At the beginning of August, gold prices settled above $1,500/ounce (oz) for the first time since April 2013. On August 8, gold closed at $1,500.70, more than $90/oz higher than the previous month. The yellow metal finally surpassed palladium, which gained considerable momentum over the last year, but finally cooled to $1,426/oz from $1,525/oz last month.

As far as prices for non-ferrous base metals, the last month has been a mixed bag. Zinc suffered a 12% decline and is now selling for $1.03/lb. Copper prices dropped 4.2% to $2.60/lb. Nickel and lead registered increases of 22.3% to $7.04/lb and 8.2% to $0.94/lb, respectively. Iron ore prices cooled as well, dropping to $97.37 per dry metric ton (dmt) from $109.18/dmt.

Trade negotiations between the U.S. and China broke down, the dollar lost strength, and the central banks continue to cut rates. With foreign exchange rates, the US dollar/Yuan ratio dropped from 0.146 to 0.142. Gold prices rallied to all-time highs in more than 20 countries and 17% this year in U.S. dollars. With China being the largest consumer of natural resources, some metal prices are feeling more pressure.

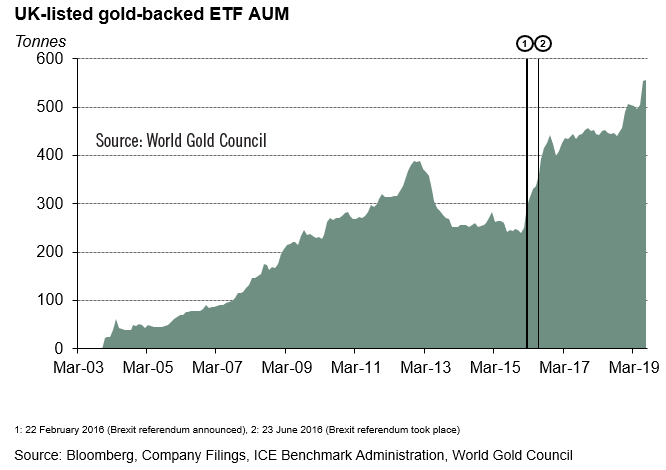

Beyond the U.S./China trade dispute, Boris Johnson was appointed prime minister of England, which means the U.K. may leave the European Union without a deal. This is weighing heavily on the psyche of U.K. investors, which is visible from the support for the AUM, a U.K.-listed gold-backed exchange traded fund (ETF).

“Both European and U.K. gold-backed ETFs have seen stellar growth in AUM since 2016, with Brexit concerns an undeniable contributor,” said Krishan Gopaul, market intelligence for the World Gold Council. “AUM now accounts for a little more than a fifth of global total in tonnage terms, up from 15% at the beginning of 2016.”

Brexit has also placed noticeable pressure on the pound (GBP), which valued gold at £1,000/oz recently. The gold price rally has seen GBP gold swing higher. Currently, the gold price in GBP broke above £1,200/oz, setting an all-time high.

“This performance, in a world starved of returns, has attracted a lot of attention from investors,” Gopaul said.

Nickel prices on the London Metal Exchange (LME) closed at their highest level in a year at $15,495/mt. Since the beginning of the year, nickel prices on the LME have climbed more than 50%. The Indonesian government is reportedly considering an export ban on nickel ore sooner than originally expected, which would tighten supplies heading into next year.

Iron-ore futures in China declined as demand weakened and supplies increased. Roy Hill’s CEO said the company plans to increase iron ore to 60 million mt per year. It’s also looking more likely that Vale will be able to restart idled mining operations in Brazil.