While block caving is not a new concept, it needs the right combination of geology and technology to make it work successfully

By Simon Walker, European Editor

|

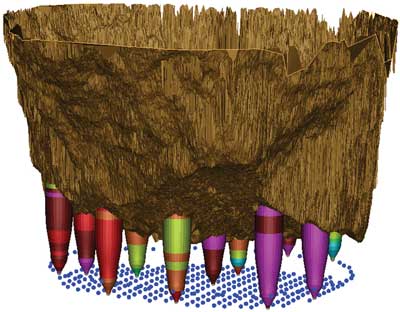

| Copper and diamonds are the predominant commodities currently being mined by block caving. Shown here is a scan, developed using Geovia’s PCBC software, of the bottom of a kimberlite pipe at the Finsch diamond mine, displaying selected draw points and draw cones. |

Writing the introduction to a special edition of the Transactions of the U.K.’s Institution of Materials, Minerals and Mining (IOM3), published in 2011, Professor Yves Potvin, director of the Australian Centre for Geomechanics at the University of Western Australia, highlighted the three main risk areas facing companies looking to develop block cave mining operations. The first, he said, “Is the capability of the undercut alone or, assisted by pre-conditioning, to generate the conditions that will allow for the fragmentation and recovery of the entire orebody.

“Once the orebody is fragmented, the potential for dilution as well as sterilization of the significant quantity of broken ore becomes a second order of risk, which can be managed by draw control.”

“A third order of risk associated with cave mining, more particularly the ones operating in high-stress environments, is the risk associated with seismic activity that can lead to rockbursting damage,” Potvin said.

Block caving offers the potential for high-volume, low-cost production usually, although not always, from low-grade deposits that could not be mined profitably by other methods. As a technique, its successful application relies on a geological endowment that is structurally favorable, backed by the substantial financial resources needed in order to prepare the extensive development infrastructure needed.

Two commodities stand out within the relatively meager ranks of operating block cave mines: copper and diamonds, reflecting the method’s suitability for working porphyry and pipe-type deposits, respectively. Indeed, a rough count of current block- and panel-caves—as separate from mines using systems such as sublevel caving—suggests that there are fewer than 20 in operation worldwide. Some of those are, however, among the world’s largest in terms of underground production capacity.

|

| The operator control station for a Sandvik Automine LHD installation. The operator loads by teleremote; the machine hauls, dumps and returns autonomously. |

Deepening the Pit Floor

Aside from blind deposits where block caving is designed as the main production system from day one, the other application has been where underground mining has replaced an earlier open pit that has reached its economic limit. Examples include several of the diamond mines and Palabora (copper) in South Africa, Argyle in Australia, and the forthcoming transition at both Grasberg in Indonesia and Chuquicamata in Chile. Other candidates include Bingham Canyon, where a sequence of caving operations has been under evaluation for several years, and some of Botswana’s diamond mines.

Nonetheless, a smooth transition is by no means guaranteed, as experience at Palabora suggests. Production from the open pit ended in early 2002, the operation having invested some $460 million in developing its replacement underground section of life. Although an output of 30,000 metric tons per day (mt/d) was scheduled, two years later that had yet to

be achieved.

There was clearly a learning curve involved and, as the company pointed out, “no other block-cave mine has been put into as competent an orebody.” Very blocky fragmentation presents a major production constraint, requiring a significant amount of secondary breaking—both by blasting and hydraulic hammers—to keep the drawpoints flowing.

Meanwhile at Grasberg, Freeport McMoRan Copper & Gold (FCX) is well on its way with the development of its “common infrastructure” underground haulage project, providing access to the forthcoming DMLZ and Grasberg block-cave mines. The DMLZ will come on stream next year, while the Grasberg block cave will replace capacity from the open pit when that closes in 2017. Later in the schedule, the company is also targeting the outlying Kucing Liar orebody for block caving.

In the meantime, FCX converted its DOZ orebody, which it began mining in 1989 using open stoping, to block caving in 2000, with production expected to continue until 2019. With an output of 49,400 mt/d during 2013, ramping up to 80,000 mt/d this year, the DOZ is now one of the world’s highest-capacity underground metal mines.

Even that will look insignificant once the Grasberg block cave comes on stream, with the company reporting in its 2013 Form 10-K that it is planning an output of 160,000 mt/d—adding to 80,000 mt/d from the DMLZ. Total investment for developing these two mines, plus the common infrastructure project, will be around

$7.8 billion between 2008 and 2021.

In Chile, meanwhile, Codelco is continuing with its evaluation of an underground mine to replace the depleting Chuquicamata open pit. The current concept involves a 7.5-km-long access decline leading to four production levels, with block caving being used to produce 140,000 mt/d of ore.

And in the U.S., the possibility of mining below the existing Bingham Canyon pit raises the prospect of extending the mine’s life beyond 2050. In a presentation given in September 2012, Kennecott Utah Copper’s then president and CEO, Kelly Sanders, gave a conceptual outline of possible underground development that includes three block caves out of six separate ore zones.

Mine Design Moves Deeper

In the mid-1990s, the South African rock mechanics expert, Dr. Dennis Laubscher, published what turned out to be a landmark paper on the design of caving operations, with the subsequent compilation of the definitive block caving manual. Based on practical experience in the asbestos industry in Southern Rhodesia (pre-Zimbabwe) and elsewhere, Dr. Laubscher also introduced his MRMR (mine rock mass rating) system—the citation at the presentation to him of the 2007 Brigadier Stokes Memorial Award of the South African IMM noted, “There is not a block caving mine anywhere in the world that has not used his empirical correlation, or stability graph, to evaluate the cavability of its deposit.”

The 1990s was a decade of considerable interest in block caving, with the establishment in 1997 of the International Caving Block Study, and the resultant publication of Block Caving Geomechanics.

Fast forward to the Caving 2010 conference, and Professor Gideon Chitombo of the University of Queensland—who was the project manager for the block caving study—provided an update to Laubscher’s contribution in one of the keynote presentations at the meeting. Amongst the more recent developments, he said, has been “an emerging approach to characterize and predict the behavior of a rock mass. The synthetic rock mass (SRM) is a numerical methodology designed to help predict the large scale response of the rock mass to caving based on its strength, discontinuity characteristics and discrete fracture network (DFN) techniques.

“The general knowledge and understanding of caving methods has significantly improved and has gone beyond a few individuals or companies being the sole custodians of caving knowledge and expertise,” Chitombo said. “However, as an industry, there are still some major challenges that may collectively threaten the viability of cave mining.” Examples, he said, include:

- Not being able to achieve continuous caving;

- Differential cave propagations due to the presence of different geological lithology;

- Seismicity caused by unfavorable undercutting practices;

- Early dilution or waste ingress and accelerated fines;

- Migration containing waste;

- Structural collapses and instabilities due to mining of large panel widths;

- Extraction level instabilities due to poor undercutting practices; and

- The presence of remnant pillars or compaction of caved materials, a consequence of poor draw practices.

In the conclusion to his address, Chitombo said, “The caving industry is now moving toward the next generation of caving geometries and scenarios (‘super caves’) where current practice and know-

ledge may be reaching its limits. Laubscher’s rules, which have a strong empirical and experiential basis, now need to be supplemented by methods that consider more of the governing physics of the caving processes.”

Chitombo’s comments were particularly apposite given the general trend toward using block caving at greater and greater depths. Opportunities for near-surface applications are becoming fewer and further between, while there is increasing interest in using the technique on both new production levels at existing mines and in situations where blind orebodies lie deep.

Rio Tinto and BHP Billiton’s Resolution project in Arizona comes to mind in this context. The orebody lies at depths of between 1,500 m and 2,130 m (5,000–7,000 ft), and panel caving is being proposed with a nominal production rate of 120,000 mt/d, and perhaps up to 25% higher. Coincidentally, the porphyry resource tonnage at Resolution is comparable to that at Chuquicamata, at around 1,700 million mt, albeit at about twice the copper grade.

|

| Atlas Copco supplied two Scooptram ST14s for autonomous operating trials at Codelco’s Andina mine during 2012. |

Modeling Assistance

Last September, Dassault Systèmes Geovia issued a white paper detailing the use of its PCBC software for calculating mineable reserves in block-caving operations. The company pointed out that this package, developed by Gemcom, has been in use for 25 years now, during which time it has been used for a wide variety of block-cave scenarios.

The author of the monograph, Dr. Tony Diering, vice-president of Geovia’s caving business unit, explained that the “peculiarities” of block-cave mining can make ore-reserve estimation more complicated. The orebody geometry, mining geometry, material fragmentation and flow, economics and mining history, and sequencing can all have an effect, as can the impact of dilution from various sources. In situations where a new lift is being designed beneath an existing block cave, there is the possibility that resources may be increased through the presence of residual ore from the level above, and Dr. Diering is of the opinion that the quantification and categorization of this type of material will play a more important role in the future.

Diering and Nat Burgio from Strata-vision in Australia co-authored a paper on the use of PCBC software for modeling the Ridgeway Deeps block cave, which they presented at the MassMin 2008 conference in Luleå, Sweden. With the trend toward the establishment of block caves at greater depths over relatively small footprints and in competent rock-mass environments, they noted that operators are also planning higher cave columns in order to maximize the profitability from the extraction level. The ability for a cave to propagate vertically in such environments is less predictable, they added.

With its production level at a depth of 1,050 m, Newcrest Mining developed Ridgeway Deeps beneath the existing sub-level caving mine. The transition took place in 2009, although as a 2012 analysis note from Credit Suisse suggested, the move here did not go completely to plan.

“The caving rate and fragmentation is in line with modeled projections. However, extraction, materials handling, secondary breaking and crusher design appear to have assumed materially finer fragmentation than is currently being achieved or was projected,” the analysts commented. “Significant additions to the loader and secondary breaking fleet have been required, adding unforeseen extraction costs.”

Nonetheless, Newcrest was not deterred but has transferred the experience gained to the design of its newest operation in New South Wales, Cadia East. Officially opened in May, at a cost of A$2 billion, Cadia East is the first panel cave operation in Australia, and in due course will become the country’s largest underground metal mine.

In addition to learning from Ridgeway, Newcrest also sought technical expertise in block and panel caving from other world players, including Codelco and Rio Tinto’s Northparkes. As the Credit Suisse report noted, “Ridgeway was very much the early prototype cave for Newcrest and has clearly shown what should not be repeated and what can be improved.”

Panel Cave 1 at Cadia East came on stream in January 2013, with Panel 2 scheduled for production next year. And, of course, Newcrest now has the in-house expertise to be able to evaluate other deposits for block caving, including its huge Wafi-Golpu prospect in Papua-New Guinea.

Hydraulic Fracturing Helps Fragmentation With near-surface opportunities for block caving becoming fewer, more recent developments are commonly encountering new challenges in terms of natural orebody caveability. Deeper rocks are stronger, less fractured and so less amenable to caving on their own—hence the need to give nature a helping hand.

With near-surface opportunities for block caving becoming fewer, more recent developments are commonly encountering new challenges in terms of natural orebody caveability. Deeper rocks are stronger, less fractured and so less amenable to caving on their own—hence the need to give nature a helping hand.

Hydraulic fracturing offers a means of doing so, effectively preconditioning the orebody by enhancing existing weaknesses while creating others. Stephen Miko from the Canadian equipment manufacturer, ConMico, said, “Caveability can be enhanced by drilling the orebody in a pre-determined pattern to a depth of up to 150 m, inserting a high-pressure packer and hydro-fracturing in 1- to 1.5-m segments for the total length of the hole. As well as pre-conditioning the orebody, the fractured area is de-stressed, making it much more predictable as to how the orebody will cave.”

ConMico has developed a 400-hp portable high-pressure hydraulic fracturing rig that is completely self-contained apart from power and water supplies. Supplied to Codelco for use mainly at El Teniente, but also at its other block-cave mines, the rig is just more than 4 m long and 2.5 m high, making it very maneuverable, ConMico noted.

Once started, Miko said, the system inflates the packer’s tubular rings to about 12,000 psi to hold it in place in the hole, then applies water at pressures of 4,000-8,000 psi to fracture the rock. Fracturing begins at the back of the hole, with the packer being moved toward the collar, section-by-section, until the entire hole length within the ore zone has been treated.

Working at such pressures, the packers themselves are fairly sophisticated pieces of equipment, according to the commercial director for Australian-based Inflatable Packers International (IPI), Howard Kenworthy. “Twin packer (‘straddle’) systems that inflate to isolate the section to be hydraulically fractured work at up to 10,000 psi (690 bar), sometimes greater,” he said.

“Operating protocols vary by mining company, but typically the packer inflation is via the same pump and an independent high pressure hose, with the high-flow/high-pressure injection through the sealed rods that have the straddle packers on the end—working either ‘up hole’ or ‘down hole.’ Controls ensure that the packers are inflated to a higher pressure than the injection pressure for safety purposes,” he added.

According to Kenworthy, only pure water is injected, which typically fractures a radius of 25 m around the hole. “The holes themselves are normally 96 mm diameter, although one mine is trialing 76-mm holes with a 750-mm separation between packer positions,” he said.

IPI’s principal product for hydraulic fracturing in block caving, the DuraFRAC HPC packer, is available for standard NQ (76 mm) and HQ (96 mm) hole sizes. The company claims that these packers are exceptionally durable, and can be used in any hole orientation, both up-holes and horizontally. The standard packer systems are either 89- or 70-mm-diameter for working in NQ [76 mm] or HQ [96 mm] holes, with fracturing intervals from 750 mm and a pressure bypass safety feature.

With Codelco’s block-cave operations well-established in harder, primary ore zone, it is not surprising that the company has made significant investment in gaining a better understanding of the relationships between orebody preconditioning and fragmentation once caving has started. As well as hydraulic fracturing, Codelco also uses confined blasting as a preconditioning mechanism.

Four of the papers presented at this year’s Caving 2014 conference in Santiago, Chile, specifically addressed aspects of preconditioning. For example, one described studies on the relationship between preconditioning and fragmentation at El Teniente, which it said, showed a clear and direct relationship between the preconditioning intensity and fragmentation performance.

In another paper, the authors reported on simulations on the effects of a number of variations of hydro-fracturing, confined blasting or combined systems on predicted secondary fragmentation, hang-ups and oversize in the drawpoints, as well as productivity and operating costs.

|

| ConMico’s 300-kW (400-hp) self-contained rig for hydraulic fracturing in block-cave orebodies. |

Equipment for the Job

With its very regular spacing of production-level drifts and drawpoints, it is not surprising that block caving has been used as a test-bed for automated loading and hauling. And, while the world’s main suppliers of LHDs and mine trucks have been developing systems that can fulfill the requirements, one of them, Caterpillar, has gone a stage further with its transfer of technology from coal mining to the hard-rock environment.

If one mine can be said to have been at the forefront of underground transport automation, it must be Northparkes in New South Wales. Underground mining began in 1995, with full production under way from the first block cave two years later. Even then, with the mine owned by North Ltd. and Sumitomo, the first flirtations with LHD automation were in the air, as an article in a 1998 edition of World Mining Equipment explained. Teleremote operations were then just being introduced on the mine’s fleet of six Tamrock 450E electrically powered LHDs.

With Rio Tinto’s acquisition of North Ltd., and Sandvik building on Tamrock’s foundations to develop its Automine loading system, Northparkes has been very successful, proving ground for the concept and the technology. According to Sandvik, that success led to Rio Tinto adopting Automine for its Argyle block cave. Newcrest also uses it at its Ridgeway Deeps mine, while Sandvik has delivered 14 LH517 LHDs, all equipped for autonomous operation, for Cadia East.

Meanwhile, Northparkes’ reliance on its surface-operated LHDs is continuing to pay off. The mine handled a record of just more than 6 million mt of ore last year, and in December its automated loaders handled a record 80% of the total tonnage produced during part of the month. That the mine has only been able to achieve that proportion despite a long involvement with automation projects is a reflection on the complexity involved, with the LHDs being controlled during loading by the operator

in the control room, then traveling autonomously to the dump and back to the next scheduled drawpoint.

One of the critical aspects of any block cave—poor fragmentation—can pose real problems, both in drawpoints and at the ore dump. Pedestal-mounted hydraulic hammers are one solution, with the Australian company Transmin having developed its Rocklogic control system for this application. First used at Ridgeway Deeps, it provides remote operation and collision-avoidance capabilities for rockbreakers.

Atlas Copco recently reported on a yearlong trial of its semi-autonomous LHDs at Codelco’s Andina block-cave operation. With two ST14s being equipped for teleremote loading and autonomous hauling, dumping and return, communication between the loaders and the control room used the mine’s WLAN system and an overland fiber-optic link—with the control room being located some 80 km away from the mine itself.

Atlas Copco noted that this was the first time that a 14-mt-capacity loader had been used in that particular area of the mine, where 10-mt units were the norm. In addition, the four operators chosen for the trial were the youngest ever to operate heavy equipment at a Codelco mine, the company selecting them for their hands-on ability with software and joystick controls.

The project has encompassed three phases, starting with the installation of the control room and some underground haulage slashing to provide adequate space for the ST14s to operate. This was followed by operator training and production ramping until round-the-clock operation was achieved.

The final five-month period focused on testing the performance of the semi-autonomous loading system in a real production environment. By the end of the trial, in December 2012, the two machines were achieving an average output of 415 mt/h, Atlas Copco reported, and were outperforming manually operated LHDs on a monthly production basis.

Meanwhile, Andina is also the venue for the current evaluation program on Caterpillar’s Rock Flow system, which was described in the June 2013 edition of E&MJ (pp. 56–61). Harnessing armored face conveyor concepts from longwall coal mining, the system is fully automated with real-time draw control and transport from the drawpoints to primary crushing units.

Speaking at ExpoMin 2012, the head of the Rock Flow project for Caterpillar, Markus Frenzel, gave some details of achievements from the first proof-of-concept trials at Codelco’s Salvador mine. Here, four Rock Feeders were used in conjunction with a 75-m-long Rock Mover chain conveyor rated at 900 mt/h capacity. In fact, Frenzel said, the system handled more than 122,000 mt of ore during the trial, with the 300-mt/h-rated Rock Feeders averaging 260 mt/h.

The Andina trial has been designed as the first industrial-scale basis for the equipment, with 32 Rock Feeders delivering ore on to four parallel Rock Movers. This gives a nominal capacity of 3,600 mt/h, with the aim of ramping up production to around 150,000 mt/month. Servicing on the Rock Feeders is done from access drifts driven between the production haulages. The system is currently being installed, with commissioning scheduled for December, Frenzel said.

Major benefits claimed for the system include lower ventilation requirements, with no diesel-engined equipment needed. Personnel are only required for maintenance, with the system being controlled remotely. With the future development of high-capacity “super caves,” Caterpillar believes that production based on LHDs will be constrained by their carrying capacity and the sheer volume of traffic; hence its interest in applying an alternative approach to drawpoint management and rock haulage.

Looking Ahead

In one of the keynote presentations at the Caving 2014 conference, German Flores from Newcrest Mining sounded a warning call that although block- and panel-caving technology has achieved significant developments over the past 30 years, the challenges ahead may require some new thinking.

“The evolution of the cave-mining industry has been driven by the requirement to adapt to change,” he said. “The industry is now moving rapidly into a new and less certain environment where arguably, another revolutionary change is required in order to continue sustaining it. The potential challenges include technical, economical, license to operate, and human capital issues. As was the case in the late 1970s when hard ore rock was first encountered, the industry must now change in order to sustain itself technically and economically.”

Certainly there is strong justification for some radical new approaches, especially as future block caves will be in even harder rock, at greater depths. Add in challenges such as water inflows, high-virgin rock temperatures and ventilation requirements, and it is easy to see that companies are going to have to be highly innovative in their approach. Deeper mines also bring with them higher capex requirements, in an industry where developing a big block cave is already only within the grasp of those with deep pockets.

Nonetheless, the incentive is there, and as past experience has shown, new concepts and technologies may take time to develop to their full potential, but they are very effective when they get there.