The dynamics of rare earths supply are changing again, according to a new report from Roskill. On January 21, the Chinese Ministry of Commerce announced that it will remove taxes on export sales of rare earths on May 2. The announcement follows the news at the end of last year that rare earths exports would instead be subject to an export licensing regime. China was widely expected to abolish the quota system and taxes following a World Trade Organization (WTO) ruling in March 2014 that the tariff and quota system was discriminatory and gave unfair advantage to domestic consumers. Rare earth exports were subject to 15% or 25% tariffs in 2014.

|

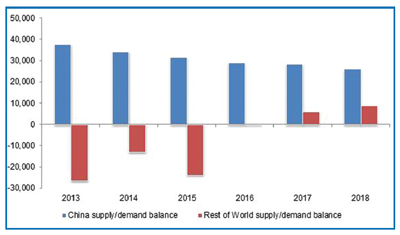

| Year on year supply/demand balance for rare earths, 2013 to 2018 (mt REO, Source: Roskill). |

China is the world’s dominant exporter and producer of rare earths and has been consolidating supply under a limited number of state-owned enterprises. An increasing proportion of Chinese supply is now required for its domestic industries, which account for more than 70% of total demand for rare earths. New projects in the rest of the world could potentially contribute an additional 45,000 metric tons (mt) of rare earth oxides (REOs) to supply by 2020.

The highest growth rates will be seen for the magnetic raw materials, neodymium, praseodymium, dysprosium and samarium, with average annual growth rates of more than 6% for these rare earths over the forecast period. More than 75% of the magnetic rare earth elements are consumed within China as of early 2015, and this proportion is expected to increase as the Chinese government encourages the development of this downstream industry.

China’s economy is entering a new paradigm. At 7.4%, GDP growth in China in 2014 was the lowest in 25 years. This creates new challenges for the global rare earths industry. Most policymakers are only just starting to recognize the far-reaching economic impact of President Xi Jinping’s recent policies. But it also creates major new opportunities for those companies prepared to restructure their business models.

The rare earths value chain is extraordinarily complex, with multiple players, business drivers, supply models and geopolitical considerations at various stages of production. Executives in the industry need an experienced overview of the end-to-end value chain that provides insight into both potential opportunities and avoidable disruptions.

The 15th edition of Roskill’s rare earths report, Rare Earths: Market Outlook to 2020, provides an overview of the entire supply chain, covering production, trade and prices. End-user markets are also analyzed in detail. The report was recently updated with an additional two year outlook to cover the latest developments in China. To order this latest edition of Rare Earths: Market Outlook to 2020, contact Christine Duggan at: +44(0)20-8417-0087 or christine@roskill.co.uk.