By Russell A. Carter, Managing Editor

|

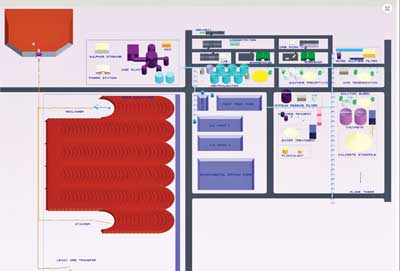

| Direct Nickel Ltd. successfully tested its DNi laterite leaching process in a 1-t/d pilot plant, a section of which is pictured above. The plant used feed from PT Antam’s Buli nickel mine in Indonesia, where Direct Nickel is considering building a 10,000-20,000 t/y commercial-scale plant. (Photo courtesy of CSIRO) |

Nickel ore has traditionally been mined by underground methods from deeply buried sulphide deposits that are amenable to conventional concentration methods. These deposits are steadily being depleted and new world-class sulphide nickel resources are hard to find. Laterite deposits, on the other hand, are relatively plentiful and generally massive-with some containing almost a billion tons of mineralized material-in addition to being located near the surface and mineable by economical open-pit techniques. But they’re also low grade, with limonite-type laterite deposits containing around 1%-2% Ni and saprolite-type ore a little more, up to 2.5% Ni-and they have other specific characteristics that make acceptable rates of metal recovery a difficult proposition. Nevertheless, they are estimated to contain more than 70% of the world’s known nickel resources and are a tantalizing target for metal producers, both large and small, industry entrepreneurs and mineral processing experts.

Presenters at technical conferences over the past few years have highlighted laterite ore processing challenges, which include high energy requirements involving both heat and pressure, high consumption of expensive reagents and sulphuric acid, and environmental risks, to name just a few. Over the past century, a number of hydrometallurgical processes have been developed to recover nickel from laterite ores, each with its own set of advantages and flaws and all with some level of commercial appeal.

As explained by Alan Taylor of ALTA Metallurgical Services at the Minerals, Metals & Materials Society’s 2013 annual meeting and conference in his paper Laterites: Still a Frontier of Nickel Process Development, the commercially applied processes for low-grade laterites are:

- Caron Process – reduction, roast, ammonia leach;

- PAL (or HPAL) Process – high-pressure sulphuric acid leach; and

- EPAL Process – enhanced pressure acid leach.

Taylor sketched the history and pros and cons of each of these methods, noting that the Caron and PAL processes are not new, having been developed anywhere from five decades (PAL) to nine decades ago (Caron), and that they’ve had varying degrees of commercial success. There are, for example, four operating PAL plants in Cuba, Australia, the Philippines and New Caledonia, two more in the commissioning stage in Madagascar and Papua New Guinea, and one under construction in Turkey. The EPAL process was developed by BHP Billiton and installed at Ravensthorpe, Western Australia; operations there were suspended in 2009 and it was later acquired by First Quantum and restarted in late 2011.

Overall, each approach has significant issues, some in common with the other processes as well as their own process-specific problems, such as high capital cost (PAL, EPAL), high energy consumption (Caron), high acid consumption with certain ore types (PAL), high corrosion and maintenance expense (PAL, EPAL), and process complexity (PAL, EPAL).

Other processes have been tested and, in some cases, adopted for projects. These include high-pressure acid leaching combined with atmospheric-pressure agitated leaching (PAL + AL) in the case of EPAL at Ravensthorpe, and stand-alone atmospheric-pressure agitated tank leaching (AL) at Weda Bay in Indonesia, along with heap leaching (AL) at Çalda? in Turkey. Other processes using chloride leaching have been tested but have not been applied to commercial recovery of laterites.

Taylor said that more recently, another approach has emerged-nitric acid leaching of laterites-offering some important potential advantages:

- It is applicable to both limonite and saprolite ores.

- It offers lower capital and operating costs than PAL.

- Nickel and cobalt recoveries are high.

- The lixiviant is regenerated and recycled.

- Secondary neutralization is not needed to remove residual iron.

- Solid/liquid separation properties are superior to sulphuric acid processes.

- There are opportunities to recover saleable byproducts.

- Drawbacks? Nitric acid solutions, said Taylor, are corrosive-but less so than chloride solutions, allowing use of standard 304 and 316 stainless steel vessels.

The handling of acid vapors involves personnel safety issues, and depending on the water balance, environmental problems can arise from the release of nitrate-containing solutions.

Moving Toward Commercialization

Currently, two nitric-based processes are actively moving ahead: a tank-leach method developed by Direct Nickel Ltd. (DNi) with research assistance from Australia’s CSIRO; and a heap-leach approach developed by GME Resources, a Perth, Australia-based nickel exploration company, which, through its subsidiary NiWest Ltd., owns a large nickel laterite deposit at Murrin Murrin in Western Australia.

Full-scale testing of the DNi process began in March 2013 at a 1-ton-per-day (t/d) pilot plant at CSIRO facilities in Western Australia. During the pilot plant testing stage, Russell Debney, managing director and CEO of Direct Nickel, said the process setup and operating costs were less than half of those of existing processes, and the DNi process was more efficient in extracting the nickel from the laterite ores. It was also believed to be the first process capable of treating all types of laterite ores. Finding a way to separate the solution containing nickel, cobalt, iron and magnesium metals from the waste products was a key step in the process development.

Earlier this year, Direct Nickel released the results of the 2013 pilot plant demonstration program, deeming it successful and a major milestone along the road to commercial development. In fact, Direct Nickel has partnered with Indonesia’s largest nickel miner, PT Antam (Persero) Tbk to develop a commercial-scale DNi plant.

Concurrently with the release of the pilot plant results, Direct Nickel said it had begun a feasibility study focused on building the first process plant at PT Antam’s Buli operation (which provided the pilot plant feed) in Halmahera, Indonesia, adjacent to Antam’s new ferronickel smelter, currently under construction. The company said the plant would likely be capable of producing 10,000 to 20,000 mt/y of nickel in concentrate.

Direct Nickel cited a number of advantages claimed by the DNi process, including:

- An “elegant” process chemistry in which reagents are regenerated and recycled within the process;

- An ability to treat limonite and saprolite ores and blends without loss in nickel recovery;

- Low process intensity; i.e., no need for high temperatures or high pressure;

- Ability to use off-the-shelf materials and equipment, with familiar design and scale-up methodology;

- Low volume, benign tailings that can be disposed as landfill; and

- Valuable byproduct recovery (MgO and hematite).

Refining the Process

|

| Tentative site layout plan for a laterite ore heap leach plant at GME Resources’ NiWest property in Western Australia. (Photo courtesy of GME Resources) |

Also earlier this year, GME Resources announced that its patent applications for acid regeneration and ore pelletization-processes that will be used in the proposed heap leach flow sheet for its NiWest nickel laterite project-had been granted.

The announcement followed the release of results in December 2013 for a scoping study of the heap leaching and direct solvent extraction/electrowinning process to be used at the NiWest project.

GME said the study confirmed the technical and potential economic viability for a project at NiWest that would produce 14,000 mt/y of nickel cathode and 540 mt/y of cobalt over a minimum 20-year mine life.

GME Managing Director Jamie Sullivan said the unique characteristics of the NiWest ore and high quality of technical work completed to date provided confidence in the development potential of the NiWest Project, adding, “The relatively simple heap-leach processing route identified in the scoping study has been considered and trialed at several other nickel laterite projects including at the adjacent Murrin Murrin nickel refinery, which has recently commercialized a heap leaching program on similar ore types.”

The company said the patented acid regeneration process was expected to enable reuse of a significant proportion of the acid applied in the heap leach stage. Test work indicated that up to 30% of the consumed acid could be regenerated.

The pelletization process is designed to stabilize the ore and begin the leaching cycle prior to the pellets being stacked on the heap.

GME said large-scale metallurgical test work would be conducted in 2014 to further refine these processes and, in particular, to increase the percentage of acid that can be regenerated.