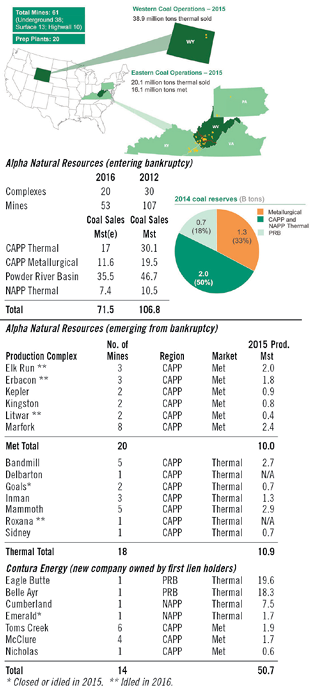

Contura Energy completed the previously announced acquisition of several core assets from Alpha Natural Resources (ANR), which was a key step for Alpha to emerge from Chapter 11 bankruptcy. Contura will be a private, Tennessee-based company with affiliate mining operations across multiple major coal basins in Pennsylvania, Virginia, West Virginia and Wyoming. It also purchased Alpha’s interest in the Dominion Terminal Associates coal export terminal in eastern Virginia. Contura will be led by former Alpha CEO Kevin Crutchfield and it will have a workforce of more than 2,200 former Alpha employees.

The new, reorganized Alpha will be a smaller, privately held company operating 18 mines and eight prep plants in West Virginia and Kentucky. David Stetson, who was appointed CEO of the reorganized company, said, “By completing this restructuring, ANR emerges as a company with a solid financial foundation and a strong team to continue to mine and sell coal. We are now also better positioned to satisfy ANR’s environmental responsibilities.” Alpha and its affiliates will have offices in Julian, West Virginia, and Kingsport, Tennessee, supporting operations at 14 mining complexes in Central Appalachia.

Contura Energy is a new company formed during the bankruptcy reorganization process from Alpha’s first lien lenders. The mining-related assets Contura acquired include the Eagle Butte and Belle Ayr operations in Wyoming, the Nicholas, McClure and Toms Creek complexes in West Virginia and Virginia, all of the company’s Pennsylvania coal operations, and certain reserves.

In return, Contura will provide contingent credit support for the reorganized Alpha moving forward; the $35 million aggregate amount will be available from Alpha’s effective emergence date (now) through September 2018. In the coming decade, Contura will also contribute up to $100 million to aid the new Alpha in its ongoing reclamation efforts.

Shortly after the approval announcement, the United Mine Workers of America (UMWA) said it had reached a tentative labor deal with both Contura and Alpha. The agreement, if ratified, will impact about 800 miners at Contura. It would also cover more than 100 UMWA members at West Virginia prep plants not being transferred to Contura.

Regarding the ongoing reclamation efforts, the West Virginia Department of Environmental Protection reached an agreement with Alpha on a previous deal regarding its bonding and reclamation obligations. The agreement, valued at more than $325 million, will pave the way to bond and reclaim all of Alpha’s legacy liability sites in West Virginia along with its continuing operations in the state.

Kevin W. Barrett, a partner of the Bailey & Glasser law firm and special assistant attorney general for West Virginia, called the agreement “groundbreaking” as it marks the first time a large coal company has committed to remain in active business while also continuing to operate for the primary purpose of reclaiming legacy mining sites.

Alpha also “donated” more than 53 million tons of reserves in Pennsylvania to a collection of environmental groups including the Sierra Club. The turnover is part of a settlement the producer agreed to with it and other environmental activist groups to gain their cooperation during the Chapter 11 reorganization process.

Alpha, which owns 2,400 acres above the Upper Freeport reserves in Pennsylvania, will donate the first $2 million in proceeds from the sale of the land to the groups. These restoration projects will be implemented by new nonprofit Appalachian Headwaters, which the group said will keep the coal from ever being mined. Alpha, in return, will get a three-year deadline extension for its ongoing Clean Water Act suit settlement between the environmentalists and two of the company’s mines.