Yamana Gold Inc. has agreed to purchase the Wasamac property and the Camflo property and mill in Quebec from Monarch Gold Corp. Yamana will acquire the properties through the acquisition of all of the outstanding shares of Monarch not owned by Yamana, including cash and shares, of approximately C$152 million. Monarch will complete a spinout to its shareholders, through a newly formed company of its other mineral properties and certain other assets and liabilities of Monarch.

Yamana Gold Inc. has agreed to purchase the Wasamac property and the Camflo property and mill in Quebec from Monarch Gold Corp. Yamana will acquire the properties through the acquisition of all of the outstanding shares of Monarch not owned by Yamana, including cash and shares, of approximately C$152 million. Monarch will complete a spinout to its shareholders, through a newly formed company of its other mineral properties and certain other assets and liabilities of Monarch.

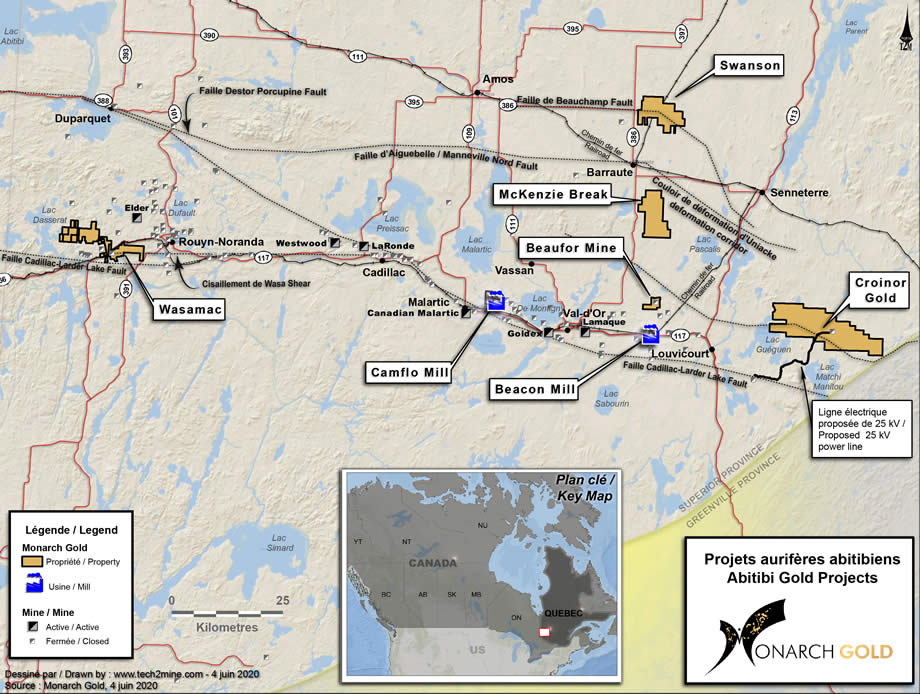

The Wasamac gold underground project, located 15 kilometers (km) west of Rouyn-Noranda in the Abitibi region of Quebec, consists of five well developed ore shoots within a single, continuous shear zone with a consistent grade distribution and wide mining widths. It has existing proven and probable mineral reserves of 1.8 million ounces (oz) of gold at 2.56 grams per metric ton (mt). Yamana said there is “excellent potential for significant future exploration success and mineral resource conversion.”

Yamana said the geological characteristics of the Wasamac ore body suggest it holds the potential to be an underground mine achieving the same scale, grade, production, and costs as the company’s Jacobina mine in Brazil, and it possesses many parallels to the company’s 50% owned Canadian Malartic underground project located in the same Abitibi region in Quebec.

Yamana said it plans to commence an exploration and infill drilling campaign and other studies to refine and expand upon the potential of Wasamac and its development alternatives.

The Camflo property, located 15 km northwest of Val-d’Or, includes the old Camflo mine, which closed in 1992, and a permitted mill. The property has not been explored since the mid-1980s and Yamana believes it has good exploration upside.

The acquisition provides the company with a high-quality project with a significant mineral reserve and mineral resource base and excellent potential for further expansion, according to the company. The acquisition adds to the company’s footprint in the Abitibi region, which Yamana said is consistent with its strategy to build on its existing presence in established mining jurisdictions. In addition, the acquisition of the Wasamac and Camflo properties adds to its pipeline of organic opportunities, significantly enhancing the company’s future growth prospects, the company added.

The transaction has been approved by the boards of directors of Yamana and Monarch. In addition to Monarch shareholder approval, the transaction is subject to applicable regulatory, court, and stock exchange approvals and certain other closing conditions. The companies are working toward closing the transaction during 2020 and not later than early January 2021.

Ownership in SpinCo, a newly created exploration company, will hold Monarch’s remaining pipeline of development and exploration projects, including the Beaufor mine, Croinor property, McKenzie Break property, Swanson property, and Beacon mill.

It is expected that Monarch’s senior executive team will continue in the same roles at SpinCo, and that SpinCo will have C$14 million in cash to support its work programs and for general corporate purposes.