Russians consider a zinc operation in one of the harshest locations on Earth

By Vladislav Vorotnikov

ARMZ believes its First Ore Mining Co. (pgrk) could produce 220,000 mt/y of zinc from the Pavlovsk deposit (above).

Within the next two years, through its First Ore Mining Co. (pgrk) subsidiary, Russia’s ARMZ Uranium Holding Co. will invest RUB 12-14 billion ($185-$215 million) in the supporting infrastructure for and the construction of an open-pit mine on the Pavlovsk deposit in Novaya Zemlya. This archipelago in the Arctic Ocean in northern Russia is almost uninhabited due to the especially harsh climate conditions, complete absence of any civil infrastructure and large-scale nuclear tests that took place there when it was part of the Soviet Union.

A project of this magnitude is unprecedented, as Russian mining companies have no experience operating mines on the islands near the Polar Circle. Pavlovsk is a polymetallic deposit with 37 million metric tons (mt) of ore that represent as much as a fifth of the world’s reserves in terms of zinc with 1.97 million mt. It also contains 549,000 mt of lead and 1,194 mt of silver. There is, however, a great interest among potential customers, according to ARMZ’s CEO Vladimir Verkhovtsev, who said his company is ready to face all of the project’s challenges.

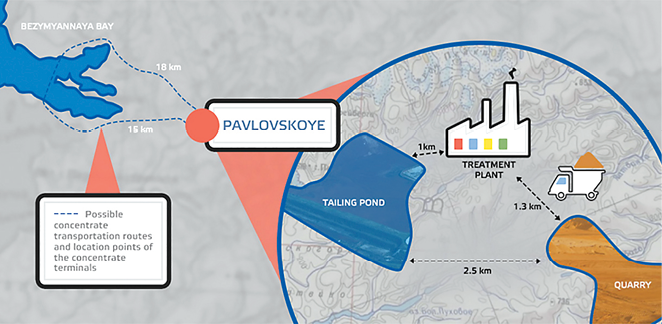

The deposit is located on Yuzni Island, 15 km away from the coast of the Barents Sea, occupying an overall area of 12 km2. By 2019, ARMZ plans to launch an open-pit mine that will produce 2.5 million mt/y of ore. Simultaneously, they will construct a flotation-based mineral processing facility on the island, which they hope to commission by 2020. Ore from the pit will be delivered to the plant by trucks.

Once Pavlovsk reaches commercial production, ARMZ believes the complex will generate 220,000 mt/y of zinc and 50,000 mt/y of lead in concentrate, and at least 16 mt of silver with a mine life of 15 years. The average ore grade is 5.8% zinc, 1.3% lead and 18 g/mt silver. Dewatered concentrates will be delivered by truck to a sea terminal.

Alexandr Lukin, the head of pgrk, said the important factors for the development of the deposit are that it has a near-surface orebody and relatively simple geological structure. From a smelter feed perspective, he also said the deposit has very good characteristics, which would make it desirable for smelters in northern Europe, which are located in relatively close proximity to the operation.

The island of Novaya Zemlya was once a nuclear weapons testing range.

Frost, Radiation, Bears…

During the exploration phase, pgrk first confronted the need to organize processes effectively. Any delays or failures would not only drive costs considerably higher, they also pose great danger to employees. From October to March, weather at the archipelago is unpredictably harsh with strong winds and temperatures diving as low as -40°C. “Given the distance and the extremely harsh climatic conditions, the organizational work and technical challenges with Novaya Zemlya are complicated,” Igor Semenov, deputy head, pgrk said. “We can only work here in a normal mode from June to October, so we had to apply very strict planning to operations.”

“Assembling expeditions, loading equipment onto ships, and exploring the island all took place at an extremely high pace,” Semenov said. “In four months, our specialists completed a full range of field exploration work, which would normally be conducted in a two-year time span. With the use of new drilling technologies, the latest software and effective pre-planning, the pace of exploration was accelerated dramatically.”

Semenov noted that, with the launch of mining and construction activities for the processing plant on the island, the company would shift to year-round operational mode. To make this a reality, pgrk will have to make a significant investment in infrastructure, especially the creation of a logistics terminal. The company has already created a transport and logistics hub in the nearest city, Arkhangelsk, ensuring the supply and transit of materials and equipment to the mine. And, it has already attracted local transport companies to deliver cargoes by sea and air, as they have experience with operating in such extreme conditions.

“In the future, it is expected that the cargo base of the mine could reach 500,000 mt/y. We intend to use transport companies of the Arkhangelsk Oblast. We are currently evaluating logistics and it is likely that regional companies will be the most competitive, due to their proximity and experience,” Semenov said.

The current plan involves the construction of a sea terminal on the coast of Yuzni Island. The terminal would be designed to accept supplies and ship concentrate on vessels with a displacement of up to 10,000 mt, and also offer docking facilities for an icebreaker fleet. Due to the project’s importance, the Arkhangelsk transport hub may get support of the state.

Heavy frost and the lack of infrastructure aren’t the only challenges to the pro-

ject’s implementation. From September 1955 to October 1990, 132 nuclear bombs were detonated at the archipelago, including 87 in the atmosphere, three underwater and 42 underground. The tests involved very powerful megaton nuclear weapons. It was this location in 1961 that the most powerful bomb was detonated. The 58-megaton hydrogen bomb (dubbed the Tsar Bomb) caused a seismic wave, which circled the globe three times.

Nearly all (94%) of the Soviet Union’s nuclear tests took place here in an area of 85,000 km2, which is equal to the territory of Netherlands. During these tests, the surrounding environment was severely poisoned. In 1970s, it was reported that 344 people had suffered radiation poisoning. The Russian Army monitors the region, and it is now believed that radiation is within the normal limits. However, other experts suggest that the half-life period for nuclear decay has still not ended, so some places underground possibly may still pose a serious threat to humans and other living creatures.

According to Ludmila Egorova, the head of logistics service and chief psychologist at the Russian army base, Novaya Zemlya also has problems with bears. “During the last 20 years, the animals have become extremely aggressive and some people say that this may be connected with the radiation, bad ecology and reduced fauna in the region,” Egorova said.

“The effects of the nuclear explosions on Novaya Zemlya on the surrounding environment have clearly not been studied enough,” said Gennady Khakhin, the head of the Wildlife Health Center at All-Russian Research Institute for Nature Protection. According to him, it is clear that radioactive contamination in the testing period has left its mark on soils, rocks and vegetation, as radionuclides were found in the body of birds and animals here.

Hunting bears is forbidden, since they are listed in Red Book (the Russian version of the endangered species), but almost every year, bears kill someone at the base. The miners’ settlement will also be at risk, since bears are attracted to the smell of wastes and it seems they are deliberately hunting humans.

With a compressed timeframe, exploration activities had to be well planned.

Commercially Attractive

ARMZ has been welcomed by the authorities from Arkhangelsk Oblast, who understand the importance of infrastructure development and they have promised to provide all possible state support.

“If necessary, the regional government is ready to come up with legislative initiatives to create the most comfortable conditions for the implementation of the pro-

ject,” said Alexei Alsufev, deputy head of government of Arkhangelsk Oblast. “Regional authorities have offered to include construction of the mining and processing plant at the Pavlovsk deposit in the state program of socioeconomic development of the Arctic zone for the Russian Federation for a period up to 2020 as a priority project. It can also be supported at the federal level.”

According to Alsufev, investors could apply for a three-year tax exemption on income and property tax and such tax breaks should significantly cut the payback period of the project. ARMZ is currently negotiating this issue with the government of Arkhangelsk Oblast. In addition, the terminal’s location near the waters of the Northern Sea Route could also serve as a base for marine rescue services.

ARMZ is obviously taking advantage of a political situation where the Russian government is promoting an increased presence in the Arctic region and willing to support private investors in the region. ARMZ said in a statement that “implementation of the Pavlovsk project, apart from its lead and zinc ore mining and processing objectives, contributes to the resolution of a number of important geopolitical tasks of the Russian Federation, such as expanding the presence of the Russian Federation in the Arctic, development of northern areas and intensification of the Northern sea route usage. Development of Arctic shelves for other natural resource prospects, such as gas, oil, and minerals highlight the need for comprehensive development of the infrastructure (industry, transportation, power engineering, etc.) for the Novaya Zemlya Archipelago and the Arctic in general.”

Given government support, ARMZ has estimated the cost of the project and possible payback period and despite serious challenges, operations in Novaya Zemlya are attractive. At the moment, the company only invests its own money into the project, aiming to attract other participants in future.

“The investment value of the deposit is directly related to the level of its development,” Semenov said. “The current stage of development of the Pavlovsk deposit implies a certain discount to the actual market value. Therefore, project financing is carried out by state corporation Rosatom [the Russian Nuclear Agency, which owns ARMZ],” Semenov said.

Semenov also added that after preparation for construction of the main facilities, ARMZ plans to attract financial investment based on the pro-

ject’s lending agreements. It will also consider long-term off-take agreements with potential purchasers, where revenue would be used to repay borrowed funds during the initial stage of the pro-

ject’s implementation. According to Semenov, ARMZ already has had a few offers for the proposed scheme.

Rosatom studied the target markets. Concentrates have been offered to two Russian zinc plants: Chelyabinsk Electrolytic Zinc Plant and Vladikavkaz Plant Electrozinc. Both companies are controlled by the Ural Mining and Metallurgical Co., which expressed some interest in purchasing the products. Sweden’s Boliden, which has several smelters in Scandinavia, has also signed a framework protocol for long-term cooperation. For the lead concentrate, similar agreements have been reached with some state-owned companies in China. ARMZ has also held preliminary negotiations with commodity traders in Europe who are interested in purchasing both lead and zinc concentrate.

The Russian government will likely support a terminal for the project at Arkhangelsk.

First, But Not the Last?

According Semonov, should the project succeed commercially, it could be expanded in the future as there are two similar deposits located nearby and preliminary exploration work shows very promising results. “Pgrk holds the exploration license for an area of 1,150 km2 in the Novaya Zemlya. The license for the Pavlovsk deposit involves only 12 km2. Therefore, Yuzni Island is the most promising place in our region.”

In 2013, a survey and assessment of natural resources were carried out at two other deposits, Severnoe and Perevalnoe, next to the Pavlovsk deposit. “Very good results were achieved at Severnoe. Geologically, it is different from the Pavlovsk deposit, but in some ways they are similar. Future plans call for further exploration and evaluation,” Semenov said. “In my opinion, it is very likely we will discover new deposits. It’s important to locate additional resources near the existing facilities. And, in general we believe we are here in the Arkhangelsk Oblast to stay.”

At the same time, it is clear that the Pavlovsk deposit is not a core asset for ARMZ. The company is implementing it largely in response to continuing problems with its traditional business—mining and processing uranium. The main ARMZ asset, Priargunsky Industrial Mining and Chemical Union (PPGHO), continues to suffer losses with declining demand and prices.

According to Verkhovtsev, deputy general of ARMZ, it plans to bring PPGHO to the breakeven point in 2016 as it has recently concluded several new contracts where price is denominated in dollars. As a result, profit in rubles should grow, improving the profitability of the uranium segment for the company as well, Verkhovtsev explained.

The goal, however, to make the uranium business profitable seems unrealistic, as the production costs for uranium in the country is RUB 9.2/kg, which is $134/kg or $61/lb compared to $37.25/lb of uranium on the global market. As a result, PPGHO suffered losses of RUB 3.5 billion in 2015 and will probably suffer about RUB 1.5 billion of losses in 2016. According to Verkhovtsev, ARMZ as a result has had to cut investment and staff, while overall production of uranium dropped by 8% since 2014.

The potential for implementing uranium production at several new deposits seems questionable. In Russia, the company has three developing projects. The first involves commissioning of the Elkon Mining Metallurgical Plant (Elkon MMP) in the Republic of Sakha (Yakutia). ARMZ wants to establish operation in the Elkon uranium ore district, which is believed to be one of the world’s largest with 319,000 mt or 6% of world’s extracted reserves.

In the same region, the company is also developing a uranium production project at the Lunnoye deposit in the Trans-Baikal Territory, Republic of Buryatia and Khabarovsk Territory. The objective is to create a cost-effective plant based on low-cost uranium heap leaching methods. Work is scheduled to begin at the Berezovoye and Gornoye deposits, with reported reserves of around 8,000 mt.

In 2015 ARMZ refused a license for the developing of Olovskoe uranium deposit, saying it was simply impossible to conduct profitable mining here. Previously, the company cut investments, but never refused licenses. It was trying to reduce production costs. In 2014, costs were reduced 5%, while in 2015 already by 11%. Still, given the logistics investment and all other spends, the price of the Russian uranium is two times higher the prices supported by the global market. With this backdrop, investments in noncore assets like Pavlovsk deposits seem quite justified.