For an industry that mostly measures its success in terms of the volume of rock blasted, hauled, processed into product and shipped, a growing dependency on an often-arcane tool such as software is both fascinating to observe and encouraging to vendors in an otherwise generally grim procurement picture. More than ever, mineral producers need to “get it right”—whether it’s optimum drill/blast designs or the implementation of a company-wide asset management system.

As a result, more mine operators are choosing to dip their toes into the digital river—or take the full plunge in a journey to achieve higher management awareness and greater operational accountability. Software developers are responding by maintaining a steady stream of upgrades to existing programs, introducing new products, and arranging alliances and acquisitions to expand their range of offerings.

Here’s a rundown on the latest developments:

Modular Mining Systems and RungePincockMinarco (RPM) formed an alliance aimed at delivering “an integrated solution to bridge the gap between planning and operations for elevated precision and optimized efficiencies to enhance mine productivity.” The alliance, according to the two companies, builds on RPM’s expertise in planning and scheduling and Modular’s know-how in systems integration and mine management solutions.

The companies said they are creating a mining framework based on the ISA-95 Business to Manufacturing Markup Language (B2MML), which facilitates the sharing of data among systems.

The integration of the systems will support bidirectional communication between the companies’ products: RPM’s XECUTE ultra-short term planning and HAULSIM haulage simulation software, with Modular’s DISPATCH Fleet Management and ProVision High-Precision Machine Guidance solutions. Shift plans and production targets will be dynamically used as control parameters for execution by the DISPATCH and ProVision solutions. The real-time execution progress will automatically feed back into the planning to refine the next short interval schedule, fostering collaboration among all stakeholders from planning, production, maintenance and operations.

Earlier this year, RPM announced it had taken steps to acquire iSolutions, a company that provides asset management, life cycle costing and budgeting software to the mining industry. iSolutions is headquartered in Sydney, Australia, with offices in Sydney, Brisbane, Santiago and Johannesburg.

RPM said the combined offering will create a single-vendor production and maintenance enterprise execution system capable of reducing the cost of mining as both the production and maintenance teams will be using the same software. Currently, Glencore, Anglo American and Newcrest are among the companies that use iSolutions software along with contracting companies such as Downer, HSE Mining and Moolmans. iSolutions recently reported that Newmont Mining will deploy its flagshop asset management software, AMT, across its Nevada operations in 2016 to conduct dynamic life cycle costing, budgeting and forecasting, along with providing visibility on maintenance strategies and associated costs.

At the core of the iSolutions suite of products is a Dynamic Lifecycle Costing (DLCC) engine. DLCC is the process of forecasting (in real time) every maintenance event for an asset to the end of its useful life including the expected future cost and performance of the asset. Being SAP, Oracle and JDE certified, AMT extends and complements the capabilities of traditional Enterprise Resource Planning (ERP) systems in the asset management space.

RPM also recently launched several updated or new software offerings, among them the latest version of HAULSIM, its mine haulage simulation solution. The company said HAULSIM 2.0 simplifies haulage simulation with improvements to its 3-D user interface, featuring in-built pivot grid reporting, and the ability to add, remove and edit roads and locations directly in the 3-D scene. Additional improvements to the user interface include enhancements to the navigator, now with extra validation steps to help guide users through the model construction process.

The company also introduced a new enterprise application, Plan Manager, designed to enable users to view, analyze and approve mine plans across different planning horizons (life of mine, long term, medium term, short term and ultra short term) and then publish an integrated plan in a variety of formats (including ISA-95 B2MML). The consolidated mine plan can be accommodated by enterprise financial systems, process control and fleet management systems, and then analyzed through the corporate business intelligence systems.

RPM said Plan Manager supports a level of detail that is appropriate to each planning horizon, with the ability to update sections of the plan without touching data that has not changed. This means that the re-planning process is faster and more efficient. Plan Manager can also pull in task status information, stockpile balances, grades and external plan inputs such as rail schedules and make them available to different mine scheduling applications.

The full plan history functionality within Plan Manager provides users with a complete audit trail for submitted and approved plans. It allows all plans that have been submitted to be checked to ensure their validity. These checks and balances deliver greater visibility and control around the entire plan consolidation process, which also comes with security built into the workflow so that the plan approval process and automated publishing is delivered with confidence.

Micromine announced that Pitram, its fleet management and mine operations program, will be integrated with Carlson Software’s GNSS-guided machine control solutions.

Pitram is used to record and process equipment, personnel, locations and materials data, providing an overall view of mine status. The software provides analytical tools that help mine managers and engineers identify operational constraints, improve the utilization of resources and increase production.

Micromine said the integration between the two systems will increase Pitram’s surface fleet management capabilities by providing high-precision machine guidance. Equipment operators will be able to perform activities such as drilling, excavation and loading more precisely.

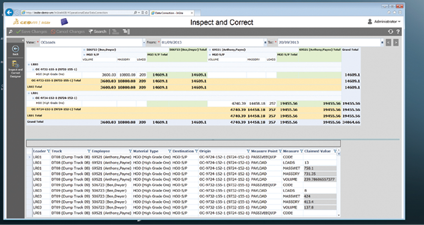

Geovia says InSite v. 4.6’s graphical interface allows users to see all critical operational information in one place.

Earlier this year, Dassault Systèmes Geovia announced a partnership with Whittle Consulting.

“With the quality of ore bodies decreasing and challenging economic conditions continuing, mining companies need to improve their Strategic Planning,” said Geovia CEO Raoul Jacquand. “The combination of Whittle Consulting’s experience and thought leadership in the Strategic Business Planning with Dassault Systèmes’ technology including the 3DExperience Mine and Geovia mining applications will provide solutions to help improve mining companies’ cash flow and NPV across the entire mining value chain.”

In April, Geovia released the latest version of InSite, designed to help mining organizations gain control of their mine production management by increasing the confidence in mining operations’ ability to meet production targets, manage costs and improve efficiencies.

Now offering an overhauled interactive graphical user interface, InSite 4.6 features a customizable dashboard that enables users to visually navigate the system in order to both see and understand all areas of variance across mining operational processes and activities. The dashboard, according to the company, provides an intuitive view of aggregated production data obtained from multiple sources, centralizing Operations Technologies (OT), with the ability to drill down to understand and analyze operational performance in order to influence in-shift decision-making.

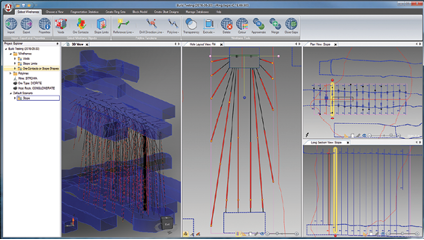

Maptek will offer iRing’s Aegis underground drill and blast software as the newest addition to its mining solutions.

“Aegis brings proven value to an underground operation’s drill and blast process, intelligently creating editable drill and blast patterns for an entire stope in seconds,” said Maptek Managing Director Peter Johnson.

“While the [Aegis] partnership is in the early stages, we are already envisioning the development roadmap for integration to include data exchange routines, with the ultimate goal of full integration with the Maptek Workbench, which was delivered alongside Vulcan 10 this year,” Johnson noted.

With Aegis, users of Maptek Vulcan at underground mines will now have access to next-generation, intelligent rapid ring design functionality, and advanced blast analysis tools available in Aegis that complement mine planning functionality in Vulcan. Maptek BlastLogic similarly offers analysis and quality management tools for surface drill and blast operations. Aegis is available in English, Spanish and Russian.

Maptek claims that with the addition of Aegis to its product line, it is now the only mining software supplier to offer a complete end-to-end solution for underground mining operations covering geology, mine planning, scheduling, stope optimization, advanced underground drill and blast and analysis, and mine survey.

“Integration throughout the mine planning and production cycle provides better information that can be used to make better decisions,” said Johnson. “For instance, engineers can optimize their stope designs using Vulcan Stope Optimizer, design the blast using Aegis, rapidly model the cavity monitoring survey data using I-Site Studio, and then feed that data back into Vulcan and Aegis for reconciliation and blast analysis.”

Hexagon Mining’s HxM Blast, Version 2, is claimed to enable users to take designed drill patterns and convert them into engineered blast designs. The addition of new charge and tie-in functionality is the latest in a series of improvements to the product, according to the company.

HxM Blast can be used in Hexagon’s Atlas or Planner for reserve calculations and scheduling. It also provides features to validate and improve the entire blasting process. Feedback and monitoring can now be directly used to continuously improve the blasting process, creating smarter designs.

The integration of Leica’s J2drill format allows designs to be exported as flat files to the Jigsaw fleet management system or any other drill fleet management system. Once drilled, the locations can be loaded and updated against designed locations. This benefits the charging process and helps adjust the blast design based on the actual hole location. It also provides a safety mechanism to avoid drilling “bootlegs” or drilling into possible misfires from the bench above.

The introduction of charging allows holes within a pattern to be attributed with explosive information. This is supported by a configurable consumable library, where blasting consumables and related properties can be entered and managed. Once supplied, the consumables, namely explosives, detonators, delays, cord, booster, and stemming, can be selectively used to create custom blasting templates. Cost and details of the shot can be tracked and reported directly within the application via integrated ARC (Advanced Reporting and Charting) reporting.

HxM Blast is set to receive Measure While Drilling (MWD) information from J2drill. This will allow information from the drill rig, such as the rock hardness, to be used to interpret different geologic units or seams. Such information can be fed back into HxM Blast to make a smarter blasting plan, according to the company.

In the field, ABB reported it has successfully implemented its Intelligent Mining Solutions (IMS) software, MineMarket and CCLAS laboratory information management system at Minera Frisco mining company in Mexico. As a producer and seller of gold, silver, copper, lead and zinc, Minera Frisco has nine mining units in Mexico.

This implementation, according to ABB, provides Minera Frisco with an integrated enterprise software solution from mine to market for material tracking, logistics, laboratory management and sales and marketing across multiple mining units, which has replaced disparate spreadsheet-based systems.

A key objective of Frisco’s project is to achieve significant time and cost savings up to 20%. ABB said it has a long and successful working relationship with Minera Frisco and the MineMarket software solution will help in the process of taking the next steps toward a more efficient, innovative and digitalized mining operation.

MineMarket enables Minera Frisco to standardize processes and automate data collection to ensure the same data is visible across the organization, facilitating analysis, adjustment and reconciliation of material movements. As a result, the company can better forecast production and respond to changing market conditions, which is critical to maximizing cash flow. It can also standardize laboratory processes with CCLAS, which enables high-volume, complex analytical laboratory data to be captured, calculated and reported to various stakeholders efficiently and on time.

Bentley Systems noted that mine owner-operators in Africa are pursuing higher production efficiency by upgrading their mine survey capability to deliver more timely information to planning and operations. Black Mountain Mining (Pty) Ltd., Boteti Mining (Pty) Ltd, ASA Metals (Pty) Ltd./Dilokong Chrome Mine (Pty) Ltd., and others have embraced new data processing and visualization technologies that accelerate mine survey cycles to enable faster, higher-quality decisions that improve mine performance.

Bentley said by deploying its MineCycle survey software, these mine owner-operators have enabled a more continuous mine planning cycle that increases the ability to maximize profits as well as respond more quickly to market fluctuations and unexpected events.

iRing’s Aegis underground drill and blast design program will be available in Maptek’s line of software solutions.

Komatsu Plans to Purchase Joy Global

Joy Global announced on July 21 that its board of directors unanimously approved a definitive merger agreement by which Japanese equipment giant Komatsu will acquire Joy Global in a transaction valued at about $3.7 billion, including assimilation of Joy Global’s $845 million of outstanding debt.

Komatsu said it intends to operate Joy Global as a separate subsidiary of Komatsu and retain Joy Global’s brand names, which in addition to Joy include P&H (surface mining equipment), Montabert (rock drills) and Continental (conveyor systems). Over the past 10 years, Joy Global also acquired and integrated equipment lines from Mining Technologies International (underground mining), LeTourneau Technologies (large wheel loaders), Stamler (feeder-breakers, underground battery-powered haulers) and Goodman-Hewitt (conveyors). Joy Global also owns several Chinese brands in the longwall equipment sector, including Huainan, Jiamusi, Jixi, Qingdao Tianxun and Wuxi Shengda. Given the company’s involvement in the Chinese market, some observers believe a competing offer, possibly from a Chinese investor, could surface before the transaction closes.

Joy Global was the entity that emerged from the bankruptcy of the former Harnischfeger Industries in 1999. Under terms of the Komatsu transaction, Joy Global will maintain its headquarters in Milwaukee, Wisconsin. Komatsu said it plans to leverage both companies’ leading technologies to pursue product and service innovation to enhance mine safety and productivity. In addition, Komatsu said the companies employ complementary products and strategies and are committed to an integrated direct sales and service model.

Tim Sullivan, who was CEO of former equipment builder

Bucyrus International—also based in Milwaukee—commented to the Duluth News Tribune that he thought, “Once the Caterpillar [acquisition of Bucyrus] happened, it was almost inevitable that a Komatsu-Joy deal would happen.” Caterpillar acquired Bucyrus, which had a portfolio of equipment lines similar to Joy Global’s, in 2011 for $8.8 billion. Komatsu reportedly looked closely at acquiring Joy Global in 2012 but ultimately determined that the timing and the numbers weren’t right.

Komatsu generates annual revenue of more than $17 billion, with about 25% of it from mining equipment sales. The com-

pany plans to finance the acquisition with funds on hand and bank loans.

Under the terms of the agreement, Joy Global stockholders will receive $28.30 per share in cash for each outstanding share of common stock held, representing a 48% premium to Joy Global’s shareholders. The deal is expected to close by mid-2017, pending stockholder and regulatory approvals.