Vision Blue Resources has raised an initial $60 million and made its first investment of $29.5 million in NextSource Materials, which is developing one of the largest and highest quality flake graphite deposits in the world, the Molo project in southern Madagascar. Studies conducted by NextSource indicate that the Molo project has one of the lowest mine capital costs and will be a lowest-quartile producer due to its low-cost, open-pit operation with negligible stripping ratio.

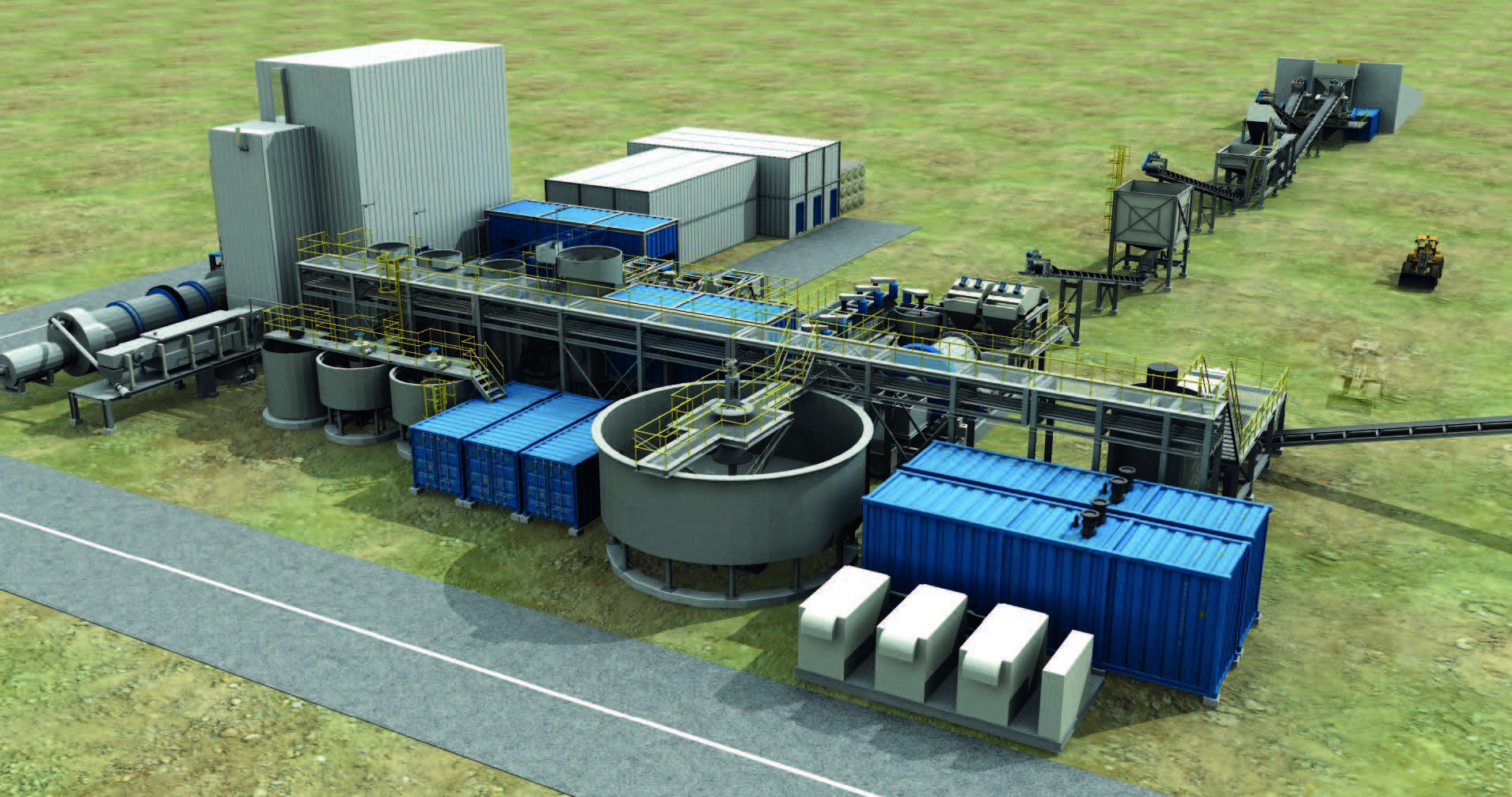

The investment by Vision Blue, which was created by Sir Mick Davis in December to acquire a portfolio of strategically significant investments in battery mineral assets, of $29.5 million will be used to fund the construction of Phase I of the Molo project, to fast track the completion of two technical studies in order to confirm the capital and operating costs for both Phase II mine expansion, and for a value-added graphite processing plant to produce spheronized, purified graphite for lithium-ion batteries in electric vehicles. The Phase I construction is expected to be completed within one year and will produce 17,000 metric tons per year (mt/y) of 98% purity graphite suitable for all end market applications.

“Vision Blue is uniquely positioned to take advantage of this emerging trend as we are nimble enough to access the opportunities currently present in battery minerals while having access to the financial firepower to undertake larger transactions when the timing is opportune,” Davis said. “Today’s announcement clearly shows our ability to raise and deploy capital on an accelerated basis.”

The former Xstrata CEO, Davis added that he is confident that production can begin within a year.

Vision Blue said it has already identified a number of opportunities and expects to rapidly grow its portfolio.

“The impact of rapidly growing demand for battery minerals is likely to lead to a surge in demand for specific commodities that will dwarf anything the mining industry has ever seen before, including the commodity impact of China’s industrialization in the last 20 years,” Davis said. “In combination with this surge in demand, a failure to develop new sources of supply highlights the need to ensure that critical mining assets are immediately financed and brought to production.”

Vision Blue said it is positioned to provide an alternative source of capital to rapidly advance projects using the experienced technical and financial team it has available and leveraging its credentials and industry relationships.