As costs rise, gold miners are reviewing optimization plans that haul less waste. (Photo: Melissa Whellams)

Gold miners look to develop more projects as lithium prospects emerge

By Steve Fiscor, Editor-in Chief

Nevada hosts a great deal of mining activity and most of it is related to gold, but not all of it. Three years after establishing a joint venture, Nevada Gold Mines (NGM) has created the world’s largest gold mining complex. In its short life, NGM has produced 10 million oz of gold and it currently employs more than 7,000 people in Nevada.

In addition to NGM, several mining companies operate gold mining operations that run the gamut from 40,000 oz/year (oz/y) to to more than 250,000 oz/y. While many of them found ways to secure their supply lines during the post-COVID-19 era, they are now seeking ways to optimize operations as costs for fuel, electricity and reagents continue to climb. In this region, that means hauling less waste tons, placing ore cost-effectively on the leach pads and reducing dilution underground.

To sustain operations that are depleting reserves, these gold miners are also drilling to further delineate existing reserves and better understand the geology in the region. Few are hunting for elephants these days. Most are drilling in the shadows of existing operations.

The race for battery minerals is also creating new opportunities for miners in Nevada. Several new lithium operations are preparing to come online in the next few years.

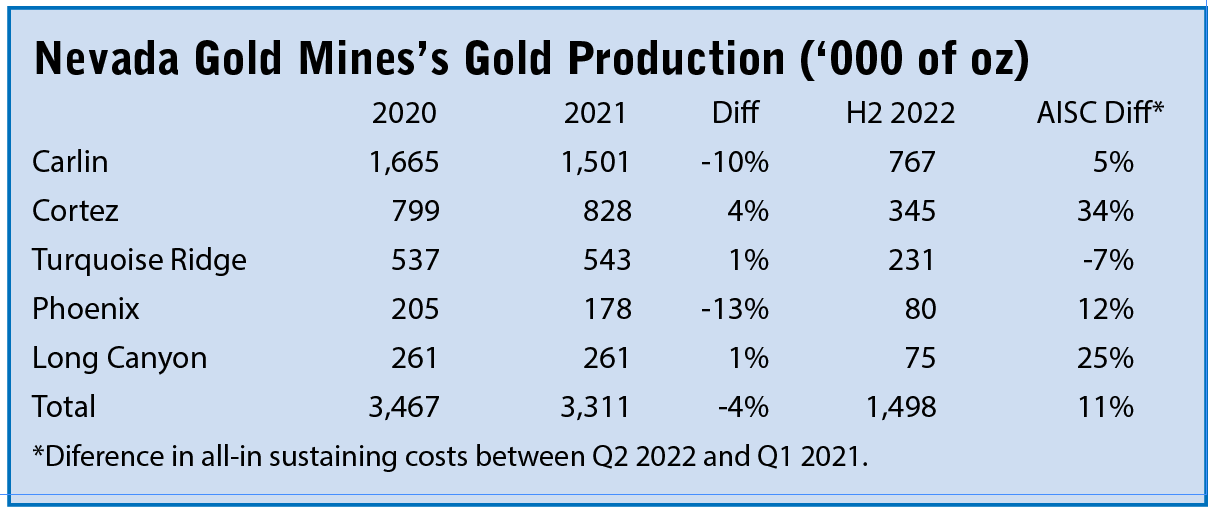

Costs Rise for NGM

In 2021, NGM produced 3,311,000 oz of gold, a 4% decrease from the 3,467,000 oz in 2020. Year-to-date for 2022, the company has produced nearly 1.5 million oz and its all-in sustaining costs (AISC) have climbed to $1,238/oz an 11% increase from the first quarter of 2022. AISC increased for most of the operations, Carlin (5%), Cortez (34%), Phoenix (12%) and Long Canyon (25%). Turquoise Ridge saw its AISC decline by 7%.

During the first half of the year, NGM posted improved operational performance at all of its sites apart from Cortez, which is making a major transition with its mining operations. Going forward, the Goldrush project will drive further improvements at Cortez.

Gold production from NGM’s Carlin operations recovered from a mechanical failure at the Goldstrike mill in 2021, which caused its annual production to drop 10% to 1,501,000 oz in 2021 from 1,655,000 oz in 2020. Through the first half of 2022, the Carlin operations have produced 767,000 oz. Quarter-to-quarter performance has improved, driven by better underground production figures from the Leeville and Portal mines, higher grades and recovery from the Gold Quarry concentrator, as well as higher heap leach production driven by the timing of the leach cycle and ore placement. More recently, NGM purchased an oxygen plant for the Goldstrike autoclave, which was previously owned by a third party.

Annual gold production at the Cortez operations grew 4% to 828,000 oz in 2021 from 799,000 oz in 2020. For the first six months of 2022, the Cortez operations have produced 345,000 oz of gold. Oxide mill and roaster production were lower in the second quarter of 2022 due to lower open pit throughput and grade as NGM transitioned from the Pipeline pit to the next phase of Crossroads. Mining was primarily focused on stripping at Crossroads and this will continue into the third quarter of 2022. The transition from Pipeline to Crossroads (Phase 5) is expected to deliver oxide ore in the fourth quarter of 2022. The drop in production from Crossroads was partially offset by an increase in the ore mined at the Cortez Hills underground operation, which was hindered during the first quarter as the mine temporary suspended operations due to a fatality.

Overall annual gold production remained consistent at Turquoise Ridge, which produced 543,000 oz in 2021 and 537,000 oz in 2020. Year-to-date production figures stand at 231,000 oz. Second quarter production increased 12% over the previous quarter due to higher throughput and recovery at the Sage autoclave following a scheduled maintenance shutdown for the entire processing plant during the first quarter of 2022. The No. 3 Shaft at Turquoise Ridge is scheduled to be completed this year, which will help improve operations.

Gold production for Phoenix for the second quarter of 2022 was 13% higher compared to the prior quarter, mainly driven by slightly higher grade and mill throughput. Phoenix produced 178,000 oz in 2021, which was down 13% from 205,000 oz in 2020. It has produced 80,000 oz through the first half of 2022.

Gold production from Long Canyon was also remained consistent as the mine produced 261,000 oz in 2021 and 2020. The operation’s second quarter production was 16% lower compared to the prior quarter, primarily due to the completion of Phase 1 mining in May 2022. NGM said it is no longer exploring a sales process for Long Canyon. The company said a review seeking to optimize the asset’s mine life extension, including required permitting activities, is ongoing.

Earlier in the year, NGM announced that a 700,000-oz maiden resource had been identified at North Leeville. The company also believes there is greater potential for resource additions at it and North Turf, which continues to expand toward North Leeville with multiple high-grade intercepts. Underground drilling is expected to reach North Leeville later this year when the two projects should be able to be combined.

At Turquoise Ridge, geological modeling of the BBT Corridor to the South has highlighted the potential for significant additional ounces, with early drill results also indicating this opportunity. The company said that drilling between and within the legacy Twin Creeks and Turquoise Ridge operations is transforming its understanding of this area, and they continue to make changes to the models with implications for exploration.

Kinross Advances Stabilization Plans for Round Mountain

Kinross Gold recently reported production figures for its Round Mountain and Bald Mountain mines in Nevada. Year-to-date gold production for Round Mountain stood at more than 102,000 oz. Last year, the mine produced more than 257,000 oz, which was down from 324,0000 oz in 2020. For the first six months of 2022, the Bald Mountain mine produced more than 90,000 oz. Last year, it produced 205,000 oz, which was up from 191,000 oz in 2020.

The company said it continues to advance the Round Mountain mine optimization program, which is on schedule to be completed later this year. The program is optimizing the mine plan sequence for Phase W, which is expected to be divided into four parts. Mining for the first two parts is ongoing and is expected to continue over the next two to three years as part of the open-pit mining plan. Phase S mining is now expected to start early next year as part of the optimized mining sequence, with permits now in hand.

Longer-term mine plan scenarios post-2024 are analyzing optimized stripping requirements for the third and fourth parts of Phase W mining. Underground mining potential is also being evaluated for the deeper portions of Phase W and Phase X. Plans for the development of an exploration drift at Phase X continue to advance well, with construction expected to begin in Q4 2022.

Last year, Kinross identified and implemented initiatives to stabilize the west wall of the Phase W, including dewatering and moving waste material from the pit rim. The program is evaluating further initiatives to enhance wall stability, including shallower pit wall slope angles over a more extensive area, and alternative mine plan opportunities, such as incorporating the Phase S pushback.

At the Gold Hill exploration project, which is located approximately 7 km northeast of Round Mountain, exploration drilling has extended the main and Alexandria veins over 300 m and 200 m down dip. New geophysical data confirms multiple deposit-scale trends along strike at Gold Hill, and results shows significant strike continuity and the open, un-tested nature of the trend.

i-80 Establishes Itself as a Contender

i-80 Establishes Itself as a Contender

At the beginning of the year, i-80 Gold Corp. released a comprehensive plan to create a Nevada-focused gold mining complex. The company is in the process of developing multiple mining operations with the hopes of ultimately producing more than 400,000 oz/y of gold. “We are concentrated on achieving our goal of becoming one of Nevada’s largest gold producers,” i-80 CEO Ewan Downie said.

After completing multiple strategic transactions in 2021, including the acquisition of Granite Creek, Lone Tree and Ruby Hill properties, i-80 became one of the largest holders of gold and silver resources in Nevada. The company also secured the ability to process all types of gold ores, including refractory gold bearing mineralization, through the acquisition of the Lone Tree processing complex and also through interim processing agreements with NGM that provide the flexibility to process material from any of the three planned underground operations until the Lone Tree autoclave is restarted. Processing of refractory mineralization remains one of the biggest barriers to entry in Nevada, and i-80 is currently one of only three companies with this capability.

Year-to-date, the company has sold nearly 5,000 oz of gold, with a little more than 3,500 oz in the second quarter and they are expecting 40% more for the third quarter. That gold was recovered from residual leaching at Ruby Hill and Lone Tree.

Management describes i-80’s development plan as a “Hub and Spoke” strategy, which involves the construction of four new mining operations over the next three years, the completion of multiple large-scale drill programs, advancement of permitting, building a tier-one management team, and restarting the Lone Tree autoclave.

Lone Tree would be the “Hub” of i-80’s Nevada operations as the central processing facility. Ore from Granite Creek, Ruby Hill, and McCoy-Cove will feed the Lone Tree Autoclave, once restarted. During the first quarter, i-80 awarded a contract to Hatch to complete a detailed engineering study for the autoclave restart.

Currently on care and maintenance, Lone Tree’s existing infrastructure includes a whole ore autoclave with capacity of 1 million metric tons per year (mt/y), a 1.8 million mt/y flotation circuit, a leach pad with 6.5 million mt of remaining capacity, a tailings dam with 1.5 million mt of remaining constructed capacity and an additional 10 million mt of designed capacity, a waste dump, along with several buildings useful for the development of all i-80’s projects, including a warehouse, maintenance shop, administration building and assay lab.

i-80 ships first ore from its Granite Creek mine.

The Granite Creek underground mine represents the company’s most advanced project. Initial rehabilitation of the underground workings was completed in 2021 and in February underground mining began. In July, the company began shipping ore from Granite Creek to NGM’s Twin Creeks processing facility. The goal is to ramp up Granite Creek ore shipments to 450 tons per day (tpd) in 2022 to 1,000 tpd during 2023.

“We have moved to full operations underground 24/7 at Granite Creek and we’re advancing the decline to access the lower ore zones, putting in several levels, setting up the operations so that, by the end of 2023, we expect to be at a full run rate of approximately 1,000 tpd,” Downie said. “We shipped our first delivery of material to NGM, and that was part of our bulk sample program, where we deliver an initial 10,000 tons of material that will be used in a blending program by NGM prior to our starting to ship on a day-to-day basis. Once the day-to-day basis mineralization and the acceptance of our ores are in place, we will then plan to make a formal production decision for the project.”

The underground deposit at Granite Creek represents one of the highest-grade gold deposits in North America, with resource grades greater than 10 grams per mt (g/mt) of gold. Exploration activities to further delineate the Ogee and South Pacific zones at Granite continue, with nearly 24,000 ft of core drilling and more than 8,150 ft of reverse circulation drilling.

Located immediately west of Eureka, near U.S. Highway 50, Ruby Hill includes an open pit mine and related mill and heap leach infrastructure. The property hosts multiple gold, silver and base metal deposits that collectively comprise one of Nevada’s largest mineral endowments. A major, multi-drill exploration campaign is underway that will see a minimum of 20,000 m drilled in 2022.

“Ruby Hill project has the potential to become a flagship asset,” Downie said. “We’ve had substantial success expanding the known deposits, which are Ruby Deeps and the 426 Zone. We’ve released several holes from Ruby Deeps that have been some of the best intercepts in our company’s history.

“We are systematically re-leaching multiple areas of the heap, including mineralization that was loaded onto [the pad] in advanced to us acquiring the project,” Downie said. “And, we completed the mining of the bottom portion of the pit and loaded that and we’re just starting to see substantial gold coming from it.” Permitting is underway for the start of a portal from the existing pit that will access the underground mineralization with 426 Zone and the Ruby Deeps zones being the primary targets.

In March, the company began development at the McCoy-Cove Project. Construction of an exploration decline has advanced to approximately 1,300 ft.

“The initial plan is to construct the exploration drift and complete approximately 40,000 m of infill and some expansion drilling on this deposit,” Downie said. “This is truly one of the highest-grade development projects in North America.”

With grades in excess of 10 g/mt gold, the deposit remains open for expansion down-dip. The company also acquired a key water rights package for the Cove project from Baker Hughes in May that included 582 acre-feet of water and a rail heading on the Nevada Central Railway, along with barite deposits and processing facilities.

Hycroft Launches 2022 Exploration Program

As it continues the engineering and design work for the next phase of its operations in northern Nevada, Hycroft Mining Corp. said it will be conducting the largest exploration program at its Hycroft mine in nearly a decade. There has been no exploration drilling at Hycroft since 2014 and, prior to that, drilling was focused on step-out drilling from the known pits for heap leach operations. The company said it will spend $15 – $20 million on an exploration campaign that will focus on higher-grade opportunities identified in its 2021 program.

For the first time, Hycroft will use a systematic approach to understanding the genesis of what they believe is a world-class scale deposit, including potential feeder systems. Hycroft is a low-sulphidation, epithermal system with numerous banded quartz veins similar to Midas-style mineralization, yet the company said there has been no prior focus on understanding these veins and what they may mean to potential feeder systems.

The 2022 – 2023 Hycroft exploration program will comprise approximately 125,000 feet of reverse circulation (RC) drilling and approximately 20,000 feet of core drilling. The RC drill rig is on site and the core drill rig is expected to arrive on site later in July. The RC drilling is being conducted by National EWP Inc. of Elko, Nev., and the core drilling will be conducted by First Drilling LLC of Montrose, Colorado.

“From the 2021 metallurgical drill program, we observed that high-grade mineralization occurs at the intersection of the steeply dipping north-south trending faults and the east-west faults,” said Alex Davidson, vice president-exploration for Hycroft. “These geologic controls of the higher-grade mineralization that are known at Hycroft are similar to structures seen at the historic high-grade, past-producing Rosebud gold mine, which is surrounded by our land position. We believe that there remains untapped potential at Hycroft.”

The results of this exploration program, together with the 2021 metallurgical drill program results, will be used for the geologic modelling, updated resource models, and mine planning activities associated with the technical studies underway for the sulphide mill operation.

“It is an exciting and promising time for the Hycroft mine as we ramp up Hycroft’s largest exploration program in nearly a decade to follow up on several higher grade intercepts and anomalies previously identified, and assess the district potential of this world-class-size resource,” Hycroft President and CEO Diane Garrett said. “The results of this exploration program will be important to the mine plan for the sulfide operation. Our activities this year and next are integral to taking Hycroft up the value chain.

“Our operating team continues to execute and exceed our plans, including producing more gold from the leach pads than we had estimated in inventory, and identifying areas of existing leach pads where additional gold ounces may be recovered,” Garrett said. “We are continuing to advance the technical studies and process design for the milling and pressure oxidation process.”

Hycroft reported gold recoveries for the second quarter and the first half of 2022 2022 of 6,487 oz and 10,924 oz, respectively, and silver recoveries were 18,566 oz and 30,515 oz, respectively. Processing of ore on leach pads is currently planned to proceed through the end of 2022 with immaterial residual recovery of ounces through the first quarter of 2023.

Nevada Gold Briefs

For the six months of 2022 and 2021, SSR Mining’s Marigold mine produced 79,557 and 125,828 oz of gold, respectively. As guided, production in the first half was impacted by fewer tons placed, as well as slower leaching due to finer ore from the north pits delaying some gold recovery. Second quarter production costs were $1,097/oz. The AISC for the second quarter of 2022 of $1,458/oz was above Marigold’s full-year guidance range due to the increased waste stripping and fewer ounces sold. The company also said it continues to face increased cost pressures, especially with fuel, electricity, and reagents across the business that have outpaced its cost-mitigation efforts this year.

Marigold stacked approximately 71,000 oz in the second quarter of 2022, including 31,000 oz in the month of June. Marigold’s production profile remains 60% weighted to the second half of 2022 as higher grade ore accessed in the second and third quarters of 2022 is expected to drive stronger production through the remainder of the year, most notably in the fourth quarter. This improving production profile and reduced waste stripping is expected to drive quarter-over-quarter reductions in mine site AISC.

Located approximately 45 miles southwest of Winnemucca, Nevada, Argonaut Gold’s Florida Canyon mine is an open pit, heap leach gold mine. In 2021, Florida Canyon produced 54,215 gold equivalent oz (GEOs) vs. 47,064 GEOs in 2020. For the first half of 2022, Florida Canyon has produced 24,472 oz vs. 25,654 oz in H1 2021.

Florida Canyon is one of Argonaut’s four producing mines. The company is slightly ahead of its operational budget in terms of GEO production during the second quarter, which yielded more than 59,000 GEOs, albeit at a slightly higher cost than budgeted due to inflationary pressures on input costs, Argonaut President and CEO Larry Radford explained. Argonaut appointed Radford to the position in March 2022. He was senior vice president and COO for Hecla Mining Co.

For the second quarter of 2022, Argonaut Gold said, the Florida Canyon mine produced 5% more GEOs at a cash cost per gold ounce that sold 43% higher than during the second quarter of 2021. The higher GEO production was attributed to higher recoveries, and higher costs were primarily related to lower ore tons and ounces mined and placed in previous months and higher key consumable costs.

Calibre Mining’s Pan mine is a Carlin-style, open pit, heap leach mine, located in east-central Nevada, approximately 28 km southeast of Eureka. Pan ramped up smoothly after restarting operations in September 2017. Gold production has increased year over year since 2017, with 2021 gold production reaching 45,397 oz and benefitting from a heap leach pad expansion and primary crushing circuit installed in 2020.

A haul truck returns to the pit at Calibre Mining’s Pan mine.

In its second quarter earnings statement, Calibre Mining reported 19,914 oz of gold for the first half of 2022. The company said waste movement increased during Q2 vs Q1 (3.1 million mt vs 2.5 million mt), resulting in an approximately $150/oz increase in cash costs. During the first half of 2022, 7.8 million mt were moved, including 2.1 million mt of ore mined at a grade of 0.41 g/mt.

Fortitude Gold sold 12,851 oz of gold at a total cash cost of $646/oz (after by-product credits) and an AISC of $733/oz. Realized metal prices during the second quarter of 2022 averaged $1,876/oz gold. The company produced 10,980 oz of gold at its Isabella Pearl mine during the quarter and maintains its target of 36,000 oz/y to 40,000 oz/y of gold.

“Our Isabella Pearl operations delivered another solid quarter,” Fortitude Gold President and CEO Jason Reid said. “This included focusing on the high-grade Pearl zone during the second quarter with less of a strip ratio. We are beginning to enjoy the benefits of moving substantially less waste at the Isabella Pearl mine, which translates directly to lower mining costs. When comparing the first half of 2022 to the first half of 2021, we moved 51% less waste year-over-year at Isabella Pearl and expect the waste tons moved on an annual basis to continue to decline in the coming years.”

The $600 million expansion project at Coeur’s Rochester mine remains on track.

Rochester Expansion Project Remains On-track

The ongoing $600 million expansion at Coeur Mining’s Rochester silver and gold operation in Nevada remains on-track for completion in mid-2023. “We have significantly advanced and de-risked this expansion project, which is expected to provide a step-change in Coeur’s production and cash flow profile once completed and commissioned,” Coeur Mining President and CEO Mitch Krebs said. “The Rochester team completed the installation of prescreens on the existing crushing circuit on July 22, which is providing the team with important operating experience that will be applied to the expansion project.”

The expansion consists of three major components: a new 300-million-ton leach pad, for which civil work is essentially complete and piping work is near completion; a Merrill-Crowe process plant, with construction completion scheduled for the first half of 2023; and a new three-stage crushing circuit, with construction completion scheduled for mid-2023.

Construction of the Merrill-Crowe process plant ramped up during the second quarter, including completion of concrete work, continuation of equipment setting, and the commencement of building and process plant steel pipe rack erection, as well as piping and cable tray installation. Work on the crusher corridor included continued civil construction in the primary crusher area, the completion of concrete work, start of steel construction, and setting of conveyor and equipment in the secondary crusher area, continued advancement of concrete work and the start of steel erection in the secondary stockpile reclaim area, completion of concrete in the tertiary crusher area, and continuation of concrete work in the tertiary reclaim and final product load-out areas.

Deliveries of equipment and materials for the project continue to support the overall construction schedule. The company also recently advanced detailed engineering on the pre-screens. Equipment procurement and construction contract development is well underway as Coeur said it continues working to align construction of the pre-screens with the completion of the new crusher. Final cost estimates related to pre-screens are expected in the third quarter.

Pumpkin Hollow Hits a Rough Patch

Nevada Copper has developed restart plans for Pumpkin Hollow, an underground copper mine located in Yerington, Nev. The restart plans, which focus on the acceleration of key capital items followed by the development of a significant stope ore inventory in advance of a mill restart and completion of production ramp-up, have allowed the company to advance financing discussions with its key stakeholders.

During June, Pumpkin Hollow encountered operational and geotechnical challenges that delayed stope mining in the East South mining area and resulted in reduced concentrate production. An unidentified weak rock structure encountered in the main ramp to the East South Zone required additional drilling and geotechnical mitigation work to reinforce the area prior to proceeding. This, together with the limited access to the main ramp, slower than planned development and longer backfill cycles, has resulted in lower than anticipated development ore production.

Executives with ioneer Ltd. rang the Closing Bell at the Nasdaq during early August.

At the time, the company was planning to continue with development of its priority heading through the dike structure and into the East North mining zone, which is expected to have significantly higher copper grades and better geotechnical conditions than the East South Zone. Significant progress was being made on the second dike crossing.

Pala Investments Ltd., the company’s largest shareholder, had agreed to provide additional funding of up to $20 million through a promissory note, which the company has now spent. Pala has indicated that it is prepared to provide additional financing of up to $20 million through further promissory notes ($4 million of which has already been advanced) while the company continues discussions with its financing partners.

The commencement of restart activities is contingent on the company obtaining long-term financing. The company continues to work with its creditors and vendors to defer payments and maintain the operation in a temporary suspension status, with only limited operational activities being undertaken to protect the company’s assets, to minimize cash burn until closing of a restart funding package.

From left to right: Brian Sandoval, University of Nevada, Reno President; Jonathan Evans, Lithium Americas’ President & CEO; Steve Sisolak, Governor of Nevada; Littlestar Abel; Maria Anderson, Lithium Americas’ Community Relations Manager; members of the Tribe; and Lithium Americas’ staff.

Excitement Grows Around Lithium Prospects

ioneer Ltd., an emerging lithium–boron supplier, rung the Closing Bell at Nasdaq MarketSite in Times Square, New York to celebrate its recent listing on the exchange. The company began trading on Nasdaq through an American Depositary Receipt (ADR) program on June 30, 2022, under the symbol IONR. To commemorate the occasion, ioneer Executive Chairman James Calaway and CEO Bernard Rowe rung the Closing Bell alongside members of the company’s board of directors and senior management team.

The bell ringing comes just days after ioneer announced it has entered into its second and third binding lithium offtake agreements, finalizing the total planned lithium carbonate output and representing a significant milestone for the company and the United States’ domestic electric vehicle supply chain. An agreement with Ford Motor Co. was announced on July 22, 2022, and an agreement with Prime Planet Energy & Solutions, Inc., a joint venture between Toyota Motor Corp. and Panasonic Corp., was announced on July 31, 2022.

“We are honored to celebrate our Nasdaq listing by ringing the Closing Bell,” ioneer Executive Chairman James Calaway said. “I would like to thank our shareholders as well as the ioneer team and board of directors for their dedication and support throughout this process.”

ioneer’s Rhyolite Ridge project, expected to come on stream in 2025, will become a major domestic supplier of refined lithium products, with enough supply of lithium materials for approximately 400,000 electric vehicles each year.

Lithium Americas Corp. celebrated the inauguration of its Lithium Technical Development Center (LiTDC) in Reno, Nevada, with a formal ribbon-cutting ceremony on July 20, 2022. The LiTDC will demonstrate the recovery methods that will be employed at the Thacker Pass project to produce lithium carbonate (Li2CO3).

The new 30,000 ft2 lithium process-testing facility commenced production as planned during June 2022, replicating the Thacker Pass flowsheet from raw ore to final product in an integrated process. So far, the facility has produced 5 kg of battery-quality Li2CO3. In addition to generating sample material, LiTDC will enable the team to optimize and de-risk each step of the flowsheet continually.

Lithium Americas said permitting and early-works construction at the Thacker Pass project, located in Humboldt County, Nevada, remain on track to commence in 2022. A request for proposal (RFP) has been issued from short-listed engineering, procurement and construction management (EPCM) firms to perform detailed engineering, execution planning and to manage Thacker Pass’ construction.

“As we prepare to break ground on Thacker Pass, we have never lost sight of our broader responsibility in developing the largest and most advanced new source of lithium in the U.S.,” said Jonathan Evans, president and CEO of Lithium Americas. “We hope to play a meaningful role in securing a domestic supply of lithium to meet our country’s electrification needs, and we are committed to doing so in a manner that benefits the people of Nevada, Native Americans, and the broader industry that has flourished in this state. Our new LiTDC will help cement Nevada’s place as a critical hub for battery development.”

LiTDC has been designed to conduct test work on new target ores and brines, and contains a state-of-the-art analytical laboratory capable of analyzing ultra-pure lithium compounds. Lithium Americas and the University of Nevada-Reno are collaborating on this commercial work, while also educating the next generation of engineers and researchers who will play an essential role in curbing harmful carbon emissions.

Lithium Americas continues to advance a feasibility study targeting an initial production capacity to 40,000 mt/y of Li2CO3 (Phase 1), with a second stage expansion targeting a total production capacity of 80,000 mt/y (Phase 2). Capital costs are expected to substantially increase from the estimates in the 2018 pre-feasibility study. Results of the feasibility study are expected in the second half of 2022, to align with the strategic partnership and financing process and ongoing engineering and process testwork at the LiTDC.

In June 2022, the Nevada State Environmental Commission upheld the company’s approved Water Pollution Control Permit by denying an appeal in a 5-0 ruling. Cultural assessment and mitigation required as part of the ROD was successfully completed in mid-July by the company’s consultant and Tribe members. The archeological assessment and mitigation work is a key milestone in moving towards the commencement of construction.

A decision on the water rights transfer application by the state engineer to transfer the company’s existing and optioned water rights, which is expected to provide sufficient water for all of Phase 1, is anticipated in 2022. The company has recently commenced the process of negotiating additional water rights expected to be required for Phase 2 operations.