By Steve Fiscor, Editor-in-Chief

By Steve Fiscor, Editor-in-Chief

The prices for metals dipped during 2019, but they finished strong for the most part. Base metals began to claw back lost ground at the end of the year when it seemed that the U.S. and China were working toward a trade agreement. With all of 2019’s strange political underpinnings — Latin American protests, Trump tweets and off-again, on-again Brexit — metals markets have become desensitized to the noise and simply plod along. Fundamentals more than speculation now drive the market.

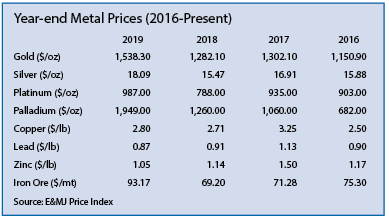

Comparing where metal markets stand today to the same point four years ago, one can identify some trends. All the precious metals are considerably higher than they were four years ago. Iron ore is also noticeably higher. Non-ferrous base metals on the other hand are a mixed bag. Viewing the market in this context, however, unfairly eliminates the swings that day traders live and die by.

Gold is a sign of the times and today’s price level is more fear-based than demand-based. No one in 2016 could have predicted palladium’s meteoric rise. In retrospect, however, it seems logical. One could argue that iron ore prices and base metal prices have benefited from unintended consequences that limited supply, such as environmental disasters in Brazil, labor issues in Chile, nationalization in Indonesia and increased costs in South Africa.

No one knows what the future holds. As far as long-term fundamentals, the migration in the developing world toward further urbanization will create more demand for metals. People will continue to strive for a better life for themselves and their children, which means better homes that consume more power, more tech and more metals. Let’s hope the world economy continues to grow. Misguided or not, the march toward further decarbonization will continue, which also creates more demand for metals.

While they could substitute other metals, there is no way for manufacturers to recycle their way into the future. Exploration activity has found

few new major deposits. Many existing operations are looking at ways to extract more metal from a deposit with a declining grade. For now, today’s miners are in a relatively good position as long as they can hold operating costs at bay. Will this trend last for another decade? Yes, it could.