Similar to the equities markets, prices for base metals started the New Year on a slightly downward trend. According to the E&MJ Prices Index, aluminum lost about $100 per metric ton (mt) or about 6% during January. Copper declined 5% or $340/mt. Lead, nickel, tin and zinc were down $35/mt (2%), $75/mt (1%), $290/mt (1%) and $120/mt (6%), respectively.

Put another way, during January, aluminum dropped from $0.79/lb to $0.75/lb; copper declined from $3.38/lb to $3.23/lb; lead slipped from $1.01/lb to $0.95/lb; nickel dipped from $6.32/lb to $6.29/lb; tin settled from $10.22/lb to $10.09/lb; and zinc slid from $0.95/lb to $0.89/lb.

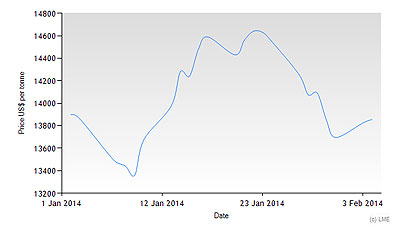

While none of these moves would indicate a dramatic market shift, nickel prices did make some erratic swings during January. After opening the month at the $13,900/mt level, it dropped to $13,300/mt before climbing above the $14,600/mt twice during the middle of the month. By month’s end, nickel prices retreated to current levels (See the E&MJ Prices Index below).

In 2012, world nickel production amounted to 2.1 million mt. Five countries represented roughly two-thirds of world production: The Philippines (330 million mt), Indonesia (320 million mt), Russia (270 million mt), Australia (230 million mt) and Canada (220 million mt).

Analysts following the market attributed the January price swings in nickel to the announcement by Indonesia that it would enforce unrefined ore export bans on miners. The country’s decision to shoot itself in the foot is expected to cause price swings to the plus side this year based on basic supply-demand fundamentals. Why didn’t prices hold?

The answer could be that, even with the Indonesian disruption, the market may remain in oversupply with a Chinese manufacturing swoon. Producers have not signaled a production pullback based on prices. The Russians are a prime example (See Norilsk Nickel, p. 46). Norilsk Nickel produced 285,000 mt of nickel in 2013, which was down 5% from 2012. The decline in production was attributed to reduced ore shipments and unscheduled repair work. While the company, similar to many mining companies, has refocused its operating strategy on tier 1 assets and improving its health and environmental compliance, reducing output is not part of the game plan. Nickel production generates revenue.