During the last month, palladium continued its steady march toward $2,000 per ounce (oz), while gold slipped below the $1,500/oz level. For December 4, the E&MJ Price Index is reporting a palladium price of $1,858/oz piercing the $1,800/oz level, which is a 3.4% ($61/oz) increase over last month. During the same period, gold prices fell 2.4% from $1,509.60 to $1,474.10. Platinum and silver also decreased 4.3% and 6.8%, respectively.

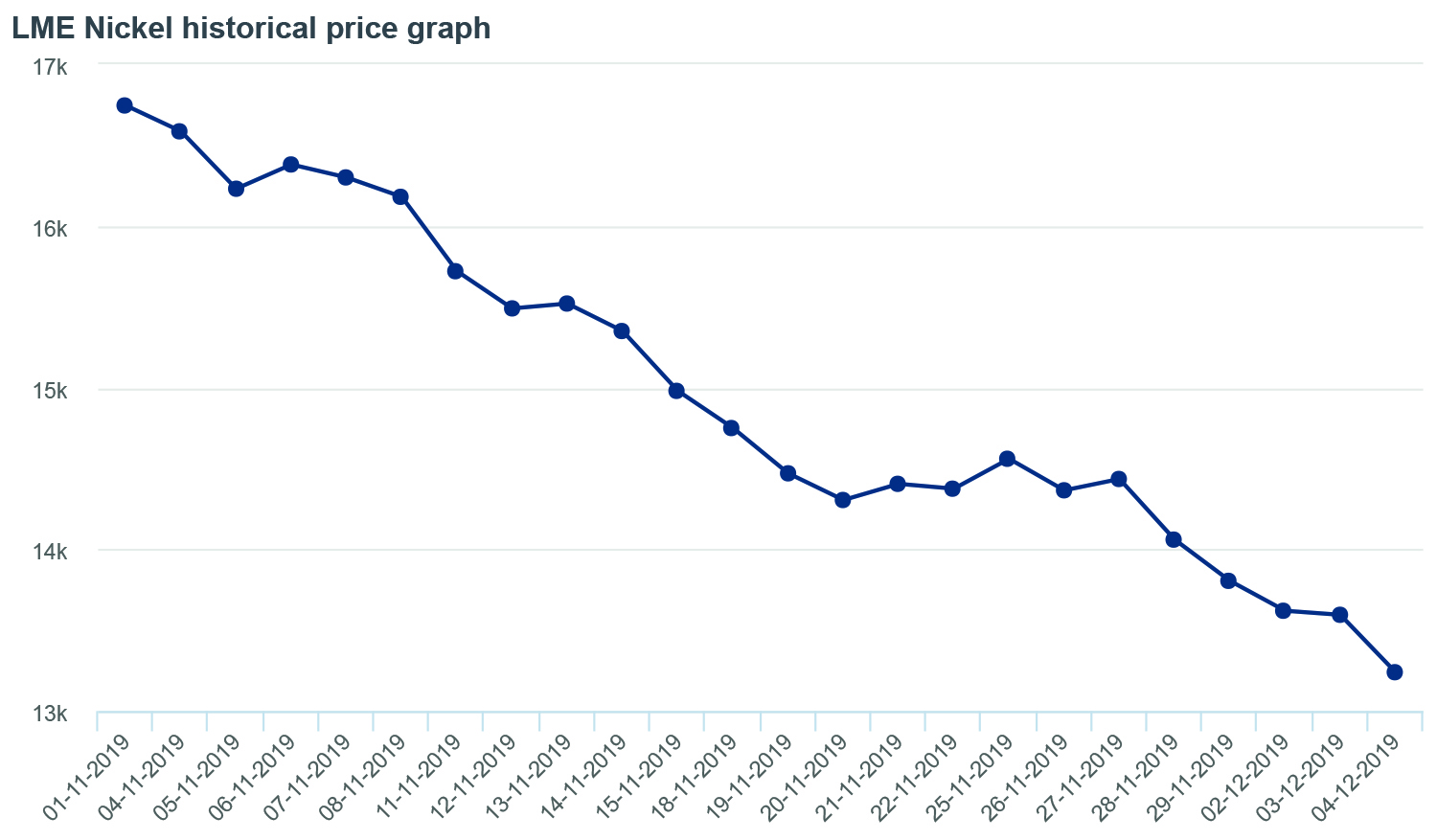

As far as price swings, the big news was with non-ferrous base metals and with nickel in particular, declining 20.2% from $16,595 per metric ton (mt) to $13,250/mt (or $7.54/lb to $6.02/lb). Lead prices dropped 12.7% from $2,176/mt to $1,900/mt (or $0.99/lb to $0.86/lb). Tin and zinc had posted modest gains of 2.4% and 6.6%, respectively, while aluminum and copper held steady.

As far as price swings, the big news was with non-ferrous base metals and with nickel in particular, declining 20.2% from $16,595 per metric ton (mt) to $13,250/mt (or $7.54/lb to $6.02/lb). Lead prices dropped 12.7% from $2,176/mt to $1,900/mt (or $0.99/lb to $0.86/lb). Tin and zinc had posted modest gains of 2.4% and 6.6%, respectively, while aluminum and copper held steady.

Nickel prices on the London Metals Exchange (LME) strengthened dramatically in Q3 2019, closing close to $8/lb at the end of September, which would be a $2.40/lb increase over $5.60/lb at the beginning of the quarter. Higher prices were based on speculation that Indonesia would implement a nickel ore export ban at the beginning of 2020, two years before the ban was scheduled to take effect. Nickel prices were also influenced by continued strong demand from China’s stainless steel sector. Prices reached a high of $8.45/lb on September 2.

Since the start of the fourth quarter, however, nickel prices have declined due to softening demand and inventory level changes. Combined, these factors suggest increased nickel price volatility in the near term. The combined nickel inventories on the LME and the Shanghai Futures Exchange (SHFE) at the end of Q3 2019 totaled 179,500 mt, down 1% from the combined total of 181,000 mt at the end of the second quarter. Total inventory levels have now decreased significantly since the start of the fourth quarter, declining by approximately 49%. This decline has been attributed to inventory stockpiling by stainless steel producers in advance of the Indonesian ore export ban. As of October 30, 2019, combined nickel inventories on the LME and SHFE were roughly 92,000 mt, the lowest level since 2012.

According to CRU, stainless steel demand is expected to grow at an average annual rate of approximately 4% through 2022. Demand for nickel from outside the stainless steel sector — particularly Class 1 nickel — is also expected to accelerate. Class 1 nickel, which contains 99.8% nickel, along with cobalt, are key metals needed to manufacture electric vehicle batteries. A shortage of Class 1 nickel is anticipated over the coming years as no new Class 1 nickel projects have been developed.