2.6 million ct ($129.3 million); and Israel, less than 1 million ct ($414.2 million). In 2011, Russia reduced its export of rough diamonds by 20% to 32.3 million ct ($3.8 billion).

The Russian diamond mining business is monopolized, and its future depends on the plans of Alrosa, which recently announced its intention to boost its mining rate to 40 million ct/y until 2020. Currently, the company mines about 34 million ct/y in Russia (97.4%) and 42.7 million ct/y worldwide, which explains why it holds top position among diamond miners. According to company officials, with the new goal, Alrosa could achieve a 30% share of the world’s diamond production within the next eight years. According to Alrosa’s Igor Sobolev, first vice president and executive director responsible for mining operations, the company was very successful in 2011 and consolidated its gains in 2012.

“In 2011, we reached all planned goals both in terms of the volume of construction work and in the level of mining,” Sobolev said. “Largely because of this, financial performance for the year was a record RUB29.5 billion ($900 million) of net profits. Such has never happened before in the history of the company. The volume of production from the entire group reached 34.6 million ct—the highest rate in the world. This is Alrosa’s third consecutive year as a world leader in terms of the production of diamonds, ahead of De Beers.”

It should be noted that Alrosa has its own way of doing things that varies greatly from other global market players.

“Diamond professionals understand it is not entirely correct to compare the production volumes of Alrosa and De Beers,” Sobolev said. “In particular, we are mining smaller types of diamonds that are not produced by any other company. We have a lower limit of the size of the stone [0.5 mm], while, for example, De Beers produces raw material the size of 1.5 mm and more. In our production, the share of small, so-called industrial raw diamond materials account for about 35% of carats. Industrial diamonds are cheap. On average in 2011 their value was $7.7/ct—so, in net sales that accounts for about 1% of the total profit. In comparison, the value of our gem-quality diamonds average $210/ct.”

An important step for the whole Russian diamond mining, according to the CEO, is the completion of the pit at Tube Udachni. The pit at Udachni has reached its limit. “We’ve made the decision to continue working here on near the edge pillars where some ore remains,” Sobolev said. “Now we purchased new technology, which will operate at high angles of inclination. But the level of production near the edge pillars will still be very low, at about 1 million mt/y and only until 2014. At the peak of the mining development at Udachni, Alrosa processed 12 million mt/y. These couple of million tons will not make us the difference, but still this is also ore and it also will make a profit. Cost of surface mining is significantly lower than the underground mining so it will be cost-effective.”

The company currently has several new projects under way, including the development of the Mayskaya and Upper Muna deposits. It also is preparing for underground mining at Udachni and is going to implement some interesting innovations. “With this and other projects successfully implemented, we will be able to boost the level of mining. Our development strategy provides growth in production up to 40 million ct by 2020,” said Sobolev.

The Promise of Impact Diamonds

The Russian government is currently considering plans to mine “impact diamonds”—those created by meteorite impact—located in the Popigai deposit on the border of the Krasnoyarsk region and Yakutia. According to recently declassified information, mineralization there could amount to as much as several trillion carats, which is much more than all the world’s reserves. According to the Institute of Geology and Mineralogy of the Siberian Branch of the Russian Academy of Sciences, only 0.3% of the crater has been studied but they have already discovered 147 billion carats of impact diamonds, while all the world’s diamond reserves are estimated at 5 billion carats.

Igor Sobolev, Alrosa’s VP and executive director of mining.

Igor Sobolev, Alrosa’s VP and executive director of mining.

Because of the anticipated high stakes involved with such a large deposit, previous research on impact diamond deposits was carried out in secrecy—until it was determined that impact diamonds could not currently be used for industrial purposes or in jewelry. Even so, mining of these diamonds could start within 5 to 7 years.

“The possibility of their use as industrial diamonds is very high, but the fact is that due to the successful experiments on the synthesis of crystals on the market, there are a lot of synthetic diamonds with specific properties, which is very important. When they are mined in nature, you cannot guarantee that it will have such properties. Consequently, the proportion of natural diamonds in the technical market is very small,” Sobolev said.

However, several major corporations have already expressed interest in further exploration of the deposit, said director of the Institute of Geology and Mineralogy of the Siberian Branch of the Russian Academy of Sciences, academician Nikolai Pokhilenko.

Alrosa’s production compared to other leaders (millions of ct).

Alrosa’s production compared to other leaders (millions of ct).

“It turns out that these diamonds have very unusual properties. They are substantially harder than conventional diamonds that are known. They can be used in a number of high-tech industries, including electronics and optics, in the manufacture of all kinds of precision lenses. With this discovery, it immediately attracted a lot of interest from large companies and corporations such as De Beers and a number of Chinese companies,” he said.

According to scientists, resource deposits in Popigai will be enough to meet the world demand for 3,000 years. Development of this resource could boost the rate of Russian diamond mining in seven- to eight-fold by 2030.